Capital Issuance - April 2024

The capital issuance statistics consist of non-government primary market issuance of bonds, commercial paper and equity, representing finance raised by UK resident entities.

Key points

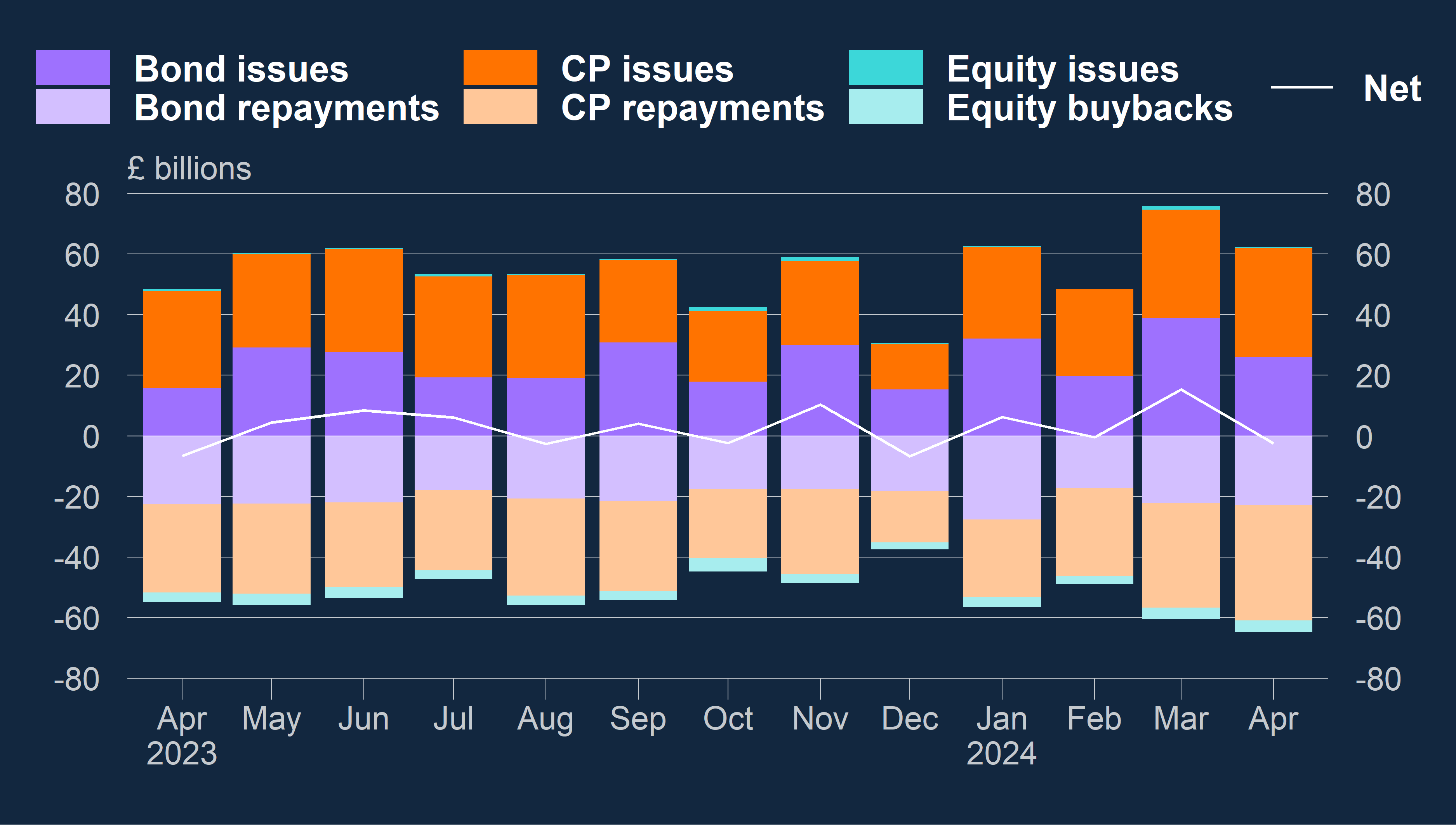

- Net issuance was -£2.5 billion in April, compared to £15.4 billion in March and the previous six-month average of £3.7 billion (Chart 1).

