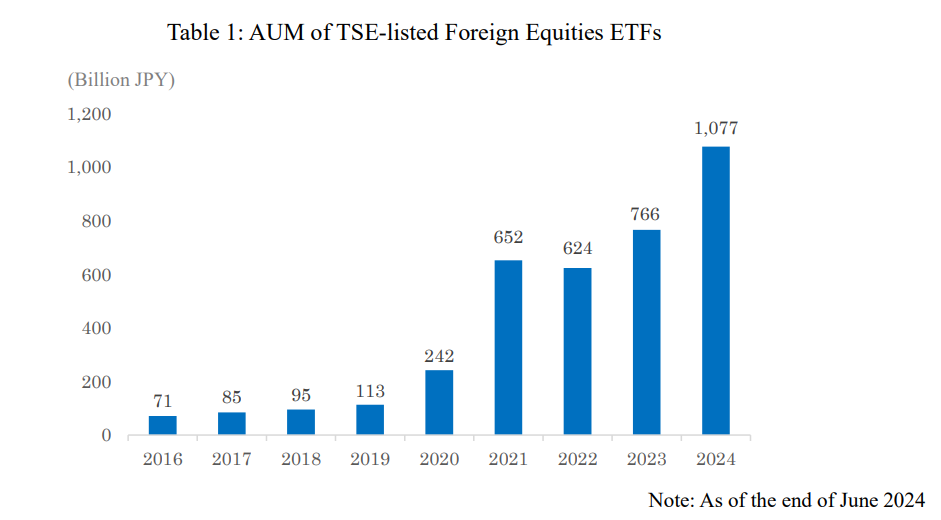

Assets under management of Foreign Equities ETFs Reaches 1 Trillion Yen

Tokyo Stock Exchange, Inc. ("TSE") announced that the assets under management ("AUM") of Foreign Equities ETFs, which invest in foreign equities, among the Exchange Traded Funds ("ETFs") listed on the TSE, has reached 1 trillion JPY as of the end of June 2024.

TSE will continue to provide our services with the aim of facilitating transactions with better price for all investors.

Foreign equities ETFs listed on the Tokyo Stock Exchange have a 17-year history since their first listing in 2007. Their AUM was approximately 100 billion JPY until the end of 2019, but it has continued to expand rapidly since 2020 and exceeded 1 trillion JPY as of the end of June 2024. This represents 10 times increase in size over the past 5 years.

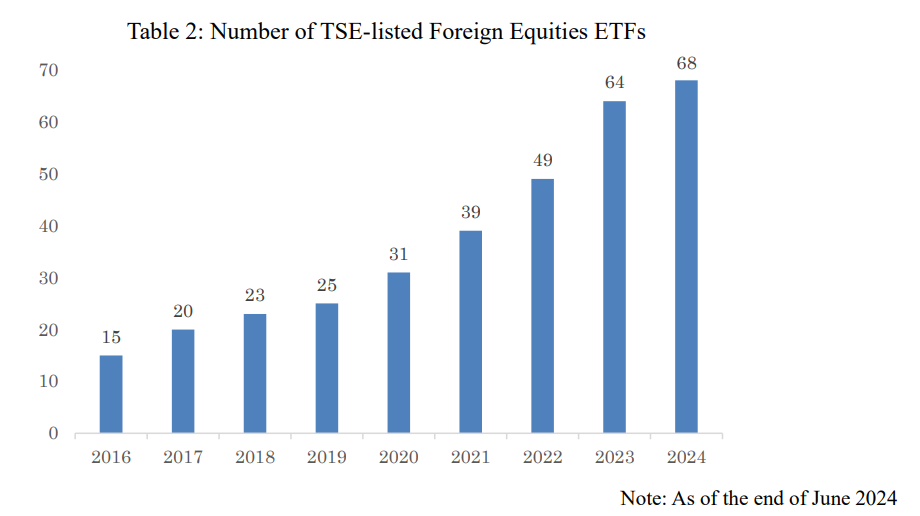

TSE offers a variety of investment options by listing ETFs, including ETFs linked to the S&P 500, NASDAQ-100, and the Dow Jones Industrial Average, which are major U.S. stock price indices, and ETFs linked to the Euro Stoxx 50 and the DAX which represent price movements of stocks in Europe and ETFs that invest in global market. From last year to this year, the number of issues has increased due to the listing of products that have been the talk of the market, such as those focusing on high dividend stocks in the U.S. and those linked to Indian equity indices, bringing the total number of foreign equities ETFs now to 68 (at the end of June 2024).

TSE-listed foreign equities ETFs can be traded during Japanese daytime hours. Even if the investment targets are foreign equities, all issues can be invested in JPY, so you can trade in the same way as Japanese stocks. Since 2018, TSE has been improving liquidity through various measures such as the introduction of the ETF Market Making Scheme and the RFQ platform "CONNEQTOR."

This expansion of our product lineup combined with improved liquidity has made foreign equities ETFs an effective investment tool. It is not only used by institutional investors, mainly domestic financial institutions, but is also widely used by individual investors.

TSE will continue to provide our services with the aim of facilitating transactions with better price for all

investors.

| Press Release |

|---|

First, please LoginComment After ~