UK Capital Issuance - November 2023

Key points

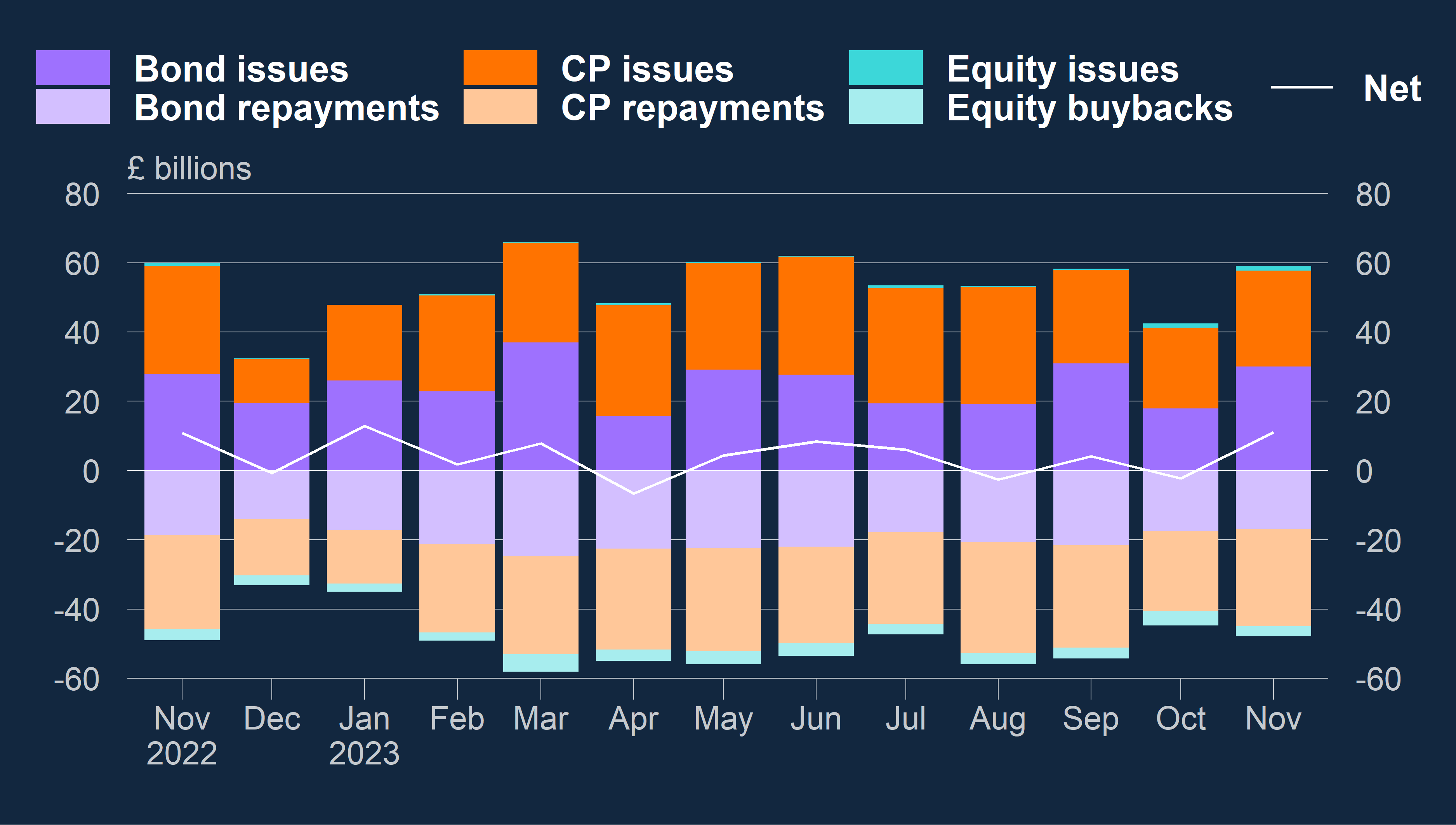

- Net capital issuance by UK residents was £11.1 billion in November1, compared to £2.3 billion in October and the previous six-month average of £3.0 billion (Chart 1).

