ASEAN Ascends – Exploring the Philippines: The Strategic Investment Priority Plan

Over recent years, the Philippines has implemented a slew of significant economic reforms dedicated to improving the country’s business climate and attracting foreign investment. These include the restructuring of the corporate tax system, a relaxation of restrictions on foreign ownership of micro, small and medium‑sized enterprises (MSMEs), and the liberalisation of the rules governing foreign ownership in specific public services.

These initiatives have created a more favourable environment for foreign investors, offering improved business conditions, tax incentives and unprecedented opportunities for the foreign ownership of projects, companies and even land in the Philippines.

If foreign investors are to make the most of these new opportunities, it is crucial for them to gain a more comprehensive understanding of the country’s key industries, especially those identified in the Strategic Investment Priority Plan (SIPP).

Strategic investment sectors

Hi-tech agriculture

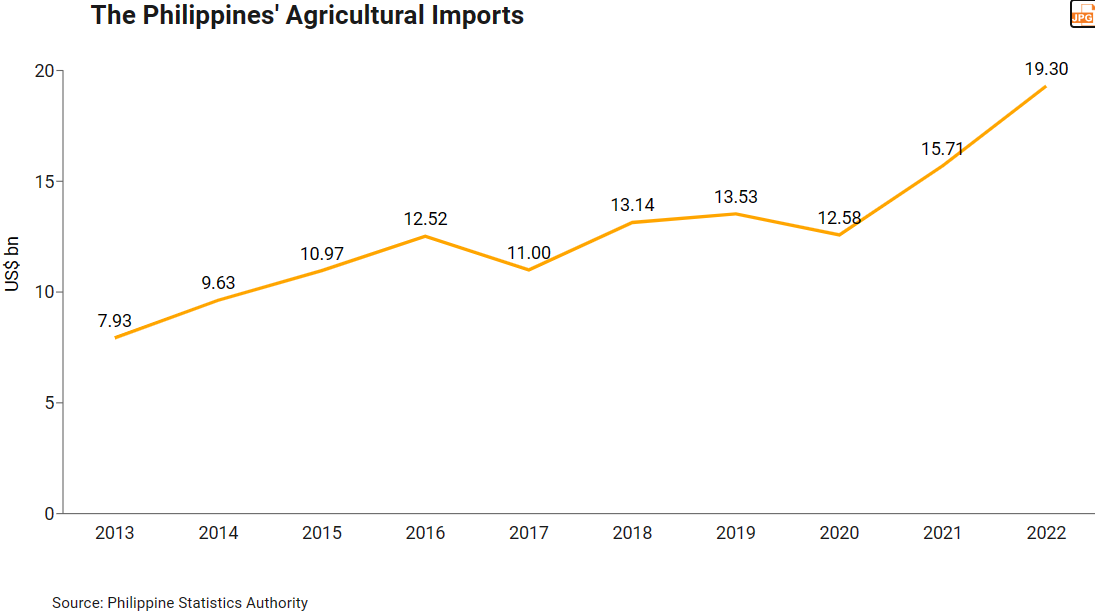

The Philippines’ agriculture sector has long been hindered by the lack of both an efficient logistical infrastructure and state‑of‑the‑art machinery, equipment and know‑how. As a result, the country has become increasingly reliant on imports for its agricultural products.

In order to tackle the double whammy of insufficient local production and food insecurity, the government is prioritising investment in food processing technology like smart agriculture and harvesting and storage facilities such as cold chains.

The Department of Agriculture (DA) has laid out plans entitled “One DA Reform Agenda: Eighteen (18) Key Strategies” to try to upgrade the country’s agricultural sector. The aim is to improve the efficiency and productivity of the sector through modernisation and industrialisation.

New ideas, such as indoor and vertical urban farming, are being looked at as ways to increase productivity and tackle climate change. Investment has been put in place to apply the technology in container‑sized greenhouses which can be sited alongside residential or commercial buildings. This would create more supplies of fresh vegetables while involving minimal levels of transportation.

