Singapore banks' earnings to be hit by rate cuts but bright spots remain

Local banks are taking steps to offset the hit their bottom lines could take once interest rates start falling in the United States.

The strategies include increasing the volume of loans that are fixed rate, putting on interest rate hedges and working to build up deposits in current and savings accounts.

DBS chief executive Piyush Gupta said on Aug 7 that the bank has added nearly $65 billion of fixed-rate assets in recent years, bringing the total to $190 billion.

The bank’s net interest income is now less sensitive to interest rate changes. For every basis point of the US Fed funds rate, net interest income will change by $4 million, down from $18 million to $20 million in 2021.

OCBC Bank is investing in high-quality but lower-yielding assets in preparation for what it expects will be two US rate cuts later this year.

Deploying liquidity to such assets has resulted in higher interest income but a moderation in net interest margin (NIM), a key gauge of profitability.

Group chief executive Helen Wong said on Aug 2 that the bank is also managing its funding and ensuring that its digital solutions allow it to take on new customers easily and so lift current and savings account deposits. The deposits are a cheap source of funds for banks.

“As interest rates come down, customers will be less inclined to put their money into long-term fixed deposits as well,” she added.

Although rate cuts will weigh on the banks’ margins, they will likely help to boost demand for loans and also strengthen market sentiment, which is good news for wealth management fees.

Phillip Securities Research senior research analyst Glenn Thum expects that the strong growth in fee income recorded by the banks in the first two quarters will continue this year, as investors continue to shift their money from deposits to investment products.

“The banks will be able to sustain this growth by concentrating on manpower resources and ensuring their software and ecosystems can support the higher volume,” he said.

IG market strategist Yeap Jun Rong noted that improving market conditions have lifted wealth management and investment banking activities.

“A combination of stable net interest income and non-interest income recovery could see earnings hold up over coming quarters, which may offer some support for share prices, although a break above previous record highs may still seem unlikely,” he said.

When rates are eventually cut, there is a possibility that loan growth will surpass the banks’ guidance of low single-digit growth for 2024, said Mr Thum.

Singapore banks' earnings top expectations

Mr Thilan Wickramasinghe, Singapore head of research at Maybank Investment Banking Group, noted that the banks’ recent loan growth has been narrow and mostly from developed markets.

“Regional growth has been tepid. We think rates would need to come off more before we see a meaningful recovery in credit growth regionally,” he said.

The Singapore banks are more sensitive to margins than volumes, he added. “So interest rate cuts could have a downside impact while lending growth support would come with a lag.”

The local banks are in a sound position to weather interest rate disruptions that may lie ahead.

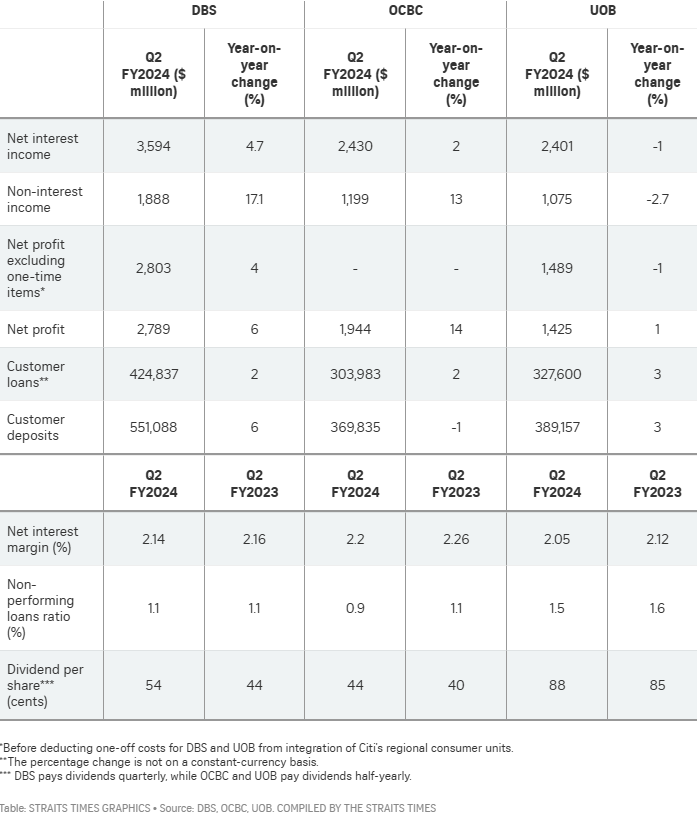

Second-quarter earnings at DBS, OCBC and UOB beat expectations, thanks to surging wealth management businesses. OCBC posted the steepest earnings growth of 14 per cent over the previous year, followed by DBS’ 6 per cent growth and UOB at 1 per cent.

CreditSights Asia-Pacific research head Pramod Shenoi and analyst Karen Wu said fee income will remain strong on the back of increasing investment activities, card consumption and loan-related fees.

Meanwhile, trading income is expected to increase when rates go down, and credit costs will normalise, said Mr Shenoi and Ms Wu.

They added that high-net-worth individuals have been paying down their loans due to high interest rates, but that should reverse as rates decline.

“Loans to mid-sized businesses should also increase, but this depends on the economic environment. Large corporates always have the ability to tap bond markets so they may or may not borrow more from banks, but we should also see some amount of loan increase here,” they added.

Meanwhile, dividend yields at the local banks remain attractive, in the range of 5 per cent to 6 per cent, noted Mr Yeap.

“Capital buffers have been healthy to weather economic risks, while asset quality has been resilient as well, with their non-performing loan ratios stable around 1 per cent.”

Lenders have also been consistently building up their loan loss provisions.

Mr Yeap said any impact from the challenging growth outlook in mainland China and Hong Kong’s deepening property downturn still seem very much limited.

“The loan-to-value ratio has been conservative, while property loans in Hong Kong tend to be heavily collateralised, which provide additional layers of safeguards in weathering the property sector risks,” he added.

The bulk of the banks’ exposure is still concentrated in Singapore, Mr Yeap noted, citing the example of how Hong Kong accounts for only around 20 per cent of DBS’ total commercial real estate exposure.

First, please LoginComment After ~