Key points of suitability obligations for private equity fund investors

Preface

Recently, the Shanghai Arbitration Commission released a case in which it believed that the private equity fund manager involved in the case "made the fund investor a private equity fund investor even though they knew the fund investor was not a qualified investor. The subsequent series of risk prevention behaviors such as interviews, evaluations, and tests were only in form and constituted a violation of the investor's suitability obligations under the Interim Measures for the Supervision and Administration of Private Equity Investment Funds.". This case has once again made the "investor suitability obligation" that private fund managers should fulfill a focus of attention in the private equity industry. What exactly is the obligation of appropriateness? The relevant normative documents in the field of private equity funds all address this issue, but none provide a comprehensive and detailed definition. The minutes of the National Conference on Civil and Commercial Trial Work of Courts (hereinafter referred to as the "Nine Minutes of the People") provide a comprehensive answer to this question for the first time. According to the relevant provisions of the Nine Principles of the People, when promoting and selling high-risk financial products to financial consumers, seller institutions must fulfill the obligation of understanding customers, understanding products, and selling appropriate products to suitable financial consumers. The fulfillment of the obligation of appropriateness is an important content and prerequisite foundation of "seller's responsibility and buyer's responsibility".

Although the "Nine Minutes of the People's Republic of China" does not explicitly list private equity funds as high-risk financial products, other laws, regulations or normative documents have not explicitly included "private equity funds" in the category of "financial products", and private equity fund managers have not been formally included in the category of "financial institutions" by any laws, regulations or normative documents. However, the Guiding Opinions on Regulating the Asset Management Business of Financial Institutions issued and implemented in 2018 clearly stipulate that private equity investment funds shall be subject to specialized laws and administrative regulations on private equity investment funds, and this opinion shall apply to those laws and administrative regulations on private equity investment funds that do not have clear provisions. In practice, regulatory authorities also regulate private fund managers in accordance with financial institutions, and many places adopt substantive pre-approval for the establishment of private fund managers. The Securities Investment Fund Law stipulates that "fund managers who serve as non-public funds shall complete registration procedures and report basic information to the fund industry association in accordance with regulations. Without registration, no unit or individual shall use the words" fund "or" fund management "or similar names to engage in securities investment activities. Although this legal system" aims to regulate securities investment fund activities, "the China Securities Regulatory Commission and the China Association for Market Regulation have already included private equity investment fund managers in the scope of mandatory registration. The company registration authority also clearly states in the business license issued to private fund management enterprises that" must be registered. "The China Securities Investment Fund Industry Association can only engage in business activities after completing registration and filing. In judicial practice, judicial authorities generally regard private fund managers as financial institutions and consider the private fund products they raise as financial products. Therefore, we understand that the provisions on "suitability obligations" in the Nine Minutes of the People's Republic of China should be applicable to private fund managers and the private fund products they raise.

