The world's central banks are treading cautiously into 2024. Here's why

♦Major central banks are convening for their last meetings of 2023 and seem to be feeling circumspect.

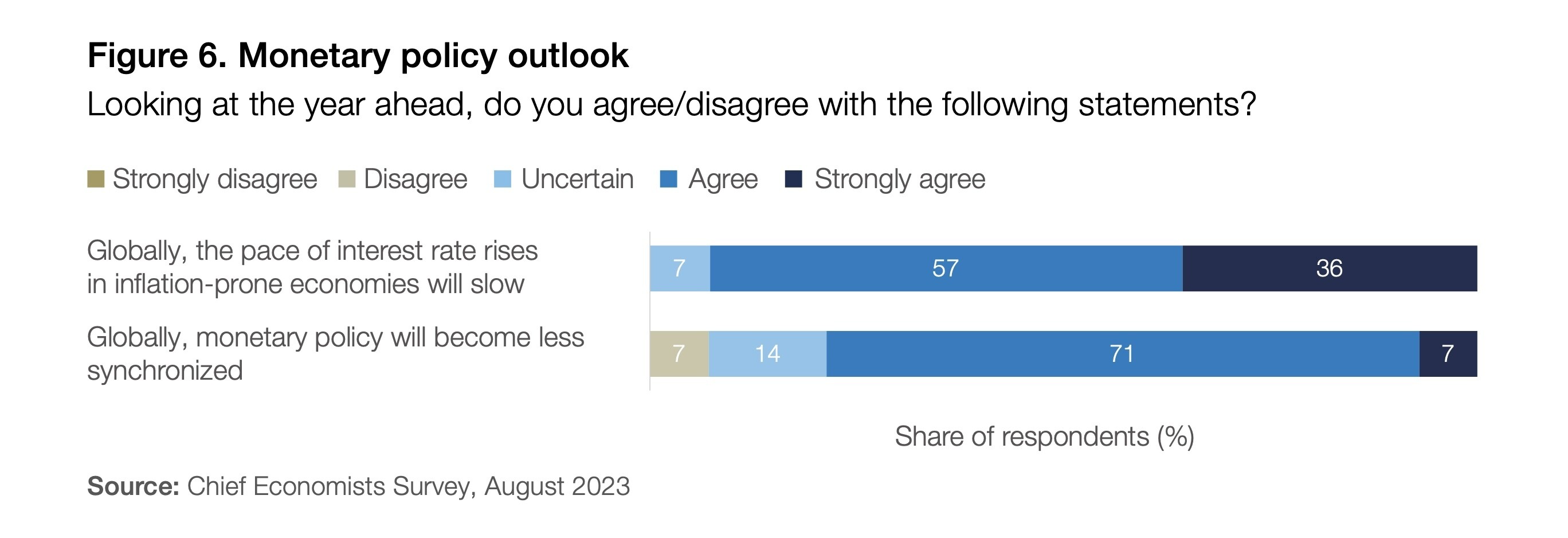

♦Chief economists are almost unanimous in expecting the pace of interest rate rises to slow, according to the World Economic Forum’s Chief Economists Outlook.

♦Rate hikes may have been paused, but that does not mean that a reversion to low rates is imminent, say chief economists.

How are you approaching the end of the year and the start of 2024?

Are you excited? Full of energy? Or full of trepidation as another 12 months looms into view?

Some of the world’s major central banks – including the US Federal Reserve, the European Central Bank and the Bank of England – are feeling cautious and are likely to avoid drama in their last set of meetings of 2023, according to investors.

Their stance matters because central banks use tools, including interest rates, to keep the economy steady, foster growth, and keep inflation in check. And those rates affect us all – directly impacting the cost of borrowing for consumers and businesses.

High levels of uncertainty

This year policymakers are grappling with an uncertain economic outlook and structural forces including deglobalization, the climate crisis, ageing populations and rapid digitalization. Chief economists are almost unanimous (93%) in expecting the pace of interest rate rises in inflation-prone economies to slow, according to the World Economic Forum’s September edition of the Chief Economists Outlook survey.

That report also shows slowing momentum and ongoing economic uncertainty around the world. Despite easing recession concerns, 6 out of 10 chief economists anticipate a weakening global economy in the coming year, with volatility.

Regional growth prospects vary, the report shows, with stronger expectations for Asia but concerns about China's outlook. The US prospects have strengthened, the report shows, and while for Europe, 77% of those surveyed expect weak or very weak growth this year, they see a significant brightening of the outlook in 2024, for the first time in years.

