Latin America: Economic Development Overview of Mexico

As the second largest economy in Latin America after Brazil, Mexico’s economic development has always attracted much attention. Its free trade agreements, extensive industrial infrastructure and friendly business environment help attract foreign investment, which contributes to technological innovations, job creation and economic growth.

The post‑pandemic reshuffling of global supply chains gives Mexico a role beyond compare in global industrial chains. The North American economy is becoming further integrated as more stringent origin rules are imposed on manufacturers from outside the region after theUS-Mexico-Canada Agreement (USMCA)entered into force in 2020 [1]. Located in the North American consumer market and with its advanced logistics infrastructure and relatively cheap labour costs, Mexico is the preferred destination for foreign companies intending to establish factories to expand their business.

HKTDC Research recently visited Mexico in its mission to find out more about the latest developments there. The delegation met with government officials and had extensive contacts with representatives of trade and investment associations and people in industry in its bid to explore Hong Kong‑Mexico business opportunities.

Prosperity after Covid

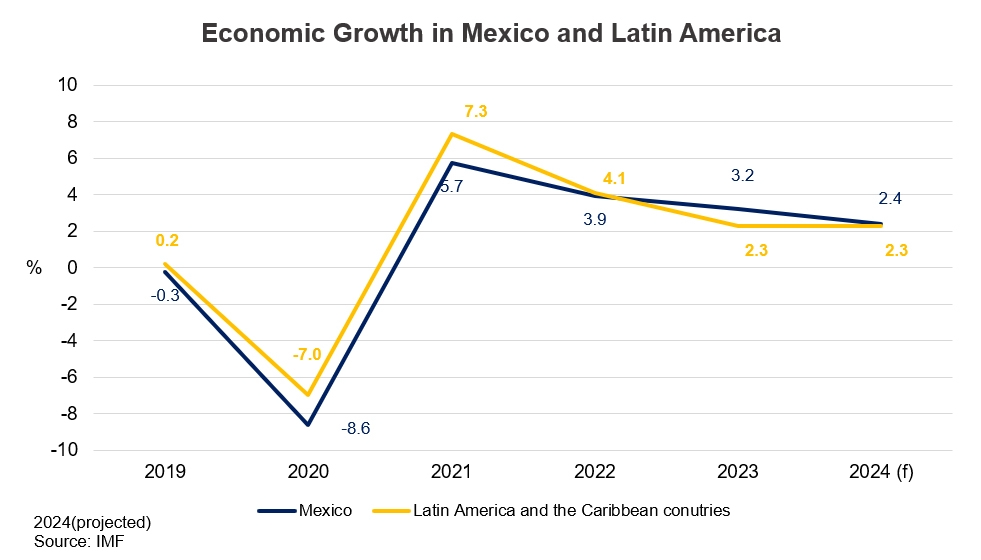

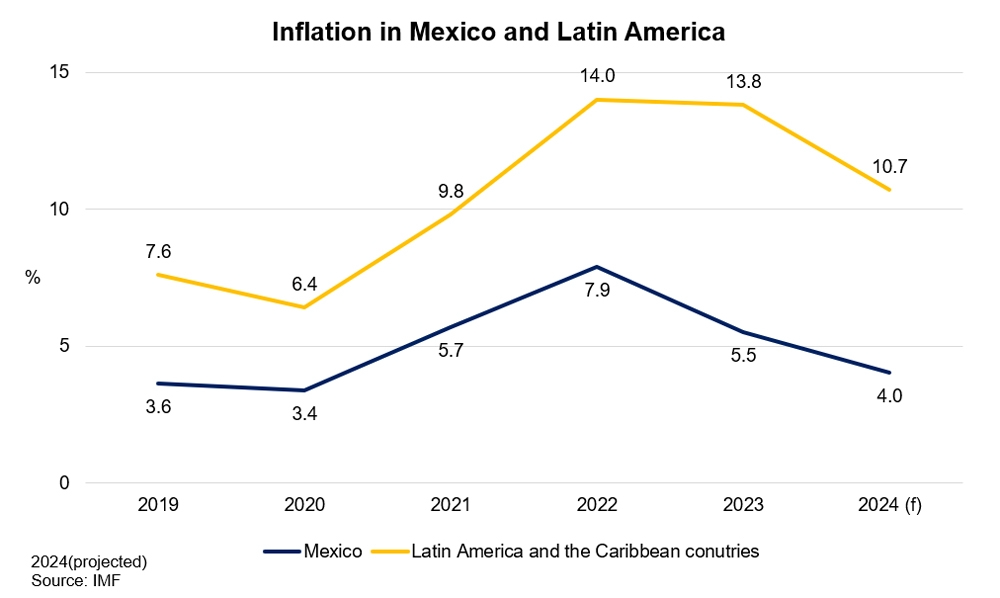

A prudent financial policy and a highly open economic system help lay a solid economic foundation for Mexico. The country’s real GDP growth reached 7.3% in 2021 and surpassed the pre‑Covidlevel in 2022. Foreign investment continues thanks to nearshoring and friendshoring. TheInternational Monetary Fund (IMF)expected Mexico’s economy to continue growing at a rate of 2.4% or more in 2024.

At the beginning of 2022, the central bank of Mexico adopted a prudent monetary policy to cope with rising commodity prices. Mexico’s inflation rate is already slowing down at 5.5% compared with other Latin American countries and even with the global average inflation rate of 6.8% in 2023. TheIMFhas predicted that Mexico’s inflation rate will drop toBanxico’s target range (2%‑4%) in 2024.

