Hong Kong-Guangdong Collaboration (2): Cross-Boundary Finance

Following the central government’s promulgation of the Opinions on Comprehensively Deepening Reform and Opening Up of Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone with Financial Support (the 30 Financial Measures of Qianhai)1, the Shenzhen Municipal Government issued a corresponding implementation plan2 in July 2023. The plan consists of 30 measures covering areas ranging from livelihood finance to cross‑border financial services.

It is noteworthy that the plan allows qualified Hong Kong‑funded small and micro businesses in Qianhai to obtain loans of up to RMB5 million from overseas and Hong Kong banks. This measure will broaden the overseas financing channel for Hong Kong companies operating in Qianhai. It will potentially also lower operating costs for entrepreneurs. As a result, Hong Kong companies expanding into mainland markets or exploring other mainland business sectors can consider exploiting this measure to obtain financing for their mainland business through channels in Hong Kong or abroad.

“Qianhai Hong Kong Enterprise Loans”

After the plan was issued, the Shenzhen Branch of the State Administration of Foreign Exchange further published the Operation Guidelines for “Qianhai Hong Kong Enterprise Loans” in August 2023.3 These guidelines spell out the specific requirements and procedures for an enterprise to obtain cross‑border financing using overseas loan funds. For example, enterprises participating in the Qianhai Hong Kong Enterprise Loans scheme must be small and micro Hong Kong‑funded companies registered in the Qianhai Co-operation Zone and have been set up for at least half a year. This scheme does not apply to real estate and related financial business companies.

Operation Guidelines for “Qianhai Hong Kong Enterprise Loans” To facilitate the cross-border financing of Hong Kong enterprises, the third measure of the 30 Financial Measures of Qianhai supports eligible Hong Kong-funded small and micro enterprises in the Qianhai Co-operation Zone in obtaining RMB loans from overseas banks within the limit of RMB5 million. In May 2023, the Shenzhen branch of the State Administration of Foreign Exchange issued operation guidelines for “Qianhai Hong Kong Enterprise Loans”, stipulating that: Hong Kong-funded small and micro enterprises registered in the Qianhai Co-operation Zone are allowed to borrow foreign debts with a cap of RMB5 million. The creditors of such foreign debts shall be limited to banks outside China and the withdrawal currency shall be limited to RMB. Enterprises participating in the “Qianhai Hong Kong Enterprise Loans” scheme shall meet the following conditions: Hong Kong-funded small and micro enterprises registered in the Qianhai Co-operation Zone and established for at least half a year. Real estate enterprises and quasi-financial enterprises (including financing guarantee companies, small loan companies, pawnshops, financing leasing companies, commercial factoring companies, local asset management companies etc) are excluded. There have been no records of foreign exchange administrative penalties in the past two years. (For those established for less than two years, there have been no records of foreign exchange administrative penalties since the date of establishment.) |

