Navigating Australia's Sustainable Finance Roadmap

Claire Smith, Emily Tranter, Sonia Goumenis and Vincent Collins

Corporate entities should familiarise themselves with the new regulations and opportunities presented by the Australian Government to ensure they are well-placed to take advantage of the integration of sustainability concepts in Australia's financial system.

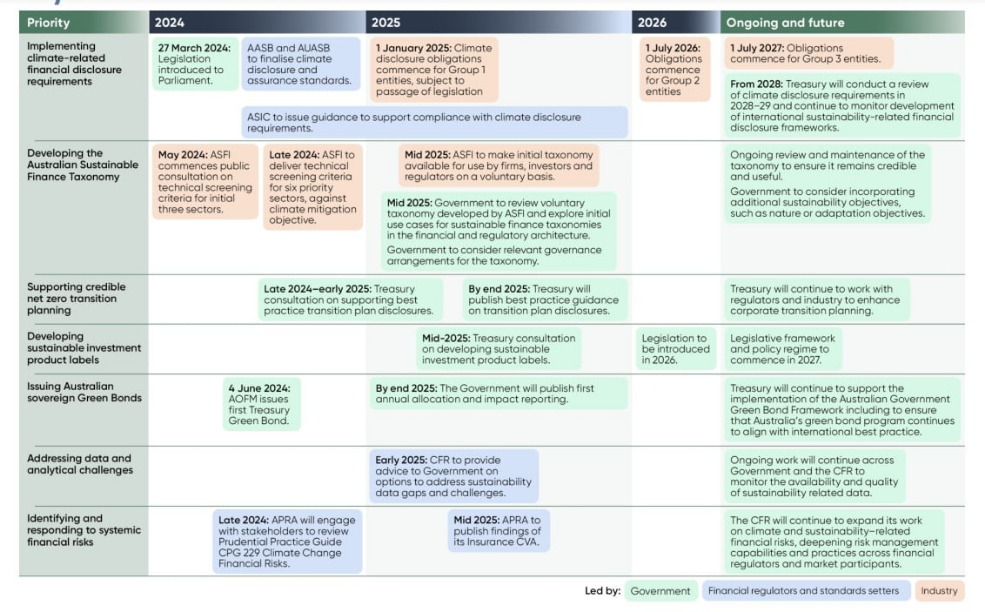

Australia's Sustainable Finance Roadmap released by the Federal Government in June 2024 marks a significant shift towards integrating sustainability within the financial system (see below key reform timeline extracted from the Roadmap).

The Roadmap is a key resource for all corporate and financial professionals, providing guidance on key new regulatory mechanisms (and timing for implementation) as well as outlining key opportunities under the framework that will likely impact businesses across a vast range of sectors. Understanding the Roadmap and the changes that will follow is a crucial step for businesses ongoing compliance with financial regulation, particularly for those businesses seeking to leverage the rapidly expanding opportunities associated with sustainable finance initiatives.

The roadmap identifies ten priorities designed to foster a sustainable financial ecosystem in Australia.

1. Implementing Climate-Related Financial Disclosures

From January 2025, large businesses and financial institutions will be required to disclose climate-related financial risks and opportunities. This mandatory reporting aims to enhance transparency and provide investors with consistent and comparable information.

2. Developing the Australian Sustainable Finance Taxonomy

This taxonomy will define criteria for sustainable economic activities, facilitating investments in projects that contribute to climate goals. Businesses should prepare to align their activities with these new standards to attract sustainable investment. According to the Roadmap an initial taxonomy will be available for voluntary use by businesses, investors and regulators on a voluntary basis by mid-2025. The Government wants the taxonomy to complement other reforms such as the development of sector decarbonisation plans and align with Australia's 2035 emissions reduction target.

3. Supporting Credible Net Zero Transition Planning

Companies seeking to leverage sustainable finance opportunities will need to formulate and disclose detailed transition plans outlining their strategies for achieving net zero emissions. This will involve setting targets, identifying actions, and managing risks related to climate change. Treasury will develop and publish guidance on best practice transition plan disclosures before the end of 2025 considering priorities of transition plan preparers (eg. companies) and users (eg. investors), emerging domestic and international frameworks and standards including the UK's Transition Plan Taskforce Disclosure Framework, the Government's upcoming Net Zero Plan and sector decarbonisation pathways, and observed transition plan disclosure practices by Australian companies, both before and after implementation of the Government’s climate disclosure reforms.

4. Developing Sustainable Investment Product Labels

A new labelling regime for sustainable investment products will be introduced with a view to mitigating greenwashing in the private sector while ensuring that products marketed as sustainable meet defined standards in line with other jurisdictions like the European Union.

