The future of the Luxembourg financial industry

During this year’s 10th edition of the Horizon Conference—Deloitte Luxembourg's annual flagship event on 28 September—Nicolas Mackel, CEO of Luxembourg for Finance, previewed the eagerly awaited study on the Luxembourg financial sector’s future, conducted in collaboration with Deloitte Luxembourg.

The study aims to give players and customers an in-depth understanding of the Luxembourg financial sector by providing a snapshot of Luxembourg’s economic trends, the forces driving the market, and the positioning of Luxembourg as a financial hub going forward.

While the Luxembourg ecosystem has evolved over the years, the economy remains stable and resilient. Its GDP growth outpaces the European Union average, buoyed by a more than 30% contribution from its financial services industry (FSI). For this reason, maintaining and nurturing the competitive strengths of the FSI is critical for the economy.

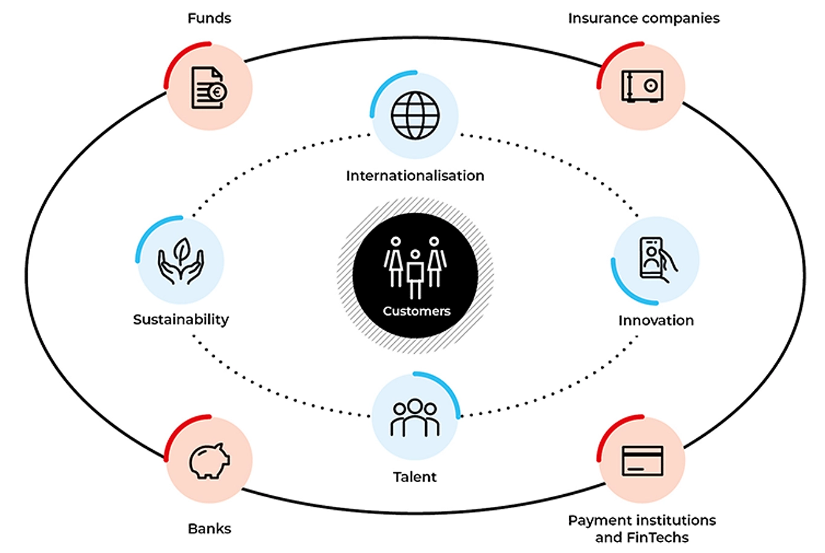

To understand how to sustain and grow business activities, Luxembourg for Finance in collaboration with Deloitte conducted a survey titled “The future of the Luxembourg Financial Service Industry”. This involved open-ended remote interviews with players active in Luxembourg, sessions with senior industry experts, and robust analysis of the market. The study’s results were unanimous: the Luxembourg FSI needs an enhanced, customer-focused perspective to strengthen its competitive positioning as a unique financial marketplace.

Four dimensions emerged as critical to continue creating a valuable proposition for the financial ecosystem:

Internationalization: the Luxembourg FSI must continue to emerge as a cross-border center of excellence to differentiate itself from competitors and attract international investors thanks to its plug-and-play model;

Innovation: technology must drive the innovation of products, services and models, to become a core pillar of the FSI’s strategy and not just an enabler;

Sustainability: the Luxembourg FSI must strengthen its position as the global hub for sustainable and impact investing by integrating purpose-driven models; and

Talent: Luxembourg must boost its attractiveness for specialized skills and cross-border expertise by focusing on the human dimension.

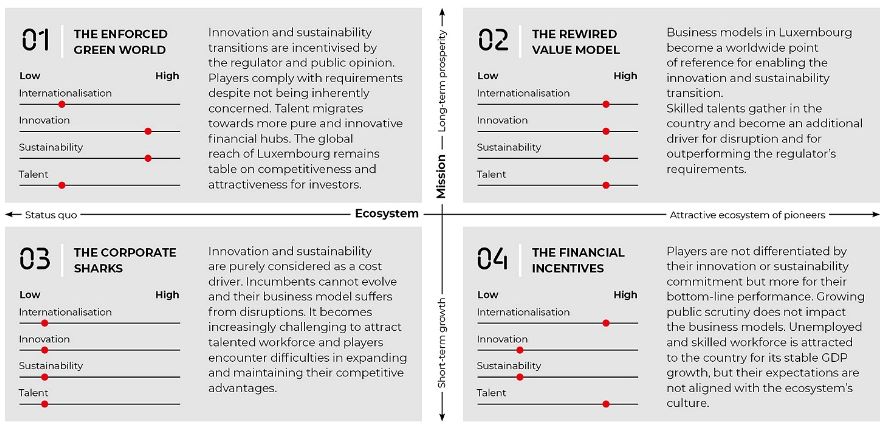

Considering these four critical dimensions and how the financial ecosystem may react towards them, the Luxembourg FSI could evolve into one of these four potential scenarios:

Most of the study’s respondents believe that Luxembourg’s ambitions will push the financial ecosystem in one clear direction. This is the rewired value model, where FSI players will focus on providing long-term added value for society by addressing these four dimensions and emphasizing the customer-centric approach.

This outlook foresees Luxembourg as one of the major global financial hubs for sustainability and innovation investments, therefore attracting international investors with increasingly sophisticated needs. FSI actors will lead the transition to 100% sustainable activities, discover new market potentials, and harness technology to enable fully efficient and end-to-end digital processes. In this scenario, Luxembourg will continue to attract the most talented minds from around the world and be able to retain a skilled and experienced workforce more than ever before.

To discover the recommended and concrete calls for action that FSI players should heed today, as well as the implications of this future scenario for both players and customers, we strongly suggest you consult the full report, now available here.

First, please LoginComment After ~