Source: Shenzhen Branch of the State Administration of Foreign Exchange

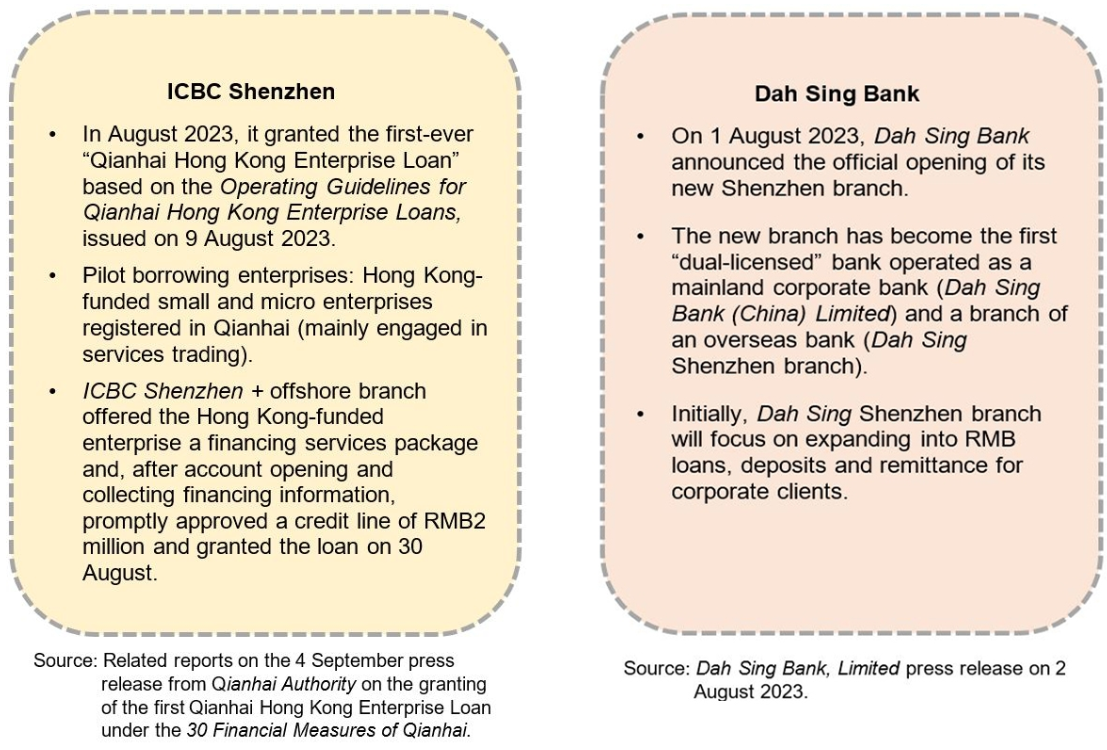

According to the Qianhai Authority4, in August, a Hong Kong‑funded company in Qianhai engaging in services trade was able to secure a credit loan of RMB2 million from the Industrial and Commercial Bank of China, Shenzhen Branch (ICBC Shenzhen), the first‑ever Qianhai Hong Kong Enterprise Loan. The company said that the measure can provide more overseas financing channels for Hong Kong‑funded enterprises, thus helping them to increase cash flow. Such additional financing channels would be critical in their expanding into mainland markets and developing their business.

The 30 Financial Measures of Qianhai also make cross‑border trade settlement easier by improving the convenience of settling funds. Pre‑registration of qualified enterprises in Qianhai is not necessary for special foreign exchange refunds if goods trading is completed beyond deadlines. Another measure supports cross‑boundary RMB settlement for new trade formats, such as cross‑border e‑commerce. The implementation of these measures helps enterprises avoid the complicated process of pre‑registration and thus speeds up the cross‑border trading process.

Furthermore, these measures widen the scope of the cross‑border fund settlement business for financial institutes, offering them additional opportunities to expand their business. One example is Dah Sing Bank Hong Kong which has announced that its new branch in the Qianhai Shenzhen‑Hong Kong International Financial City is now officially open for business. This branch, which is operating on a “dual licensed” basis both as a mainland corporate bank (Dah Sing Bank (China) Limited) and a branch of an overseas bank (Dah Sing Bank Shenzhen branch), will offer its corporate clients services in RMB loans, deposits and remittances as a way to expand into the mainland market5.

Leveraging favourable measures

The 30 Financial Measures of Qianhai not only provide convenience to Hong Kong‑funded enterprises operating in Qianhai, but also bring additional business opportunities to Hong Kong's financial industry players. Guangdong, at the forefront of China's foreign trade, has formidable economic strength. In 2022, its regional GDP reached RMB12.9 trillion, making its economy the largest among all provinces6. Guangdong also has higher income levels and its residents' consumption ranks among the top in the country. In 2022, the average per‑capita disposable income of its residents was RMB47,065, surpassing the national average of RMB36,883.

