Chile: A Stable Partner in Latin America

Thanks to its stable economy, an open and extended trade network, and a supportive investment regime, the Chilean economy has made a rapid recovery from the global pandemic. Boosted by the Free Trade Agreement (FTA) that came into effect in 2014, Chile has become an increasingly significant market for Hong Kong, and has been the city’s third‑largest trading partner in Latin America for nearly a decade.

In April 2023, Hong Kong and Chile updated their commitments on trade in services under the Hong Kong‑Chile FTA, creating a new window of opportunity for Hong Kong service providers. As an international financial centre, Hong Kong could further extend its reach to Chile, while deeper technological exchanges could facilitate incubation of state‑of‑the‑art technologies, particularly in that are considered up‑and‑coming fields such as sustainability and digitalisation.

To keep track of Chile’s latest economic developments and identify new business opportunities, HKTDC Research recently undertook a consultative visit and talked to a diverse panel of government officials, trade and investment associations, and industrial practitioners.

Stable and export-oriented

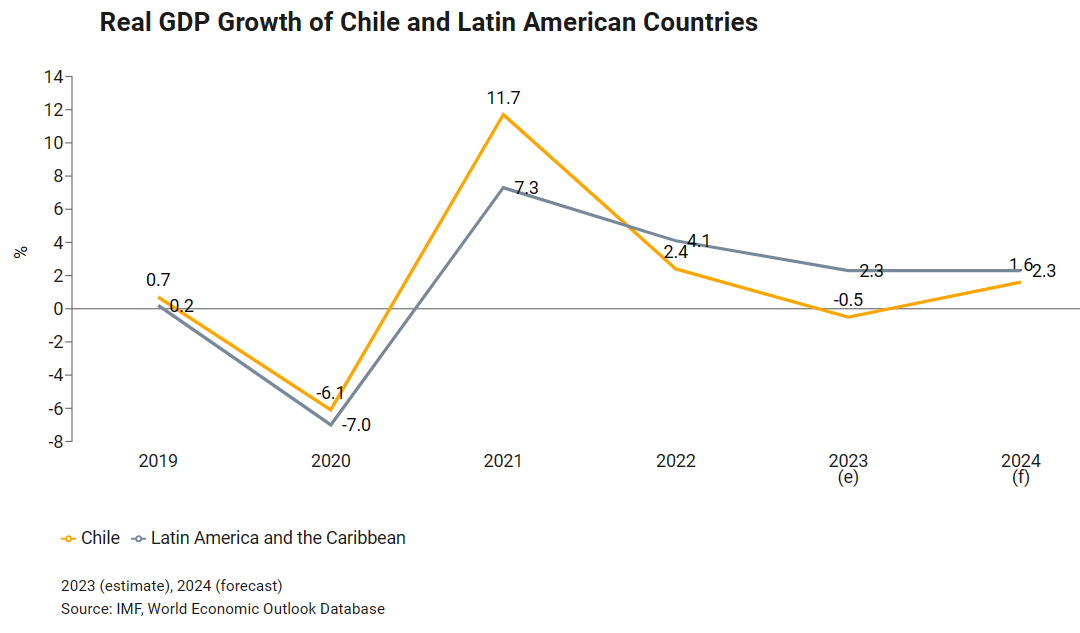

Chile, thanks to its rich copper and gold reserves, has had a quick economic recovery after the pandemic as commodity prices have skyrocketed. The export‑led Chilean economy outperformed the Latin America and the Caribbean region as a whole (7.3%) with an economic growth of 11.7% in 2021. Despite setbacks in 2022 and 2023 as commodity prices stabilised, Chile is expected to grow by 1.6% in 2024 in the light of a thriving services sector which accounts for more than 60% of the country’s GDP.