Mechanisation is an important way of improving agricultural productivity in the Philippines, as many farmers still rely on traditional farming methods. The country also faces challenges in managing the oversupply of certain crops (such as tomatoes) during the harvesting season. Food processing technologies and advanced storage facilities, particularly those suited for fresh produce, are therefore urgently needed to lengthen products’ shelf life and reduce post‑harvest loss and wastage.

The government is currently transforming the urban area of Clark, in the Central Luzon region, into a thriving food and agriculture hub. It has attracted investors and industry players from Canada and Thailand to the area to set up agricultural development offices. Clark’s excellent infrastructure, including its well‑maintained roads and bridges, makes it an ideal location for the food processing industry and logistics. Its proximity to the Western Philippine Sea and access to ports like Subic are also conducive to agricultural trade.

Smart/hi-tech light manufacturing

The manufacturing sector in the Philippines has been growing steadily, with the manufacturing purchasing managers’ index (PMI) hovering above 50. The government wants the sector to progress beyond its existing labour‑intensive manufacturing activities and embrace smart manufacturing.

One factor hindering the Philippines’ transition to a smart manufacturing economy is the instability of power supply across the nation. The government is putting its faith in renewable energy to improve this (see below), and some manufacturing bases have installed renewable energy plants as a safeguard, to complement the national power grid.

Another obstacle to developing smart manufacturing is the difficulty involved in maintenance, and in particular, the shortage of talent and materials needed to carry it out. While the required technicians and items are available locally, the price premium and lead times involved have a negative impact on overall cost effectiveness.

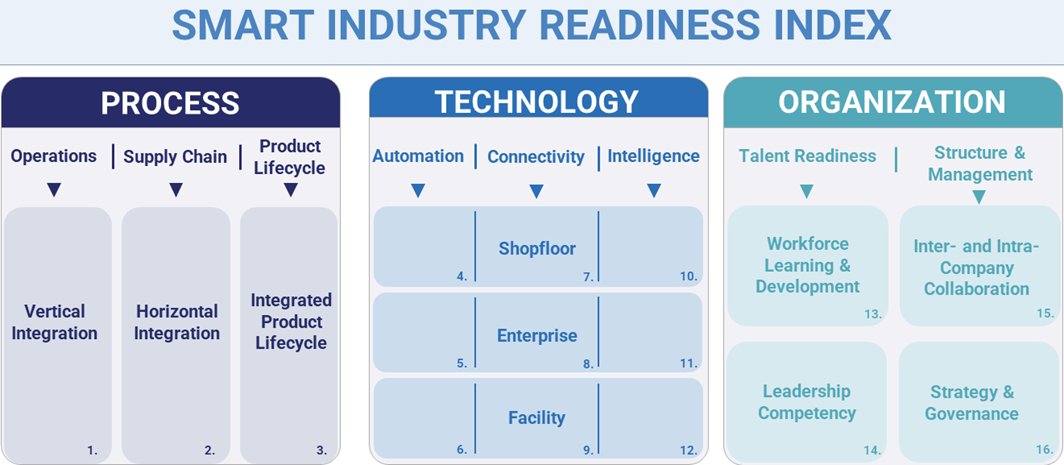

To try to overcome these problems, the Department of Trade and Industry (DTI) has adopted the Smart Industry Readiness Index (SIRI) framework, which was developed in Singapore. This is designed to guide, oversee and speed up the smart transformation of the manufacturing sector. The DTI is also working towards the establishment of an Industry 4.0 pilot factory, with cutting‑edge manufacturing technologies like advanced robotics, Internet of Things (IoT), drones and virtual/augmented reality for factory simulations. The government has been proactively looking for foreign investors with the relevant advanced manufacturing technology, in order to boost the adoption and understanding of smart manufacturing in the Philippines.