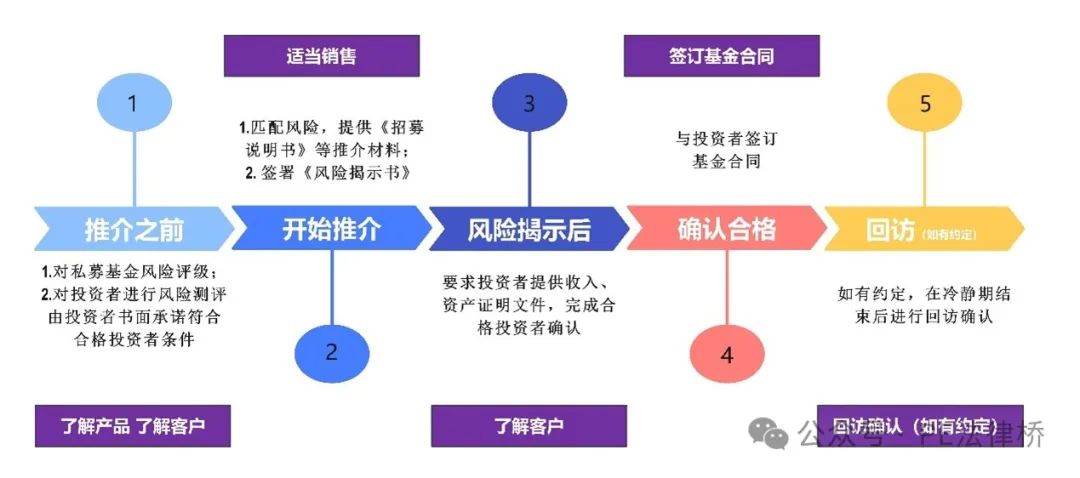

So, what specific operations and procedures should be included in "understanding customers, understanding products, and selling appropriately"? According to the Regulations on the Management of Private Investment Fund Raising Behavior, the specific procedures that private fund managers should follow during the fund raising process are shown in the following figure:

01

Understanding clients - conducting risk assessments on potential fund investors and confirming whether they are qualified investors

Whether to conduct risk assessment and qualified investor qualification confirmation for potential investors is an important aspect of judging whether private fund managers have fulfilled their suitability obligations, and it is also a prerequisite for managers to recommend private funds that match their risk identification and tolerance to potential investors. Therefore, private fund managers should evaluate the risk identification and tolerance of potential investors through scientific and effective questionnaires [3], and strictly review the asset and income proof documents provided by potential investors, and require them to make written commitments. In other words, the manager should make every reasonable effort to confirm whether potential investors are qualified investors and understand their risk identification and tolerance.

In the case of other contract disputes between Juzhou Asset Management (Shanghai) Co., Ltd., Shanghai Jupai Investment Group Co., Ltd., and Zhou (2021) Hu 74 Min Zhong 375, the first instance court held that if the fund manager did not conduct a risk assessment on the investor, it can be determined that they did not properly fulfill their suitability obligations during the sales process. Specifically, although Zhou has indeed signed the Risk Disclosure Statement for the fund involved in the case, the fund manager is unable to provide relevant evidence of the risk assessment conducted on Zhou. The first instance court determined that the fund manager failed to properly fulfill its suitability obligations, and combined with other serious faults of the fund manager during the investment and management stages, ordered the manager to compensate the investors for all investment losses. The second instance court upheld the original judgment.

If the fund manager has fully fulfilled all the procedures in the flowchart above, can it be deemed that they have fulfilled their investor suitability obligations? The recent case released by the Shanghai Arbitration Commission, which we introduced in the preface of this article, has given the answer: the performance of the obligation of appropriateness should focus on substance rather than formality. In this case, the staff of the fund manager knowingly assisted investors in collecting funds despite knowing that their subscription funds were below the limit set by qualified investors; Despite knowing that investing with pooled funds would objectively lead to the disguised splitting of fund products, relevant investment procedures were still processed for investors. Therefore, the Shanghai Arbitration Commission ultimately determined that the fund manager was selling fund products to non qualified investors, which violated the investor's obligation of suitability.

02

Understanding the product - Fully understand and classify the risk of the recommended fund products [4]

If a comprehensive understanding of potential investors is a prerequisite for fund managers to promote private equity funds, then a thorough understanding of the products being promoted and risk grading them is a prerequisite for ultimately selling the products to potential investors. Imagine: If the manager does not have a clear understanding of the recommended product and does not classify its risk level (i.e., is not clear about the product's risk level), how should they determine whether the product is suitable for potential investors (i.e., whether it matches their risk identification and tolerance)? How can we achieve "appropriate sales" if we cannot make a correct judgment?

