Market resilience, non-bank financial institutions and the central bank toolkit – practical next steps

Last Autumn, Andrew Hauser, the then Executive Director to Markets, set out in a speech, entitled “a 1000-mile journey starts with a single step” that the Bank had started work to expand the tools it has to intervene when liquidity related dysfunction in core markets threatens UK financial stability. Since then, Andrew has gone on a 10,000 mile journey to take up a role as Deputy Governor at the Reserve Bank of Australia. But our focus remains on continuing the journey to develop tools to help ensure the resilience of core markets.

Our initial area of focus is the gilt market, given its size, interconnectedness to other markets and the real economy and its importance to financial stability. Therefore, in the first phase of our work we are looking to develop a tool that will act as a backstop in stress by providing liquidity to this market by lending cash to non-bank financial institutions (NBFIs) against gilts.

Today I want to update you on our progress, what we have learned along the way, and the practical next steps we are taking in the first phase of our work.

In doing so there are some points that I’d like to emphasise:

- First, that we are seeking to develop a tool that alleviates risks of significant disorder in the gilt market.

- Second, we expect this to be a contingent tool that we activate in stress rather than a standing facility that is available in normal times.

- Third, while this is an innovative facility it will draw on traditional central banking principles: the facility will be priced to be effective in periods of stress, but expensive in normal times; and the provision of liquidity to the system will be supported by prudent levels of haircuts. These will help ensure market participants are suitably incentivised to self-insure against a range of liquidity shocks and improve resilience.

- Fourth and finally, that as we progress this work, we are open to feedback every step of the way. We will continue to set out our thinking as it evolves and will be keen to hear feedback from markets participants.

The reason we are taking this action is the growing importance of non-bank financial institutions. These institutions have grown in significance across a range of markets, including those that households, businesses and governments use to borrow, save or access financial services.

The figures are striking. Non-banks now account for around half of total UK financial assets;footnote[1] over the last two decades they have accounted for the entirety of the cumulated increase in new corporate lending in the UK;footnote[2] and non-bank financial institutions now account for 50% of the stock of corporate lending.footnote[3]

This trend is also clear and present in the UK government bond market. The gilt market is critical for government financing, but also of significant broader importance as a source of safe assets, the basis of much secured lending and has an extremely high level of interlinkage with other financial markets and the real economy.

Non-banks are significant holders of gilts and users of gilt repo.footnote[4] And while bank dealers (GEMMs) play a key role in providing liquidity to the gilt market their capacity to do so, proxied by their asset holdings, is little changed since 2008, while the stock of gilts in issue has tripled.

The implications of this are far from theoretical and have given rise to new vulnerabilities and sources of liquidity risk that have all too real a potential to cause financial instability and impact the broader economy. Two recent examples of extreme dysfunction underscore that and help illustrate why we initially plan to focus the tool on the gilt market, and insurance companies, pension funds and liability-driven investment funds (collectively ICPFs) as counterparties.

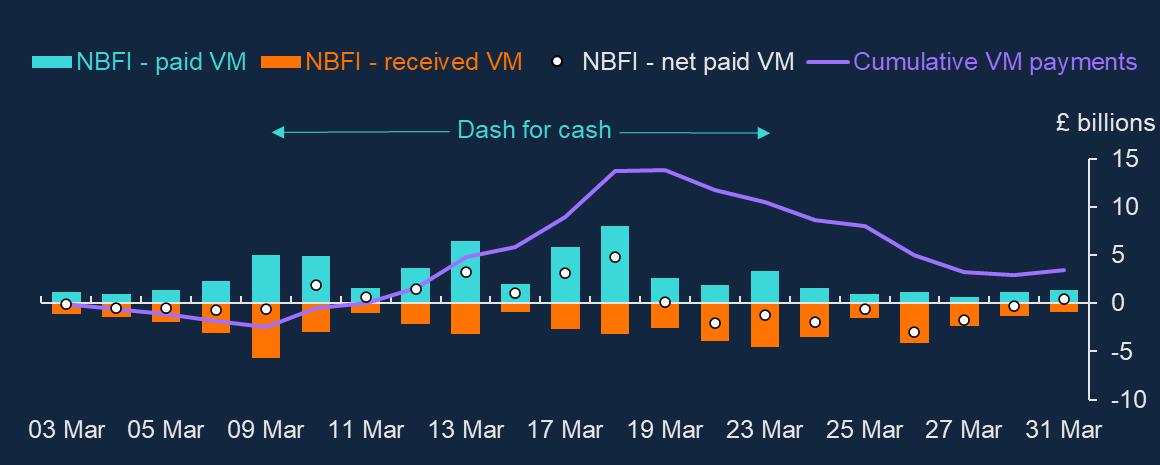

In March 2020, conditions in government bond markets deteriorated rapidly as demand for short-dated cash-like instruments increased sharply. This reflected market participants, and in particular non-banks, selling a range of assets, including government bonds in very large quantities to raise cash to meet margin calls and redemptions (Chart 1). Net selling activity in that episode was broad-based, but ICPFs accounted for just under 40% of NBFI net sales.footnote[5]

