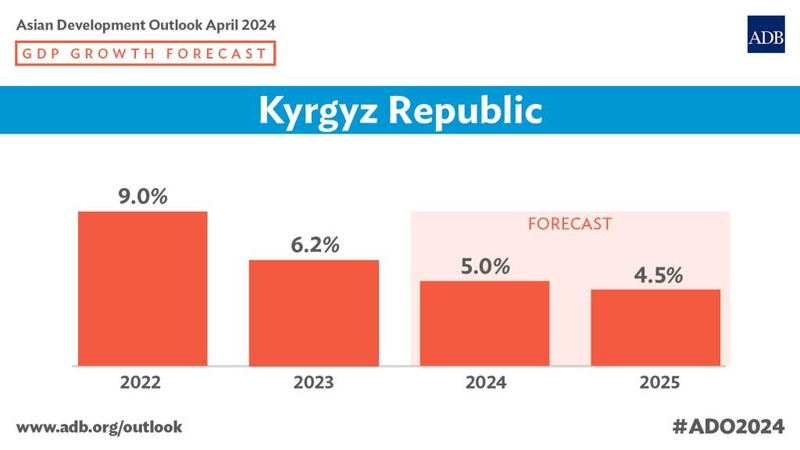

ADB forecasts 5% growth and slowing Inflation in Kyrgyzstan in 2024

The Kyrgyz Republic’s economy is expected to grow moderately in 2024 and 2025 with slower gains in construction and services, eventually reaching its long-term potential rate, according to a new Asian Development Bank (ADB) report.

The Asian Development Outlook (ADO) April 2024, ADB’s flagship economic publication, forecasts the Kyrgyz Republic’s gross domestic product (GDP) growth to slow to 5.0% in 2024 and 4.5% in 2025 driven by slower growth in construction and services. Investment and private consumption will continue to be the main drivers of growth, supported by higher household incomes due to a projected slowdown in inflation and robust remittances.

"This year and next growth-enhancing external spillovers, including trade growth, are expected to subside," said ADB Country Director for the Kyrgyz Republic Zheng Wu. "Therefore, we project growth to moderate to its long-term average level. In this context, ADB remains fully committed to supporting structural reforms and investments that can enhance growth prospects and contribute to economic development."

Inflation is projected to decelerate to 7% in 2024 and 6.5% in 2025, as an improved global food market and slowing domestic demand reduce inflationary pressures. Fiscal stimulus is projected to remain limited in 2024 and 2025, while high value-added tax collections may subside as growth in reexports slows down or even reverses.

Public programs for housing notwithstanding, construction on urban infrastructure, irrigation, and social and industrial facilities will slow in 2024 and stabilize in 2025. The current account deficit is expected to narrow in 2024 and 2025 as gold exports rise and imports slow due to lower domestic demand and lower re-exports.

According to the ADO, despite the decline of inflation to 5.5% in February 2024, inflation expectations remain elevated. To address this, monetary policy should be strengthened by implementing measures to reverse dollarization, enhancing operational independence and credibility as well as communication of the central bank.

First, please LoginComment After ~