ASEAN Ascends – Exploring the Philippines: The Road South

Rising labour costs and increasing geopolitical strife are driving manufacturers to look for alternative production bases beyond their established networks in traditional hubs, especially those in mainland China. ASEAN’s business friendly investment policies and incentives, increasingly efficient distribution networks and strategic access to key global markets are all adding fuel to this trend for diversification.

The bloc’s intra and inter regional connectivity not only facilitates international trade and the transport of goods, it also provides a practical way for global manufacturers to mitigate supply chain risks and enhance their resilience. It goes without saying that ASEAN’s growing middle class is also making the region an increasingly lucrative consumer market in itself.

All of these factors, combined with ASEAN’s growing economic power, have increased the bloc’s attractiveness as a destination both for investors and those looking to diversify their supply chains. As part of an overall assessment of business and supply chain opportunities in Southeast Asia, HKTDC Research has undertaken a field trip to the Philippines to assess the many things that the country’ has to offer Hong Kong companies and investors.

Hong Kong’s investment

According to the Central Bank of the Philippines, or the Bangko Sentral Ng Pilipinas (BSP) as it is known there, Hong Kong was the ninth largest source of foreign direct investment (FDI) inflows into the Philippines in 2022, responsible for US$24.84 mn (HK$194.3 mn) of a total US$1.78 bn.

Hong Kong’s strategic position as a global financial hub and its robust economic fundamentals mean that a there is vast amount of untapped potential for Hong Kong investors to take advantage of in the Philippines, a country with a population of nearly 120 million people. The country’s rapidly growing consumer market, young and dynamic workforce and favourable business environment all paint a rosy picture for Hong Kong companies looking to diversify or expand their operations.

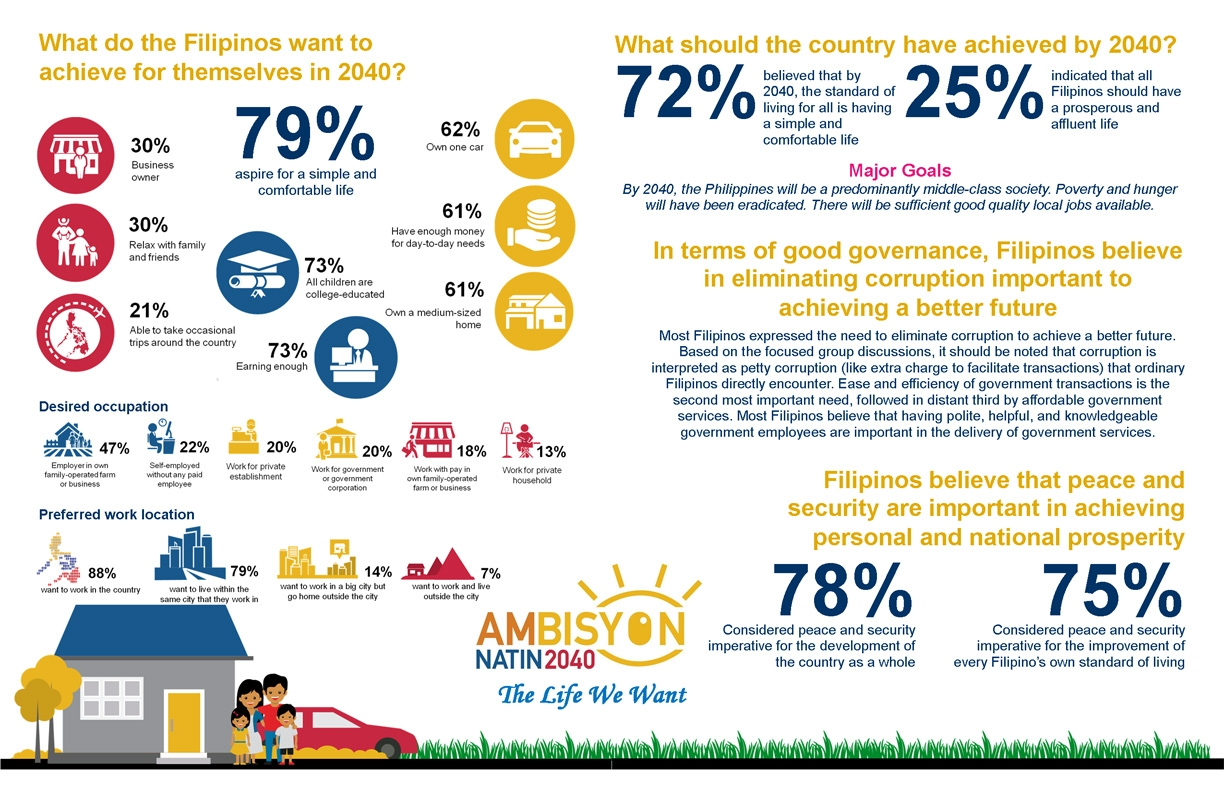

In 2016, the Philippines’ National Economic and Development Authority (NEDA) introduced “Our Ambition 2040 (AmBisyon Natin 2040)”, to develop long term policies, projects, programmes and development plans designed to promote the economy and foster a stable and prosperous lifestyle for the country’s people.