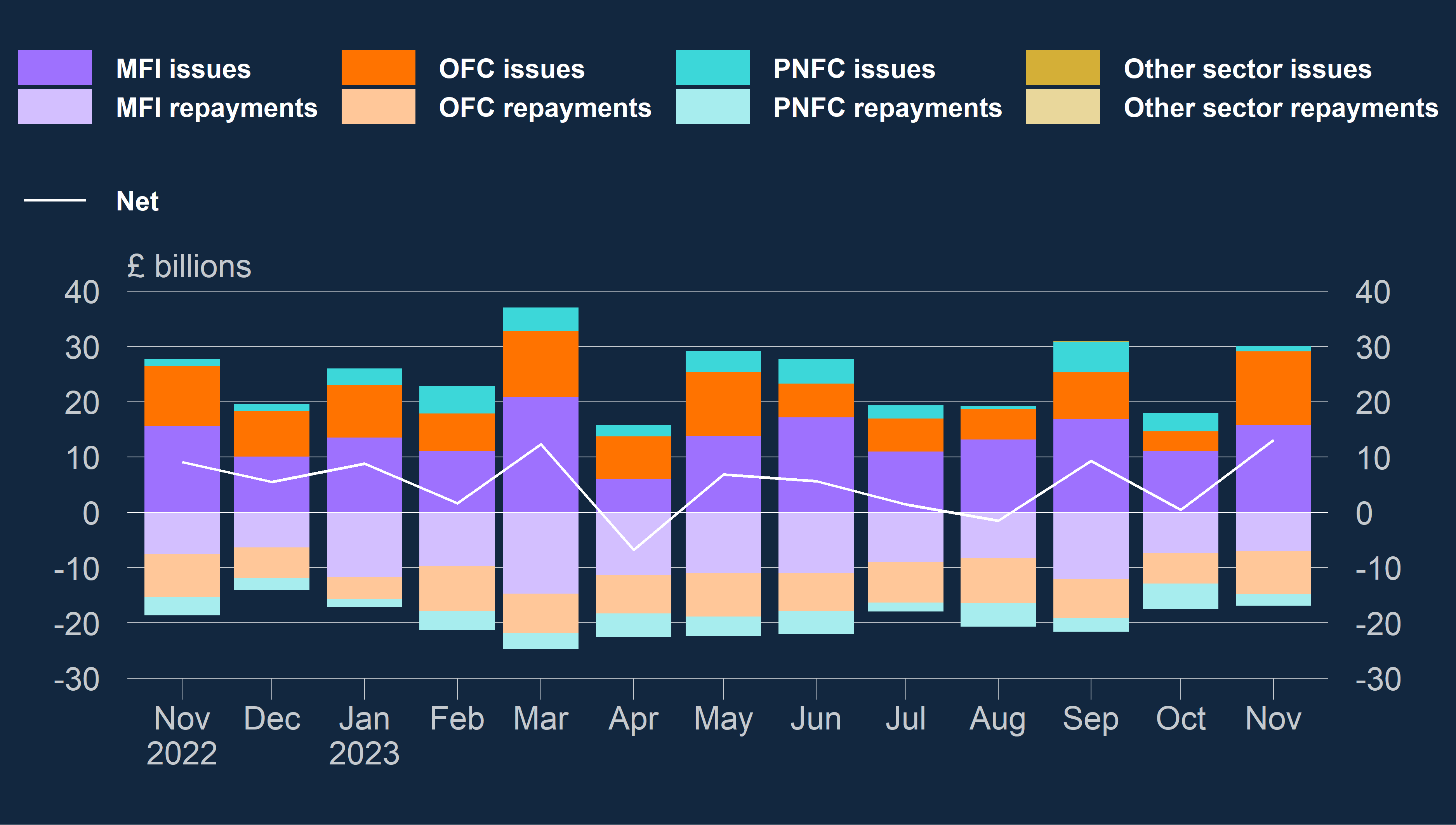

- By instrument, bonds saw the largest increase in net issuance as net bond issuance rose from £0.5 billion in October to £13.1 billion in November (Chart 4).