In the case of contract dispute between Xinchuan Investment Management (Shanghai) Co., Ltd. and other parties such as Li (2022) Hu 74 Min Zhong 1474, the fund manager involved in the case did not conduct a risk rating on the fund products during the management of the involved funds, and the manager also failed to provide evidence to prove that they had fulfilled the appropriate obligations of risk assessment to investors. The second instance court hereby confirms that the fund manager involved in the case did not fulfill the obligation of appropriateness, and combined with its violation of information disclosure obligations and failure to invest within the agreed scope of investment in the contract, upheld the judgment of the first instance court on the manager's compensation of all investment principal to investors.

In the contract dispute case between Dong and Zhonghengtian Construction Engineering Co., Ltd. (2021) Jing 0105 Min Chu 57598, the risk level of the involved fund shown in the Fund Investor Classification and Product Rating submitted by the fund manager to the court was inconsistent with the risk level stated in the Fund Contract. The court believes that for the same fund product, the manager has assigned different classification levels to different investors, and there are obvious discrepancies in the risk rating of the fund product, inadequate disclosure, and inappropriate promotion by the manager, which is a failure to fully and appropriately fulfill the obligation of suitability to investors.

03

Appropriate sales - selling appropriate products to suitable fund investors

On the basis of understanding potential investors and the recommended fund products, private fund managers should ensure their accurate and comprehensive fulfillment of investor suitability obligations, and also sell "appropriate" fund products to "suitable" fund investors, that is, to sell fund products that match their risk identification and tolerance to potential investors. We understand that at this stage, the fund manager should fulfill at least three obligations: disclosure and explanation, appropriate recommendation, and follow-up confirmation (if agreed).

(1) Notice and Explanation - Risk Disclosure

In the aforementioned contract dispute case between Dong and Zhonghengtian Construction Engineering Co., Ltd. (2021) Jing 0105 Min Chu 57598, the fund manager provided the court with a risk warning letter, basic investor information table, fund investor risk assessment questionnaire, investor risk matching notification letter, investor confirmation letter, and follow-up confirmation letter to prove that he provided warning explanations and risk warnings to investors. But the court believes that on the one hand, the signing behavior of investors does not exempt the fund manager from the obligations of risk warning, risk tolerance and risk level investigation, and suitability product matching that should be fulfilled; On the other hand, as investors deny that the manager provided risk warnings and claim that some of the materials were not signed by them themselves, in this case, the manager should further prove that they informed investors of various relevant information and risks when selling the involved fund products. However, since the manager did not provide further evidence to prove, they should bear the adverse consequences of being unable to provide evidence. In the end, the above situation also became one of the situations where the fund manager involved in the case was found by the court to have failed to fully and appropriately fulfill their suitability obligations.

In addition, in the case of the commission contract dispute between Changjiang Securities (Shanghai) Asset Management Co., Ltd. and Huang (2023) Hu 74 Min Zhong No. 603, the involved asset management product is a closed private equity asset management product that is regularly open, which makes it impossible for investors to withdraw stop loss at any time after discovering risks, and the valuation method used for the product cannot reflect risk fluctuations in a timely manner. However, the involved manager did not inform the investors and disclose the risks of the significant credit rating and market value decline of the bonds held by the involved asset management products in a short period of time and facing suspension or no buying before signing the asset management contract with the investors. The court believes that the administrator should fulfill the contractual obligation to inform investors of important information that may affect their interests, fully disclose product risks, and ensure that investors make a true expression of their intentions. Due to the lack of notification from the fund manager, the court ultimately supported the investor's claim for compensation of principal and interest losses from the fund manager.

