YRD Companies Actively “Go Out” to Expand International Business

Joint Research by HKTDC and Shanghai Municipal Commission of Commerce

Despite sluggish global economic growth and ongoing geopolitical tensions, many Chinese companies remain keen on “going out” to invest in a bid to expand into overseas markets and find more growth drivers. Figures recently released by the Ministry of Commerce, the National Bureau of Statistics and the State Administration of Foreign Exchange show China’s overall outward foreign direct investment (FDI) reaching US$163.1 billion in 2022, second only to the United States and accounting for over 10% of global outward FDI for seven consecutive years. At the end of 2022, the outward FDI stock from China reached about US$2.75 trillion, ranking among the top three in the world for six years running. (For further details, see: China’s Going Out Programme: Optimised Outcomes)

Outward FDI from the Yangtze River Delta (YRD) region has always been a frontrunner among all mainland provinces and municipalities. In China's non‑financial outward direct investment, US$86.05 billion came from local enterprises, accounting for 61% of overall outward FDI (up 3.3% year‑on‑year). Zhejiang, Shanghai and Jiangsu ranked first, third and sixth in China's outward FDI with 17.7%, 12.4% and 6.7% shares respectively, suggesting that the YRD is one of China's major sources of outward FDI.

Outward FDI Flows in 2022, by Province/Municipality | ||

| US$ billion | Share of national total |

Jiangsu | 15.28 | 17.7% |

Guangdong | 11.67 | 13.6% |

Shanghai | 10.66 | 12.4% |

Shandong | 6.46 | 7.5% |

Beijing | 6.00 | 7.0% |

Jiangsu | 5.76 | 6.7% |

Tianjin | 3.31 | 3.8% |

Sichuan | 3.16 | 3.7% |

Jiangxi | 2.80 | 3.3% |

Hebei | 2.76 | 3.2% |

Others | 18.19 | 21.1% |

Source: Statistical Bulletin of China’s Outward Foreign Direct Investment 2022 | ||

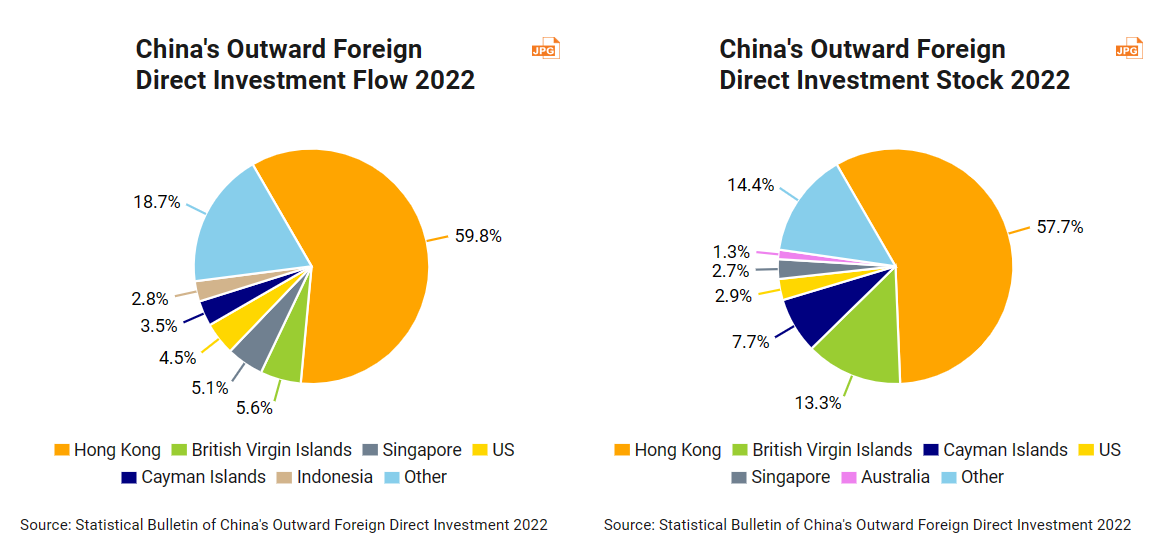

Over the years, Hong Kong has been the most important platform through which mainland companies venture into overseas markets. Many YRD enterprises use Hong Kong as a “going‑out” platform for managing and investing in overseas business. In 2022, as much as 59.8% of China’s overall outward FDI was destined for Hong Kong. The mainland’s FDI stock in Hong Kong accounted for 57.7% of China’s total at the end of 2022.

