28/ Money Market Statistical Reporting (MMSR): Enlarged reporting population including three reporting agents based in Luxembourg

1.INTRODUCTION [1]

The earlier blog article 8 emphasised the importance of money market data and money market reference rates. The aim of this blog post is twofold. In a first step, this article recalls the relevance of statistical information about the euro area money market from a central bank perspective. The blog post also highlights the role of the Money Market Statistical Reporting (MMSR) Regulation that serves as a basis for the euro short-term rate (€STR), the well-established euro risk-free overnight benchmark rate.[2] In a second step, this article draws attention to the enlargement of the MMSR population — including three banks based in Luxembourg — launched on 1 July 2024.

2.RELEVANCE OF MONEY MARKET STATISTICAL INFORMATION

The money market is key for short-term funding and liquidity management; it comprises short-term borrowing, lending, buying, and selling of very liquid, low-risk financial instruments. These instruments usually include, among others, treasury bills, commercial paper, certificates of deposit, call/notice money, swaps and repurchase agreements (‘repos’), all with original maturities of up to one year.

As money market rates serve as benchmarks for the pricing of corporate and consumer loans, they have a direct and indirect impact on financing conditions in the real economy. Well-functioning money markets are therefore of major importance for the proper transmission of monetary policy.

Accordingly, accurate granular and high-frequency data on money market transactions are essential for the conduct of monetary policy. Evidence collected on the basis of transaction-by-transaction data, for example, has proven particularly helpful to assess money market dynamics and functioning in periods of asset purchases, throughout the COVID-19 pandemic and between July 2022 and September 2023 when the ECB raised the key policy rates.[3]

3.THE ANALYSIS OF EURO AREA MONEY MARKETS

Prior to the MMSR, the ECB and Eurosystem NCBs relied on a combination of surveys and statistical sources to monitor money market activities.[4] While effective, these sources had limitations in terms of granularity of data, their frequency and/or scope and they did not form a unified and standardised framework.

Since the beginning of the monetary union, the Euro Money Market Survey (EMMS) was the central cornerstone of the Eurosystem's money market analyses. While essential for the assessment of overall money market activity and trends, owing to lack of data, the EMMS focused only on turnover and maturity, not on interest rates. First published in 2002[5], the EMMS is now a biennial publication, with topical content realignments and time-varying topics.

The Money Market Statistical Regulation (EU/1333/2014), implemented by the ECB on 26 November 2014 (ECB/2014/48), significantly enhanced the availability of money market data.[6] It requires selected banks (reporting agents, RAs hereafter) to provide detailed daily reports of transactions of EUR 500,000.00 or higher, denominated in euro. The MMSR focuses solely on granular transaction-by-transaction data, not on stocks or positions. Data submissions by RAs are subject to a precise timeframe (T+1, 7:00 am CET, on the first TARGET2 settlement day after the trade date).[7]

They comprise all transactions booked in headquarters and branches in the European Union (EU), the European Free Trade Association (EFTA) and the United Kingdom. Excluded are transactions booked in branches located in other regions/countries or booked in subsidiaries as well as intra-group transactions, according to accounting/consolidation standards. MMSR reporting is subject to international specifications in data harmonisation and standardisation.[8]

The Money Market Statistical Regulation covers transactions spanning up to 397 days in the following four money market segments:

Unsecured money market segment

·Includes all daily unsecured transactions covering lending[9] and borrowing, in particular unsecured deposits, call accounts and fixed-rate or variable-rate short-term debt securities with an initial maturity of up to and including one year.

Secured money market segment

·Includes all fixed-term and open-basis repurchase agreements (‘repos’), sell/buy-backs, and certain securities lending transactions against cash that are economically equivalent to a repo.

Foreign exchange swaps (FX swaps) money market segment

·Includes daily transactions where euro are bought or sold on a near-term value date against a foreign currency, with an agreement to reverse the transaction on a pre-agreed forward maturity date.

Euro overnight index (OIS) money market segment

·Includes all daily transactions, denominated in euro, of any maturity. The maturity of the underlying asset qualifies the OIS as a money market instrument, irrespective of the OIS's final maturity.

Given the sheer number of transactions and the criticality of the data,[10] the collection, processing and storage of MMSR data require an extensive IT and organisational infrastructure with adequate back-up functions. The collection, processing and storage systems are therefore interlinked via largely automated processes. In order to ensure a high data quality, the MMSR has been flanked by algorithms and machine learning processes from the very beginning.

The technical infrastructure of the MMSR is based on the Local Collection Platforms (LCP) of the Deutsche Bundesbank, Banco de España, Banque de France, Banca d’Italia, and the ECB. They serve the purpose to collect data from RAs, perform initial data validations and monitor the RAs’ data submissions. Thereafter, additional data quality checks are performed.

RAs are also required to provide a set of mandatory attributes per transaction for each market segment in their data reporting that further enhance the Eurosystem’s money market analysis and research.[11]

4.JULY 2024: EXTENSION OF THE MMSR POPULATION INCLUDING THREE RAs BASED IN LUXEMBOURG

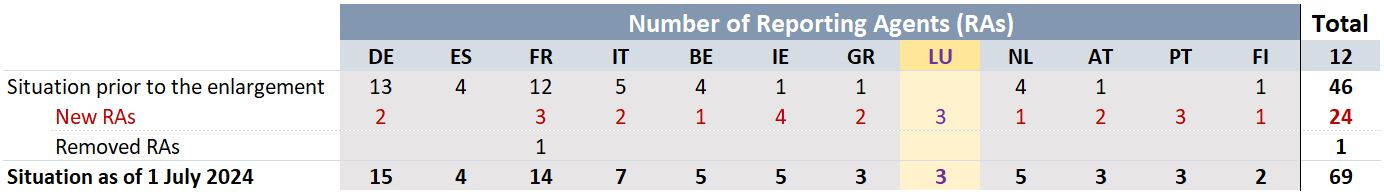

At the start of the MMSR in 2014/2015, 53 RAs had been identified based on their 2014 balance sheet size[12], spanning 10 euro area countries excluding Luxembourg; due to mergers, by June 2024, the reporting population comprised only 46 RAs. On 1 July 2024, the reporting population was enlarged by 24 additional RAs to better cover the various money market segments, activities and jurisdictions while one entity is no longer part of the reporting population.