- The increase in net bond issuance was driven by a rise in issuance of £14.4 billion by the MFI and OFC sectors.

In addition to the summary statistics contained within this release and the associated tables, the Bank publishes a number of more granular series; please see our Bankstats tables (E3.1) and the full list of series and interactive charts.

All sectors

- Gross capital issuance by UK residents was £59.0 billion in November, compared to £42.5 billion in October and the previous six-month average of £55.0 billion (Chart 1).

- Net issuance was £11.1 billion in November, compared to -£2.3 billion in October and the previous six-month average of £3.0 billion (Chart 1).

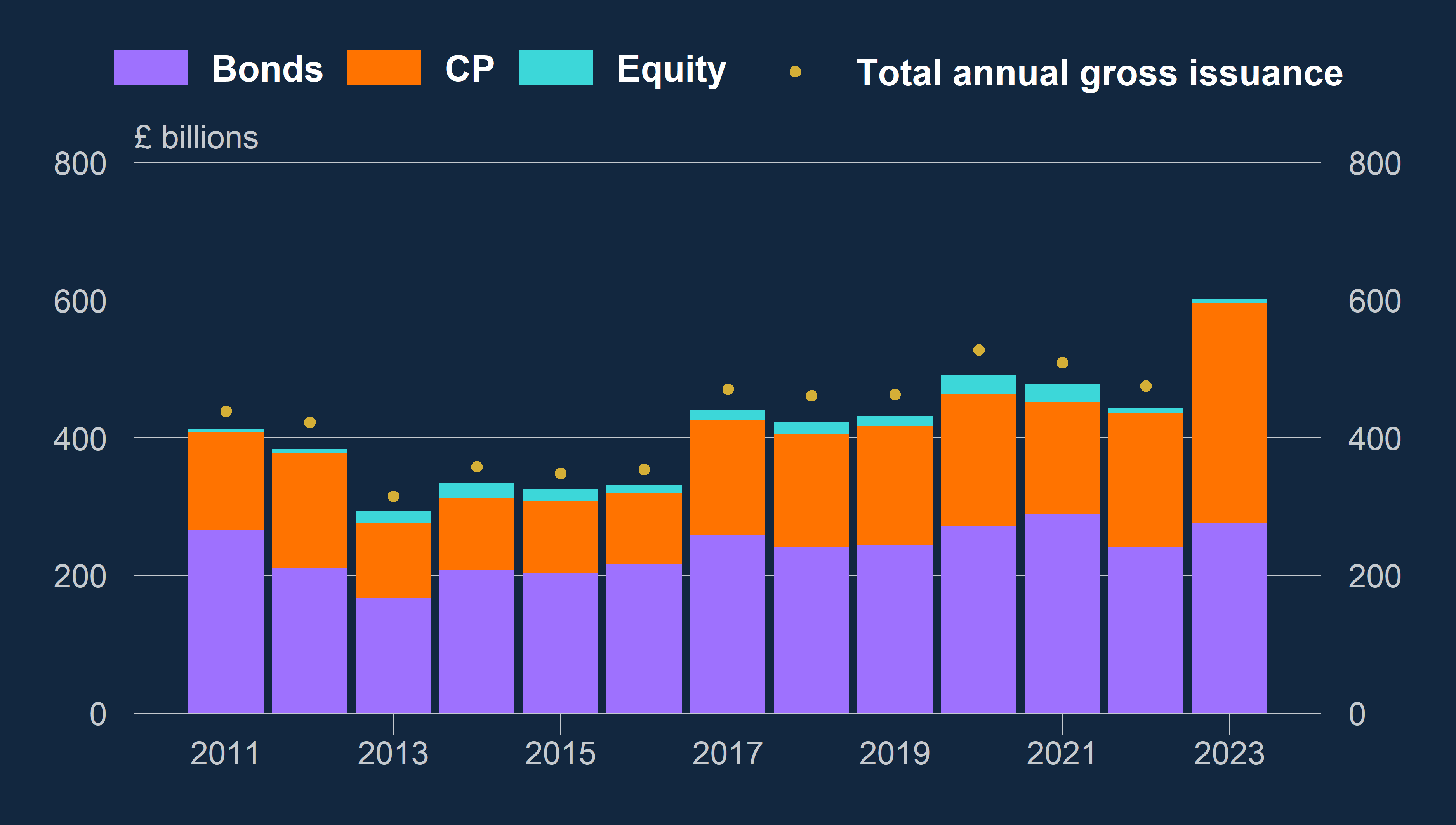

- Year to date gross issuance was £601.8 billion, £159.0 billion higher than at the same point the previous year (Chart 2) and £141.0 billion higher than the previous four-year average.

