The Road to Net Zero: Building a Regenerative Economy

Environmental, social and governance (ESG) issues have grown so much in importance that they are now matters of concern for different stakeholders in society. Small and medium enterprises (SMEs) can build their corporate image and tap green opportunities by incorporating ESG considerations into their business.

Hong Kong as an ESG business hub

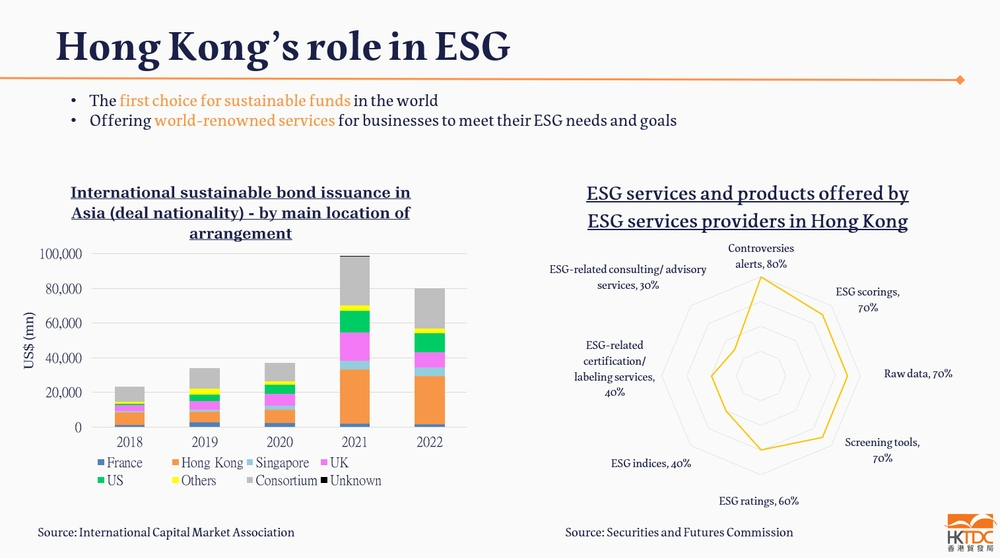

Speaking at the recent webinar titled “The Road to Net Zero: Building a Regenerative Economy”, Nicholas Fu, an HKTDC Global Research Team Economist, pointed out that in recent years, as diverse stakeholders including consumers and banks are demanding that businesses adopt ESG practices , ESG has come to the attention of a wide range of industries. Hong Kong not only vigorously promotes ESG practices, but its status as a mature global finance and business centre also offers lots of ESG opportunities, including the availability of various ESG products, services and certification solutions. In 2022, the city was Asia’s largest issuer of green and sustainable bonds, which amounted to one‑third of the total issued in the region.

In this respect, the HKTDC conducted an offline/online questionnaire survey from July 2022 to April 2023. The companies surveyed were 2,360 local and overseas buyers from more than 20 international trade fairs and conferences organised by the HKTDC. The respondents generally recognised that Hong Kong possesses considerable ESG advantages and has the potential to become a top ESG business hub in the region. They also noted that these advantages are closely related to their corporate ESG strategies and they wished to procure or use related services through Hong Kong.