The SIRI Framework. (Source: Singapore Economic Development Board)

Electronics and semiconductors

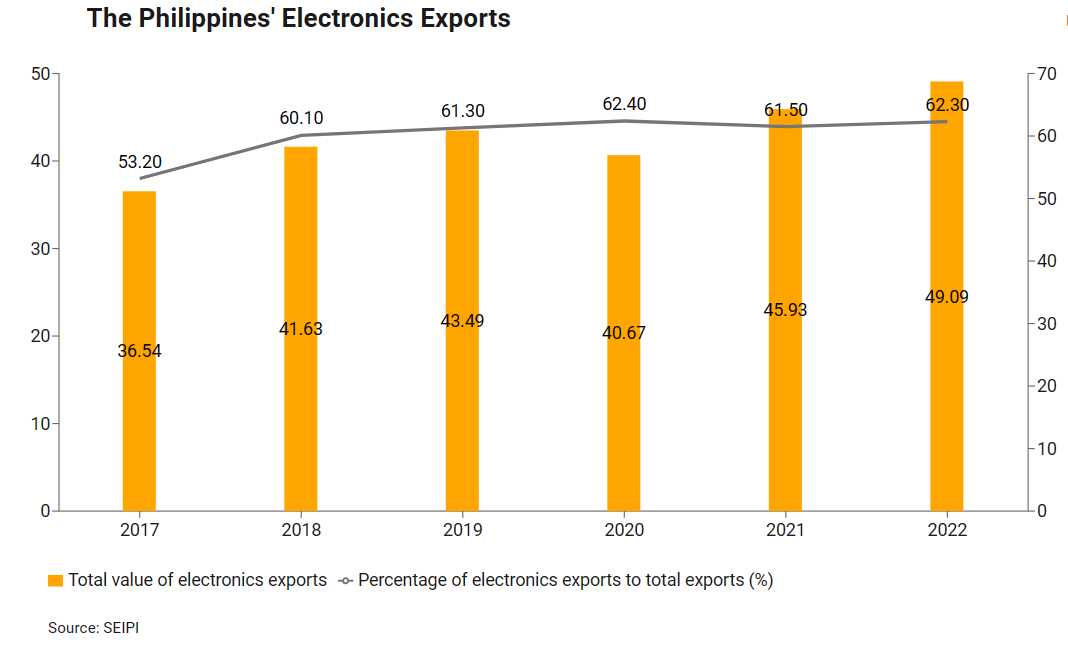

More than 60% of the Philippines’ exports are electronics‑related products, with semiconductors accounting for the lion’s share and Hong Kong being one of the country’s top export destinations. Most of the Philippines’ electronics companies are located in Metro Manila, Calabarzon, Northern/Central Luzon and Cebu. According to the Semiconductor & Electronics Industries in the Philippines Foundation (SEIPI), the electronics and semiconductor industry is one of the largest contributors to the country’s economy. In 2022, the value of electronics and semiconductor exports reached a record level of US$49 bn (HK$383.15 bn).

The Philippines’ competitive advantages and growth opportunities lie in the test, packaging and assembly of semiconductors. The government is trying to attract more global semiconductor companies to invest in the country. Recognising the importance of integrated circuit (IC) design, it has established a dedicated centre to support this crucial aspect of the industry.

In addition to its current strengths, the Philippines has extensive experience in electronics manufacturing services (EMS) manufacturing. Local EMS companies are increasingly willing to embrace modernisation to meet the rising demand for higher value‑added products such as electric vehicles (EVs).

Furthermore, the Philippines is actively engaged in digital upskilling and training its domestic talent to attract foreign investment. Together with the country’s relatively low cost of labour, this is becoming a prime attraction for businesses looking to the enter the Philippines’ electronics and semiconductor industry.

