Consumer Price Developments in January 2024

Summary

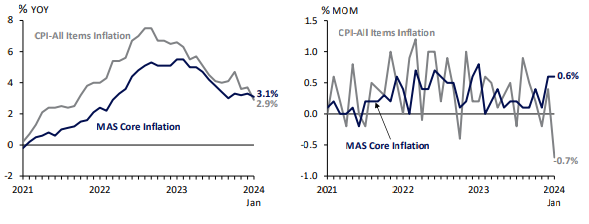

• MAS Core Inflation fell to 3.1% on a year-on-year (y-o-y) basis in January, from 3.3% in December.

o This was driven by lower services and food inflation, notwithstanding the increase in the GST rate from 8% to 9% in January.

o On a month-on-month (m-o-m) basis, core CPI rose by 0.6%, due in part to the 1%-point GST rate increase.

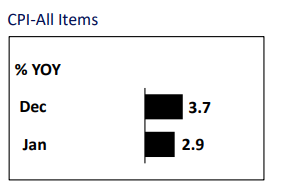

• CPI-All Items inflation eased to 2.9% y-o-y in January, from 3.7% in December.

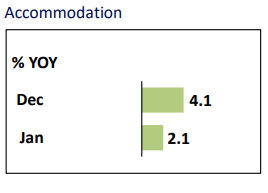

o Apart from slower core inflation, both accommodation and private transport inflation also declined.

o On a m-o-m basis, CPI-All Items fell by 0.7%, as lower accommodation and private transport costs outweighed the increase in core CPI.

Chart 1: MAS Core and CPI-All Items Inflation

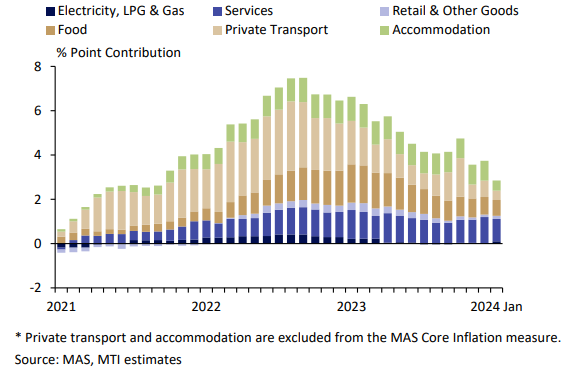

Chart 2: % Point Contribution to Year-on-year CPI-All Items Inflation

CPI-All Items inflation fell to 2.9% y-o-y in January.

CPI-All Items inflation moderated on account of lower inflation for accommodation, private transport, services and food.

Accommodation inflation fell as a larger amount of Service & Conservancy Charges (S&CC) rebate was disbursed in January this year.

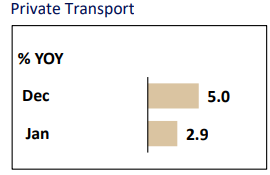

Private transport inflation declined due to a slower rate of increase in car prices, which in turn reflected lower COE premiums.

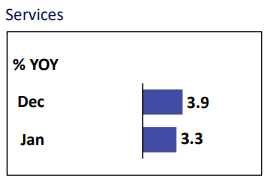

Services inflation eased on the back of a smaller increase in holiday expenses and a larger decline in airfares.

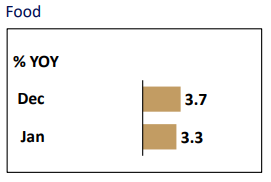

Food inflation moderated as the prices of cooked and non-cooked food rose at a more gradual pace.

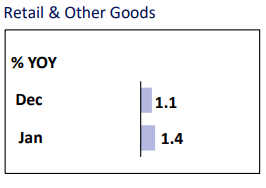

Retail & other goods inflation picked up due to an increase in the prices of clothing & footwear, as well as medicines & health products. At the same time, the prices of personal effects recorded smaller declines.

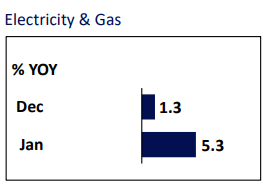

Electricity & gas inflation rose on account of larger increases in electricity and gas tariffs.

First, please LoginComment After ~