International Investors’ KRW Trading For Local Stocks and Bonds Investment To Be Easier

The Korean government aims to improve convenience for international investors in line with global practices as part of its efforts to enhance foreign investors’ access to the Korean onshore capital markets. The Bank of Korea, the Ministry of Economy and Finance, the Financial Services Commission, and the Financial Supervisory Service have prepared measures to enhance efficiency and stability of securities settlement and FX trading for offshore investors, reflecting opinions collected through rounds of discussions with foreign investors, including the recent Investor Relations session in London held by First Vice Minister Kim Byoung-hwan.

The Foreign Exchange Transactions Regulations will be revised during the first quarter. Through this revision, it is expected that foreign investors will be able to trade locally-listed stocks and bonds without going through complex FX procedures and paying additional FX costs. The following is a brief overview of the measures:

(1) KRW overdrafts allowed to avoid settlement failures

First, offshore investors are allowed for KRW overdrafts to reduce the burden of potential settlement failure resulting from delayed FX procedures. FX settlements failure was not an issue until recently as foreign investors have been conducting FX transactions only with local custodian banks which they mainly traded with. While such practice was effective in minimizing the risk of settlement failure arising from time difference, complex interbank transfer processes and computer errors, etc., this has been limiting opportunities for reducing their FX costs. Although FX trading with third parties have been liberalized since last year to help reducing costs, the risk of settlement failure has hindered active operation of FX trading with third parties.

Going forward, however, foreign investors will be able to choose a favorable FX trading institution without fear of settlement failures, as they will be able to borrow money for securities settlement even if any issue arises in the process. Offshore investors will be automatically authorized for overdrafts from local custodian banks once they notify the banks that they have FX transactions in progress with other financial institutions.

(2) Extending Foreign investors’ usability of KRW cash account using ICSDs

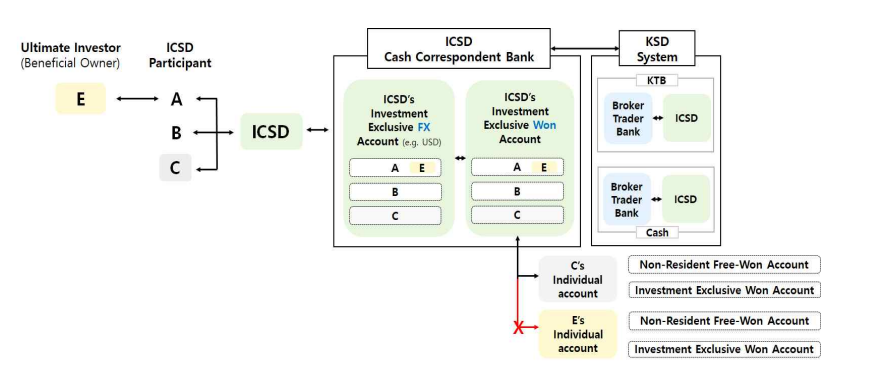

Once any International Central Securities Depository (ICSD) starts operation in Korea, international investors using ICSD or ICSD participants are expected to buy securities and settle their payments via ICSDs’ cash and custody accounts without opening their own personal accounts. This already allows easier KRW trading for foreign investors investing in Korea Treasury Bonds and Monetary Stabilization Bonds, but restrictions on KRW accounts will be further eased to facilitate efficient KRW cash management.

For example, if there already exist separate personal KRW accounts under individual investors’ names opened in local Korean banks, those investors will be allowed to freely transfer their KRW between their own accounts and ICSD’s accounts, as long as they can verify the funds belong to them. In this way, they can utilize their existing KRW holdings to newly participate in ICSDs, without having to retrieve KRW to change into foreign currency and then reinvest via ICSDs. Investors can also decide to transfer KRW under ICSD’s cash account to their own personal KRW accounts, in case they decide to invest independently with their own accounts.

(3) FX transactions streamlined in line with omnibus accounts practice

Last December, the registration requirement (IRC, Investment Registration Certificate) was abolished. Additionally, the reporting duty for using omnibus accounts through global asset management companies and foreign financial investment companies was simplified under the Financial Investment Services and Capital Markets Act. For example, offshore investors using omnibus accounts were previously required to report their transactions immediately, but they are now allowed to report them monthly. To complete the reform, corresponding FX trading will also be streamlined so that individual investors are exempted from the requirement to contract standing agents and open cash-based accounts under their name for FX transactions.

Foreign investors that are actively investing in Korean capital market would especially benefit from this change. For instance, previously if a global asset management company “A” created 100 feeder funds investing in semiconductors, secondary batteries and AI etc., it had to open 100 separate accounts for settlements with securities firms and banks, and exchange currencies separately by each account. However, after the reform, the company using omnibus accounts will be able to trade securities and currencies collectively through a single account under the name of the company “A”.

(4) Clearing uncertainties to establish better market practices

The Korean government is strengthening communication with offshore investors to clear uncertainties surrounding FX trading and KRW transactions. In recent consultations, the need was found to provide explanations of issues that have not yet been established as market practices even with relaxed regulations.

▶ For example, there is a misconception that FX hedging capacity is constrained to the scope of actual demand (the value of invested won-denominated asset) when foreign financial institutions and pension funds invest in won-denominated asset. As foreign financial institutions and pension funds are deemed as professional financial intermediaries that are exempted from the restriction, they are authorized for any amount of FX derivatives transactions for hedging purposes regardless of their actual demand.

▶ Additionally, there exists a misconception that KRW cannot be exchanged in advance without an actual securities transaction. The real demand-based currency exchange system has been phased out, and now investors are allowed to exchange currencies into KRW at any time at optimal prices.

▶ Finally, third party FX trading is fully liberalized, so there is no need to set up their own personal accounts within the institutions they trade with. Only one KRW account under their name in the custodian bank would be sufficient for onshore KRW trading, and investors are free to choose FX trading partners tht provide the best offer.

We will diligently endeavor to dispel all these misunderstandings and devise plans to offer comprehensive guidelines. Concurrently, relevant ministries and agencies will collaborate to firmly establish these practices as new standard practices in the market.

The FX and financial authorities will pursue the revision of Foreign Exchange Transactions Regulations during the first quarter to address the aforementioned issues. Furthermore, we will continue to identify additional tasks necessary to improve foreign investors’ accessibility to the Korean markets. We welcome questions and suggestions from offshore investors.

First, please LoginComment After ~