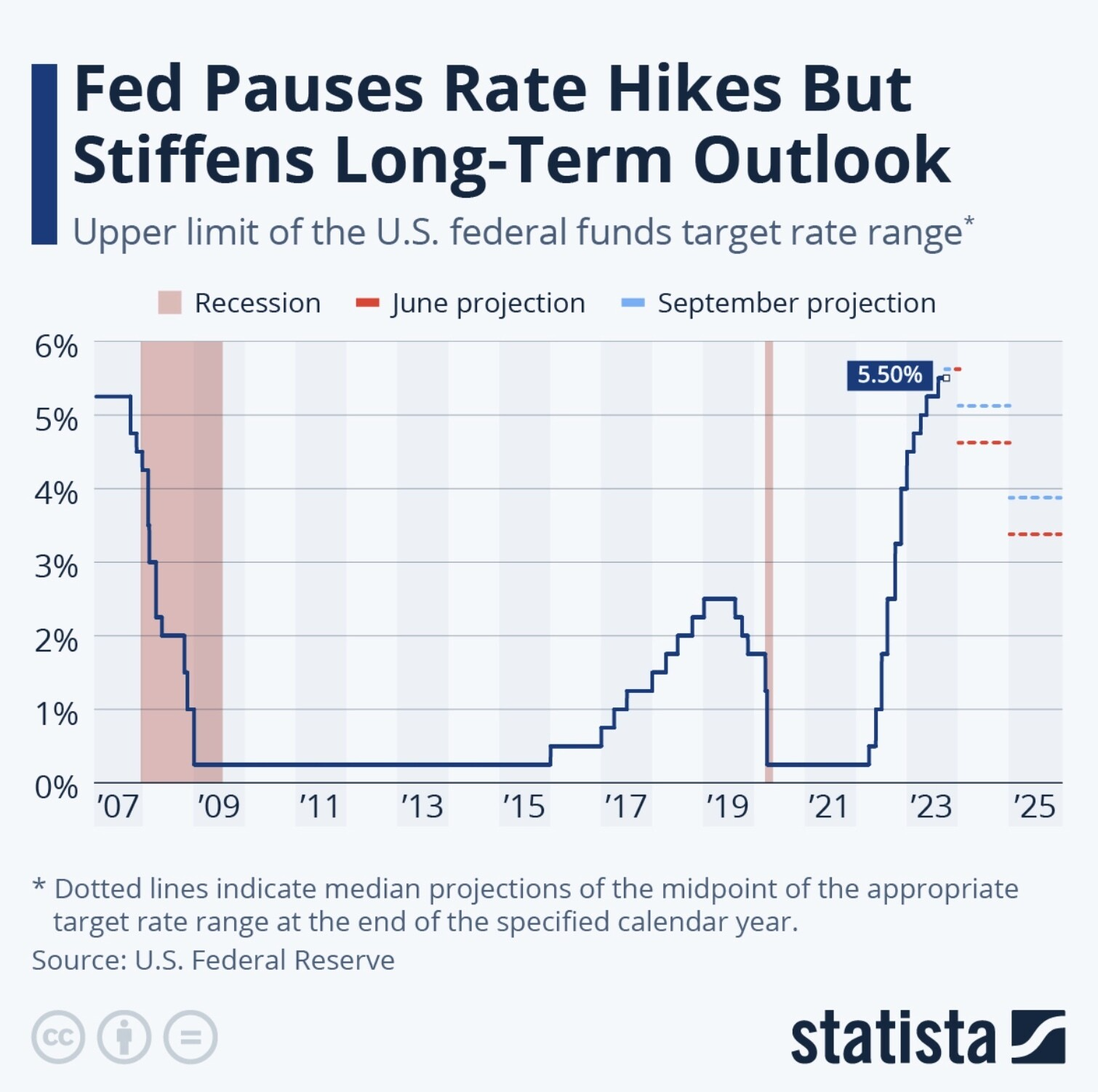

Most central banks around the world have been increasing their interest rates to manage price increases and slow down inflation. And the relatively high levels of global rates compared to recent years has raised investor expectations of imminent interest rate cuts.

Rate cuts in 2024?

Earlier this month, the Federal Reserve announced that interest rates would remain unchanged at 5.25% to 5.50%, up from 4% a year ago. The Bank of England and the European Central Bank also announced this month that interest rate would remain unchanged. Yet experts note that rate cuts are expected worldwide.

"The unequivocally good news over the past few months is that inflation has slowed by more than expected globally. Major central banks are relieved their most aggressive tightening in four decades now appears to be over," said Janet Henry, Global Chief Economist, HSBC. "Now they will need to decide both when to cut interest rates, and by how much."

Henry added that cutting rates too soon could mean central banks have to reverse course if the downward trend in inflation stales while cutting too late could result in an undershoot of inflation mandates over the medium term.

"With lower inflation and growth, the question is not if, but by how much central banks will cut policy rates in 2024," said Marieke Blom, Chief Economist and Global Head of Research, ING Group.

Still, while futures markets show that investors are betting on monetary policy easing in the new year, there are signs that central banks could take a cautious approach as they weigh several factors including wage growth and the health of the job market.

