贊比亞礦業最新投資與發展的詳細回顧

引言

贊比亞的礦業仍然是其經濟的基石,特別是因為它作為世界頂級銅生產國的地位。最近的發展帶來了新的投資和擴張,承諾在全球商品價格波動中重塑行業。

Introduction

Zambia’s mining industry remains a cornerstone of its economy, particularly driven by its status as one of the world's top copper producers. Recent developments have brought fresh investments and expansions, promising to reshape the industry amidst fluctuating global commodity prices.

重大投資和戰略發展

贊比亞礦業景觀最近見證了表明對該國礦產財富和監管環境信心的實質性投資.

Significant Investments and Strategic Developments.

The Zambian mining landscape has recently seen substantial investments that signal confidence in the country's mineral wealth and regulatory environment.

巴裏克黃金公司的盧瓦納擴展:巴裏克黃金已承諾投資13億美元擴大盧瓦納銅礦。這一舉措預計將至少將礦山的運營壽命延長20年。擴展計劃包括升級現有工廠基礎設施,引入尖端采礦技術,並擴大廢物管理系統。該項目旨在將礦山的年銅產量增加約45%,將其總生產能力提高到每年超過27萬噸銅。

Barrick Gold Corporation’s Lumwana Expansion: Barrick Gold has committed a significant investment of $1.3 billion to expand the Lumwana Copper Mine. This initiative is projected to extend the mine's operational life by at least 20 years. The expansion plan includes upgrading existing plant infrastructure, introducing cutting-edge mining technology, and expanding the waste management systems. This project aims to increase the mine’s annual copper output by approximately 45%, enhancing its total production capacity to over 270,000 tonnes of copper per year.

First Quantum Minerals的坎桑希擴展:First Quantum Minerals宣布對坎桑希礦進行20億美元的投資以開發S3擴展項目,這是贊比亞最大的銅礦。這一擴展預計將顯著增加銅產量,一旦完成,預計每年增加約10萬噸銅。該項目包括建設新的加工廠和開發兩個新的露天礦。這一擴展至關重要,因為它確保了礦山至2044年的長期運營。

First Quantum Minerals’ Kansanshi Expansion: First Quantum Minerals has announced a $2 billion investment to develop the S3 expansion at the Kansanshi mine, which is Zambia’s largest copper mine.

This expansion is expected to increase copper output significantly, adding an estimated 100,000 tonnes of copper annually once completed. The project includes the construction of a new processing plant and the development of two new open pits. This expansion is critical as it ensures the longevity of the mine up to 2044.

紫金礦業在贊比西河下遊的投資 :

中國礦業巨頭紫金礦業已啟動一個3.8億美元的項目,在贊比西河下遊地區開發一座新的銅礦。這一發展尤為引人註目,因為它標誌著在新的政府協議下,聚焦於可持續采礦實踐的重大中國投資。該項目承諾采用環保技術和方法以最小化生態影響。

Zijin Mining’s Investment in the Lower Zambezi: Chinese mining giant Zijin Mining has initiated a $380 million project to develop a new copper mine in the Lower Zambezi region. This development is particularly noteworthy as it marks a major Chinese investment in Zambia under the new governmental agreements focused on sustainable mining practices. The project promises to adopt environmentally friendly technologies and methods to minimize ecological impact.