From this, it can be seen that in terms of form, only providing relevant materials such as risk disclosure letters and confirmation letters signed by investors may not fully prove that the manager has fulfilled their suitability obligations in specific cases. At the same time, according to the relevant provisions of the Measures for the Administration of Investor Appropriateness in Securities and Futures and the Implementation Guidelines for the Administration of Investor Appropriateness in Fund Raising Institutions, private fund managers should record or record (i.e. "double recording") the risk warnings provided to ordinary investors during the fundraising process. Otherwise, they may face self regulatory measures from the China Securities Association and administrative supervision measures from the China Securities Regulatory Commission and its dispatched agencies. Therefore, we suggest that private fund managers, when selling fund products to potential investors, should make a "dual record" of informing and disclosing risks to investors in accordance with the aforementioned regulations. When relevant disputes arise, the administrator can also use the double recorded materials as strong evidence to prove that they have properly fulfilled their obligation to inform and explain. In terms of content, the scope of notification and explanation to investors should be comprehensive and compliant. In addition to complying with the clear provisions of laws and regulations, departmental rules, and the self-discipline rules of the China Securities Association, managers should also pay attention to considering factors such as the characteristics of the fund product itself, the importance of information, and the impact of information on investor decision-making.

(2) Appropriate Recommendation - Risk Matching

The Securities Investment Fund Law and other laws, regulations, and departmental rules, as well as the Implementation Guidelines for Investor Appropriateness Management of Fund Raising Institutions (Trial) and other self regulatory rules of the China Association for Market Regulation, all stipulate the risk matching obligations of private fund managers in selling fund products. Private fund managers should comply with relevant regulations, establish a reasonable correspondence and matching principle between the type of risk tolerance of investors and the risk level of fund products, and sell fund products of different risk levels according to the risk tolerance of investors in the process of selling fund products.

In the case of the dispute over the financial entrusted wealth management contract between Ye and Shenzhen Chongrong Company Management Co., Ltd. (2021) Yue 03 Min Zhong No. 16338, the court found that the risk survey questionnaire and other factors involved in the case reflected that the investor was a prudent investor, while the private equity product involved in the case was a high-risk product, and selling it to that investor did not match. The court hereby determines that the fund manager in question has performed its duty of appropriateness improperly, and has taken into account the fund risk control measures of the manager's failure to actually fulfill its commitments, resulting in losses to the fund assets, as well as the use of the managed fund for personal gain. The court orders the fund manager to compensate the investor for all principal and interest losses.

(3) Follow up confirmation - to be fulfilled under clearly agreed circumstances

The Measures for the Administration of Private Investment Fund Raising Behavior clearly stipulate the cooling off period follow-up system, which stipulates that "the fund contract should stipulate that investors have the right to terminate the fund contract before the successful follow-up confirmation of the fundraising institution.". However, in the notice of the release of the self-discipline rules by the China Association for the Betterment and Progress of Funds, it was also clearly stated that it encourages fundraising institutions to implement such a follow-up system, and the confirmation of follow-up was not included as a necessary clause in the fund contract during the review process of fund filing materials. However, it is worth noting that if the fund manager and investors have clearly agreed in the fund contract on the relevant content such as follow-up confirmation upon the expiration of the cooling off period, they should fulfill the obligation of follow-up according to the agreement. In the dispute over the entrusted wealth management contract between Shanghai Shenghongjin Equity Investment Fund Management Co., Ltd. and Li, as well as the dispute over the entrusted wealth management contract between Tang and Shenzhen Ju Chuang Tou Asset Management Co., Ltd. as stated in the fund contract (2019) Hu 74 Min Zhong 275 and (2020) Yue 0106 Min Chu 1281), the court ultimately determined that investors have the right to terminate the fund contract in accordance with the provisions of the fund contract, as the fund contract explicitly stipulated that investors have the right to terminate the fund contract before the successful confirmation of the fundraising institution's follow-up. However, the fund managers involved did not fulfill their corresponding follow-up obligations according to the contract.

04

Strictly grasp the timing of performance - avoid backsigning for fundraising and promotional materials

According to laws and regulations as well as the self-discipline rules of the China Association for Market Regulation, the manager shall first fulfill the obligation of suitability, complete all statutory or agreed procedures, and then allow investors to subscribe to fund products. But if the actual situation is that the investor pays the investment amount first and the fund manager fulfills the suitability obligation later, and the investor claims that the manager has not fulfilled the suitability obligation based on this, how can the court make a judgment?