Renewable energy

The Philippines has the second highest energy costs of any of the ASEAN countries, and one of the highest energy cost levels in the world. The country relies primarily on diesel and coal in its energy mix. In December 2022, those two sources accounted for 61.8% of total energy generation. Because of the limited domestic availability of natural fossil resources, the Philippines relies heavily on coal imports. In 2021, coal imports stood at 31.2 million tonnes, more than double the amount of domestic production (14.4 million tonnes).

The Philippines Energy Plan (PEP) prioritises ensuring accessible, reliable and resilient energy supplies, while encouraging a transition to cleaner and more sustainable sources, especially renewable energy. Four strategic pillars have been set out so far: (1) accelerating the development of renewable energy; (2) building a smart, green grid system that supports renewable energy development; (3) developing ports to support off‑shore wind projects; and (4) voluntarily retiring and/or repurposing coal plants.

Under its National Renewable Energy Program 2020-2040, the government has set ambitious targets of 35% usage of renewable energy in its energy mix by 2030 and 50% by 2040. The increasing ESG requirements of foreign buyers have underscored the need for a transition to clean energy.

The Philippines possesses substantial untapped renewable energy potential, with an estimated 246,000 megawatts (MW) of capacity available. Its geothermal capacity of 1,900 MW is the third largest in the world.1 With more than 17,000 islands, the country offers significant opportunities for hosting off‑shore wind, solar, hydro, biomass and geothermal projects.

As mentioned in the article ASEAN Ascends – Exploring the Philippines: The Road South, foreign investors are now allowed to own 100% of many renewable energy generation projects. This creates significant potential for overseas companies looking to participate or invest in the Philippine renewable energy sector. Furthermore, there are promising business opportunities in supplying raw materials and equipment to support the country’s growing renewable energy industry.

Renewable energy was the top‑performing sector for investments approved by the Philippines’ Board of Investments (BOI) in 2023, accounting for nearly 80% of the investments approved – with a total value of US$17.6 bn (PHP987 bn). To accommodate the influx of renewable energy solutions and players, the DOE is streamlining the approval for project permits.

A recent research report by Bloomberg ranked the Philippines fourth among developing economies in terms of clean energy investment, behind only India, China and Chile.2 Combined with the government’s determination to boost investment to support its renewable energy generation targets, this points to a new window of opportunity for investors.

Information technology and business process management (IT-BPM)