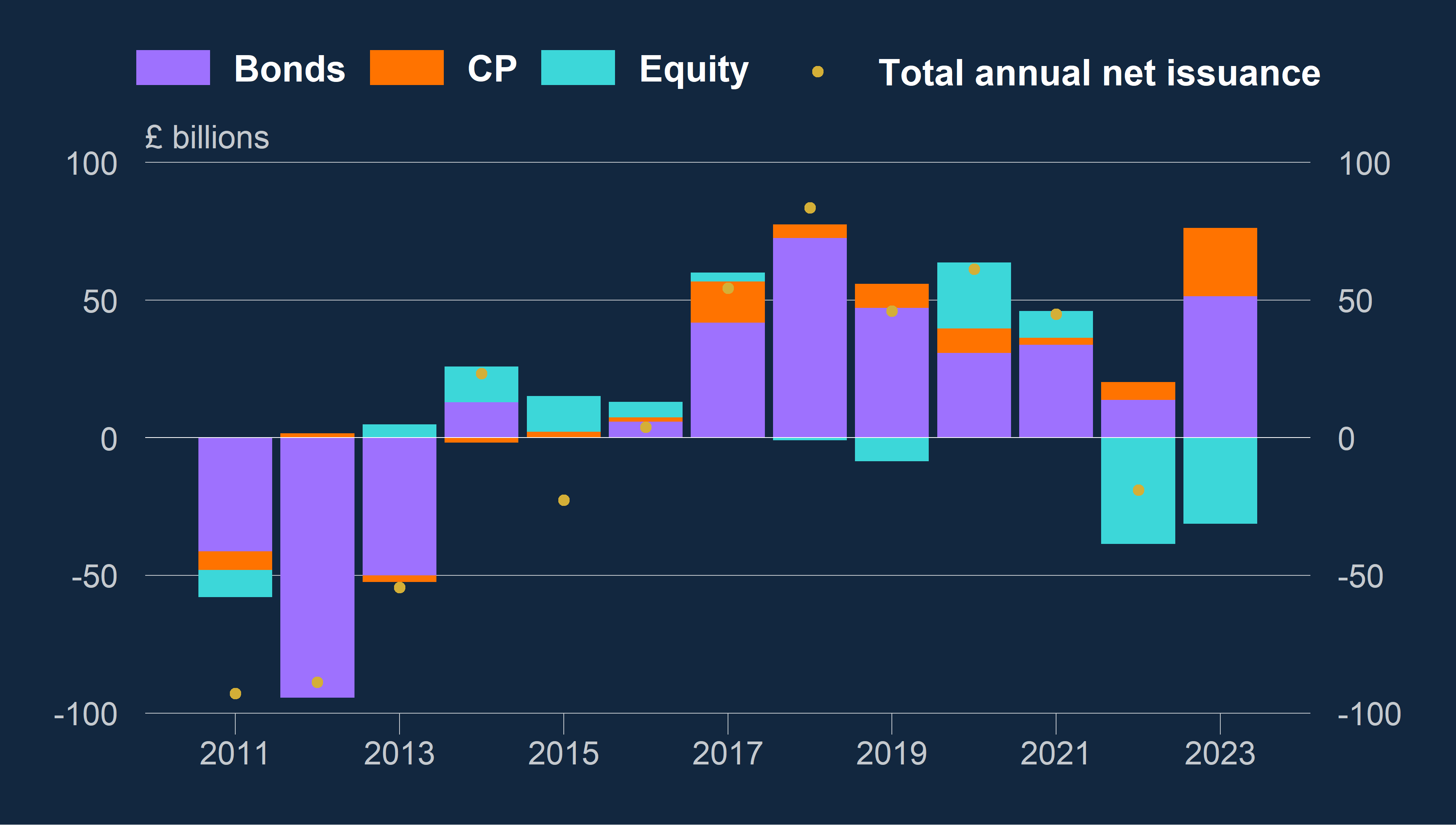

- Year to date net issuance was £44.8 billion, £63.2 billion higher than at the same point the previous year (Chart 3) and £10.1 billion higher than the previous four-year average.

Chart 1: Total capital issuance by UK residents (all currencies)