Hong Kong and Mainland Companies Join Hands to Exploit BRI Opportunities

Although the Covid-19 pandemic gradually subsided in 2023, many economies are still feeling its impact on investment consumer spending due to rising inflation and high interest rates. At the same time, the geopolitical situation is becoming increasingly complicated. In addition to the ongoing US‑China trade conflict, there are increased uncertainties in the global economic and investment environment after the outbreak of the Israel‑Palestine conflict in October 2023 which affect the business development plans of many companies. As market demand from advanced Western nations weakens, many mainland companies are shifting their focus to the growing Asian region. Encouraged by the positive impact of the Regional Comprehensive Economic Partnership (RCEP) which entered into force in 2022, they are focusing their attention on the ASEAN and other RCEP investment destinations as well as countries and emerging markets along the Belt and Road Initiative (BRI) routes.

It is notable that China’s economic and trade ties with countries along BRI routes and other countries under the BRI umbrella have grown closer since the initiative was first put forward in 2013. In October 2023, on the occasion of the 10th anniversary of the BRI, President Xi Jinping announced eight major initiatives [1] that China will take to support high‑quality BRI co‑operation, clearly charting the direction for the development of the BRI. Thus, many companies are reappraising their business strategies and stepping up their efforts to utilise external resources and international markets to further advance their development.

Hong Kong has the advantage of enjoying strong support from the mainland and plays a unique role in assisting mainland companies in connecting with the world. According to a questionnaire survey recently conducted by HKTDC Research on the mainland, Hong Kong is the preferred platform for mainland enterprises to “go global”. Of those planning to expand overseas, 62.1% said they would look for professional services support in Hong Kong, while 47.7% said they would opt to find such services in mainland provinces and cities. Overall, most GBA‑based respondents see Hong Kong as their preferred service platform, whereas those operating in the YRD tend to use the professional services of both Hong Kong and Shanghai.

Meanwhile, close to 90% of respondents indicated that they plan to “go global” in the next one to three years and over 70% of those surveyed said they would like to expand into RCEP, BRI and other emerging markets. (For further details, see: Hong Kong: The Premier Platform for Mainland Companies to Expand into the BRI and RCEP Markets.)

Hong Kong Platform

In order to obtain a better understanding of how mainland enterprises, especially those from the YRD, actually fare in Hong Kong, the China Business Adviser seconded from the Shanghai Municipal Commission of Commerce to HKTDC joined hands with HKTDC Research to interview mainland firms and relevant companies that have invested and set up shop in Hong Kong. The intention was to find out how they are doing in Hong Kong under the current changing domestic and international situation, including (1) their latest overseas business plans and strategies; (2) the difficulties they are facing and (3) the services support they need. It is hoped that Hong Kong services providers can provide the professional services needed by YRD and other mainland enterprises to help them “go global”, respond to challenges, and exploit RCEP and BRI opportunities more effectively.

The respondents' views are summarised as follows:

Many mainland companies in Hong Kong use the city as the first port of call in their going-out strategy. They first establish their presence in the local market and then leverage Hong Kong’s leading edge in financial and professional services, including capital flow, corporate governance, and tax, accounting, legal and other professional services, to help them to exploit overseas markets.

As a leading financial and trading centre of the Asia-Pacific region with professional services to international standards, Hong Kong attracts mainland companies setting up regional headquarters/regional offices for the Asia-Pacific or international markets. Hong Kong resources and expertise can then help them to expand into the ASEAN market in Southeast Asian countries like Malaysia and Indonesia and explore market opportunities in the Middle East and other BRI

Meanwhile, mainland companies in Hong Kong generally have a high opinion of the knowledge base in the territory, believing that the understanding of international business regulations and familiarity with the mainland business environment and culture will help the companies co-operate better with global partners and assist them in their communications with foreign companies, which are vital to their efforts to build and maintain international business.

Mainland companies are keen to use Hong Kong’s open environment to bring in foreign goods and technologies to better develop and serve the mainland market. “Going global” can also help mainland companies find foreign partners to expand their mainland business, better integrate into the national development blueprint, and better bring into play the crucial role of domestic and international dual circulation.

[1] On 18 October 2023, Chinese President Xi Jinping delivered a keynote speech entitled “Building An Open, Inclusive and Interconnected World for Common Development” at the Third Belt and Road Forum for International Co-operation. In this speech, he announced eight major initiatives China will take to support the joint pursuit of high‑quality BRI co‑operation. The eight initiatives include building a multidimensional BRI connectivity network, supporting an open world economy, carrying out practical co‑operation, promoting green development, advancing scientific and technological innovation, supporting people‑to‑people exchanges, promoting integrity‑based BRI co‑operation, and strengthening institutional building for international BRI co‑operation. (For further details, see President Xi Announces Raft of Eight New BRI Initiatives.)

First, please LoginComment After ~