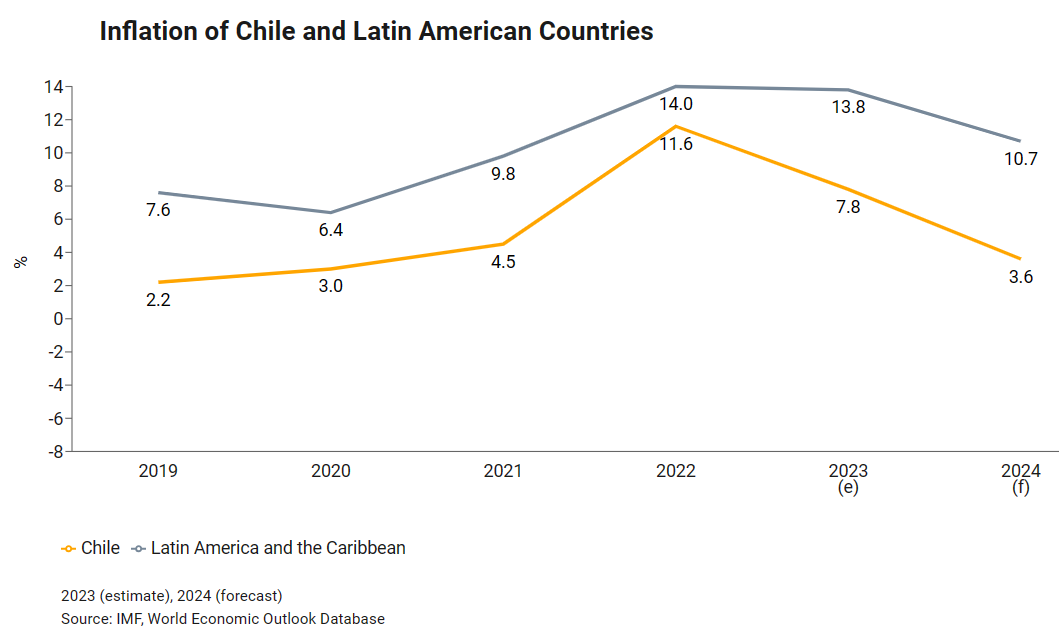

Unlike most of its Latin American peers, Chile tamed inflation effectively during the pandemic with its prudent monetary policy. The country’s inflation eased to 3.8% in January 2024, showing good progress on achieving the central bank’s target rate of 3%. This relatively low inflation has helped Chile boost investment and maintain consumer confidence to keep the economy moving.

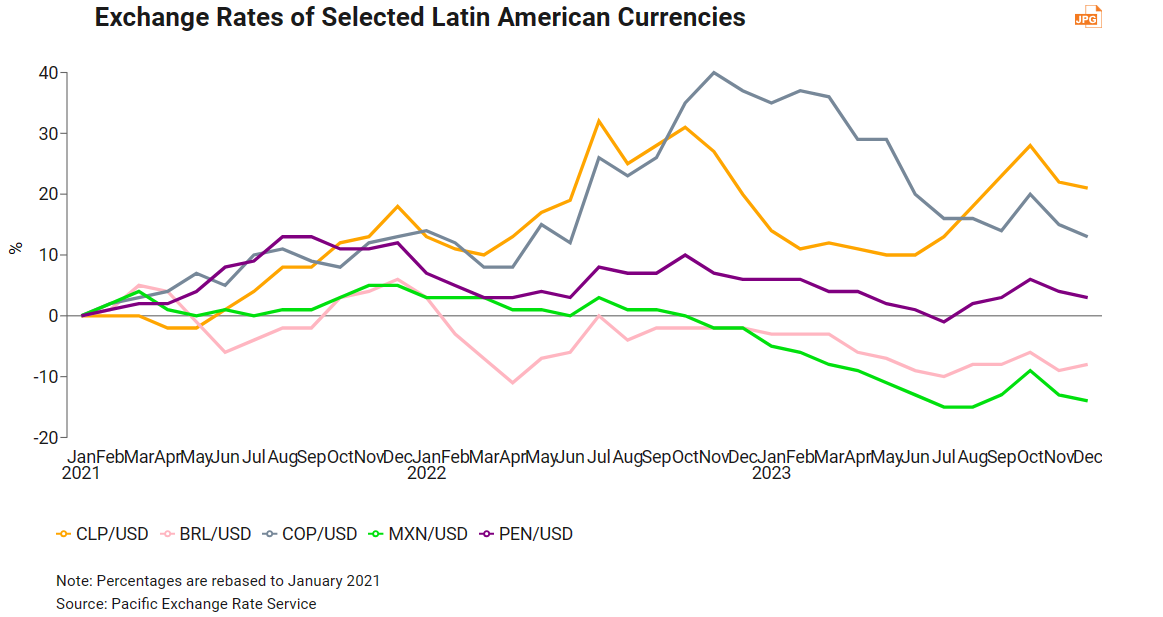

Looking ahead, Chile’s economic growth will continue to be reliant on its primary exports, including minerals, agricultural goods and fishery products, despite an anticipated appreciation of the Chilean Peso after a 10%‑plus depreciation against the US dollar since January 2021.