Non seasonally adjusted

Chart 2: Gross year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

Chart 3: Net year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

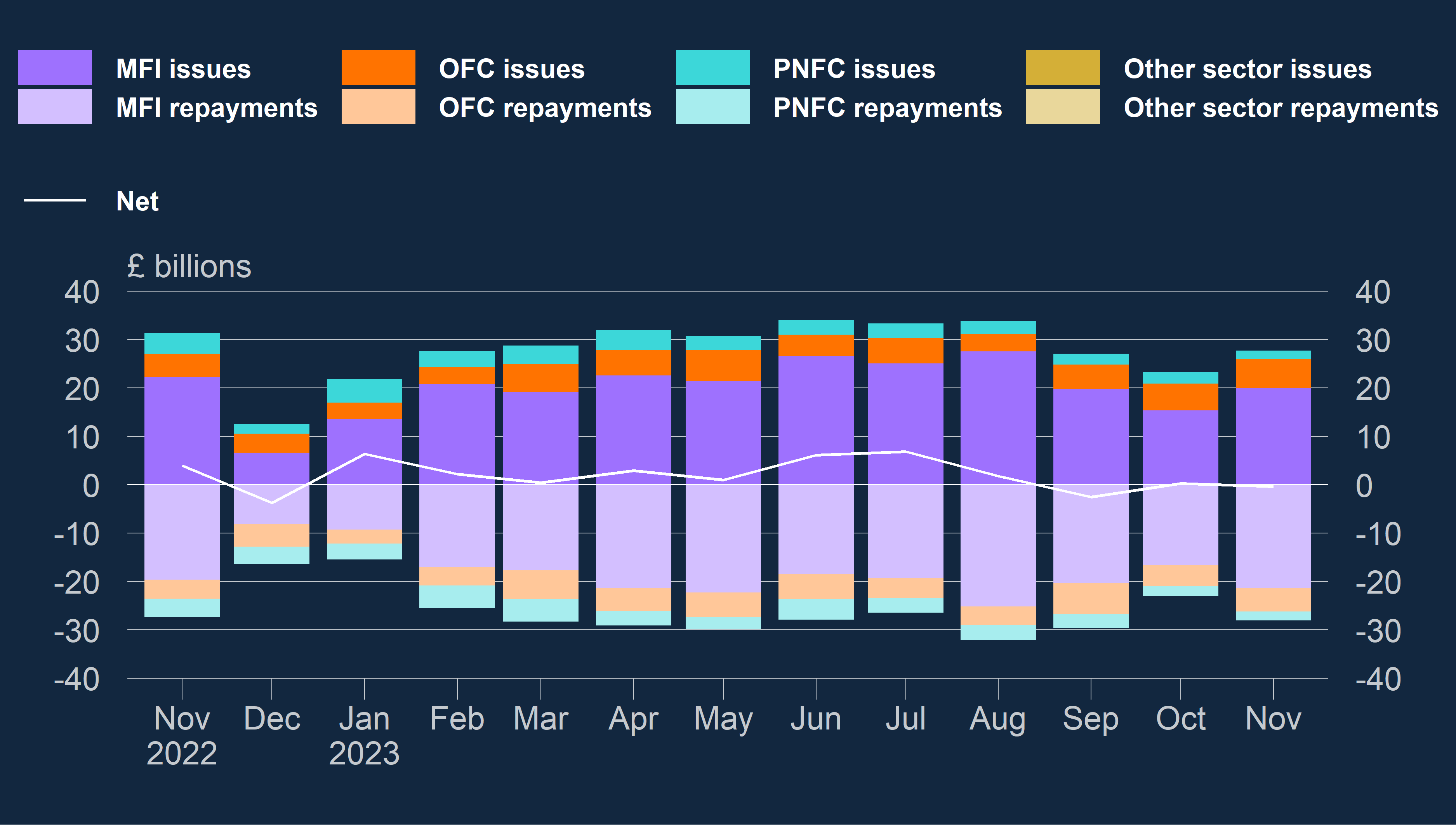

Bond issuance

- Gross bond issuance was £30.0 billion in November, compared to £17.9 billion in October and the previous six-month average of £24.0 billion (Chart 4).

- Net bond issuance was £13.1 billion in November, compared to £0.5 billion in October and the previous six-month average of £3.7 billion (Chart 4).

- The increase in net issuance was driven by a rise in issuance of £14.4 billion by the MFI and OFC sectors.

Chart 4: Bond issuance by UK residents (all currencies)

Non seasonally adjusted

Commercial paper issuance

- Gross commercial paper issuance was £27.7 billion in November, compared to £23.3 billion in October and the previous six-month average of £30.4 billion (Chart 5).

- Net commercial paper issuance was -£0.4 billion in November, compared to £0.3 billion in October and the previous six-month average of £2.2 billion (Chart 5).

- The decrease in net issuance was driven by an increase in repayments of £4.8 billion by the MFI sector, despite a £4.6 billion increase in issuance by the same sector.

Chart 5: Commercial paper issuance by UK residents (all currencies)