Since then, the Philippines has undergone significant structural reforms in investment policies which have helped support its economic development. The nation’s commitment to business friendly investment policies, coupled with its continuous efforts to enhance the investment climate, have helped solidify its position as an attractive investment destination.

Our Ambition 2040. Source: National Economic and Development Authority (NEDA)

Investor-friendly reforms

Over the last few years, the Philippines has introduced a number of key economic reforms, with the aim of improving the business climate in the country and attracting FDI. Notable examples include the amendments to foreign investment policies and the implementation of the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE).

Retail Trade Liberalisation Act Amendments

On 10 December 2021, President Rodrigo Duterte signed into law Republic Act No. 11595, commonly referred to as the “Act amending the Retail Trade Liberalisation Act of 2000 (RTLA)”. It came into effect on 21 January 2022. The legislation contained measures designed to facilitate investment by foreign retail enterprises, including lowering the paid up capital requirement. Under RA 11595, the minimum capitalisation requirement for foreign retailers was reduced from US$2.5 mn (PHP140 mn) to US$450,000 (PHP25 mn). The minimum investment per store was also lowered from US$250,000 (PHP14 mn) to US$180,000 (PHP10 mn).

Foreign Investment Act Amendments

On 2 March 2022, Republic Act No. 11647 was enacted, amending the Foreign Investment Act (FIA). The aim of the amendments was to foster and attract foreign investment by granting international investors the opportunity to establish and wholly own domestic micro, small, and medium sized enterprises (MSMEs) in the Philippines. Under the original terms of the FIA, MSMEs with paid in capital of less than US$200,000 were reserved for Filipino nationals. Among the many changes brought in by the amendments, foreign ownership and control of MSMEs with a minimum paid in capital of US$100,000 is now permitted, as long as the businesses are using advanced technologies, are endorsed as a start up or start up enabler, or have mainly Filipino employees (i.e. no less than 15, a reduction from the 50 needed previously).

Public Service Act Amendments

On 20 March 2023, the NEDA’s amendments to the Public Service Act (PSA) (Commonwealth Act No. 146) were implemented, enabling the liberalisation of key public services in the Philippines. As a result of the legislation, selected industries such as airports, railways, expressways and telecommunications can now be put completely under foreign ownership. Beforehand, foreign ownership in these industries was limited to 40%. Most importantly, the amendments have established a clear differentiation between the terms “public services” and “public utilities”. By narrowing the scope of a “public utility,” there is now a clearer framework for foreign control and investment in these industries.

Renewable Energy Act Amendments

As part of the country’s significant transformation of its investment policies, the Philippines has taken a momentous step towards fulfilling its long term climate targets by fully opening the renewable energy sector to foreign ownership. On 15 November 2022, the country’s Department of Energy (DOE) issued Circular No. 2022 11 0034, amending the Renewable Energy Act of 2008. The amendments eliminated the requirements for Filipino ownership in specific renewable energy resources and allowed foreign investors to hold 100% equity in the exploration, development and utilisation of solar, wind, hydro, ocean and tidal energy resources.

Enormous investments in energy sector in 2023. Source: Board of Investments

Green Lanes for Strategic Investments

On 23 February 2023 in Executive Order No.18, “green lanes” were introduced to fast track strategic investments under the Strategic Investment Priority Plan (SIPP). All national government agencies are required to establish “green lanes” to streamline and expedite the process of acquiring investment licences and permits.

Foreign Investment Negative List

Foreign investors are allowed 100% ownership in sectors that are not explicitly listed in the negative list of Executive Order No. 175, issued in 2022. This liberalisation applies to a wide range of sectors, including the majority of manufacturing industry, renewable energy generation, telecommunications and airports, although restrictions are still in place where there are national security concerns. For example, foreign investment is prohibited in water and energy transmission and seaport businesses due to their sensitive nature and/or their categorisation as “public utilities”.

The CREATE Act

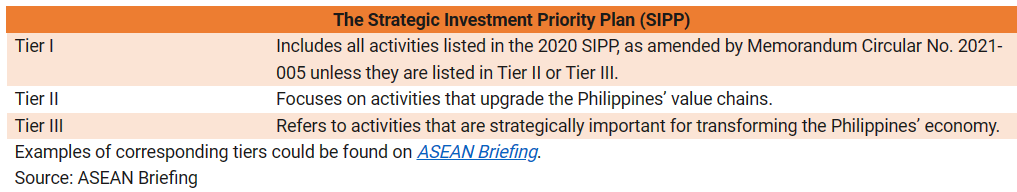

The Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act (Republic Act No. 11534) was implemented on 11 April 2021, alongside bold tax cuts and generous incentive packages. The aim was to promote competitiveness, attract investment and streamline administrative processes.

The CREATE Act applies across the entire country, encompassing all special zones such as economic zones and free port zones. However, eligibility for its investment incentives is limited to industries that fall within the purview of the SIPP. Given the breadth of the SIPP, businesses currently operating or planning to invest in the Philippines are advised to evaluate whether they qualify for the incentives. It is also worth noting that the SIPP undergoes a comprehensive review every three years to recalibrate its priorities.