The outside world generally expected Mexico to make some changes on economic and livelihood issues in the coming year. Mexico had its presidential election in June 2024 and Claudia Sheinbaum, the president‑elect, will be sworn into office in October. The new left‑wing president promises to continue the social welfare programmes of her predecessor (Andres Manuel Lopez Obrador) to increase people’s buying power while coping with budget deficits. On economic development, the first woman president of Mexico promised during her election campaign that she would encourage private investment, particularly foreign investment in infrastructure and renewable energy projects.

Externally, Mexico is expected to tiptoe along the geopolitical tightrope of trying to befriend both China and the US. The outside world generally believes that Sheinbaum will try to strengthen Mexico‑US ties. Besides beefing up economic and trade relations, she will also seek to tackle the problems of border crimes and illegal immigrants. The nearshoring tide which brought many Chinese and foreign companies to set up factories in Mexico in recent years has given a great boost to the local economy. China‑US relations are unpredictable in the days leading up to the November US presidential elections. Mexico is expected to stay put and see what comes next.

Trade relations

Mexico boasts a sound logistics infrastructure for trade and industry and has been the second largest trading country in the Americas for many years. With the Atlantic to the west and the Pacific to the east, it adjoins Latin American countries to the south and has the US and Canada as its northern neighbours. This positioning has helped Mexico to develop an export‑oriented economy with regional and global supply chains.

Having signed 14 free trade agreements with 50 countries and territories, Mexico has trading partners throughout the world. The US has always been Mexico’s largest trading partner given its geographical proximity and the benefits of theUSMCA. The US had a 60% share of its total trade volume in 2023, followed by mainland China (10.4%), Canada (2.6%), Germany (2.5%) and Japan (2.1%).

|

Mexico’s Trade in 2023 (By Market) |

Total (US$ bn) |

Share (%) |

|

US |

72,816 |

61.1 |

|

Mainland China |

12,334 |

10.4 |

|

Canada |

3,082 |

2.6 |

|

Germany |

2,998 |

2.5 |

|

Japan |

2,446 |

2.1 |

|

Source: ITC Trade Map | ||

Industries in Mexico are diversified with manufacturing leading both imports and exports. With theUSMCAserving as a catalyst and the nearshoring trend gaining momentum, many multinational companies have set up factories in Mexico, thus speeding up the adjustment of division of labour in international industrial chains.