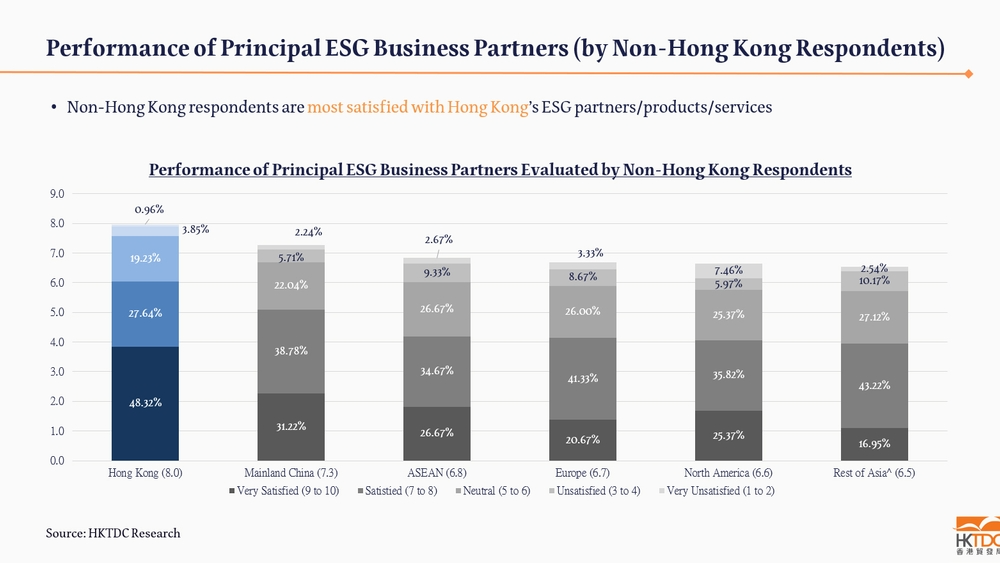

Fu said that, of all companies surveyed, 70% were non‑Hong Kong based and gave higher scores than respondents from Hong Kong. Typically, Asian and in particular mainland companies gave higher ESG scores to Hong Kong, believing that Hong Kong can satisfy their ESG strategy needs. To overseas companies, Hong Kong’s major ESG advantages were the availability of (1) a wide array of ESG products including design and solutions; (2) ESG professionals; and (3) many types of ESG investment products.

Hong Kong plays an important role in ESG, including being Asia’s largest issuer of green and sustainable bonds in 2022.

Hong Kong boasts the highest ESG performance score

In analysing the survey results, Fu mentioned that all respondents rated Hong Kong’s ESG advantages similarly. Specifically, mainland respondents believed that Hong Kong has bigger advantages in terms of ESG professionals and investment products. This is because the financial and professional services talent that Hong Kong has assembled over the years can help towards ESG development. Moreover, as the world’s largest offshore renminbi business centre, Hong Kong is one of the top investment choices for investors, and this draws them to come and seek ESG jobs and opportunities. To European buyers, Hong Kong’s ESG products, services and certification solutions have distinct cost advantages.

As regards ESG partnership, some 36% of the respondents said that Hong Kong is their principal ESG business partner, followed by mainland China (32%) and Europe (12%). For non‑Hong Kong respondents, 37% said the mainland is their principal ESG business partner, while 31% and 11% cited Hong Kong and Europe respectively. In evaluating the performance as an ESG business partner, non‑Hong Kong respondents were more satisfied with the performance of Hong Kong. On a scale of 10, Hong Kong’s performance scored an average of 8.0, followed by mainland China (7.3) and ASEAN (6.8).

Fu concluded that the survey reveals that Hong Kong, in addition to being a global financial and business centre, is poised to become an ESG business hub. He suggested that SMEs should take more note of the trend in sustainable development in their business plans. They should also leverage Hong Kong’s unique advantages in building their corporate image in sustainability in their existing business solutions or services.

In the performance evaluation of principal ESG business partners, Hong Kong scores higher than the mainland and other Asian regions.

ESG Community Benchmark facilitates ESG reporting

Stanley Cheng, Chief Secretariat Officer of the ESG Consortium, said that there are three benefits for SMEs to actively disclose their sustainability‑related practices and compile a comprehensive ESG report. First, it is good for business because ESG has become a new type of certification and the related requirements will not be backtracked and will only become increasingly stringent. Second, sustainability will help get financing, as more and more banks and financial institutions are taking the ESG performance of a company into consideration in approving loans. Third, sustainability can enhance the competitiveness of a company as ESG is favourable to improving corporate image and the company will no longer have to compete solely on product functions or prices.