During this “dash for cash”, UK-based dealer banks were able initially to absorb some of this pressure. They provided an additional £50bn of lending to clients via reverse repo against gilt collateral and expanded their gilt inventory by around £10bn.footnote[6] But this was insufficient to meet all of the market demand for liquidity. Bank of England staff analysis suggests that dealer intermediation constraints contributed to the sharp deterioration in market functioning and may have accounted for around a third of the rise in term gilt repo spreads.footnote[7]

Chart 1 – Net NBFI variation margin in the dash for cash

Footnotes

- Source: Assessing the resilience of market-based finance | Bank of England

Of course, in this instance central banks across the world acted. In the UK, the Monetary Policy Committee judged that, “an increase in the Bank’s gilt purchases would help improve the functioning of the gilt market and help to counteract a tightening of monetary and financial conditions that would put at risk the MPC’s statutory objectives, especially as the economy was now likely to be weakening very rapidly.”

A second example of severe dysfunction was in 2022 when UK financial assets saw a significant repricing, with a particular impact on long-dated gilts. The episode exposed vulnerabilities in liability-driven investment (LDI) funds and the FPC judged that UK financial stability was at risk due to the dysfunction in the gilt market and recommended that the Bank take action. In this instance the Bank intervened via temporary purchases of long-dated gilts. During that period 70% of net selling was from ICPFs, including liability-driven investment funds.

Actions by central banks and global regulators are seeking to address such vulnerabilities in the non-bank sector, which should in turn, and over time, reduce their demand for liquidity in times of stress and lead to increased resilience in core markets. A number of international and UK domestic reforms are under way, including improving margin practices, mitigating financial stability risks from NBFI leverage, increasing the resilience of MMFs and addressing structural vulnerabilities in open ended funds.footnote[8] The Bank is also conducting a system-wide exploratory scenario (SWES) to improve our understanding of the behaviours of banks and non-bank financial institutions during stressed financial market conditions and how those behaviours might interact to amplify shocks in financial markets that are core to UK financial stability.

This work is seeking to ensure that responsibility for appropriate levels of resilience resides with NBFIs. Just as is the case with banks,footnote[9] it is unrealistic (and arguably undesirable) to ask firms to insure against the most severe, system-wide stresses. Therefore, in parallel to, and aligned with, those reform efforts, we want to take some practical steps to backstop market functioning in severe market stress by expanding our central bank toolkit with the ability to be able to lend against high quality collateral to non-banks. While we cannot rule out needing to perform financial stability purchase operations again, a lending tool is likely to be effective, and preferable to asset purchases, when market participants face temporary shortfalls in liquidity, due to large margin calls, for example.

Last year, we set out a two-part plan to expand our toolkit to include such a lending tool.

First, we are developing a tool that helps ensure financial stability in the gilt market by providing back stop liquidity in periods of market dysfunction to eligible insurance companies, pension funds and associated liability driven investment funds. These sectors have been significant sellers of gilts in past stress episodes and have higher levels of resilience relative to other non-bank sectors.footnote[10]

Second, and over time, we will consider how this tool might be broadened in scope and scale to include a broader range of NBFIs as counterparties. We will do this in a way that is aligned with, and helps support, improvements in resilience in those sectors. While our initial focus is on the gilt market, we will review whether any other financial markets should be in scope if they are core to financial stability.

Since setting this out publicly we have undertaken a range of market engagement, with a particular focus on the first phase of our plan. We have spoken to a number of firms across the insurance company, pension fund and LDI sectors, and have also engaged with market infrastructure providers, relevant regulators, other central banks and international bodies. From those various engagements a few themes have emerged, which have helped inform our work (see Figure 1). I’d like to draw out a few of these.

- First, we have received a positive reaction from firms and regulators. Firms felt that the tool would be a useful source of liquidity in times of stress. However, they noted that the terms of the tool would be important in determining whether they would sign up for it, the extent that it might be used in stress and therefore its effectiveness. We agree that the terms will be important for determining the effectiveness of the tool and it is also important that they help mitigate moral hazard and maintain appropriate incentives for firms to self-insure.

- Second, firms thought the presence of a gilt-market focussed tool would be helpful. However, some raised a question of whether a wider set of collateral would further increase the effectiveness of the tool. We are clear that the first phase of this tool should be focussed on addressing the risk of dysfunction in the gilt market given its clear systemic importance, and that eligible collateral should therefore be restricted to gilts. Over time we will assess whether other markets might also be deemed as “core”, but this will be based on their size, interconnectedness and importance to financial stability and the real economy.

- Third, firms suggested that we set eligibility rules to maximise the efficacy of the tool. We agree that it’s important that the tool is effective in stress by reducing the risks of fire sales from those firms that are significant holders of gilts and also exposed to liquidity risk. This will inform our eligibility approach.

- Fourth, and finally, firms noted that to ensure operational readiness it would be preferable to have a standing facility. It is important that firms have a high level of operational readiness, but we think that the set of considerations around whether a facility should be always on, or just activated in stress, is much broader, as I will go on to discuss.