In the case of the dispute over the entrusted wealth management contract between Dong and Beijing Zhongrong Dingxin Investment Management Co., Ltd. (2021) Jing 74 Min Zhong No. 482, the second instance court held that the fund manager should fully inform investors of investment risks and complete the investor's risk tolerance assessment no later than the formal establishment of the fund product. Otherwise, after the fund assets are transferred to the custody account for investment according to the plan, it is found that the investors are not qualified investors, and there is a risk that it is difficult to fully withdraw the corresponding funds. Therefore, the fund manager in question only conducted a risk tolerance assessment on investors after the establishment of the fund product in question. Even if the investor's subsequent assessment meets the requirements or fully understands the risks and agrees to continue subscribing, it cannot offset the fault of the manager in not fulfilling their obligations in a timely manner. Finally, the second instance court considered the circumstances of the case and determined, at its discretion, that the fund manager would provide appropriate compensation to investors based on a standard of 20% of the subscription amount.

In other contract disputes between Han et al. and Sichuan Hengkang Development Co., Ltd. (2022) Hu 74 Min Zhong No. 1674, investors also engaged in the behavior of paying before signing the contract. However, the court confirmed the risk assessment and investment behavior based on the investor's behavior of supplementing the information and filling out the form date after the fact. The investor's risk assessment results showed that their risk tolerance was higher than the risk level of the fund product in question, and the investor's investment experience was relatively rich. It was determined that Xinchuan Company did not substantially violate the obligation of appropriateness.

In summary, it can be seen that there are flaws in the timing of the fund manager's performance of suitability obligations, which may not necessarily be considered as a violation of suitability obligations. However, considering that the act of reverse signing and supplementary signing of fundraising materials itself contradicts the original intention of the investor's suitability obligation, and there are many cases in practice where courts support investor compensation requests based on this, we suggest that fund managers strictly follow the order of fulfilling suitability obligations first and investors subscribing to fund products later in fund fundraising.

05

Appropriateness obligations of private fund managers in the case of entrusted sales

According to the Management Measures for the Raising of Private Investment Funds, fund sales institutions [5] can be entrusted to raise private equity funds. However, if a private fund manager entrusts a fund sales agency to raise private funds, they shall not be exempted from their legal responsibilities due to the entrusted fundraising. That is to say, in the case of entrusted sales, the suitability obligation of private fund managers is not exempted. If investors suffer losses due to the failure of fund sales institutions to fulfill their investor suitability obligations, they can still claim compensation from the fund manager.

In the dispute over the entrusted wealth management contract between Qianhai Open Source Asset Management Co., Ltd. and Shenzhen Jin'an Fund Sales Co., Ltd. (2020) Yue 03 Min Zhong No. 19093, 19097, 19099), the involved fund sales agency accepted the commission of the involved fund manager to sell the involved asset management products on behalf of them, but did not conduct risk matching during the sales process, resulting in a mismatch between the risk tolerance level assessed by investors and the risk rating of the involved asset management products. Based on this, the second instance court determined that the fund sales institution in question failed to fulfill its suitability obligations in accordance with the law and should be liable for compensation for the funds and interest invested by investors. Meanwhile, according to Article 16 of the Interim Measures for the Supervision and Administration of Private Equity Investment Funds, suitability review is a common obligation of issuers and sellers of private equity fund products. In this case, the involved fund sales agency accepted the commission of the involved fund manager to sell the involved asset management products on their behalf, thus forming a commission agency relationship between the involved fund sales agency and the involved fund manager. As the principal fund manager involved in the case, it is responsible for supervising and inspecting the agent's performance of suitability obligations by the fund sales agency involved in the case. It knows or should know whether the agent's performance of suitability obligations by the fund sales agency involved in the case has been fulfilled. In the event that it is determined that the involved fund sales institution has not fulfilled its suitability obligations in accordance with the law, the fund manager in question shall bear joint and several liability for repayment with the involved fund sales institution.