Non seasonally adjusted

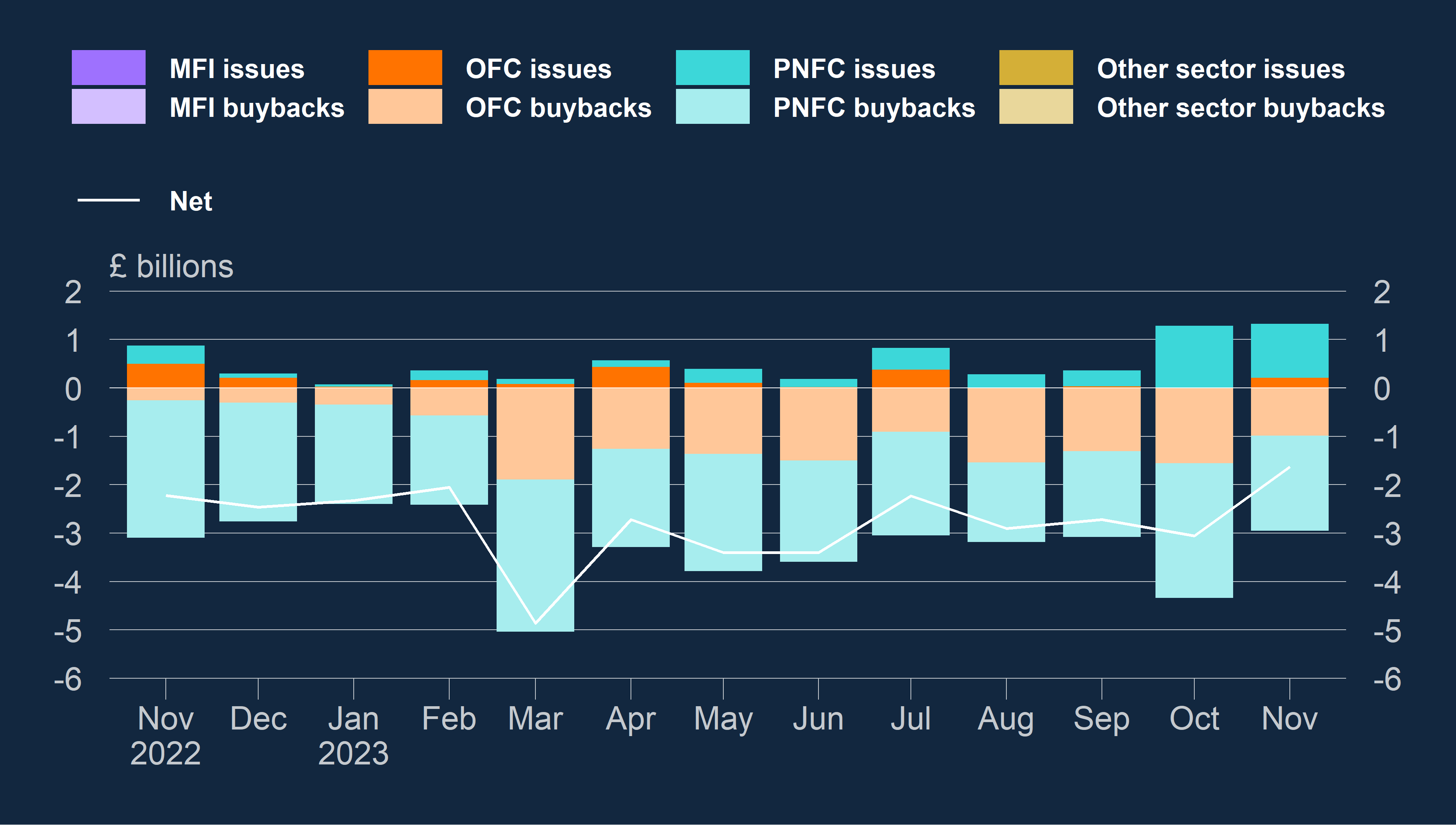

Equity issuance

- Gross equity issuance was £1.3 billion in November, same as in October, compared to the previous six-month average of £0.6 billion (Chart 6).

- Net equity issuance was -£1.6 billion in November, compared to -£3.1 billion in October and the previous six-month average of -£3.0 billion (Chart 6).

- The increase in net issuance was driven by a decrease in buybacks of £1.4 billion across the PNFC and OFC sectors.

Chart 6: Equity issuance by UK residents (all currencies)

Non seasonally adjusted

1. PNFC bond repayment data for November 2023 may be subject to revision due to a reclassification of an issuer from non-resident to resident. The amount involved is less than £1.0 billion.

Key:

- PNFC = Private non-financial corporations

- MFI = Monetary financial institutions

- OFC = Other financial corporations

- “Other sectors” contains public corporations and non-profit institutions serving households

- CP = Commercial paper

Queries

If you have any comments or queries with regard to this release please email DSDSecurities@bankofengland.co.uk.

Next release date: 26 January 2024

More information

Further data are available in Table E3.1 of our latest Bankstats tables.

First, please LoginComment After ~