In addition to American and European goods, Mexico also has a keen demand for Asian commodities. Asia accounted for about 38% of Mexico’s total imports between 2019 and 2023. In terms of major imports, electrical machinery, equipment and parts thereof originating from Asia accounted for nearly 70% of Mexico’s imports of these products in 2023. The top five import origins were mainland China (33%), Malaysia (8%), Taiwan (6%) and Vietnam (5%), together accounting for 52%. Japan and South Korea were also Mexico’s major Asian trading partners, each contributing to 2% of Mexico’s total trade volume.

|

Mexico’s Trade in 2023 (By Product) |

Total (US$ bn) |

Share (%) |

|

Major Exports | ||

|

Vehicles and parts and accessories thereof |

156.47 |

26.4 |

|

Electrical machinery and equipment and parts thereof |

103.41 |

17.4 |

|

Nuclear reactors, boilers, machinery and mechanical tools; and parts thereof |

93.50 |

15.8 |

|

Mineral fuels, mineral oils and products of their distillation |

32.59 |

5.5 |

|

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical… |

27.33 |

4.6 |

|

Major Imports | ||

|

Electrical machinery and equipment, and parts thereof |

121.33 |

20.3 |

|

Nuclear reactors, boilers, machinery and mechanical tools; and parts thereof |

95.72 |

16.0 |

|

Vehicles and parts and accessories thereof |

61.28 |

10.2 |

|

Mineral fuels, mineral oils and products of their distillation |

43.25 |

7.2 |

|

Plastics and articles thereof |

30.72 |

5.1 |

|

Source: ITC Trade Map | ||

Giving laggards a leg up

Mexico has a diversified industrial landscape and different states have different priorities. Among them, Nuevo León is aspiring to become a “state of start‑ups”. Nuevo León is one of Mexico’s most advanced states and the state capital Monterrey is the country’s fastest growing city. Nuevo León and Monterrey are the biggest destinations for foreign direct investment on the state and city levels outside the national capital.

PeakNL reinforces the start‑up ecosystem of Nuevo León through a variety of activities and support programmes.

To achieve this “state of start‑ups” ambition, Nuevo León has various institutions and 13 industrial clusters to help identify promising start‑ups in different sectors. They have regular contacts with government, academic and industrial bodies in the form of co‑operative ventures or alliances to create synergy and a sizable entrepreneurship ecosystem.

PeakNL, a government platform for promoting entrepreneurship in Nuevo León, reinforces the start‑up ecosystem of Nuevo León through a variety of activities and support programmes. Together with the training programmes offered by itsPeak Growth School,PeakNLhas trained many startup professionals for the state.

Nuevo León is home to some of Mexico’s top universities. Their indisputable lead in scientific research lays the foundation for technological innovation and talent development.

The state owes its remarkable technological achievements to the support of industrial clusters. Its 13 industrial clusters cover different strategic sectors, including automotive, information technology, aviation, healthcare, nanotechnology and biotechnology. Their close co‑operation with universities promotes the early‑stage development of new technologies.

Financial pressure is a problem generally facing start‑ups in Mexico. Funding shortages inhibit efforts to develop new technologies and limit overseas expansion opportunities. Interested parties may leverage Hong Kong’s position as an international financial centre to explore potential development opportunities.

Investment from Asia

Mexico has for some time been the most important target for foreign investment in Latin America after Brazil and accounts for about a quarter of foreign direct investment (FDI) in the region. FDI in Mexico mainly goes to the manufacturing sector, with nearly 40% of FDI invested in this sector annually between 2019 and 2023. The percentage soared to 50% in 2023 to reach US$36.28 billion.

Nearshoring has quite a long history in Mexico, the largest Spanish‑speaking country. It is nothing new for Asian countries to invest and establish factories there. Japanese and Korean companies were operating in Mexico as early as the 1960s and 1970s [2]. Mainland Chinese companies were also doing business there half a century ago.