- Gross capital issuance by UK residents was £62.3 billion in April, compared to £75.8 billion in March and the previous six-month average of £53.2 billion (Chart 1).

- The decrease in net capital issuance was driven by a fall of £12.9 billion in bond issuance and an increase of £3.5 billion in commercial paper repayments.

In addition to the summary statistics contained within this release and the associated tables, the Bank publishes a number of more granular series; please see our Bankstats tables (E3.1) and the full list of series and interactive charts.

All sectors

- Gross capital issuance by UK residents was £62.3 billion in April, compared to £75.8 billion in March and the previous six-month average of £53.2 billion (Chart 1).

- Net issuance was -£2.5 billion in April, compared to £15.4 billion in March and the previous six-month average of £3.7 billion (Chart 1).

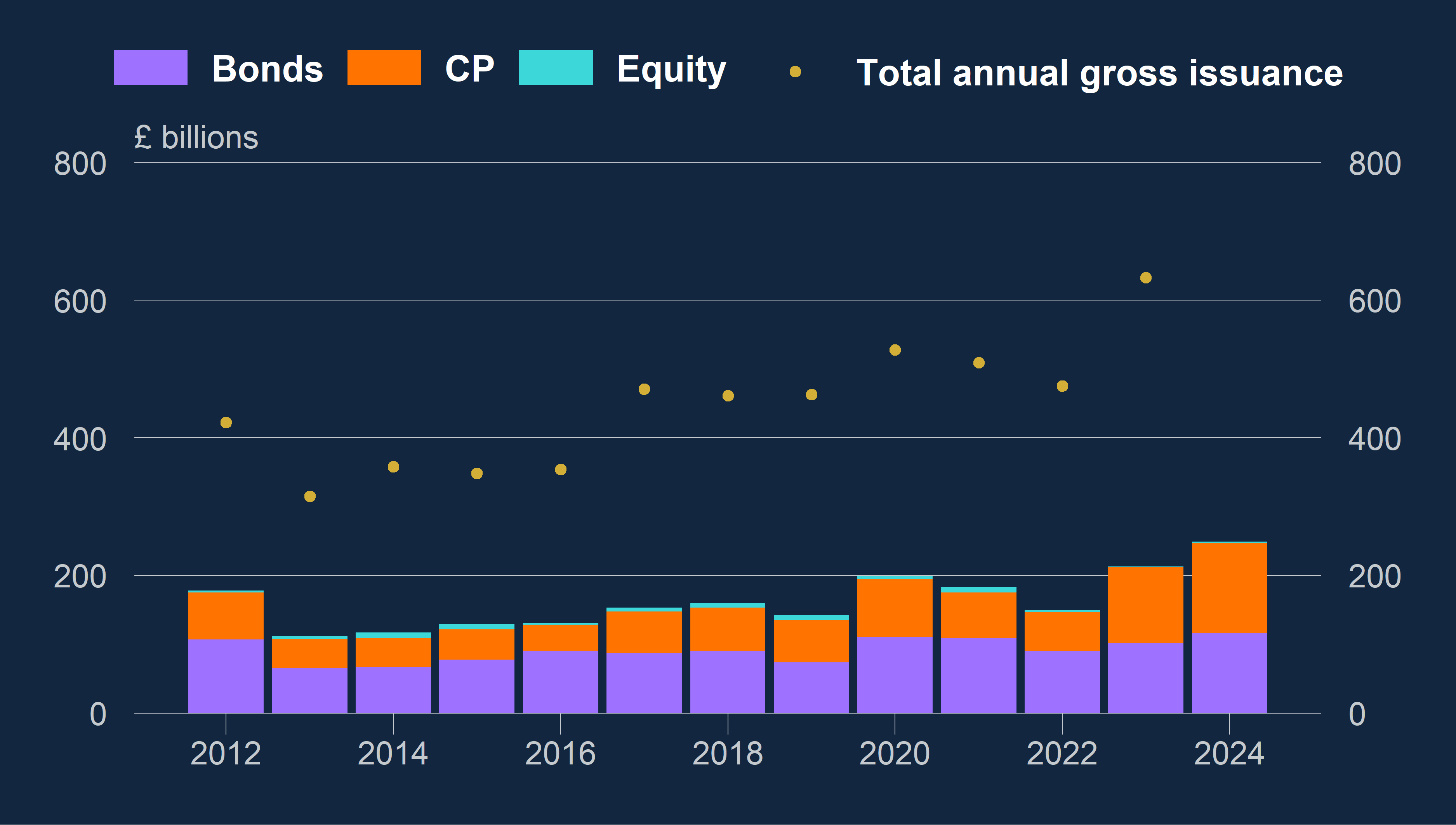

- Year to date gross issuance was £249.3 billion, £36.2 billion higher than at the same point the previous year (Chart 2) and £62.9 billion higher than the previous four-year average.