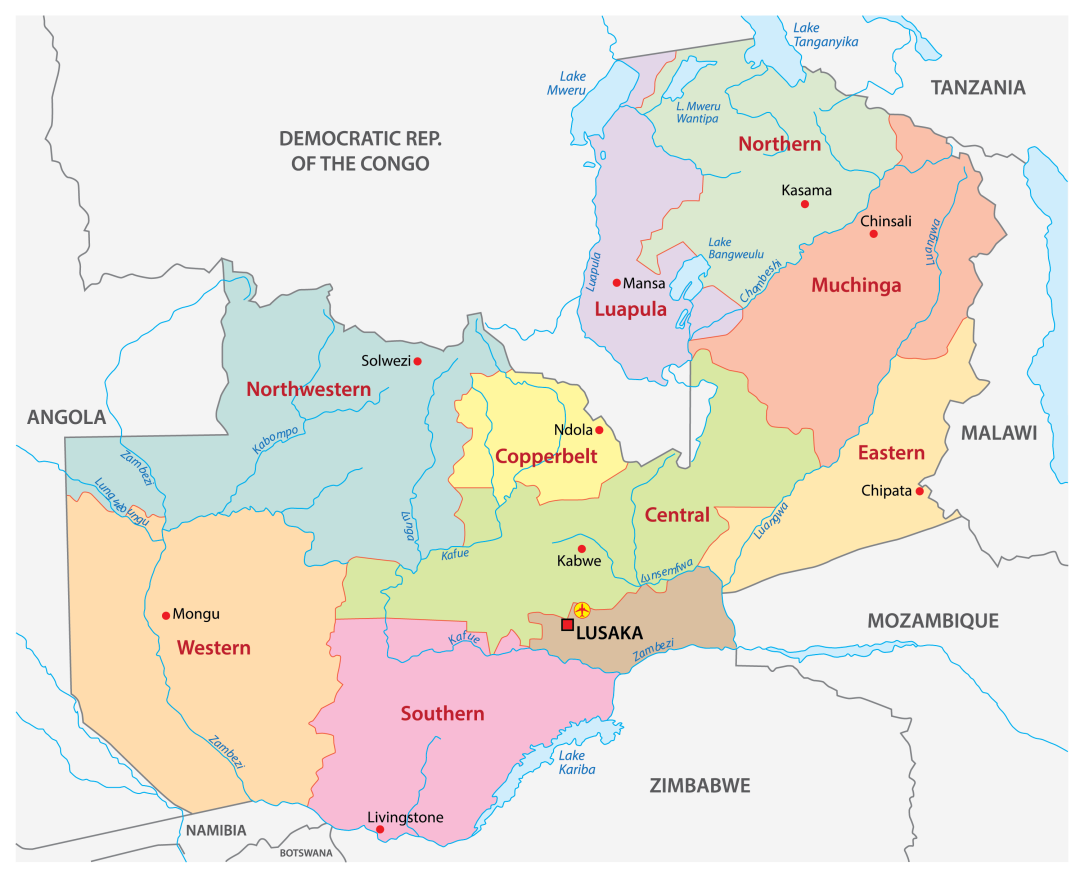

高潛力行業和地理位置.

以下行業和位置被認為是贊比亞礦業和勘探的高潛力機會:

銅帶省:傳統的銅礦強區,同時也顯示出鈷和鎳的潛力,這些都是電池技術中關鍵的元素。

西北省:作為黃金和寶石開采的新中心逐漸嶄露頭角,擁有大量未開發的礦床。

東部贊比亞:以高品質紫水晶礦產而聞名,具有擴展和引入新采礦技術的潛力。

High Potential Sectors and Geographical Locations.

The following sectors and locations in Zambia are identified as high-potential opportunities for mining and exploration:

Copperbelt Province: Traditional stronghold for copper but also showing potential for cobalt and nickel, critical for battery technology.

North-Western Province: Emerging as a new hub for gold and precious stones mining, with significant untapped deposits.

Eastern Zambia: Known for high-quality amethyst mining, with potential for expansion and introduction of new mining technologies.

行業面臨的挑戰.

盡管有這些樂觀的發展,贊比亞的礦業部門仍面臨幾個挑戰:

能源供應:

國內頻繁的電力短缺對礦業運營構成重大風險,常常因需要替代電力解決方案而導致運營成本增加。

監管環境:

近期稅製和礦業政策的變動造成了不確定性,這可能影響未來的投資決策。

環境問題:

關於礦業活動的環境影響,尤其是關於水資源使用和汙染問題,本地社區和國際觀察者的審查越來越嚴格。

Challenges Facing the Industry.

Despite these optimistic developments, Zambia's mining sector faces several challenges:

Energy Supply:

The frequent power shortages in the country pose a significant risk to mining operations, often leading to increased operational costs due to the need for alternative power solutions.

Regulatory Environment:

Recent changes in the tax regime and mining policies have created uncertainties that could affect future investment decisions.

Environmental Concerns:

There is growing scrutiny from both local communities and international observers regarding the environmental impact of mining activities, especially concerning water usage and pollution.