5. Enhancing Market Supervision and Enforcement

Sustainable finance is one of ASIC’s four external strategic priorities for the period 2023–2027. ASIC will support market integrity and efficiency through supervision and enforcement of current governance and disclosure standards to reduce harms from greenwashing, while engaging closely on climate-related financial disclosure requirements. ASIC will continue to undertake targeted greenwashing surveillance and enforcement and oversee sustainability-related disclosure and governance practices across its regulated entities including listed companies, responsible entities and superannuation trustees. ASIC has also separately announced it will issue new regulatory guidance on climate-related financial disclosures and other resources which will be relevant to corporates engaged in sustainable finance who also are required to comply with new sustainability reporting obligations set to commence from 1 January 2025.

6. Identifying and Responding to Systemic Financial Risks

The roadmap highlights the importance of addressing systemic risks associated with climate change and sustainability. Companies need to develop robust risk management frameworks to mitigate these risks effectively. In practical terms, this will likely attract increased scrutiny of companies' sustainability claims from key regulators like ASIC and the ACCC.

7. Addressing Data and Analytical Challenges

The Roadmap emphasises the importance of improving the availability of sustainability-related data sources in Australia to enhance informed decision-making by both corporate entities and consumers in the financial sector. The CFR Climate Working Group has been tasked by Treasury to consider:

·accessibility of corporate climate data by market participants;

·estimation and use of scope 3 emissions by business and financial institutions;

·data to inform companies’ assessments of physical and transition-related climate risks; and

·nature-related data relevant to understanding financial risks.

The process will involve close consultation including with financial market participants and other government agencies. The CFR will present key findings and recommendations to the Treasurer in early 2025. Accordingly, businesses will need to stay across the latest guidance to enable them to comply with new regulatory requirements, but also to ensure they are well-placed to take advantage of the increasing interest in sustainable investment products and services.

8. Ensuring Fit-for-Purpose Regulatory Frameworks

The Roadmap also recognises the need for regulatory frameworks that support sustainable finance while maintaining market integrity. Businesses should ensure that they remain adequately informed about regulatory changes and should consider seeking advice if they hold any concerns about their ability to comply with these changes.

9. Issuing Australian Sovereign Green Bonds

The Roadmap confirms the Government's commitment to a well-designed and credible green bond framework that seeks to mobilise additional climate-aligned capital to support the further development of Australia's sustainable finance markets. In December 2023, the Australian Office of Financial Management published the Australian Government Green Bond Framework, which provides a comprehensive overview of the Government's climate and environmental priorities and outlines how green bonds will be used to finance Eligible Green Expenditures. The first green bond was issued on 4 June 2024. The bond line is $7 billion in size and will mature in June 2034.

10. Stepping Up Australia's International Engagement

Australia aims to enhance its international engagement on sustainable finance to promote global standards and frameworks. This will facilitate cross-border investments and create new opportunities for businesses operating internationally. Some examples provided in the Roadmap include:

·Implementation of the recommendations Australia's Southeast Asia Economic Strategy to 2040;

·Building cooperation agendas or commitments including in the Australia – New Zealand 2+2 Climate and Finance Dialogue, Singapore–Australia Green Economy Agreement, the Australia–Indonesia Climate and Infrastructure Partnership, and the Australia–UK Free Trade Agreement; and

·Further engagement with the G20 Sustainable Finance Working Group, Coalition of Finance Ministers for Climate Action, and the International Platform for Sustainable Finance.

Broader impact of the Sustainable Finance Roadmap and considerations

The Roadmap will significantly impact businesses in a wide range of sectors, presenting both challenges and opportunities to those entities that engage with the financial market in Australia and internationally. Accordingly, we encourage affected businesses to implement strategies aimed at:

·Ensuring adherence to new disclosure requirements consider legal advice on governance and risk management disclosure requirements as well as an external legal review.

·Aligning business activities with the sustainable finance taxonomy to attract investment and support from environmentally conscious investors.

·Developing comprehensive net zero transition plans that detail strategies for reducing emissions and managing climate risks and obtain appropriate legal review to minimise greenwashing risk.

·Leveraging the new sustainable investment product labels to market products effectively and attract sustainability-focused investors.

·Identifying and mitigating systemic financial risks associated with climate change through robust risk management frameworks.

·Enhancing data collection and reporting capabilities to meet the new sustainability data requirements and support informed decision-making.

·Exploring new funding opportunities through government-issued green bonds and other sustainable finance initiatives.

Australia's Sustainable Finance Roadmap represents a comprehensive approach to integrating sustainability into the financial system. Given the far-reaching impact of the Roadmap on all sectors, we encourage our clients to proactively address and adapt to the proposed changes to ensure they are well placed to capitalise on new opportunities. By understanding and adequately preparing for these impacts, our clients can position themselves for success in the rapidly expanding sustainable economy.

Corporate and commercial clients should:

·Review the specific requirements and timelines outlined in the roadmap.

·Engage with legal and financial advisors to ensure compliance and strategic alignment with new regulations.

·Invest in the necessary resources and expertise to navigate the sustainable finance landscape effectively.

For detailed information and ongoing updates, clients are encouraged to refer to the full Sustainable Finance Roadmap and seek appropriate advice where new obligations or requirements may be unclear.

First, please LoginComment After ~