ASEAN Ascends – Exploring the Philippines: Freeports and Special Economic Zones

Complementing the nationwide investment incentives and priorities mentioned in previous articles, Economic Zones (EZs), Freeport Zones (FZs) and the related investment promotion agencies (IPAs) are crucial points of contact for Hong Kong companies and investors exploring the Philippines.

EZs and FZs

The Philippines first embarked on EZ development in the mid 1990s as a means to foster investment, both domestic and foreign. Over the intervening decades, EZs have become a magnet for foreign direct investment (FDI), particularly with regard to manufacturing, with the Netherlands, Japan, Singapore, the US, and – more recently – South Korea, proving to be the biggest investors.

Playing a pivotal role in the country’s EZ development is the Philippines Economic Zone Authority (PEZA), a nationwide IPA that, as of January 2024, oversaw 422 EZs throughout the country under the auspices of the Department of Trade and Industry (DTI) and alongside the Board of Investment (BOI). These EZs play a significant role in the Philippine economy, accounting for about 56% of the country’s commodity and goods exports and more than 16% of its GDP.

Of the 422 zones, 297 are located in the Luzon region, while 84 are in Visayas and 41 in Mindanao. Collectively, they accommodate a diverse range of industries, such as electronics, information technology (IT) and metals. It is, however, worth noting that the related facilities are widely dispersed across multiple locations, making it difficult to pinpoint geographically specific manufacturing or industry clusters.

EZs aside, several FZs have also been established regionally to facilitate industry agglomeration. For example, the Clark Development Corporation (CDC) oversees the Clark Freeport and Economic Zone, while the Subic Bay Metropolitan Authority (SBMA) supervises the Subic Bay Freeport Zone. Investors seeking to explore EZs and FZs are advised to contact the relevant IPAs for guidance.

PEZA

As a one stop shop, PEZA provides assistance to enterprises seeking to set up in the Philippines. In 2023, PEZA approved total investment of PHP175.7 bn (US$3.05 bn), marking a notable 24.9% year on year increase.

Complementing the nationwide incentives under the CREATE Act (as referenced in ASEAN Ascends – Exploring the Philippines: The Road South), PEZA acts as a comprehensive one stop shop facility. It works to guide investors through resource draining administrative procedures and EZ selection. By granting a PEZA Visa that entitles foreign investors – as well as their employees and immediate family members – multiple entry privileges, PEZA is committed to facilitating smooth access.

Prior to the CREATEAct, eligibility for PEZA was limited to manufacturing, processing, assembling for export, and other export facilitation activities. Nowadays, the scope of eligible activities covers everything under the Strategic Investment Priority Plan (SIPP), no matter whether or not it is export oriented. Various types of EZs cater to different industry sectors within the PEZA network, covering manufacturing, IT and medical tourism.

PEZA welcomes and offers enhanced flexibility in terms of zone location, scale and industry composition to investors looking to establish new EZs. Interested investors can identify and develop any locations they see as suitable before applying for PEZA EZ status. However, it is important to note that non Filipino entities are generally not allowed to own land in the Philippines, so the operating entity of the EZ is mandated to maintain a minimum Filipino ownership of 60%.

To establish a PEZA EZ, investors have to submit an application to PEZA for evaluation. Upon preliminary approval, documents proving land ownership and environmental compliance, in addition to certification from the National Water Resources Board, plus other relevant certificates and endorsements specific to the type of EZ being established, have to be submitted to PEZA for review before final approval is given by the Office of the President of the Philippines.

FZs in focus: Subic Bay Freeport Zone

Subic Bay, situated approximately 2.5 hours away from Manila and 40 minutes from Clark by land, is an FZ near the city of Olongapo. Not adjacent to the National Capital Region (NCR), businesses in Subic Bay can enjoy the most favourable tier treatment under the CREATEAct.

The Subic Bay Freeport Zone (SBFZ) has long served as a manufacturing and logistics hub in the Philippines and has developed its industrial parks and ports in order to attract FDI. As of September 2023, the SBFZ hosts more than 1,800 entities, representing a cumulative investment of more than US$11 bn, while employing a workforce of about 150,000 individuals.

One of SBFZ’s key advantages is its strategic location at the heart of Asia. With its proximity to several major East Asian and Southeast Asian cities, the SBFZ serves as a pivot for the regional trade network. The Subic New Container Terminal, the newest international container port in the country, has a potential capacity of 600,000 TEUs per year. In 2023, the terminal handled 250,000 TEUs, accounting for about 3.3% of the nation’s total container traffic.