The enlarged reporting population includes the following three MFIs based in the financial centre Luxembourg[13] which has a strong footprint in the cross-border euro money market ever since:[14]

·Banque et Caisse d'Epargne de l'Etat (BCEE), Luxembourg,

·Banque Générale du Luxembourg (BGL) BNP Paribas S.A., and

·Société Générale Luxembourg S.A.

Number of RAs by country before and since the enlargement on 1 July 2024

Source: Eurosystem

Source: Eurosystem

With a view to ensure a smooth on-boarding, in recent months, the ECB and the respective NCBs supported the new RAs with, among others, the implementation schedule, the technical implementation, methodological aspects and operational preparations.

Following a test and preparation phase, the reporting of the new RAs started on 1 July 2024, with respect to transactions with trade date 28 June 2024.

5.INTEGRATION INTO €STR

The MMSR serves as the basis for the €STR, the key benchmark interest rate for the euro money market.[15] The data of the new RAs will be included in the €STR after 1 July 2025, that is, no earlier than 12 months after the first reporting date.[16] Before the data reported by the new RAs will be integrated into the official €STR, the quality of the data submissions needs to be monitored and the impact of the data reported on the €STR to be analysed. The increasing €STR coverage from 10 to 12 jurisdictions and from 46 to 69 banks will contribute to making the €STR even more robust and representative.

6.IMPLICATIONS AND OUTLOOK

The MMSR is a milestone in the field of money market data/information; the granular and extensive database has fundamentally improved the Eurosystem's analytical view of the euro money market and its functioning. MMSR data proved very helpful to monitor in a timely manner the monetary transmission mechanism of monetary policy; in addition, the data is also of great analytical importance in other areas, such as financial stability and microprudential supervision.[17] These achievements are further corroborated by the enlargement of the reporting population from 46 RAs to 69 RAs as of 1 July 2024.

Going forward, the enlargement of the reporting population will make the €STR, the well-established euro (risk free) overnight benchmark rate, even more reliable and robust.

[1] I would like to thank Martin Lempe for support in preparing this article.

[2] The €STR is based on real transactions and published on every TARGET2 business day at 8:00 am CET.

[3] Cf. Coeuré, B. (2017), Asset purchases, financial regulation and repo market activity [Speech at the ERCC

General Meeting]; Schnabel, I. (2020), Shifting tides in euro area money markets: From the global financial crisis to the COVID-19 pandemic [Opening remarks of the ECB Conference on Money Markets]; Lane, P. (2022), Monetary policy and the money market [Opening remarks of the Meeting of the ECB Money Market Contact Group].

[4] Money market data and information were extracted, among other sources, from balance sheet statistics, securities statistics and surveys like the Bank Lending Survey (BLS). Some information was also obtained from commercial data providers, brokers and trading platforms as well as via specific associations like the ACI (Association Cambiste International), today known as the ACI-FMA (ACI Financial Markets Association).

[5] Cf. ECB (2003), Euro Money Market Study 2002, https://www.ecb.europa.eu/pub/pdf/other/moc2002en.pdf.

[6] Accordingly, starting 2018, the EMMS is largely based on MMSR data.

[7] The 7:00 am CET deadline applies for RAs reporting directly to the ECB while earlier deadlines apply for RAs reporting via their respective NCBs.

[8] Examples are, among others, the Legal Entity Identifier (LEI), the International Securities Identification Number (ISIN) as well as the sectorisation according to the System of National Accounts (SNA) / European System of Accounts (ESA).

[9] Only unsecured lending to the financial sector is covered.

[10] Based on the Euro Money Market Study, average daily transaction volumes (flows) in 2022 stood at roughly EUR 1.3 trillion.

[11] These are 15 to 20 attributes. For each money market segment, the attributes are listed in the annex to the regulation.

[12] According to Article 2 of the Regulation: “Upon the date of entry into force of this Regulation, the Governing Council may decide that an MFI is a reporting agent if the MFI has total main balance sheet assets larger than 0,35 % of the total main balance sheet assets of all the euro area MFIs on the basis of the most recent data available to the ECB.”

[13] Cf. https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/money_market/html (Navigation: Home > Statistics > Financial markets and interest rates > Euro money market).

[14] In particular, the financial centre Luxembourg can be considered an international hub for money market funds. With approximately EUR 530 billion in assets as of 31 March 2024, money market funds domiciled in Luxembourg account for nearly one third of the assets held by money market funds domiciled in the euro area. Source: ECB Data Portal, https://data.ecb.europa.eu/publications/money-credit-and-banking/3032551.

[15] The ECB publishes some accompanying figures for the €STR on: https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/euro_short-term_rate/html/index.en.html.

[16] See also the ECB’s press release (21 April 2023): “Euro money market statistics and the €STR: Expansion of reporting population” and the MMSR section of the ECB’s website (https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/money_market/html/index.en.html).

[17] The analytical potential can be further enhanced by linking the MMSR with adjacent databases. In this vein, linkages can be made to the likewise granular data sets of the Securities Financing Transactions Regulation (SFTR) and the European Market Infrastructure Regulation (EMIR). The joint usage of the databases will not only allow for more tailored analyses but also enables a reciprocal data quality management.

First, please LoginComment After ~