Figure 1 – Key takeaways from external engagement

The engagement with the market has therefore been very helpful in shaping our thinking and has contributed to a number of emerging design choices, on which we want to engage further.

In considering these choices we continue to be mindful of balancing the need to have a tool that is impactful in stress; and reduces the need to make use of financial stability purchase operations, while also ensuring that the operation itself remains a backstop to market functioning and does not fully substitute for a firm’s self-insurance against shocks.

I’d like to focus on a small number of emerging design choices (Figure 2). It is important to emphasise though that no final design choices have been made yet:

- Operating model – we have considered a range of operating models for this tool. In the first phase of the tool, and given the initial focus on ICPFs, we think the simplest approach is one where these institutions directly interact with the Bank. It’s important to emphasise that while we would look to lend to these eligible institutions, we would not be extending reserve account access. In the second phase of our work, we will consider a range of indirect models, including the possibility of central clearing, which may offer much greater scalability.

- Eligibility – firm eligibility will initially be limited to ICPFs. Eligibility criteria will be set out in a Market Notice, so firms can judge whether they are likely to be eligible. Eligibility criteria are likely to take account of a firm’s presence in the gilt market, the extent of liquidity risk that they face, and that they are appropriately regulated. This will be important in obtaining a good level of market coverage for the tool, given the direct model of operating will place constraints on the overall number of participants. The Bank is carefully considering whether to apply a minimum standard of credit risk for firms to access the tool.

- Contingent, not standing – our NBFI lending tool is intended to address gilt market dysfunction rather than being a source of individual firm liquidity insurance. A standing facility would go against that intention, as it could be used as a bilateral facility when an individual firm faces an idiosyncratic shock, unless the pricing is very penal. But having very penal pricing could undermine the effectiveness of the tool in times of market-wide stress. We therefore think a contingent tool that can be activated during stress is likely to be more effective in delivering on our objectives. The challenge that firms have raised regarding operational readiness will be addressed via the onboarding process and a programme of regular test trades, something that is already a feature in our Sterling Monetary Framework operations with banks.

- Pricing – work is underway on the pricing, and it is likely that the pricing of the tool would be announced at the time of activation rather than in advance. To be effective as a backstop the pricing would therefore be set at a level that may not be attractive in normal conditions but would encourage wide usage in times of stress, helping increase impact and minimise stigma.

- Flexibility and transparency – market participants will want to understand some features of the tool in advance. For example, we are likely to have a published haircut schedule and any fees for access to the scheme will be set out clearly. However, we may need to retain some flexibility in design so that the tool can respond effectively to the stress that it is intended to counter. In those areas where we retain flexibility, such as pricing, we would communicate about the principles behind our approach.

- Information reporting - to help inform the Bank’s understanding of the evolution of the market, business models and attendant risks, we would expect counterparties to regularly provide such liquidity and risk management information as the Bank may require, where such information is not already provided to the Bank or the PRA. As with our existing Sterling Monetary Framework, we would also expect participating firms to provide high quality market intelligence, which has been shown to be a very effective way of identifying and diagnosing market stress, along with our data-driven market analysis.

Figure 2 – summary of emerging design choices

As we continue this work, we will also remain mindful of the future evolution of the tool in our two-part plan: first to launch a tool for ICPFs; second to pursue a scalable model that could be extended to other sectors. In particular we will consider:

- what sectors the tool should be expanded to cover and how that assessment will be made;

- how we can achieve a model that is scalable not just to new sectors but also a much larger number of firms than we engage with in our existing operations; and,

- how to ensure that an appropriate balance is struck between the incentives of firms to continue to improve their own resilience levels and engage with international regulatory reform efforts, while also ensuring that the tools can be effective in stress.

None of the answers to these questions are easy. But the prize is significant. A lending facility that can help ensure financial stability in periods of potential market turmoil, will mean that we are less reliant on in extremis interventions such as financial stability asset purchases while maintaining appropriate incentives for self-insurance and regulatory reform.

As we continue this journey, we look forward to continuing to work closely with firms, industry bodies and regulators.

Thank you

I would like to thank Phil Blackburn, Clare Macallan, Pierre Ortlieb and Alexandre Rousseau and for their help preparing this speech as well as many Bank colleagues for their helpful comments and suggestions.

Assessing the resilience of market-based finance | Bank of England

Financial Stability Report - December 2023 | Bank of England

Assessing the resilience of market-based finance | Bank of England

Assessing the resilience of market-based finance | Bank of England. Analysis based on analysis on the methodology used in Decomposing changes in the functioning of the sterling repo market | Bank of England

See Financial Stability Report - December 2023 | Bank of England

Loughborough lecture: Banking today - speech by Andrew Bailey | Bank of England

Insurance companies are regulated by the PRA, LDI funds are subject to minimum resilience standards (Bank staff paper: LDI minimum resilience - recommendation and explainer | Bank of England) and pension funds are regulated by The Pension Regulator (TPR).

First, please LoginComment After ~