Chile’s exports showed impressive resilience in the face of Covid‑led supply chain disruptions. In 2020, according to WTO, global exports of goods shrank by 7.4%, but Chile maintained an export growth of 7.6%. The country’s export growth (28.0%) continued to outperform the world average (26.6%) in the following year, before it fell back to 4% growth in 2022 in the wake of falling commodity prices.

A revival of brick-and-mortar

Despite an unprecedented and ongoing expansion of e‑commerce which offers convenience and a wide range of goods, physical shopping in Chile has revived post‑pandemic. One of the reasons is that shopping malls serve Chileans and other Latin America consumers as an important social venue to establish and maintain relationships.

Favourable business dynamics

Chile is one of the most dynamic Latin American nations with a competitive and liberal regime for business and investment. The country came second in Americas region in the 2023 Index of Economic Freedom [1] rankings, surpassed only by Canada, thanks to a transparent business climate, an efficient regulation system and an open‑market mentality. A more stable and predictable political environment after the 2025 presidential election is expected to lead to higher investor confidence in Chile and a more favourable business climate.

Chile actively welcomes foreign direct investments (FDI) in a number of strategic industries and key development projects. According to Banco Central de Chile Canada (FDI stock of US$35.5 billion), the US (US$22.8 billion) and the Netherlands (US$21.2 billion) were the principal investors in Chile in 2022.

Investment from China has also grown rapidly in recent years, with FDI stock surging more than 760% from US$81 million to US$700 million over the decade ending 2022, compared to a 43% overall inward FDI stock growth in Chile.

Investment opportunities are prioritised in alignment with national targets, including sustainability, value‑adding expansion of mining products such as copper, lithium and cobalt, and infrastructure for better interconnection, to name but a few.

|

Chile’s Inward FDI Stock in 2022 | ||

|

Total (US$ mn) |

Share (%) | |

|

World |

256,516.7 |

100 |

|

Canada |

35,537.1 |

13.9 |

|

The US |

22,758.2 |

8.9 |

|

The Netherlands |

21,220.5 |

8.3 |

|

Source: Banco Central de Chile | ||

Chile has bolstered their start‑ups ecosystem and productivity through a range of financial, innovation and technological support and incubator/accelerator schemes. With synergy from academia, industry, R&D institutions and trade and technology associations, start‑ups have a survival rate of 47% under the seed accelerator schemeStart-Up Chile. Although there are no specific treatments or requirements stipulated for different sectors under the scheme, start‑ups in the field of logistics and retailing or wholesaling of consumer products have registered the biggest successes.

Thirst for sustainability

Chile is dedicated to delivering sustainability and achieving carbon neutrality by 2050. The adoption of the United Nations’ 2030 Sustainable Development Agenda in 2015 and the ratification of the Paris Agreement in 2017 aside, the Andean state updated its Nationally Determined Contributions (NDCs) in 2020 with the absolute goal of reducing carbon dioxide emissions by 45% from 2016 levels. Apart from various ESG disclosure requirements imposed on large corporates, the country has been actively promoting improved waste management and a transition to renewable energy.

The country’s foreign investment promotion agency,InvestChile, has been proactively promoting various sustainability‑related investment projects to foreign investors. Early successes include an expansion of a Brazilian waste management company to work in Chile’s mining and salmon farming sectors, and a French‑invested recycling plant in the Antofagasta Region specifically designed to handle some 70% of used mining tires in Chile.

Chile’s climate features strong winds and high intensity solar radiation, offering favourable conditions for transition to renewable energy. The country was ranked 14thglobally and 1stin Latin America inEY’sRenewable Energy Country Attractiveness Index (RECAI)[2] report in 2023. With the goal of generating 80% of its electricity from renewable energy sources by 2030, Chile has invested substantially building renewable energy plants, including South America’s largestfloating solar plantbuilt on a dam with nearly 2,000 panels, and the region’s firstgeothermal power plant.