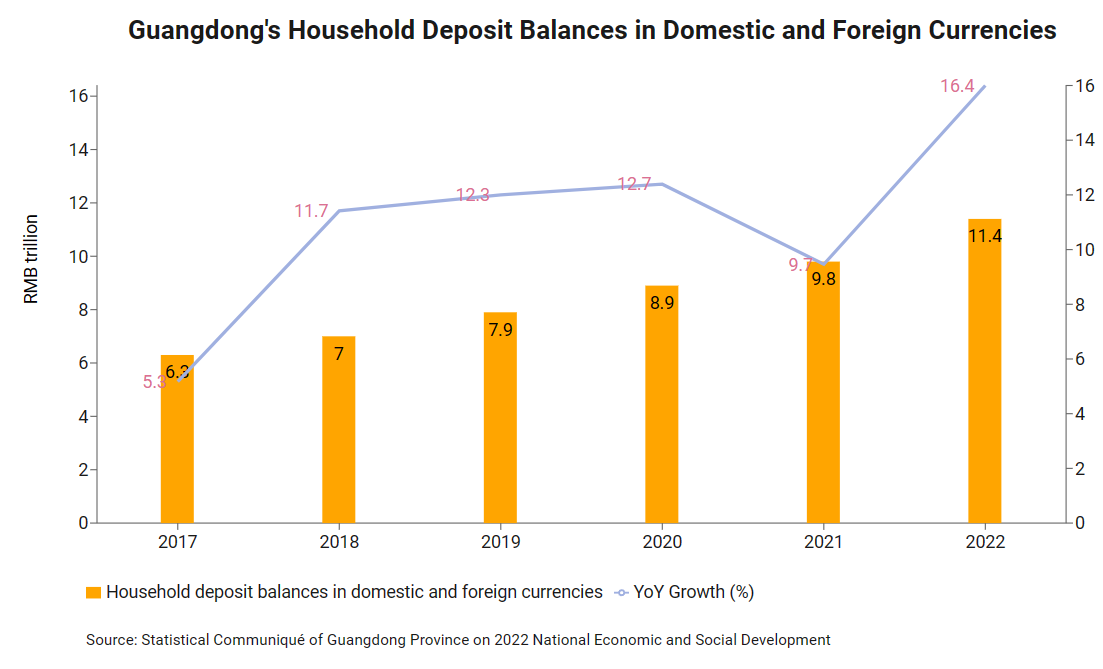

Moreover, Guangdong residents have robust demand for financial services, and their investment amounts have been growing continuously. For example, as at the end of 2022, the deposit balances in domestic and foreign currencies in Guangdong financial institutions reached RMB32.2 trillion, of which close to RMB11.4 trillion were household deposit balances in foreign currencies6. This was the highest figure among all provinces and municipalities, so Guangdong is a regional market that should not be overlooked in developing mainland business.

Against such a background, at a time when Guangdong is accelerating its opening up of pilot projects to Hong Kong and Macao enterprises, Hong Kong's practitioners in financial and related industries can consider establishing a base in Qianhai to secure a strong foothold. After familiarising themselves with the business environment in mainland markets, they can then expand their business scope. This includes optimising financial products and services to prepare for expansion into Guangdong and other financial services markets.

[For more information, please read Hong Kong-Guangdong Collaboration (1): Financial Services Liberalisation]。

1 On 23 February 2023, the People's Bank of China, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange and the People's Government of Guangdong Province jointly promulgated the Opinions on Providing Financial Support for Comprehensively Deepening of Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (Yinfa No.42 [2023]) (30 Financial Measures of Qianhai).

2 On 10 July 2023, the Shenzhen Municipal Government issued a notice on the Plan for Implementing the Opinions on Providing Financial Support for Comprehensively Deepening Reform and Opening Up of the Qianhai Shenzhen-Hong Kong Modern Service Industry Co-operation Zone (Shenfuban No.8 [2023]) aimed at executing the 30 Financial Measures of Qianhai.

3 On 14 August 2023, the Shenzhen Branch of the State Administration of Foreign Exchange issued the Operation Guidelines for “Qianhai Hong Kong Enterprise Loans” (Shenwaiguan No. 20 [2023]).

4 Source: Related reports on the 4 September 2023 press release from the Qianhai Authority concerning the granting of the first Qianhai Hong Kong Enterprise Loan under the 30 Financial Measures of Qianhai (《「金融支持前海30條」新政下首筆「前海港企貸」業務落地》).

5 Source: Press release from Dah Sing Bank, Limited on 2 August 2023

6 Source: Statistical Communiqué of Guangdong Province on the 2022 National Economic and Social Development

First, please LoginComment After ~