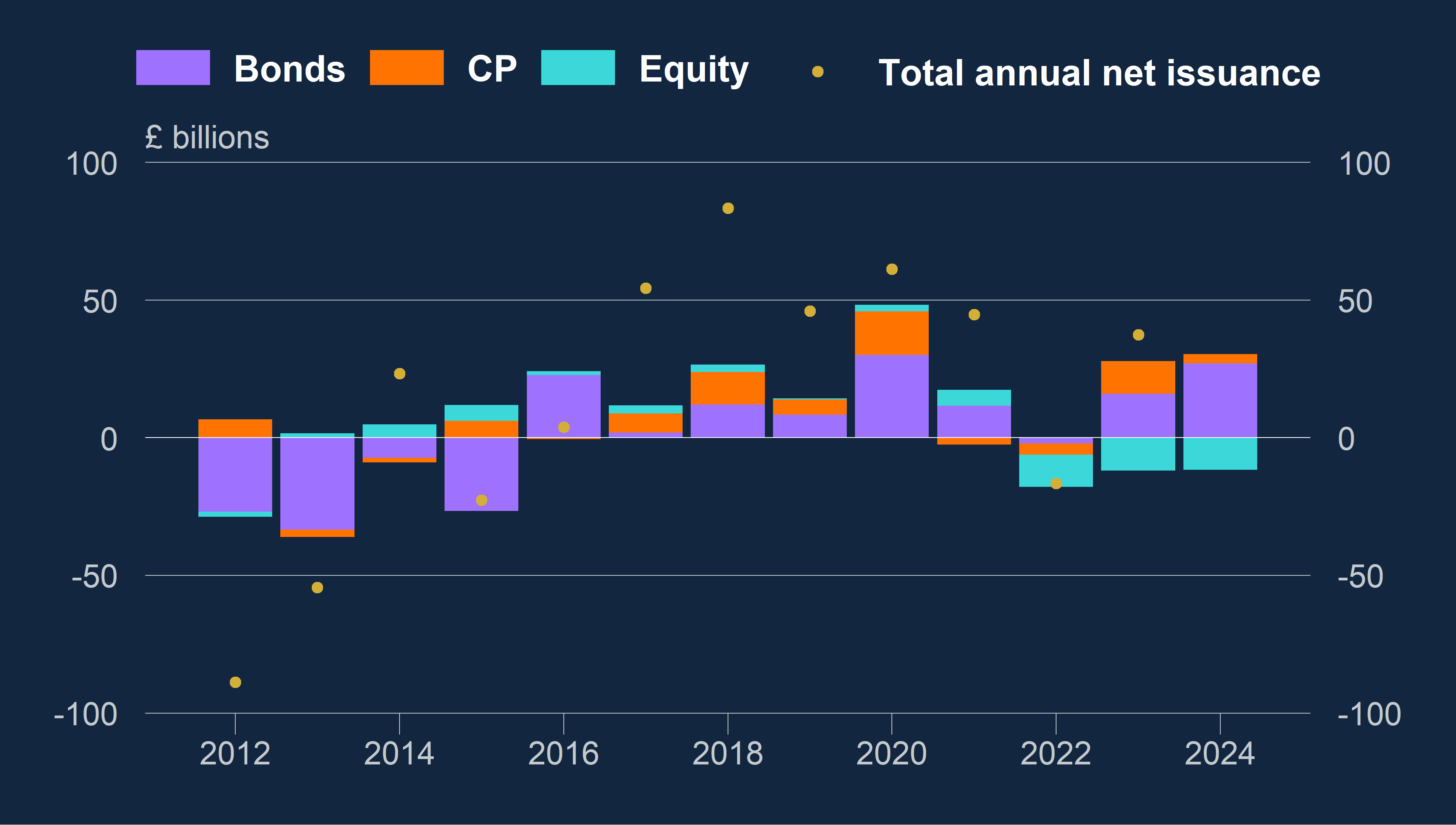

- Year to date net issuance was £18.6 billion, £2.8 billion higher than at the same point the previous year (Chart 3) and £3.4 billion higher than the previous four-year average.

Chart 1: Total capital issuance by UK residents (all currencies)

