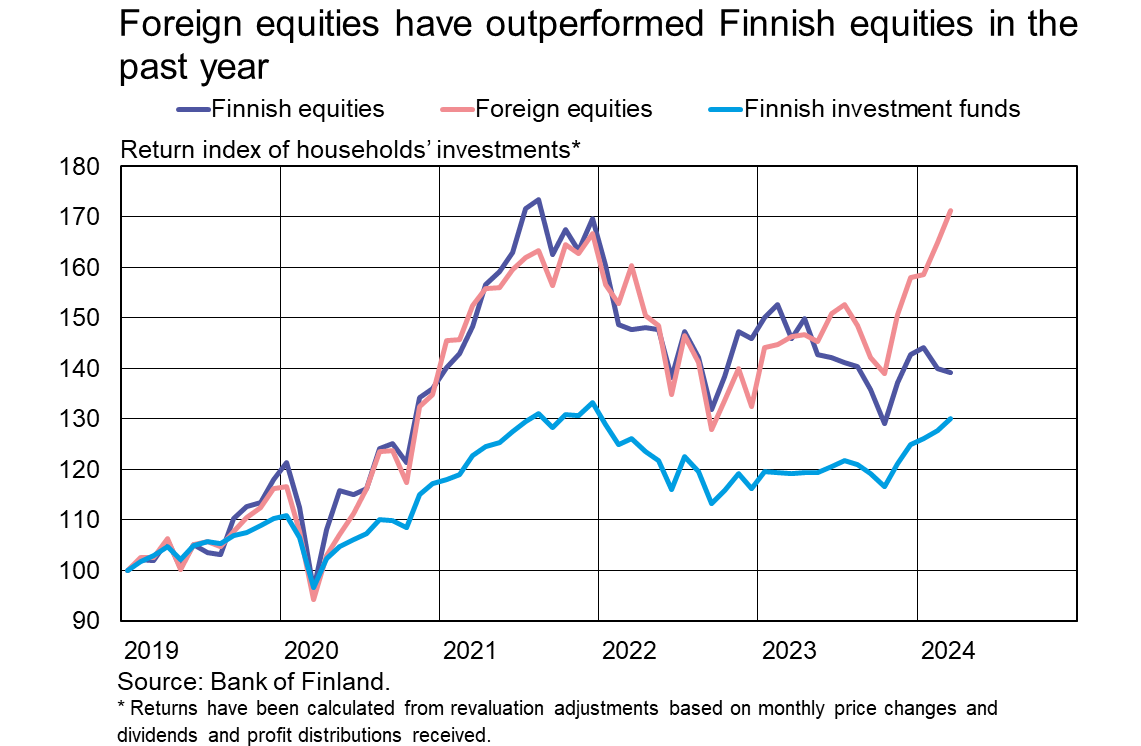

Foreign equities have outperformed Finnish equities in the past year

At the end of March 2024, Finnish households owned listed equities worth EUR 46.3 billion, as opposed to EUR 47.3 billion a year earlier. Most (86%) of Finns’ listed shareholdings consist of Finnish companies’ equities, although the proportion of foreign companies’ equities has recently increased. In March 2024, 13.6% of listed shareholdings consisted of foreign companies’ equities, as opposed to 11.2% a year earlier. The increase in the proportion of foreign equities reflects the appreciation of foreign equities and the depreciation of domestic equities. Furthermore, in relative terms, households have invested more in foreign equities during the past year.

The return[1] on domestic equities held by households amounted to -4.6% in the past 12 months, i.e. from April 2023 to the end of March 2023. In the same period, the return on foreign equities was 17.1%. In the past 12 months, the value of domestic equities held by households declined by EUR 3.6 billion, while the value of foreign equities increased by EUR 780 million. In the same period, households received dividends worth EUR 1.7 billion from domestic companies and EUR 140 million from foreign companies.

The value of investments in domestic companies has declined due to depreciating prices steadily in the past 12 months except for November-January when the value of households’ holdings increased clearly (by EUR 4.1 billion) on the back of revaluation adjustments. In the first quarter of 2024, the value of investments in domestic companies declined by EUR 1.2 billion. In the same period, households invested EUR 1.1 billion in net terms in domestic shares. Meanwhile, in January–March 2024, the value of equity investments in foreign companies increased by EUR 460 million, and households made new net investments of EUR 190 million therein.

Equity funds have been the best-performing investment funds

At the end of March 2024, Finnish households held investments worth EUR 35.9 billion in Finnish investment funds[2], as opposed to EUR 31.2 billion a year earlier. The value of the investment fund holdings has increased due to both new investments (EUR 1.8 billion in net terms over 12 months) and revaluation adjustments (EUR 2.9 billion over 12 months).

In the past 12 months, households’ return[3] from domestic investment funds amounted to 9.1%. The best returns were generated by equity funds (13.4%) and mixed funds (11.3%). Negative returns were made only by real estate funds, whose return over the past 12 months was -7.8%. Bond funds, which have become increasingly popular recently, made a return of 7.1% for households.

| Finnish deposits and investments (EUR million), 2024Q1 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 232 718 | 3 199 | 46 257 | -751 | 44 748 | 1 940 |

| (18 752) | (1 308) | (6 326) | ||||

| - in domestic shares | 119 495 | -5 481 | 39 968 | -1 176 | 16 953 | -404 |

| (2 110) | (1 120) | (209) | ||||

| Bonds | 219 436 | -910 | 2 366 | 17 | 28 967 | -111 |

| (-1 733) | (-20) | (-251) | ||||

| - in domestic bonds | 95 031 | -484 | 1 883 | 12 | 4 034 | 10 |

| (-1 548) | (-27) | (-454) | ||||

| Fund shares | ||||||

| Domestic investment funds | 124 102 | 4 449 | 35 874 | 1 394 | 5 493 | 132 |

| (1 211) | (418) | (-30) | ||||

| Foreign funds | 174 921 | 6 402 | 7 149 | 435 | 128 165 | 4 186 |

| (-4 897) | (263) | (-5 611) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 136 020 | 8 | 68 003 | -1 | 4 056 | 1 |

| (-6 472) | (-2 553) | (-1 705) | ||||

| Other deposits | 50 122 | 5 | 41 042 | 0 | -* | -* |

| (3 188) | (2 925) | -* | ||||

| * Confidential. | ||||||

| ** Insurance corporations' securities and mutual fund information is missing. | ||||||

First, please LoginComment After ~