Global situation of undertakings for collective investment at the end of April 2024

I. Overall situation

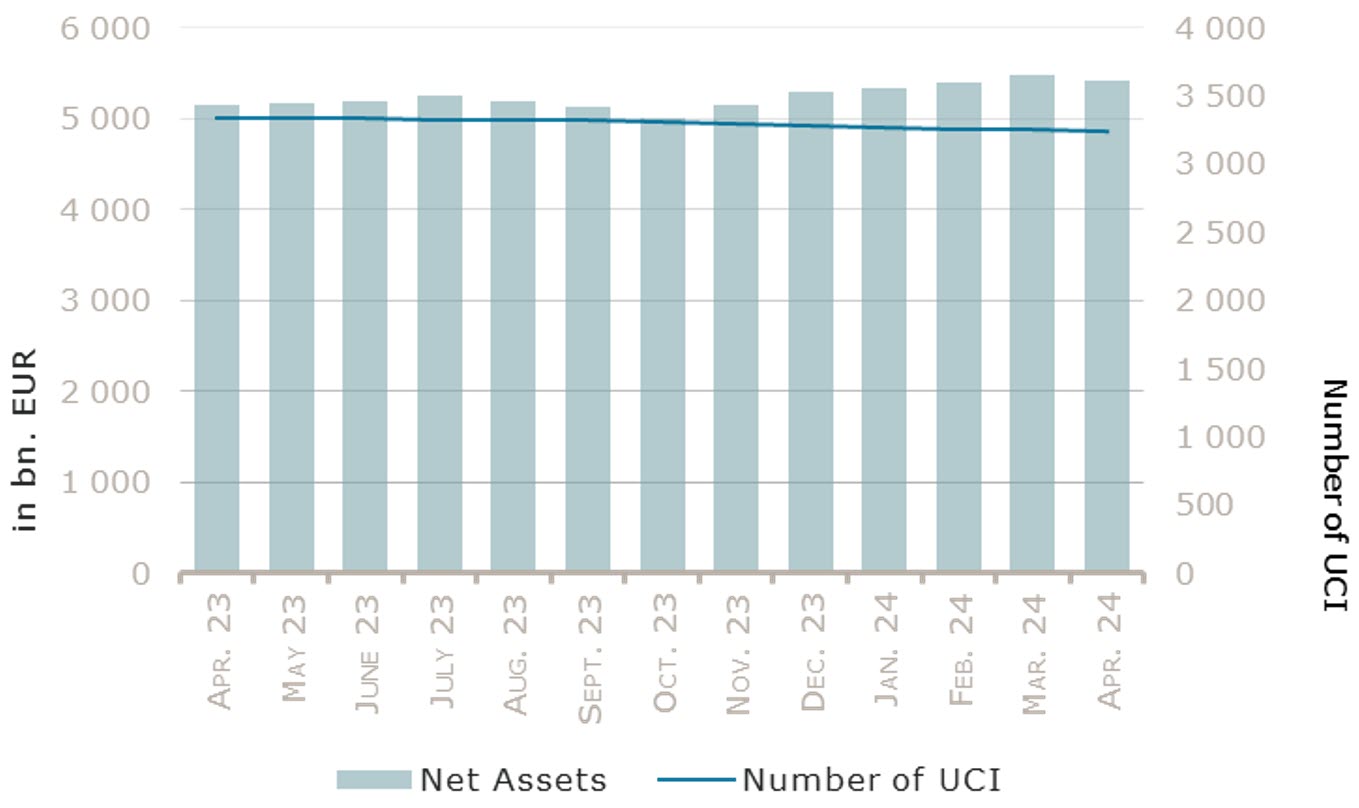

As at 30 April 2024, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,421.538 billion compared to EUR 5,485.248 billion as at 31 March 2024, i.e. a decrease of 1.16% over one month. Over the last twelve months, the volume of net assets increased by 5.50%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 63.710 billion in April. This decrease represents the sum of negative net capital investments of EUR 5.141 billion (-0.09%) and of the negative development of financial markets amounting to EUR 58.569 billion (-1.07%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,236, against 3,251 the previous month. A total of 2,116 entities adopted an umbrella structure representing 12,765 sub-funds. Adding the 1,120 entities with a traditional UCI structure to that figure, a total of 13,885 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of April.

Global equity markets were mainly driven down by inflation in the US, with a higher-than-expected figure for March, delaying further the prospects of a first rate cut by the Fed. Economic data also revealed a declining growth of the US economy. In addition, the ongoing conflicts in Ukraine and in the Middle East continued to weight on market sentiment, especially after a direct confrontation between Israel and Iran arose in the beginning of April.