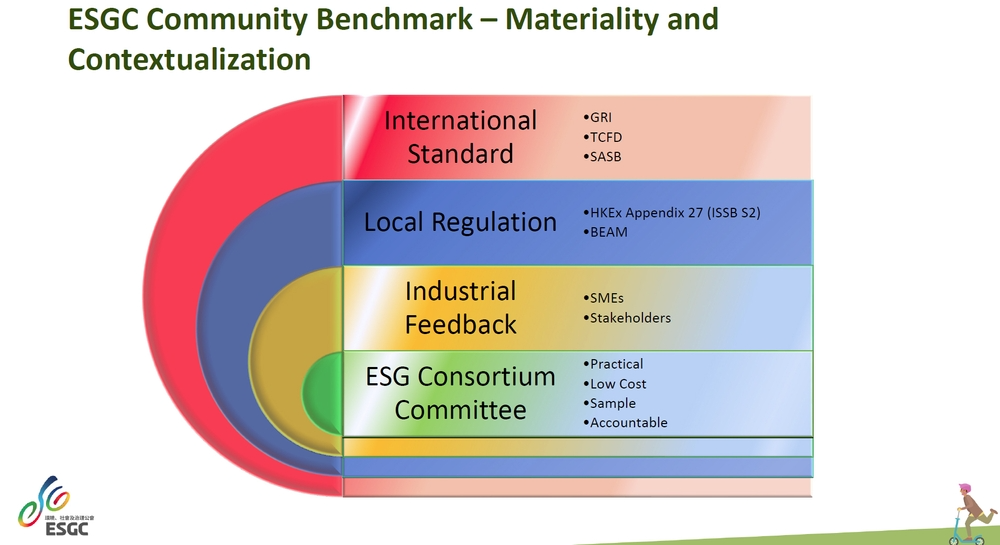

In May 2023, the ESG Consortium introduced the ESG Community Benchmark to help SMEs implement their ESG projects and compile a thorough ESG report. Cheng said that in establishing the benchmark, the ESG Consortium has referenced existing international standards and made suitable simplifications and adjustments. This way, SMEs have a lower threshold to practise ESG and obtain the required certification.

The ESG Consortium has been paying close attention to changes in market standards and made minor adjustments to keep abreast of the times. He said: “For example, in June 2023, the International Sustainability Standards Board (ISSB) issued a new set of standards and the Hong Kong Stock Exchange subsequently expected listed companies to revise their ESG reports according to these new standards and framework. Since SMEs are at the upper and lower streams of the supply chains of listed companies, we introduced the ESG Community Benchmark 2.0 last August based on the ISSB framework and simplified the ESG indicators to only 10 items so that SMEs would find it easier to adopt.”

Cheng said SMEs can enter relevant corporate data into the ESG Community Benchmark platform and view their reports. To prepare an ESG report, all it takes is for them to spend an hour or so every quarter to enter 10 items of information, such as electricity consumption, usage of environmentally friendly materials and the number of community service hours participated. When entering related data in the next quarter, they would know the change in every indicator and the differences from industry standards. The Certification Committee will be responsible for reviewing the information entered by the members and carrying out random checks to add to the accuracy and acceptance of the benchmark.

In the ESGC ESG Community Benchmark, simplification and reference to existing international standards have been made to make it easier for SMEs to practise.

The ESG2Go App

Other than promoting ESG at the corporate level, the ESG Consortium has also introduced the ESG2Go mobile app to promote ESG to employees through game playing. Cheng mentioned that companies can devise different games on the app so that users can earn ESG points by participating in training, “checking in” their water drinking, recycling items or taking part in community activities. As these ESG points can be redeemed for rewards, employees will have a deeper understanding of ESG actions while the related data can also be shown in the company's ESG report.

ESG Consortium is also reaching out to relevant institutions on the mainland with the hope that there will be more collaboration in helping the preparation of ESG reports by the mainland offices or factories of Hong Kong SMEs.

First, please LoginComment After ~