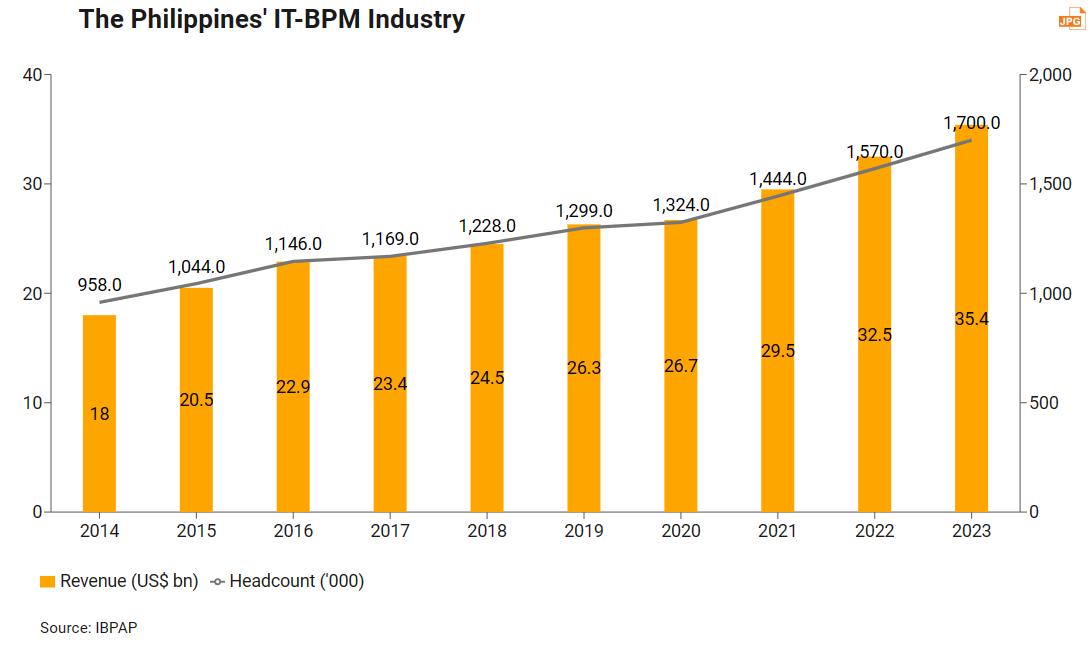

The Philippines’ business process outsourcing (BPO) sector, an important component of the IT‑BPM sector, continues to provide crucial support services to multinational corporations, generating US$32.5 bn in revenue and employing more than 1.57 million staff in 2022. The IT and Business Process Association of the Philippines (IBPAP) expects the sector to have registered 10% more growth in 2023 as the country firmly establishes itself as a premier BPO destination.

Companies around the world are increasingly interested in BPO and utilising global business services offered by low labour cost countries like the Philippines. The Philippines has witnessed a surge in demand for BPO and data centres from multinational companies such as Amazon. Many factors have contributed to the country’s rise as a leading BPO hub, including its skilled English‑speaking workforce, competitive labour costs and possession of an IT infrastructure which can support cross‑border communications and operations.

Because of its ongoing transition towards a more digitally‑driven economy, the Philippines is in dire need of a more robust telecoms infrastructure. Singapore’s restrictions on the construction of new data centre facilities due to space limitations and environmental considerations have encouraged a growing number of data centre operators to consider using the Philippines as an alternative, especially given that the latter‘s vibrant IT‑BPM sector has been one of its best‑performing economic areas in recent decades.

Challenges

While the Philippines presents an attractive market for investors, it is important to acknowledge the challenges prevail.

Power and costs

One of the main challenges facing the Philippines is its high energy costs compared to its rivals. This has been a longstanding obstacle to attracting energy‑intensive industries to the country. The Philippines’ heavy reliance on imported diesel and coal in its energy mix has made this problem even more chronic.

