Middle East Opportunities: Bridging Two-way Investments

Economic links between China and the Middle East are rapidly becoming stronger and more mutually beneficial. One company that epitomises this is ARTE Capital, a leading regional investment group with its headquarters in Hong Kong and offices in Shenzhen and Abu Dhabi. It has several billion US dollars' worth of assets under management (AUM), and has spent almost a decade working with the largest sovereign wealth funds (SWFs) in the Middle East.

Last year, in order to expand its business, the group's regional headquarters ARTE Capital Middle East Limited acquired a licence to operate in the Abu Dhabi Global Market (ADGM) free zone – the emirate's International Finance Centre (IFC).

ARTE Capital Middle East Limited is the first Chinese private corporation to be granted a financial license by the ADGM Financial Service Regulatory Authority to serve Gulf Cooperation Council (GCC) institutions. This unique status positions it exceptionally well to facilitate investment flows between the Middle East and the Greater China region.

Wealth funds of opportunity

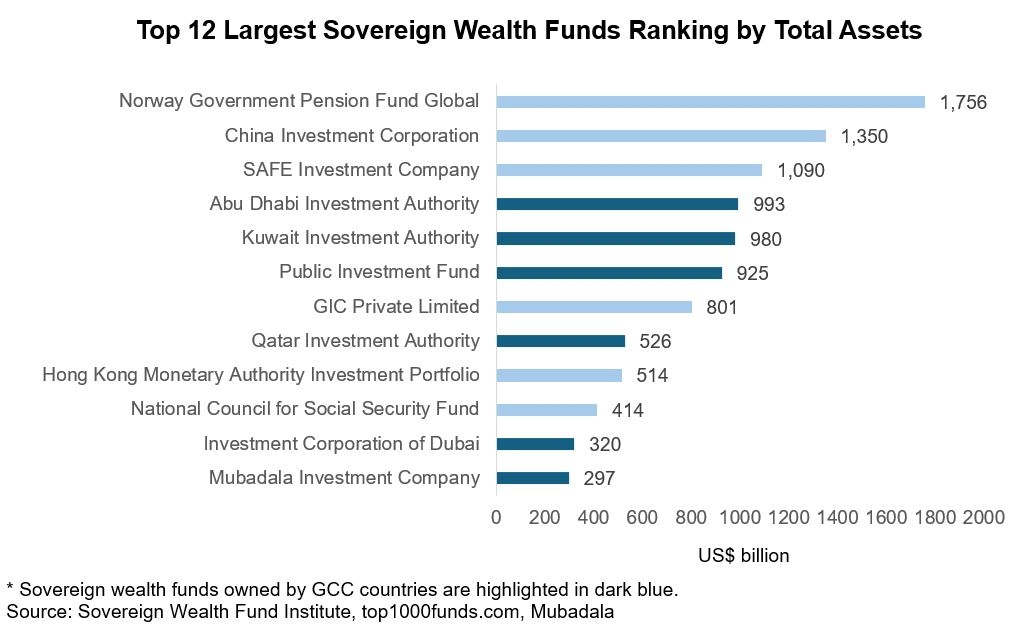

The GCC countries, with their rich reserves of oil and gas, offer huge opportunities for fund management groups like ARTE Capital. Six of the biggest 12 SWFs (in terms of total assets) are owned by GCC countries, according to the Sovereign Wealth Fund Institute.1

These SWFs often do not have sufficient manpower to micromanage the enormous amounts of money at their disposal. They focus more on managing the funds' exposures in each market and sector on a macro level, and require external fund managers like ARTE Capital Group to help identify investment opportunities. ARTE Capital Group also brings strategic investments into the Middle East by partnering with Chinese industry leaders looking to expand into the region.

The Middle East's appetite to invest in China is robust. State owned investors from GCC countries invested over US$2.3 bn (HK$17.9 bn) in Greater China in 2023, according to SCMP citing the data platform Global SWF. That compares to just US$100 mn the year before.

This rapid growth has been encouraged by the increasingly closer ties between the two regions. President Xi's visit to Saudi Arabia in December 2022 has been followed by frequent exchanges between officials and entrepreneurs. The portfolios of some SWFs are typically very exposed to developed markets, so increasing their exposure to Asia can help them diversify.