International trade

Chile is quite possibly the most liberal trader in Latin America, with an extensive FTA network with over 65 countries. Located on the Pacific side of the South America continent, Chile has a long coastline and is one of the few transportation hubs connecting Latin America with Asia. This geographic advantage enables the country to serve as a transhipment hub for its neighbours (including Argentina, Bolivia, Brazil and Paraguay), reducing the sea voyage to and from Asia from Chilean ports, compared to Atlantic alternatives.

|

Chile’s Trade (by product) in 2022 |

Total Value (US$ mn) |

Share (%) |

|

Key Export Commodities | ||

|

Ores, slag and ash |

27,248.3 |

26.6 |

|

Copper and articles thereof |

21,556.3 |

21.0 |

|

Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, ... |

10,391.7 |

10.1 |

|

Edible fruit and nuts; peel of citrus fruit or melons |

8,029.4 |

7.8 |

|

Fish and crustaceans, molluscs and other aquatic invertebrates> |

7,457.8 |

7.3 |

|

Key Import Commodities | ||

|

Mineral fuels, mineral oils and products of their distillation |

109,265.6 |

25.9 |

|

Vehicles other than railway or tramway rolling stock, and parts and accessories thereof |

28,296.8 |

11.0 |

|

Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof |

12,051.9 |

9.8 |

|

Electrical machinery and equipment and parts thereof |

10,730.6 |

7.9 |

|

Plastics and articles thereof |

8,636.9 |

3.1 |

|

Source: ITC Trade Map | ||

Chile’s imports encompass a broad array of goods, including machinery and equipment, electronics and cars. In terms of exports, Chile is renowned for its hard and soft commodities such as minerals, fruits, fish and meat. In fact, the country is the world’s largest copper exporter (responsible for one‑fourth of global copper exports) and salmon farming surged as the second largest export sector of the country (responsible for 7% of Chile’s exports).

|

Chile’s Trade (by market) in 2022 |

Total Value (US$ mn) |

Share (%) |

|

Exports | ||

|

Mainland China |

38,915.4 |

37.9 |

|

US |

15,586.4 |

15.2 |

|

Japan |

7,759.4 |

7.6 |

|

South Korea |

6,147.4 |

6.0 |

|

Brazil |

4,886.4 |

4.8 |

|

Imports | ||

|

US |

26,109.0 |

23.9 |

|

Mainland China |

25,227.0 |

23.1 |

|

Brazil |

10,983.0 |

10.1 |

|

Argentina |

6,495.8 |

5.9 |

|

Germany |

2,868.3 |

2.6 |

|

Source: ITC Trade Map | ||

Mainland China is by far Chile’s largest trading partner, followed by the US. Product‑wise, the market share of Chinese‑made cars has been fast growing in recent years, thanks to their quality and competitive pricing. Sales growth of Chinese carmakers such asDongfeng,BYDandGWM have all surpassed that of many Japanese and South Korea brands in Chile.

On the other hand, mainland China is a key buyer of Chilean mining and agricultural products such as copper, cherries and wine. For example, more than 88% of Chilean cherries, 364,000 tons in total, were sold to mainland China in 2023 to meet the high demand during festivals such as Chinese New Year, Single’s Day and Christmas.The Chilean Fruit Exporters Association (ASOEX)anticipates that Chilean cherries will become a regular part of the daily diet in mainland China given the fruit’s versatility in a wide range of culinary creations.

An updated Hong Kong-Chile FTA

With FTAs being an essential engine for trade and economic growth, more opportunities are set to come for Hong Kong businesses in tandem with the new services commitments, which entered into force in April 2023, in addition to the 2014 Hong Kong‑Chile FTA.