In that context, most UCI equity categories posted significant losses during the month. Losses for European equities were slightly lower than for US equities, as they benefitted from better economic data, notably on inflation, supporting a potential first rate cut by the ECB at its June meeting. The Eastern European equities category reported strong gains mostly due to Poland, Hungary and the Czech Republic. The Asian equities categories also reported strong gains mostly due to a rebound in China, although concerns remain on the economy, particularly the troubled real estate sector.

In April, most equity UCI categories registered a negative capital investment, whereas the Japanese and Eastern European equities UCI categories benefitted from limited inflows.

Development of equity UCIs during the month of April 2024*

Market variation in % | Net issues in % | |

| Global market equities | -1.68% | -0.72% |

| European equities | -1.29% | -0.89% |

| US equities | -3.52% | -0.60% |

| Japanese equities | -3.21% | 0.56% |

| Eastern European equities | 2.64% | 0.57% |

| Asian equities | 3.60% | -1.14% |

| Latin American equities | -3.93% | -4.00% |

| Other equities | -2.42% | -0.47% |

* Variation in % of Net Assets in EUR as compared to the previous month

The above-mentioned economic indicators drove yields higher not only in the US but also in Europe, whereas spreads declined only slightly, resulting in losses for all bond UCI categories.

In April, fixed income UCIs registered an overall positive net capital investment with marked differences among categories. The UCI categories Global money market, Global market bonds and Others benefitted from the largest inflows.

Development of fixed income UCIs during the month of April 2024*

Market variation in % | Net issues in % | |

| EUR money market | 0.26% | -0.17% |

| USD money market | 0.95% | -0.98% |

| Global money market | 0.20% | 2.18% |

| EUR-denominated bonds | -1.02% | 0.53% |

| USD-denominated bonds | -1.42% | -0.46% |

| Global market bonds | -1.19% | 0.44% |

| Emerging market bonds | -1.28% | -0.12% |

| High Yield bonds | -0.61% | -0.13% |

| Others | -1.14% | 1.18% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of April 2024*

Market variation in % | Net issues in % | |

| Diversified UCIs | -1.14% | -0.20% |

| Funds of funds | -1.17% | 0.46% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following five undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- DEKA-ROHSTOFFSTRATEGIE, 6, rue Lou Hemmer, L-1748 Findel

- RUTH ASSET MANAGEMENT SICAV, 31, Z.A. Bourmicht, L-8070 Bertrange

UCIs Part II 2010 Law:

- BROOKFIELD OAKTREE WEALTH SOLUTIONS ALTERNATIVE FUNDS S.A. SICAV-UCI PART II, 26A, boulevard Royal, L-2449 Luxembourg

- UBS (LUX) PRIVATE MARKETS, 33A, Avenue J.F. Kennedy, L-1855 Luxembourg

SIFs:

- SHERE LUX – SICAF-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

The following twenty undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ESSENTIAL PORTFOLIO SELECTION, 88, Grand-Rue, L-1660 Luxembourg

- GLOBAL MASTERS, 16, rue Gabriel Lippmann, L-5365 Munsbach

- LYXOR, 5, allée Scheffer, L-2520 Luxembourg

- RIVERTREE EQUITY, 88, Grand-Rue, L-1660 Luxembourg

- SALAM-PAX SICAV, 14, rue de Strassen, L-2555 Luxembourg

- UNIINSTITUTIONAL BASIC EMERGING MARKETS, 3, Heienhaff, L-1736 Senningerberg

- UNIINSTITUTIONAL BASIC GLOBAL CORPORATES HY, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- LAMPAS INVESTMENT, 4, rue Peternelchen, L-2370 Howald

SIFs:

- GEM2 SICAV-SIF, 14, boulevard Royal, L-2449 Luxembourg

- LT FUND INVESTMENTS, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- MATRIS, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MERCER INFRASTRUCTURE SELECT, 68-70, boulevard de la Pétrusse, L-2320 Luxembourg

- MERCURY FUND, 4, rue Robert Stumper, L-2557 Luxembourg

- NORTHERN HORIZON NORDIC AGED CARE SCSP SICAV-SIF, 31, rue de Hollerich, L-1741 Luxembourg

- SODERIVA, 26, avenue de la Liberté, L-1930 Luxembourg

SICARs:

- GAIN CAPITAL PARTICIPATIONS II SA, SICAR, 5-11, avenue Gaston Diderich, L-1420 Luxembourg

- GAIN CAPITAL PARTICIPATIONS SA, SICAR, 5-11, avenue Gaston Diderich, L-1420 Luxembourg

- INTERNATIONAL REAL ESTATE PORTFOLIO 08/09 – FTL S.C.A., SICAR, 18, boulevard de la Foire, L-1528 Luxembourg

- PARTNERS GROUP GLOBAL VALUE 2008 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg

- PARTNERS GROUP SECONDARY 2008 S.C.A., SICAR, 35D, avenue J-F Kennedy, L-1855 Luxembourg

First, please LoginComment After ~