Hong Kong best platform

ARTE Capital Group's Founder and Chairman, Ethan Chan argues that Hong Kong stands to benefit significantly from the GCC SWFs' increasing interest in the East. As Asia's international financial centre and a gateway to Chinese mainland, Hong Kong is naturally the best platform for those searching investment opportunities in the Greater China region. Pointing to the factors that give Hong Kong this status, Chan said: “Hong Kong has a huge pool of financial talent, you can find the top fund managers in Hong Kong for the Greater China market.

“It is Hong Kong’s unique advantage that we have unmatched expertise and connections in investing in the Greater China market as compared to other international financial centres.”

One major industry ARTE Capital Group invests in is electric vehicles (EVs). Chan explained how the company leverages its specialist knowledge to determine where funds should go, saying: “Building an EV requires over a thousand components. We leverage our own expertise and local experts based in the mainland to identify segments in the EV supply chain that boast great potential. Thanks to Hong Kong's proximity to the Chinese mainland, we are able to maintain close connection with the local experts.

“Despite the current headwinds in the EV industry, you can still find opportunities in this gigantic market if you work hard enough. ADAS (advanced driver assistance systems), smart cockpit and panels, and sensors, for instance, are some of the segments in which we see potential.”

Business-friendly environment

It’s not just the Middle East’s significant wealth that makes it an attractive location for companies like ARTE Capital Group. The business friendly environment in states like the United Arab Emirates (UAE) is also a pull factor. For example, Abu Dhabi’s ADGM (where ARTE Capital has established its office) employs a common law system and offers a 0% tax.

Chan noted that it’s not merely the tax advantages that encourage foreign companies and their staff to relocate there, saying: “Zero percent personal income tax is attractive to our employees of course, but the diversity and inclusiveness of the society is also an important factor which makes our employees willing to relocate to our Abu Dhabi office.”

Rising costs

However, despite the various incentives and opportunities on offer, the operating cost in ADGM is increasing. In fact, the ADGM announced in July that, starting from 2024, new registration fees and annual renewal fees for companies in the financial category will increase from US$15,000 and US$13,000 respectively, to US$20,000 and US$15,000.2

It can be argued that this rise in fees is justified by the increase in businesses which have set up in the free zone hoping to tap into the local market. The number within the IFC grew to 1,825 in 2023, up 32% from the year before. AUM increased by 35%, with 102 asset managers operating in the free zone managing 141 funds. ADGM says that this makes it the region’s fastest growing IFC.3

While the UAE is a rapidly growing financial sector, the high (and rising) operating costs should make Hong Kong businesses consider all the costs and benefits comprehensively before entering the market. However, Chan emphasised that it is particularly important for companies to make close connections with local clients, saying: “The SWFs and rich families often prefer fund managers to show commitment to the market, by doing things like setting up an operation office. Having a representative office is far from sufficient.”

Enhancing mutual understanding

While economic ties between China and the Middle East are set to become closer than ever, it remains important to improve mutual understanding between two sides. As one of China’s most internationalised cities, Hong Kong should proactively use its position to play an important role in clarifying misperceptions between the two.

For instance, people in the Middle East counterparts may have developed an inaccurate impression of the Chinese EV industry as a result of negative media coverage. ARTE Capital Group’s expertise and track record of identifying attractive investment opportunities in the Chinese EV industry showcases how Hong Kong could bridge the information gap between the two regions.

Businesses in Hong Kong, meanwhile, should be aware that many Middle East countries are trying to bring in technologies and services that improve quality of life, enhance sustainability and help to diversify their oil dependent economies. Last year, ARTE Capital Group led a delegation of Chinese industry leaders to Middle East markets to explore opportunities for future cooperation and strategic investment in this direction.

HKTDC is also supporting delegations to the Middle East, including the delegation led by Chief Executive John Lee in February 2023 and another in May 2024 led by Secretary of Justice Paul Lam. HKTDC also led the Hong Kong Watch and Clock Mission to UAE after Lee’s visit.

First, please LoginComment After ~