"Monetary policy affects economies with a delay," Blom added. "Corporates, households and governments refinance their debts gradually, so next year they will pay higher interest rates on average as cheap loans mature. This will slow down economies that are flirting with recession anyway."

Cautious mood

“The mood remains very cautious,” according to the Forum's latest Chief Economists Outlook. “Rate hikes may have been paused, but that does not mean that a reversion to low rates is imminent.”

Central bankers have emphasized the need to respond to structural challenges for the global economy, like the climate crisis, demographic shifts and deepening geopolitical fractures, the Forum's report said.

What's clear is that the complexity and challenges that central bankers have faced are going to continue.

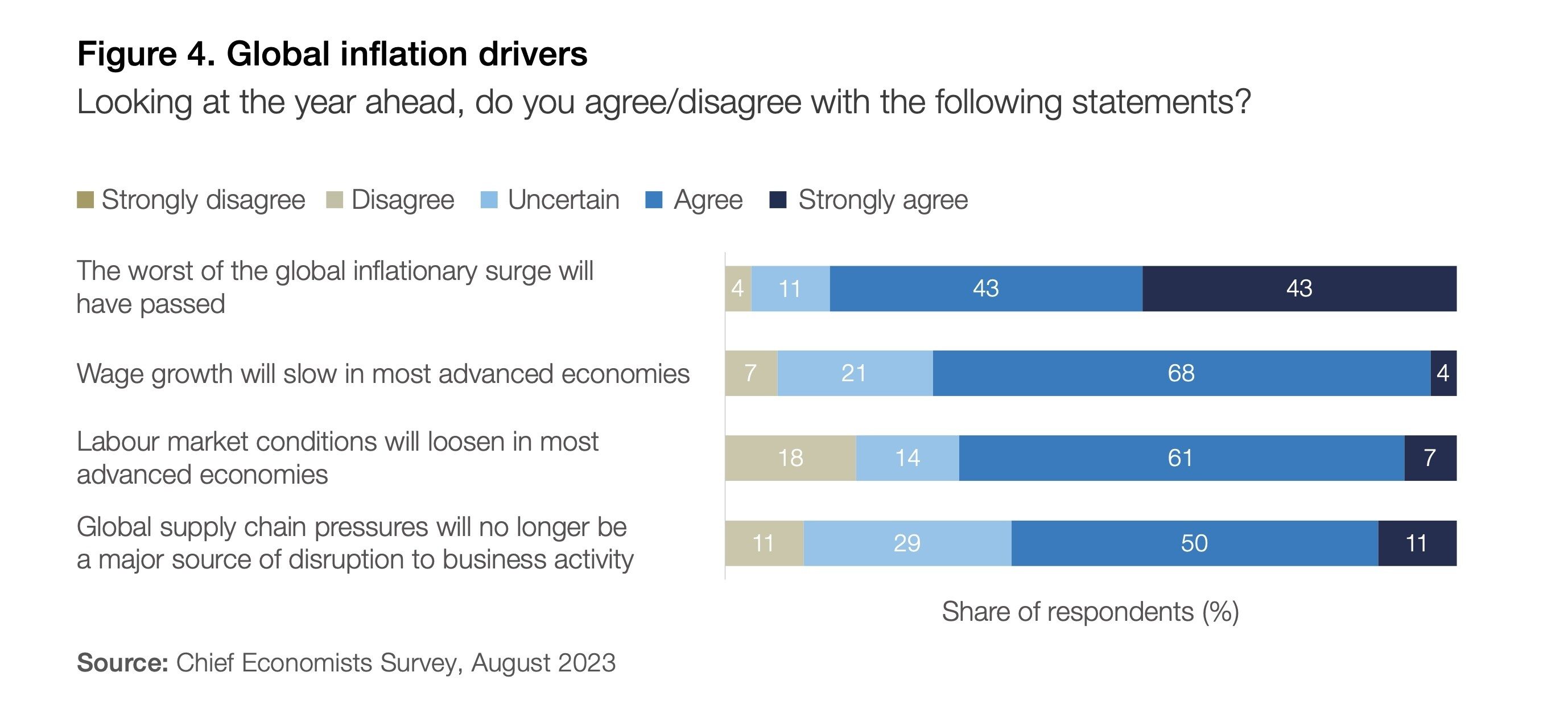

The worst of the inflationary surge will have passed a year from now, according to 86% of respondents to the Forum's report. And this is driven by weaker wage growth, loosening labour market conditions and diminishing supply-chain pressures.

Nearly 80% of respondents to the Forum's report predict a reduced synchronization of monetary policy across central banks in the upcoming year, highlighting a focus on the unique dynamics of individual economies.

“Monetary policy is therefore likely to be carefully calibrated in the months ahead,” the Forum's report said. “As central banks navigate delicate domestic and global economic conditions.”

First, please LoginComment After ~