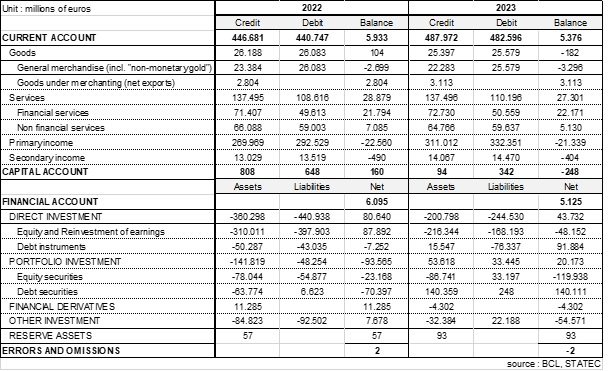

BALANCE OF PAYMENTS OF LUXEMBOURG DURING THE YEAR 2023

The Banque centrale du Luxembourg (BCL) and STATEC inform that, according to the first provisional results, the current account for 2023 showed a surplus of 5 376 million euros, a decrease of 558 million compared to last year.

The goods deficit stood at 182 million euros compared to the surplus of 104 million euros of 2022. For exports and imports of goods, exports decreased by 3 % while imports decreased by 2 %. Net exports from goods under merchanting (purchases of goods abroad and their resale abroad) went up (+310 million euros). For general merchandise (i.e. excluding merchanting), exports went down by 4,7 % (-1 100 million euros), while imports also decreased by 1,9 % (-504 million euros).

The balance of international trade in services fell by 5,5 % in 2023 (-1 579 million euros), mainly because exports stagnated (0 %) while imports increased (1,5 %). At the level of sub-items, evolutions were diverse. Trade in non-financial services decreased for exports (2 %) and increased for imports (1,1 %). International trade in financial services, meanwhile, experienced moderate growth, with an increase of 1,9 % for both exports and imports. This evolution is mainly driven by the slight increase in average assets managed by investment funds in the same order of magnitude (2 %) in 2023.

In the financial account in 2023, direct investment flows are still characterized by new disinvestments for both assets (-200 billion euros) and liabilities (-244 billion euros) sides. Theses disinvestments concern essentially a small number of SOPARFI’s that are continuing restructuring, ceasing or reallocating their activities.

When it comes to portfolio investments, transactions of Luxemburgish equities result in net inflows of 33 billion euros 2023, compared with net outflows of 55 billion euros during 2022. On the other hand, Luxembourg debt securities experience net inflows of 248 million euros, which represent a decrease compared to the last period (net inflows of 6.6 billion euros).

For their part, transactions in foreign equity securities result in net outflows of 86 billion euros, compared to net sales of 78 billion euros in 2022. Foreign debt securities register 140 billion euros net purchases during the year 2023, which differs significantly to the same period in 2022 where we had net sales for an amount of 63 billion euros. In a context of increasing interest rates, investors are partially reallocating their portfolio towards debt securities rather than equities.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg

First, please LoginComment After ~