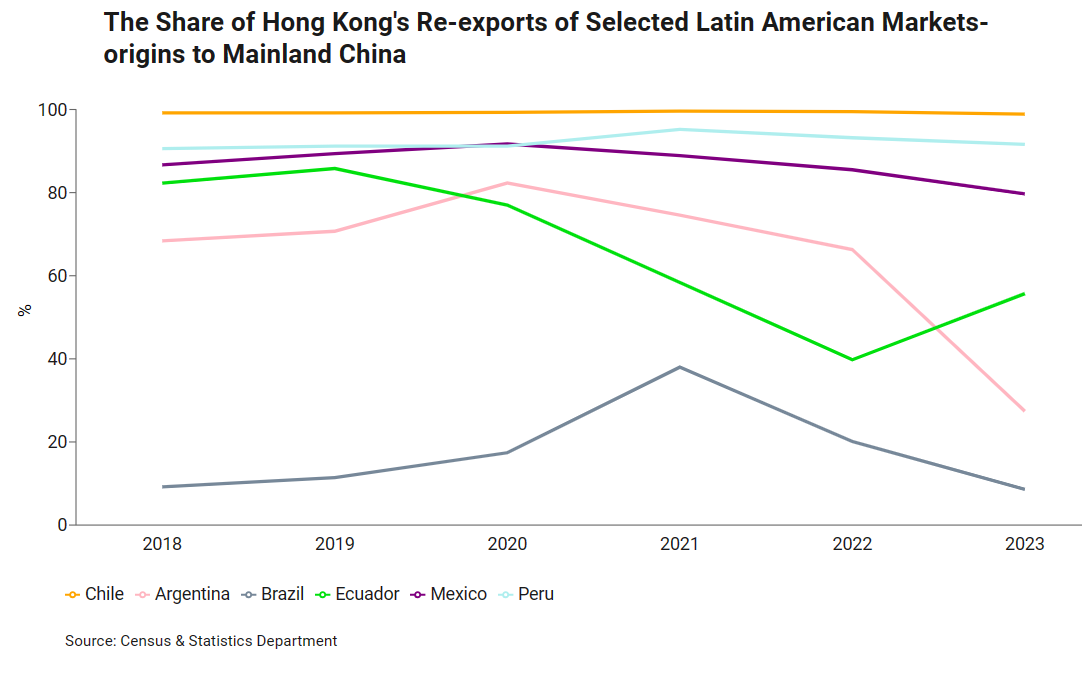

Hong Kong’s efficient custom procedures, recognition of standards, and financial and investment framework are just some of the incentives for Chileans to work with Hong Kong companies and trade through Hong Kong. Consequently, Hong Kong has often been the first port of call for Chilean products to enter Asian markets. In the past 5 years, Hong Kong re‑exported almost all of its imports (99.3%) from Chile to mainland China, including wines and fruits.

To further strengthen economic ties between the two economies, Chile’s Undersecretariat of International Economic Relations (SUBREI) announced new and modernised services commitments which entered into force in April 2023 under the existing Chile‑Hong Kong FTA. The new commitments span over 50 new service sectors, including those where Hong Kong already excels or has potential for further development, such as professional and business services, technical testing and analysis services, engineering and construction services, convention services, computer and related services, research and development services, scientific and technical consulting services, and distribution and transport services.

The expanded commitment on services trade under the FTA is set to strengthen Hong Kong’s service business ties with Chile. Given the lack of market understanding and language barriers, Latin American firms are in constant need of reliable suppliers and business partners in Asia and mainland China with value‑for money products and market intelligence. Hong Kong, as an international trading and logistics hub, can offer its Chilean counterparts an extensive web of professional services, particularly when it comes to sourcing, quality control, marketing, branding, and business consultation and advice.

A logistic bridge between Asia and Latin America

The strategic location of Chile enables it to play a vital role in connecting Asia and Latin America and facilitating trade between the two. Every year, around 40% of Chile’s goods are exported to neighbouring markets such as Argentina, Brazil and landlocked countries like Bolivia and Paraguay.

Shipping from Iquique, the major free trade port located in Northern Chile, takes 30 days, reducing the shipping time by 30% compared to the 45‑day voyage from Brazil to Asia through the Panama Canal. The Pacific route became a very important alternative in 2023 because of port congestion (in Brazil, which is said to have caused 6 days delay before berthing, and the recent drought capping the capacity of Panama Canal at 60% of its maximum level.

Notable projects to ready the country for the expansion of Asian‑Latin American trade include the expansion and modernisation of the San Antonio Port, Chile’s primary container port, and the construction of the 2,200‑km Bi‑Oceanic Corridor (Corridor Bioceanico) in collaboration with Brazil, Argentina and Paraguay, connecting the Port of Santos in Brazil with Iquique.

A bright future for Hong Kong-Chile trade and investment

Chile’s stable market‑oriented economy lays down a solid foundation for businesses, both local and international, to flourish. With its ample natural resources, business‑friendly government, and future‑proof development initiatives, Chile is poised to take up a more prominent role in Asian‑Latin American trade and investment. Numerous opportunities in different sectors from merchandise trade to services and investment are there for Hong Kong businesses and their Chilean counterparts to explore under the expanded Hong Kong‑Chilean FTA.

[1] The Index of Economic Freedom measures economic freedom based on 12 factors, including aspects such as the extent of law protection on property rights, tax burdens on individuals and firms, efficiency of business environment, interventions and restrictions on trade and investment. Factors related to regulatory systems and market openness contribute to Chile’s friendly business environment.

[2] The RECAI Index measures the attractiveness of countries’ investment and deployment of renewable energies through identifying markets’ performance in the areas of energy mix, government support, project delivery and natural resources.

First, please LoginComment After ~