How to navigate sidecars in reinsurance and insurance-linked securities

Andrew Franklin, Vice President Insurance Fund Services

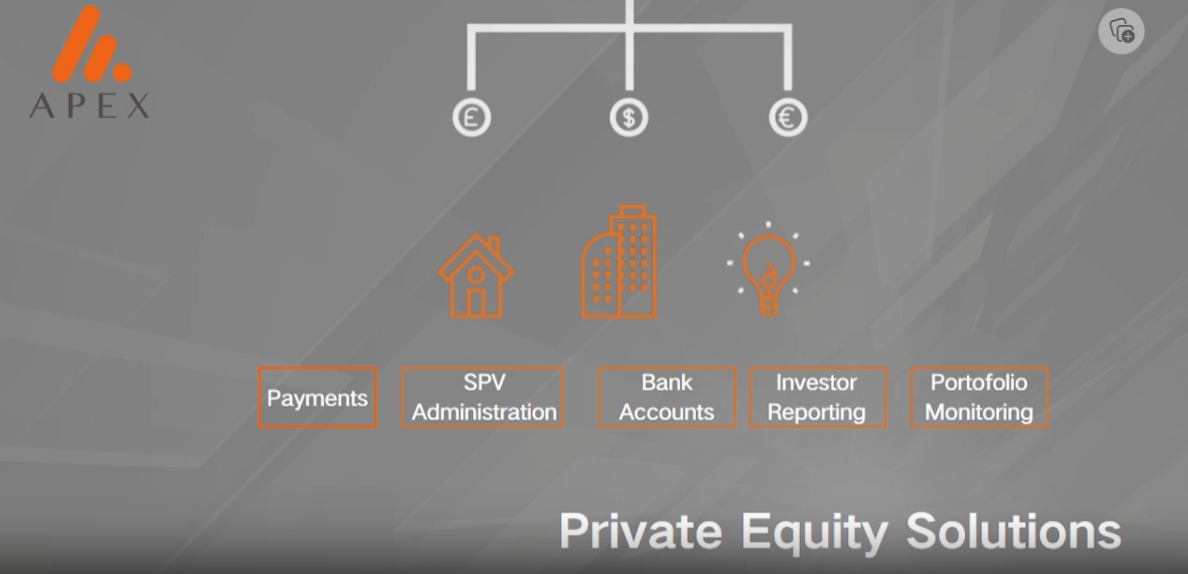

Sidecars have become an integral feature in the landscape of reinsurance and insurance-linked securities (“ILS”) over the last decade. These special purpose vehicles (“SPVs”), established to enable investors to assume insurance risk in exchange for a share of the premiums and profits, have developed into an innovative method for insurers to transfer risk and raise capital while providing a lucrative investment opportunity for those with the appetite for it.

At its core, a sidecar is a financial structure that facilitates risk transfer from a reinsurer to capital market investors. The vehicle is typically set up by a reinsurer and funded by third-party investors. These investors then take on a share of the reinsurer's risk in exchange for a proportion of the profits. The sidecar structure is, therefore, an example of convergence between traditional insurance and the capital markets, with investors essentially acting as reinsurers.

There are two main types of sidecars: quota share and excess-of-loss. In a quota share sidecar, the investor takes on a pro-rata share of the reinsurer's entire book of business. This means that the investor is exposed to both the losses and profits of the reinsurer in direct proportion to their investment. In contrast, an excess-of-loss sidecar sees the investor take on only the losses above a certain threshold, up to a specified limit. This structure, therefore, allows the investor to benefit from the reinsurer's profits while capping their exposure to losses.

Pros and cons of sidecars for investors and reinsurers

From the investor's perspective, sidecars offer several advantages. For one, they provide access to a diversified stream of returns that is largely uncorrelated with other asset classes, making them an attractive addition to a broader investment portfolio. Additionally, because the sidecar is a finite entity, typically lasting for one or two years, the investor has a clear exit strategy. Conversely, sidecars expose investors to significant risk, with the potential for substantial losses if the reinsurer's book of business performs poorly. Furthermore, the lack of liquidity in sidecar investments can be a drawback for some investors.

The payoff for a sidecar investment is dependent on the performance of the reinsurer's book of business. If the reinsurer experiences lower-than-expected losses, the investor stands to make a healthy return on their investment. Conversely, if losses exceed expectations, the investor could lose their entire investment. The exact nature of the payoff will depend on the structure of the sidecar, with quota share arrangements providing a more straightforward pro-rata share of profits and losses, while excess-of-loss arrangements cap the investor's exposure to losses.

From the reinsurer's perspective, sidecars provide an effective means of transferring risk and raising capital. By offloading some of their risk to the capital markets, reinsurers can free up their balance sheets and reduce their exposure to catastrophic events. At the same time, the influx of capital from the sidecar can be used to underwrite new business, providing a boost to the reinsurer's bottom line. The downside for the reinsurer is that they must share their profits with the sidecar investors, potentially reducing their overall return.

Revenue streams from sidecars

In terms of the mechanics of how investors make money from sidecars, it is worth noting that there are two main revenue streams: premiums and investment income. The premiums are the payments made by the cedant (the entity transferring the risk) to the reinsurer in exchange for the coverage. These premiums are then passed on to the sidecar, with the investor's share being proportional to their investment. The investment income is generated by the sidecar manager investing the capital provided by the investors. The profits from these investments are then shared between the investors and the sidecar manager. It is important to note that the investment income can be significant, with some sidecar managers employing sophisticated strategies to increase returns.

In conclusion, sidecars have emerged as an innovative method for reinsurers to transfer risk and raise capital while providing an investment opportunity for those with the appetite for it. The two main types of sidecars, quota share and excess-of-loss, offer investors different ways to gain exposure to the reinsurance market, each with their own distinct advantages and disadvantages.

First, please LoginComment After ~