Non seasonally adjusted

Chart 2: Gross year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

Chart 3: Net year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

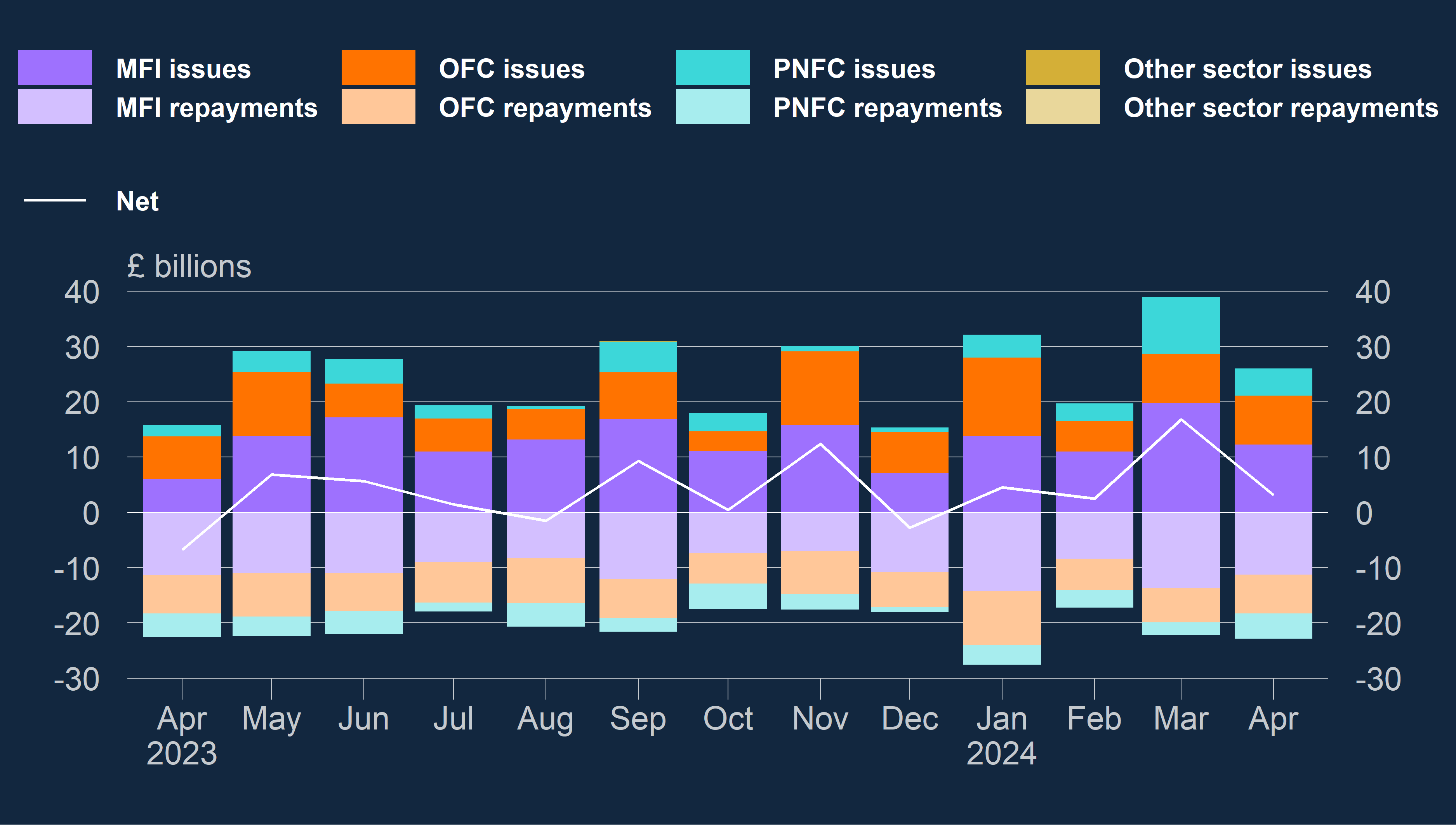

Bond issuance

- Gross bond issuance was £26.0 billion in April, compared to £38.9 billion in March and the previous six-month average of £25.7 billion (Chart 4).

- Net bond issuance was £3.2 billion in April, compared to £16.8 billion in March and below the previous six-month average of £5.6 billion (Chart 4).

- The decrease in net issuance was driven by a fall in MFI and PNFC issuance of £7.5 billion and £5.3 billion respectively.

Chart 4: Bond issuance by UK residents (all currencies)

