HY24 Results: Resilient result in subdued economic environment

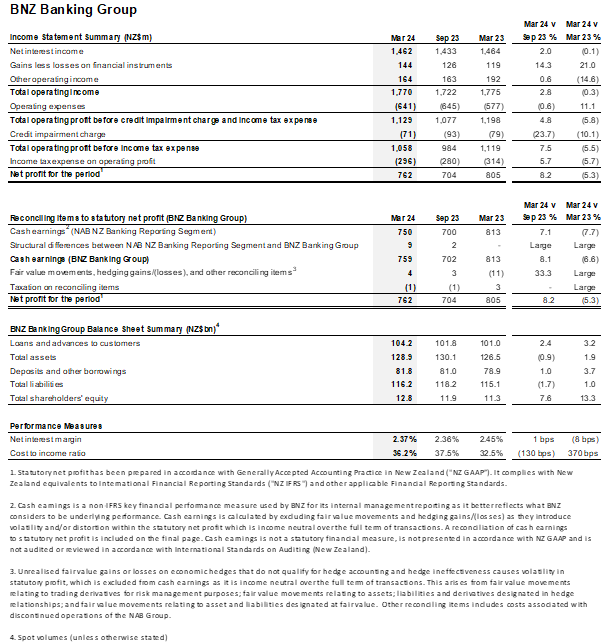

Bank of New Zealand (BNZ) today announced a statutory net profit of $762 million for the six months to 31 March 2024, a decrease of $43 million or 5.3% on the prior year.

This reflects continued growth in BNZ’s lending and deposits, and an increase in operating expenses, up $64 million or 11.1%, as BNZ invested in its people and digital capability.

BNZ CEO Dan Huggins says this is a resilient result in a subdued economic environment and the bank is in a strong position to continue supporting its customers.

“High interest rates and cost of living pressures continue to impact business and household finances.

“While easing inflation is encouraging, it is expected to remain outside of the Reserve Bank's target band until the end of year. Economic conditions are likely to remain challenging until there is a material reduction in interest rates.

“Supporting our customers through these challenging times remains our top priority.

“Our teams continue to proactively contact customers who we have identified as potentially needing additional support. For customers feeling under pressure, our message is get in touch.”

Revenue for the first six months was broadly flat at $1,770 million, while Net Interest Margin dropped by eight basis points on the prior year, reflecting strong competition across the banking sector and a change in deposit mix as customers shifted funds into term deposits to take advantage of higher interest rates.

Mr Huggins says despite the challenging operating conditions, the bank has maintained momentum across the business.

“Our team is focused on serving our customers brilliantly every day and supporting their ambitions, whether that’s investing in their business or buying their first, or next, home.”

“This focus is paying off with more New Zealanders choosing to bank with BNZ.”

BNZ’s total lending increased $2.4 billion or 2.4% in the first six months, with home lending up $1.1 billion or 1.9% and business lending up $1.3 billion or 3.0%. Total customer deposits increased by $1.5 billion or 1.9%.

Innovating to make banking simpler and easier

“We are always looking for new ways to integrate the latest technology into the way we work and how our customers’ bank to enhance their experience and make banking simpler and easier,” says Mr Huggins.

“We continue to invest heavily in protection measures to help keep our customers safer online, while also delivering digital solutions designed to free up time in their busy lives.

“Initiatives like our digital onboarding process which makes switching banks easier and faster for new customers by enabling them to open accounts digitally without having to go into a branch.

“Similarly, Open Banking, which will allow customers to share their data safely with third parties and enable more personalised products and innovative services for customers.”

BNZ has been leading the market in developing Open Banking APIs, with more than 250,000 BNZ customers already benefiting from secure budgeting and reconciliation tools and alternative payment options.

“We're committed to continuing to drive innovation across our business to provide more value to our customers,” says Mr Huggins.

An unaudited summary of financial information for the six months ended 31 March 2024 follows:.

.

First, please LoginComment After ~