Final

"Seller's responsibility" is a prerequisite for "buyer's self responsibility", and the comprehensive and appropriate fulfillment of investor suitability obligations by private fund managers is one of the major prerequisites for investors to bear fund risks. We suggest that fund managers should strictly follow the three principles of "understanding customers, understanding products, and selling appropriately" and bottom line to fulfill investor suitability obligations during the fundraising process, in order to avoid falling into investor claims disputes due to failure to fulfill investor suitability obligations, or being subject to regulatory or self regulatory measures taken by regulatory authorities or self regulatory organizations.

[1] Article 72 of the Minutes of the National Court Civil and Commercial Trial Work Conference: The obligation of appropriateness refers to the obligations that the selling institution must fulfill in the process of promoting and selling bank wealth management products, insurance investment products, trust wealth management products, securities firm collective wealth management plans, leveraged fund shares, options and other over-the-counter derivatives and other high-risk financial products to financial consumers, as well as providing services for financial consumers to participate in high-risk investment activities such as margin trading, securities lending, the New Third Board, the Growth Enterprise Board, the Science and Technology Innovation Board, and futures, such as understanding customers, understanding products, and selling (or providing) appropriate products (or services) to suitable financial consumers. The purpose of the seller's institution assuming the obligation of suitability is to ensure that financial consumers can make autonomous decisions based on a full understanding of the nature and risks of relevant financial products and investment activities, and bear the resulting returns and risks. In the field of promoting and selling high-risk financial products and providing high-risk financial services, the fulfillment of suitability obligations is the main content of "seller's responsibility" and also the premise and foundation of "buyer's self responsibility".

[2] For example, the Shanghai Financial Court described private fund managers as "financial institutions" in the "12.4 National Constitution Day - Shanghai Financial Court and Shanghai Securities Regulatory Bureau jointly released ten typical cases involving private funds" published on the WeChat official account on December 4, 2023.

[3] According to the Management Measures for the Raising Behavior of Private Investment Funds, the main content of the questionnaire survey should include but is not limited to basic information of investors, financial status, investment knowledge, investment experience, and risk preferences.

[4] According to the Interim Measures for the Supervision and Administration of Private Equity Investment Funds, private equity fund managers who sell or entrust sales institutions to sell private equity funds shall conduct risk ratings on the private equity funds themselves or entrust third-party institutions to recommend private equity funds to investors with matching risk identification and risk-taking abilities. According to Article 38 of the Implementation Guidelines for Investor Suitability Management of Fund Raising Institutions (Trial), the risk level of fund products or services should be divided into at least five levels in descending order of risk: R1, R2, R3, R4, R5. Fund raising institutions may further subdivide risks based on the levels listed in the preceding paragraph according to actual circumstances.

[5] Article 2, Paragraph 1, Paragraph 2 of the Measures for the Administration of Private Investment Fund Raising Activities: Private fund managers, institutions registered with the China Securities Regulatory Commission and qualified for fund sales business and have become members of the China Securities Investment Fund Industry Association (hereinafter referred to as fundraising institutions), and their employees who raise funds from investors in a non-public manner shall be subject to these Measures.

Institutions that register as private fund managers with the China Securities Investment Fund Industry Association (hereinafter referred to as the China Fund Industry Association) can independently raise their established private funds. Institutions that register with the China Securities Regulatory Commission and have obtained the qualification for fund sales and become members of the China Fund Industry Association (hereinafter referred to as fund sales institutions) can be commissioned by private fund managers to raise private funds. No other institution or individual shall engage in the fundraising activities of private equity funds.