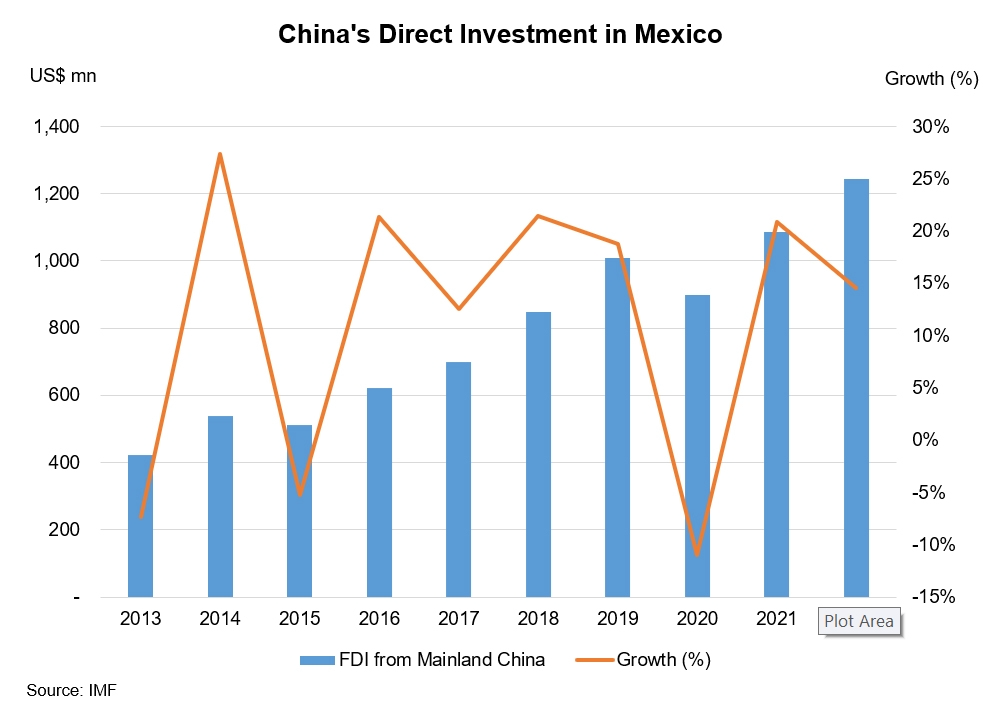

China and Mexico upgraded their bilateral ties to a comprehensive strategic partnership in 2013. Chinese‑funded companies have mushroomed in Mexico since then. Financial institutions including theIndustrial and Commercial Bank of Chinaand theBank of Chinahave officially opened for business there. Although funds from mainland China only account for a small percentage of foreign investment in Mexico at present, the growth rate has been phenomenal. According toIMFsources, the value of Mexico’s FDI stock from China soared by 190% in the last decade from US$420 million in 2013 to US$1.24 billion in 2022. By comparison, Mexico’s FDI stock saw an overall growth rate of just 43% during this period.

Stronger infrastructure

Logistics facilities in Mexico are already in a mature state. With the development of nearshoring, public institutions and private companies have adopted appropriate plans and more logistics facilities are expected to be commissioned in the coming years.