By way of contrast, the Manila International Container Terminal, the largest international gateway in the Philippines, handled nearly 2.8 million TEUs in 2023, representing 37.3% of the country’s total. Situated just 110 kilometres north of Manila Bay, Subic Bay is an ideal alternative for container vessels, especially those destined for central or northern Luzon.

In recent years, Subic Bay has been upgrading its infrastructure and connectivity in line with a series of comprehensive development plans. To this end, road networks have been expanded and new entry points established to accommodate the needs of tourists and cruise ships. To catalyse growth in sectors such as port operations, warehousing and transshipment, significant efforts have also been made to expand the capacity of the container terminal, naval supply depot compound and vault cargo port facilities.

Thanks to the formal adoption of the Luzon Economic Corridor strategy during a historic trilateral meeting in April 2024, discussions with the US and Japan are underway regarding the establishment of a railway connection, primarily for cargo transportation purposes, between Clark, Subic and Batangas.

Investing in Subic

Subic represents a promising investment opportunity across five key sectors – manufacturing; logistics; leisure and tourism; information and communications technology; and institutional development. The SBMA provides one stop services to guide investors through various business concerns, visa applications and other regulatory compliance issues.

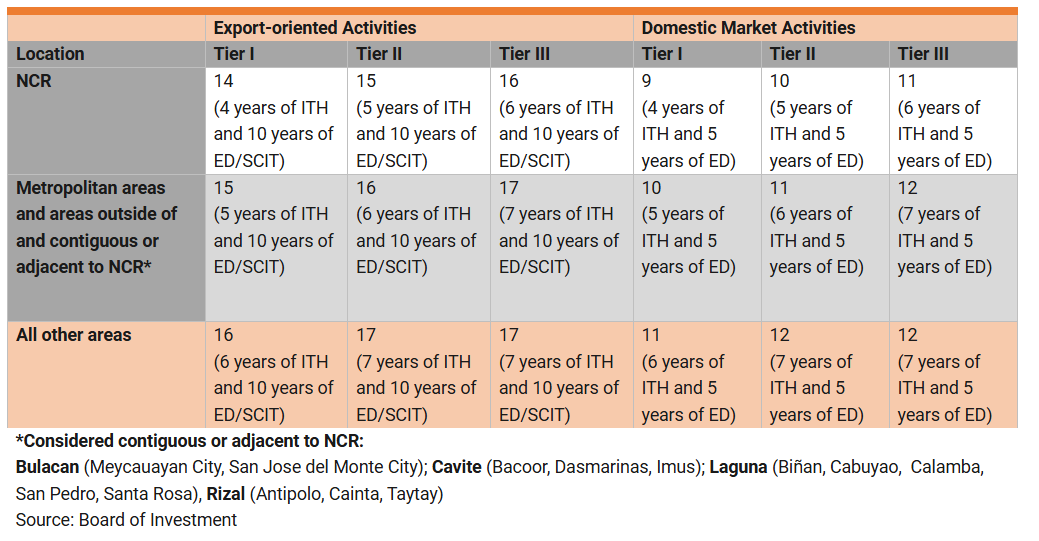

Under the fiscal incentives standardised by the CREATE Act, Subic, given its location outside of the NCR, can give investors and enterprises the most preferential terms, as highlighted below:

Subic Bay's logistical convenience has made it an appealing location for export‑oriented manufacturers. The international container terminal facilitates direct connections between Subic Bay and several major cities in East Asia and Southeast Asia. Manufacturers can receive imported parts and components directly from the port in Subic, while the nearby Clark International Airport provides enterprises with easy access to other regions for higher value‑added items, sidestepping the high costs and possible congestion involved in transportation to and from Manila. Meanwhile, the currently not‑in‑service Subic Bay International Airport – once a main diversion airport for the Ninoy Aquino International Airport – also offers a wealth of potential for future redevelopment.

With transit times as short as two days from Hong Kong and a mere three days from mainland China and several Southeast Asian metropolises, Subic Bay offers unparalleled logistical connectivity when it comes to accessing the region’s natural materials. Seamless customs clearance, according to some enterprises, is another significant advantage for manufacturers when setting up in the Subic Bay area.