[6] Article 16, Paragraph 1, Paragraph 2 of the Interim Measures for the Supervision and Administration of Private Equity Investment Funds: If a private equity fund manager sells private equity funds on their own, they shall use methods such as questionnaire surveys to evaluate the investor's risk identification ability and risk bearing ability. The investor shall make a written commitment to meet the requirements of a qualified investor; A risk disclosure letter should be prepared and signed by investors for confirmation.

If a private fund manager entrusts a sales agency to sell private funds, the private fund sales agency shall take the evaluation, confirmation and other measures specified in the preceding paragraph.

Author

Lawyer Yang Chunbao

First class lawyer

Senior Partner of Dentons (Shanghai) Law Firm

Mail:

chambers.yang@dentons.cn

Leader of private equity and investment fund professionals in Dacheng China, member of the Capital Market Professional Committee, and member of the Shanghai Foreign Legal Talent Pool. Bachelor of Law from Fudan University (1992), Master of Law from the University of Science and Technology of Sydney (2001), and Master of Law from East China University of Political Science and Law (2001).

Lawyer Yang has been practicing for 29 years, specializing in legal services for private equity funds, investment and financing, and mergers and acquisitions, covering industries such as TMT, big finance, big health, real estate and infrastructure, exhibition industry, and manufacturing. Since 2004, he/she has been selected multiple times on the "Private Equity Fund" and "Company and Business" lists of The Legal 500, and has received special recommendations or comments from Asia Law profiles. Since 2016, he/she has been continuously selected as one of the "100 Outstanding Lawyers in Chinese Business" by the internationally renowned legal media China Business Law Journal, and has been awarded the title of "China's Annual Corporate Law Expert" by Leaders in Law 2021 Global Awards; Ranked in the recommended list of excellent lawyers and law firms recommended by the First China Famous Enterprise Law Society; Has won multiple awards such as the Lawyer Monthly and Finance Monthly China TMT Lawyer Award and the China Mergers and Acquisitions Lawyer Award. Has the qualification to serve as an independent director of a listed company, and is a part-time professor at the Law School of East China University of Science and Technology, a part-time supervisor at the Law School of Fudan University, a part-time graduate supervisor at East China University of Political Science and Law, a lecturer in the Private Equity President Class at Shanghai Jiao Tong University, and a lecturer in the Cross border Business Talent Training Class at the Shanghai Municipal Commission of Commerce. Published 16 monographs including "Risk Prevention and Control Operation Practice of Private Equity Investment Funds", "Practical Operation and Case Analysis of Enterprise Legal Risk Prevention and Control", and "Perfect Capital 2: A Guide to the Complete Operation of Corporate Investment and Financing Model Process". Lawyer Yang's practice areas include companies, investment mergers and acquisitions, and private equity funds. Capital markets, TMT, real estate and construction engineering, as well as dispute resolution in the aforementioned fields.

Author

Lawyer Sun Tian

Partner of Dentons (Shanghai) Law Firm

Mail:

sun.zhen@dentons.cn

Prior to practicing, Lawyer Sun worked as an executive assistant to global, Asia Pacific, or China regional presidents or vice presidents in Fortune 500 companies such as Watts, Ingersoll Rand, and Alcatel Lucent in the United States. He has accumulated rich experience in enterprise operations and management, and possesses excellent bilingual communication and coordination skills in both Chinese and English. Lawyer Sun has published "Practical Practice in Risk Prevention and Control of Private Equity Investment Funds" and has published dozens of articles in the fields of mergers and acquisitions, funds, and e-commerce. Lawyer Sun specializes in areas such as private equity investment, corporate mergers and acquisitions, e-commerce, and labor legal affairs。

Author

Li Jiaxin

Law Assistant at Dacheng (Shanghai) Law Firm

Bachelor of Law from Fudan University, has participated in due diligence for selecting fund managers and establishing sub fund projects for multiple parent funds, due diligence for fund investment target companies, and daily legal services related to fund fundraising, investment management, and retirement.

First, please LoginComment After ~