Non seasonally adjusted

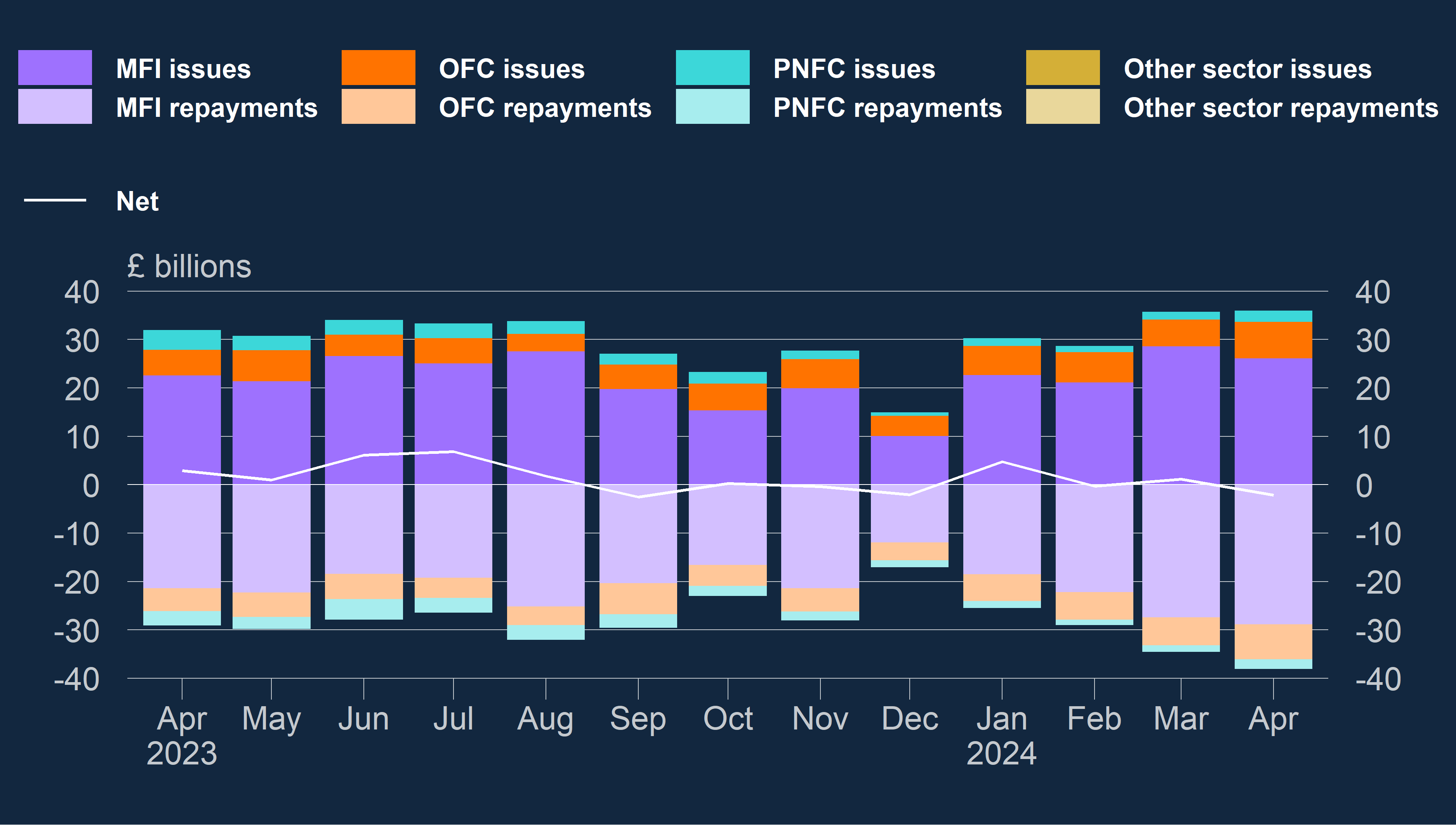

Commercial paper issuance

- Gross commercial paper issuance was £35.9 billion in April, compared to £35.7 billion in March and the previous six-month average of £26.8 billion (Chart 5).

- Net commercial paper issuance was -£2.2 billion in April, compared to £1.1 billion in March and below the previous six-month average of £0.6 billion (Chart 5).

- The decrease in net issuance was driven by an increase in repayments of £1.5 billion and £1.4 billion by the OFC and MFI sectors respectively.

Chart 5: Commercial paper issuance by UK residents (all currencies)