戰略投資機會.

先進勘探技術:投資地球物理和地球化學勘探技術可以在像盧阿普拉省這樣的較少探索的地區發現新的礦產資源,該地區顯示出鎳和鈷的潛力。實施無人機技術和3D地震成像可以將勘探成本降低多達20%,並加速發現過程。

基礎設施發展夥伴關系:參與公私合營(PPP)項目,為礦區(如道路、電力和水供應)的基礎設施發展可以降低運營成本並增強項目可行性。例如,投資太陽能基礎設施可以將能源成本降低15-25%,考慮到贊比亞的高太陽能潛力。

自動化和環保礦業操作:采用自動化礦業操作和環保采礦方法可以提高效率並減少環境影響。投資自動化鉆探和礦石處理系統可以將操作效率提高大約30%,同時減少環境修復責任。

Strategic Investment Opportunities.

Advanced Exploration Technologies:

Investing in geophysical and geochemical survey technologies can uncover new mineral deposits in less explored regions like the Luapula Province, which shows potential for nickel and cobalt. Implementing drone technology and 3D seismic imaging can reduce exploration costs by up to 20% and speed up the discovery process.

Infrastructure Development Partnerships:

Engaging in public-private partnerships (PPPs) for the development of infrastructure (roads, power, and water supply) in mining areas can reduce operational costs and enhance project feasibility. For example, investing in solar power infrastructure can decrease energy costs by 15-25%, considering Zambia's high solar energy potential.

Automated and Eco-friendly Mining Operations:

Adopting automated mining operations and eco-friendly mining methods can increase efficiency and reduce environmental impact. Investment in automated drilling and ore handling systems could increase operational efficiency by approximately 30%, while reducing environmental remediation liabilities.

潛在投資的可行性步驟.

進行全面的可行性研究:

在投資資本之前,進行包括環境影響評估、市場分析和物流評估在內的詳細可行性研究。這些研究有助於理解投資的潛在回報和可持續性。

與當地社區和政府機構接觸:

與當地社區和政府機關建立牢固的關系可以促進更順暢的運營並確保遵守當地法規。參與社區發展項目還可以增強企業的社會責任感和項目的地方支持。

跨商品多元化投資:

為了減輕大宗商品市場價格波動帶來的風險,應在不同礦物和金屬之間多元化投資。這一策略不僅可以穩定收入流,還可以利用不同商品的市場周期。

Actionable Steps for Potential Investment.

Conduct Comprehensive Feasibility Studies:

Before committing capital, conduct detailed feasibility studies that include environmental impact assessments, market analysis, and logistical evaluations. These studies help in understanding the potential returns and the sustainability of the investment.

Engage with Local Communities and Authorities:

Building strong relationships with local communities and government authorities can facilitate smoother operations and ensure compliance with local regulations. Engaging in community development projects can also enhance corporate social responsibility and local support for projects.

Diversify Investments Across Commodities:

To mitigate risks associated with price volatility in the commodities market, diversify investments across different minerals and metals. This strategy not only stabilizes revenue streams but also capitalizes on different market cycles for various commodities.

結論

鑒於贊比亞豐富的礦產資源和不斷改進的監管框架,投資贊比亞的礦業部門提供了重大機會。然而,在這一領域取得成功需要戰略規劃、采用先進技術以及對可持續實踐的強烈承諾。通過遵循這些可操作的步驟並關註現實的結果,投資者可以最大化他們的回報,同時為贊比亞的經濟發展做出貢獻。

這一深入分析為業內人士提供了堅實的基礎,以便做出明智的決策並在贊比亞動態的礦業部門中製定穩健的投資策略。

Conclusion.

Investing in Zambia’s mining sector offers significant opportunities given the country's rich mineral resources and improving regulatory framework. However, success in this sector requires strategic planning, adoption of advanced technologies, and a strong commitment to sustainable practices. By following these actionable steps and focusing on realistic outcomes, investors can maximize their returns while contributing to the economic development of Zambia.

This in-depth analysis provides a solid foundation for industry insiders to make informed decisions and develop robust investment strategies in Zambia's dynamic mining sector.

請先 登錄後發表評論 ~