Under the provisions of the CREATE Act, eligible enterprises are entitled to an income tax holiday (ITH) of four to seven years, depending on the nature and location of the business. Once their ITH has ended, export oriented enterprises can choose to pay a reduced Special Corporate Income Tax of 5% based on their gross income earned, in lieu of all national and local taxes, or they can adopt the Enhanced Deduction Scheme (EDS) for another ten years. A five year EDS is available for domestic market oriented companies.

The CREATE Act exempts foreign enterprises from duties on the importation of capital equipment, raw materials, spare parts and accessories. It also exempts them from VAT on imported goods and provides VAT zero rating on local purchases in order to help reduce the cost of importing inputs for business operations.

For a company to qualify as export oriented, a minimum of 70% of its total sales must be derived from exports. In turn, companies with domestic sales exceeding 30% of its total sales are classified as domestic market oriented.

Another pain point for foreign investors concerns the ownership of land, which is restricted to Filipinos only. As part of its continued efforts to improve the investment climate in the Philippines, the government is actively considering amendments to the existing laws on land ownership. In tandem with some other recent developments, corporations with less than 60% Filipino investment have been given the option to lease land for a period of up to 75 years, subject to registration with the Board of Investments(BOI) of the Department of Trade and Industry (DTI), while corporations with a higher proportion of Filipino investment are allowed to purchase and own land in the country.

Building a vibrant start-up eco-system

Furthermore, the Philippines is actively fostering the growth of its start up ecosystem in a bid to attract foreign investment, generate jobs, and cultivate a culture of innovation. The Innovative Startup Act enacted in April 2019, for example, is aimed to incentivise and alleviate constraints that hinder the establishment and operation of innovative new businesses. The legislation also seeks to foster a thriving ecosystem encompassing businesses, government entities and non government institutions to bolster an entrepreneurial culture rooted in innovation within the Philippines.

On the other hand, the Innovation Act and Technology Transfer Act serve as another pillar in supporting innovation, thrusting the Philippines into a tech ecosystem valued at US$10 bn by the end of the Marcos administration (i.e. 30 June 2028). Currently, Metro Manila hosts a robust community of over 1,100 operating start ups and is valued at US$3.5 bn.

Notably, the Department of Information and Communications Technology (DICT) and the Department of Science and Technology (DOST) have established start up grants to enhance the quality of Filipino start ups and provide them support in overcoming R&D challenges. There are also programmes and offices within institutions like the DTI and the Intellectual Property Office of the Philippines (IPOPHL) to facilitate innovation and support start ups.

On a related note, the DTI have established the Regional Inclusive Innovation Centres, while there are approximately 80 Innovation Technology Support Offices under the Intellectual Property Office to facilitate research, patent protection and intellectual property (IP) safeguarding.

Having said that, the Philippine Startup Ecosystem Report of 2023 revealed that majority of the surveyed start ups (80% plus) had never participated in any government programs.

Complicating matters further is the dearth of mature start up accelerators in the Philippines, except a number of incubators catering to early stage start ups. Advanced stage start ups are therefore often being left with little, if any customised mentorship or support, creating a huge service gap in the ecosystem.

The start up landscape in the Philippines encompasses a diverse range of industries, with fintech and e commerce leading the way, each accounting for approximately 22% of the total respondents. Additionally, start ups in sectors such as health, education, entertainment, and climate are seeing robust growth and development.1 On the contrary, sectors like agri tech and smart cities remain relatively uncharted with relatively few competitors, thereby presaging growth promise for aspiring entrepreneurs.

Priority setting

The Philippines is strategically positioning itself as an export oriented hub, setting its sights on the US and EU markets. The new administration has resumed free trade agreement (FTA) negotiations with the EU. The Philippines is currently the only ASEAN country that enjoys tariff free access to the EU market under the Generalised Scheme of Preference Plus (GSP+).

In order to invest in the Philippines and enjoy the incentives provided by the CREATE Act, investors are required to register with the relevant investment promotion agencies (IPAs). The BOI is the principal entity responsible for approving investments coming into the country.

Investors interested in locating in freeport zones (FZs), economic zones (EZs) or other special zones need to register with corresponding IPAs rather than the BOI. For instance, the Clark Development Corporation (CDC) is responsible for the Clark clusters, the Subic Bay Metropolitan Authority (SBMA) oversees the Subic Bay Freeport Zone and the Philippine Economic Zone Authority (PEZA) manages general economic zones across the country.

These agencies are also categorised into specific industry clusters such as manufacturing and logistics, tourism and agro industry. The aim is to use resources more efficiently by bringing in a collection of companies, technologies, and resources relevant to each cluster’s specialisation.

Different clusters for investors from different industries. Source: Board of Investments

This publication will be published in parts. To continue, please read ASEAN Ascends -Exploring the Philippines: The Strategic Investment Priority Plan.

1Gobi Core - Philippine Startup Ecosystem Report Founders Edition

First, please LoginComment After ~