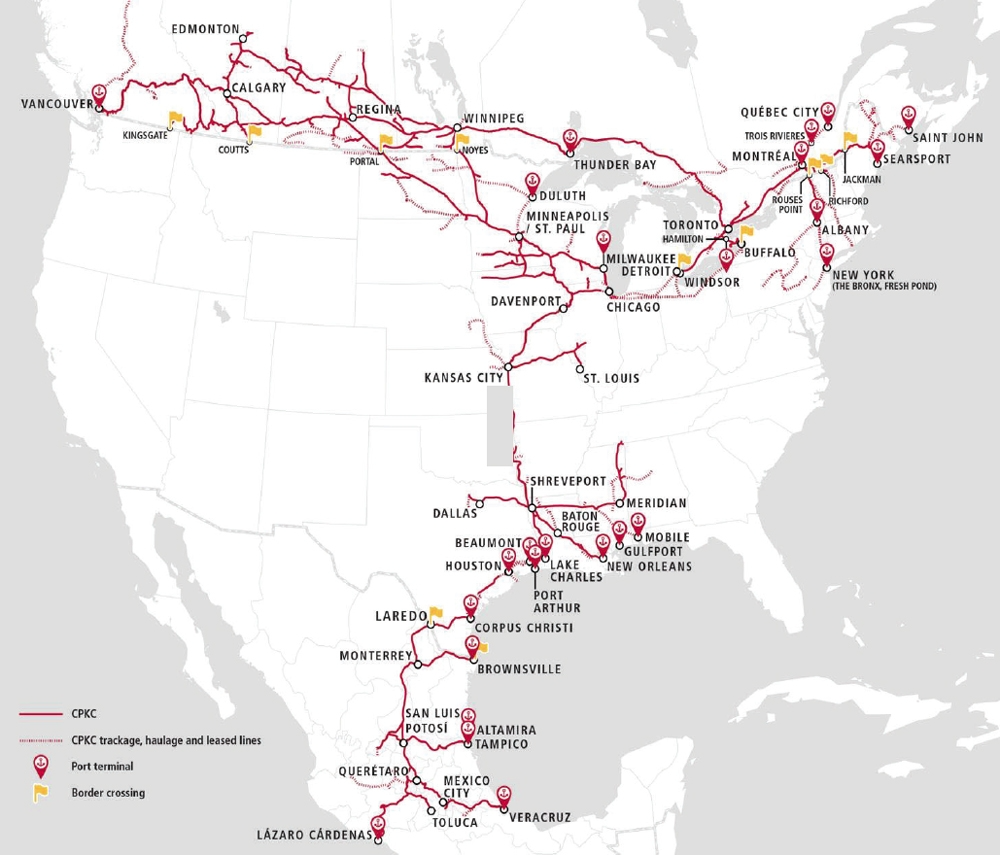

At present, Mexico already has an extensive network of roads and railways connecting its ports to the east and west. Passing through all the major industrial and commercial cities, they converge in the central highlands, running north from Nuevo León to Texas as a link to US and Canadian consumers.

Foreign investment is on the ascent. Capricious China‑US relations and logistics bottlenecks caused by theCovidpandemic have hastened Mexico’s nearshoring process. States along the US border, such as Nuevo León, Sonora and Chihuahua, have become prime sites for Chinese and foreign companies to invest and establish factories. Their upstream and downstream companies also extend their operations to Mexico.

Mexico has well‑developed highway and railway networks leading to consumer markets in the US and Canada.

The state of Nuevo León on the US‑Mexico border has emerged as the nearshoring leader thanks to its easy accessibility, attracting about 76% of the business. Its high‑tech infrastructure and electronic customs clearance system also contribute to higher cross‑border logistics efficiency. The electric vehicle giantTeslais also planning to build a gigafactory here because of its advantageous position.

More and more companies are investing in Mexico and moving into industrial parks like this to share the business opportunities.

Mexico has been actively trying to increase the capacity of its infrastructure to reinforce its position in the new supply chains. Several infrastructure expansion projects are slated for completion in the next few years and new railways, ports and expressways will go into operation.

Chinese support

Besides its excellent logistics network, Mexico also owes its extensive industrial foundation to the presence of numerous industrial parks. There were over 460 industrial parks in different parts of the country in 2023. Of these, about 30 were newly established in the same year. Mexico is actively trying to attract foreign companies to these industrial parks in view of their importance to the country’s economy. Relevant industrial organisations and associations also offer all kinds of business services beginning from site selection to help potential investors get started. Generally speaking, electronic‑related products and high value‑added industries tend to set up factories in industrial parks in the north while consumer goods, food and manufactured goods tend to concentrate on the south.

In 2018, China’sHolley GroupandFutong Groupjoined hands with Mexico’sSantos Familyto establish theHofusan Industrial Park, the first Chinese‑funded industrial park in the country, in the northern part of Monterrey. More than 30 mainland manufacturers have since moved into the park. They mainly produce consumer goods such as furniture and home appliances. The park only provides one‑stop professional services to tenants at this stage but plans to build an all‑round community in the vicinity complete with commercial and residential areas in the future.

With its solid industrial foundation, excellent infrastructure facilities, outstanding scientific research ecosystem and massive North American market, more and more multinational companies are expected to come to Mexico to invest, establish factories and move into industrial parks to share the opportunities they have to offer. Mexico is therefore well‑poised to play an even more important role in trade and investment in Asia and America.

[2]From a 17th-century shipwreck to ‘strategic global partners’: 400 years of Mexico-Japan history,Mexico News Daily, 27 May 2024

Mexico and Korea: a strong partnership looking to the future,The Korea Herald, 14 Sep 2021

First, please LoginComment After ~