Non seasonally adjusted

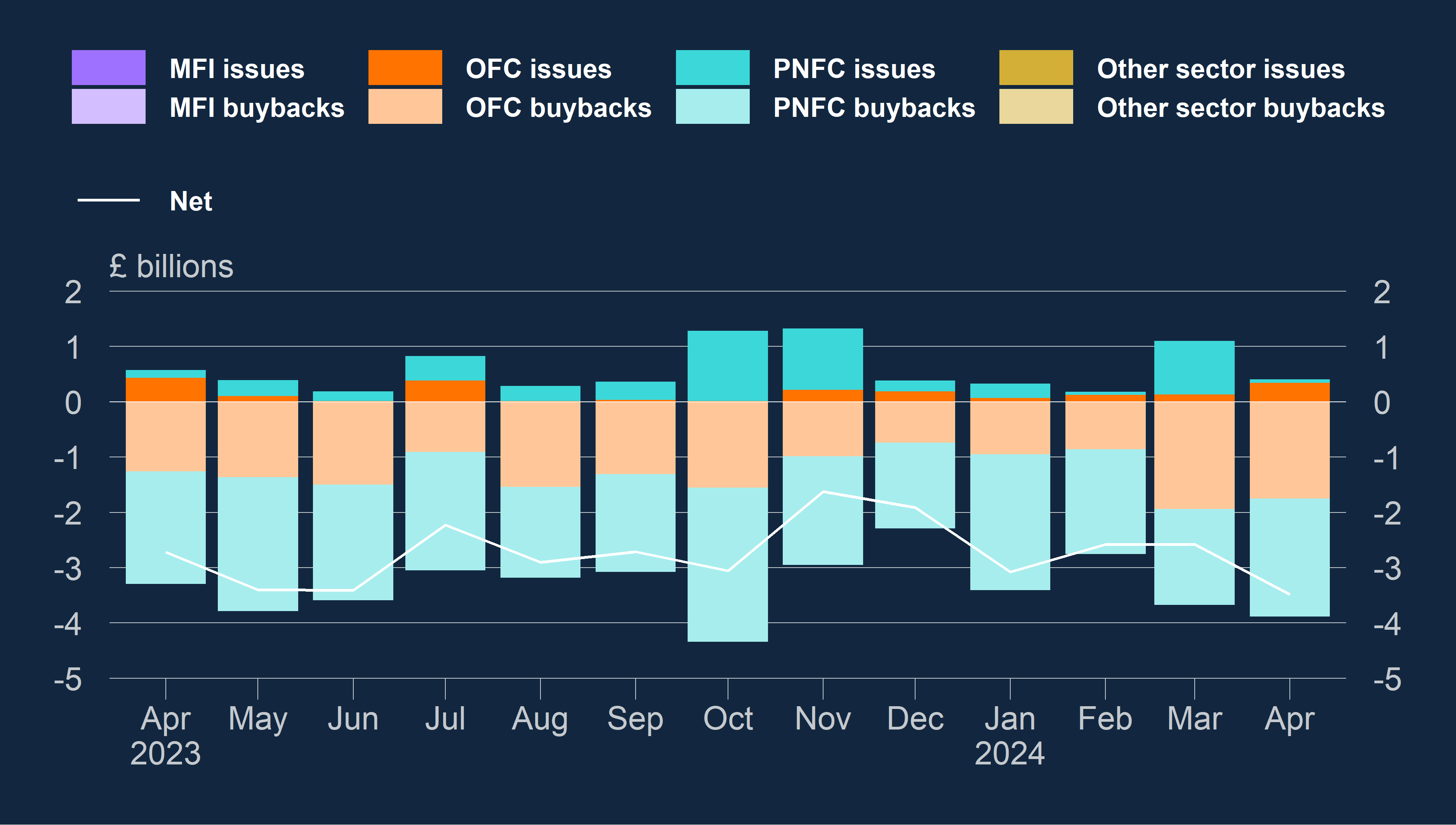

Equity issuance

- Gross equity issuance was £0.4 billion in April, compared to £1.1 billion in March and the previous six-month average of £0.8 billion (Chart 6).

- Net equity issuance was -£3.5 billion in April, compared to -£2.6 billion in March and below the previous six-month average of -£2.5 billion (Chart 6).

- The decrease in net issuance was driven by a fall in issuance of £0.9 billion combined with an increase of £0.4 billion in buybacks by the PNFC sector.

Chart 6: Equity issuance by UK residents (all currencies)

Non seasonally adjusted

Key:

- PNFC = Private non-financial corporations

- MFI = Monetary financial institutions

- OFC = Other financial corporations

- “Other sectors” contains public corporations and non-profit institutions serving households

- CP = Commercial paper

Queries

If you have any comments or queries with regard to this release please email DSDSecurities@bankofengland.co.uk.

Next release date: 27 June 2024

More information

Further data are available in Table E3.1 of our latest Bankstats tables.

First, please LoginComment After ~