Manufacturing and logistics parks

Three industrial parks have been established in the SBFZ to facilitate manufacturing and logistics activities. The Subic Bay Gateway Park, primarily developed with funds from mainland and Taiwanese investors, has a focus on light and medium industries. As of September 2023, it hosted more than 200 investors and employed some 16,000 workers. The park operates as a well‑coordinated joint venture between the SBMA and occupants.

Meanwhile, the Subic Bay Techno‑Park, which mainly attracts Japanese backers, currently accommodates around 20 investors, while having hired approximately 10,000 workers. It plays a significant role in hosting environmentally friendly, high‑technology and high value‑added industries, including such renowned MNCs as Sanyo and Nidec, spanning a variety of sectors, including electronics, home appliances, medical devices, and industrial equipment. Similar to the Subic Bay Gateway Park, the Techno‑Park is managed through a joint venture between the SBMA, the Japan International Cooperation Agency and several Japanese occupants of the park.

Elsewhere, the Tipo Hightech ECO Park is a newly developed mixed‑use industrial centre with an emphasis on logistics and industrial functions, especially warehousing, electronics manufacturing and light industrial production and assembly.

Within the park, brand‑new, standardised warehouses are available for rent, while a dedicated on‑site maintenance team caters to the diverse needs of investors. For investors looking to set up factories in Subic Bay, the Tipo Park represents not only an attractive warehousing option, but also a range of land lease options accommodating different usage.

Renewable energy development

Renewable energy has increasingly become a priority for the Philippine government. The SBFZ has, accordingly, been recognised by the Department of Energy (DOE) as a designated port of entry for the support of the logistical requirements of offshore wind energy projects. Subic Bay’s existing port infrastructure and capabilities make it well equipped to facilitate the transportation and handling of large power generation components.

Compared to many of the ports in Manila, Subic is far less congested, making it a more favourable location for transporting sizeable wind turbines and their components. Turbines can be shipped to Subic, where they are built and assembled before being dispatched to the designated areas in Central Luzon where the DOE‑awarded wind projects are sited.

SBFZ is also committed to reducing local carbon footprints and promoting sustainability. One local firm, Jobin-SQM, has a total installed and operational solar power capacity of 172MW connected to the national power grid. Subic has also attracted the interest of various international companies with regard to energy projects, most notably Sharp Solar Solution Asia, a subsidiary of the Sharp Corporation. To support its sustainable development, Subic is looking for manufacturers specialising in renewable energy parts and components to establish operations in the zone.

Leisure and tourism

Noted for its diversity in terms of culture, cuisine, leisure and activities, Subic Bay is a popular destination for water sports enthusiasts and adventure seekers. The region offers a variety of tourism and recreational attractions appealing to different interests and preferences. Visitors can enjoy such activities as golfing and eco‑tourism‑related pursuits or explore the bay’s many marinas, which are host to a wide range of pleasure boats and yachts. Subic Bay welcomed about 40 cruise ships annually before the Covid-19 pandemic. More recently, the number has been gradually recovering following the full resumption of normal travel.

While Subic Bay offers a diverse range of tourism attractions and recreational activities, more luxury hotels and better infrastructure are needed if tourism is to develop further. To address this, Subic is actively seeking to reclaim 50 hectares of waterfront land to establish a new integrated business, leisure and commercial centre.

In addition to the reclamation project, Subic is seeking investments in various sectors including hotel and resort construction and management, housing development, retirement communities, and other tourism‑related ventures. Plans are also underway to construct new hotels and amusement facilities.

Challenges

While there are plenty of opportunities in Subic, the bay lacks a comprehensive supply chain, obliging manufacturers to source certain raw materials or semi‑finished goods from other regions. This can result in additional sourcing time and production costs, offsetting the investment incentives available in the FZ.

The dearth of a regular shipping schedule between Subic Bay and the US or Europe could present another stumbling block for manufacturers. Those whose primary target markets are in these regions would need to forward their products to Manila for overseas shipping.

The acquisition of talent and skilled workers poses another significant challenge. To address this concern, the Labour Centre in Subic Bay has been working with technical schools to assist enterprises in the recruitment of well‑trained candidates. Finding suitable labour for the high‑end manufacturing sector is a global challenge, however, and the Labour Centre is seeking to create talent pools by establishing partnerships with the relevant training and educational institutions.

First, please LoginComment After ~