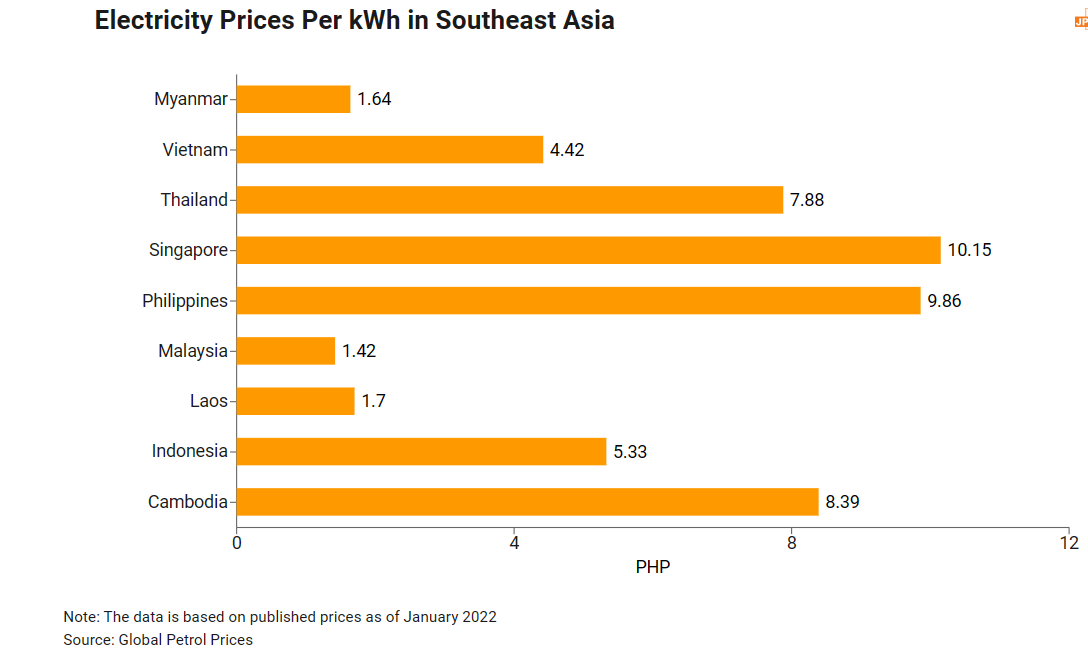

Electricity prices in the Philippines are PHP9.86 per kilowatt‑hour (kWh), the second highest level of any ASEAN country (only Singapore has more expensive electricity, at PHP 10.15/kWh). The average price for the region is only PHP4.53/kWh.3 The price of electricity in Indonesia and Vietnam is roughly half that of the Philippines, while in Malaysia and Myanmar it is less than one‑fifth.4

To tackle the difficulties brought about by high energy costs, the government has taken measures to enhance the country’s attractiveness to investors seeking supply chain diversification.

Saturation of Metro Manila

The increasingly congested environment in the capital Metro Manila has led to a slowdown in the construction of new hotels and office buildings, and also in the renovation of existing structures. This has prompted the Philippine government to devise plans and deploy resources to relocate businesses and some public administration operations away from Manila to other places, such as Clark.

Meanwhile, Cebu and other popular tourist destinations are undergoing a rapid wave of development. The resumption of economic activity after the Covid-19 pandemic has resulted in a resurgence in delayed projects. There is now strong momentum to make up for lost time, and there is a healthy pipeline of construction activities planned for the 2023‑2025 period.

Infrastructure deficiency

Most economic activity in the country is concentrated in Luzon, particularly in the bustling urban area of Metro Manila. Unfortunately, this region has long been plagued by severe congestion on its roads, at its ports and even in its airspace. Despite the government’s continual efforts to invest in the construction of new skyways and the expansion of seaports, the existing transport infrastructure still falls short of demand. Poorly maintained metro rail transit systems, insufficient public transportation, excessively congested roads and overburdened airports have all significantly reduced the country’s attractiveness to traders and investors.

While the world’s attention in the past decade has been on the development of smart cities, the Philippines has fallen behind due to its inadequate digital infrastructure. A recent World Bank study emphasised the need for the Philippines to actively pursue and implement reforms designed to foster competition and attract investment, with the ultimate goal of upgrading its broadband infrastructure.

In comparison to its neighbouring countries in Southeast Asia, the Philippines trails behind in terms of affordability, speed and accessibility to internet connectivity. This is particularly true in rural areas, creating an imbalanced landscape for digital participation. Access to digital resources and proficiency in utilising technology remain constrained and unevenly distributed, with some locations and socio‑economic groups unable to take full advantage of the potential benefits offered by digital technology.

In the light of these circumstances, Hong Kong companies are in good position to provide professional and technical services to infrastructure and construction project owners in the Philippines. Hong Kong has a pool of highly skilful experts in various fields, such as master planning, transport planning, engineering consulting, architectural design and financial modelling, who have extensive experience in planning and implementing similar projects throughout Southeast Asia. Their practical knowledge, proven best practise and track record in adhering to budget in the construction and management of infrastructure and building projects could well be of interest to their counterparts in the Philippines.

1 ASEAN Briefing: Philippines Opens Renewable Energy to Full Foreign Ownership

2 BloombergNEF 2023 Climatescope report

3 The region’s average is calculated through the arithmetic mean of ASEAN countries excluding Brunei.

4 Philippines Center for Investigative Journalism - Filipinos pay more for electricity compared to many ASEAN neighbours. What can Marcos do about it?

First, please LoginComment After ~