Opening Remarks at the HKIMR 14th Annual International Conference on the Chinese Economy

1.Professor Wei [Shang-Jin, N.T. Wang Professor of Chinese Business and Economy, Columbia University], Distinguished guests, Ladies and Gentlemen, Good Morning!

2.It is my pleasure to welcome you all to the 14th Annual International Conference on the Chinese Economy, organised by the Hong Kong Institute for Monetary and Financial Research. The theme of this year's conference is “China and the Changing Global Trade Landscape: Challenges and Opportunities”. This is a timely and important topic – not just for China, but also with far-reaching and enduring implications for the global economy.

3.There is ample evidence that globalisation has brought enormous benefits to the world, through increasing cross-border flow of trade, investments, technology, ideas, and people. For emerging market economies, integration into the global supply chain has been a crucial contributor to their economic development. As global income rose in tandem with global trade from the 1980s onwards, billions of people have been lifted out of poverty.

4.Since the 2008 global financial crisis, however, the golden era of globalization has given way to a gradual slowdown in global trade in goods. There is a combination of factors. First, it reflects doubts or even skepticism about the distributional effects of globalization. Secondly, rising geopolitical considerations in recent years have led to a re-imposition of various trade and investment restrictions by some jurisdictions. And thirdly, recent disruptions to supply chain, caused by the pandemic and regional military conflicts, have prompted discussions about ways to mitigate such risks.

5.These developments have not yet translated into a wholesale reconfiguration of the global trade landscape. But it appears that the slow-down in global goods trade is likely to continue. A recent joint study by the HKMA and the Bank for International Settlements (BIS) suggests that some supply chain realignment has already been taking place during the pandemic.

6.Any escalation of geo-economic fragmentation would almost certainly result in a costly transition, especially for Asia given the region's relatively open economies. For those who believe in the value of free trade and globalization, the key question then is how best to collectively minimize the risks of full blown economic fragmentation, and what actions can be taken to sustain globalization, even in the face of a changing global trade landscape?

7.Since this is a conference about the Chinese economy, perhaps we can start with a quick examination of how China is adapting to the change and turning the challenge into opportunity. Despite the headwinds in the trade sector, China's world export share has remained at around 15 per cent since 2018. This reflects two important trends.

8.First, China has continued its economic diversification and regional collaboration through expanding its import and export network, particularly to broader emerging markets. It has also stepped up outward direct investments to establish stronger footholds in the global supply chain amidst friend-shoring or near-shoring.

9.Second, China's manufacturing industries have doubled down on their efforts to move up the value chain, from low-end, labour intensive component manufacturing to higher-tech, full spectrum product manufacturing, supported by China's own domestic market and growing capability in more sophisticated technology goods.

10.Indeed, this is a process that pre-dates the recent rise in global trade protectionism, if just for the classic reason of comparative advantage. What we have witnessed is that even as some production may have been diverted away from China, these have been largely concentrated in a few sectors – namely, textiles, electronics and autos – and in the assembly segment rather than upstream. While Chinese exports might take up a smaller share of some markets as a result, it is exporting more intermediate goods and capturing a larger share of imports from other regional economies.

11.China's search for new trade opportunities through diversification and supply chain upscaling has brought structural transformation to the Chinese economy and helped maintain China's key position in global manufacturing. The process, together with other changes in the global supply chain, will bring fundamental changes to global trade and investment. It would be premature to predict what the new order will be. But one thing is for sure, those who embrace the change and rise to the challenge will benefit greatly, and it should not be a zero-sum game.

12.Now let me shift gear and touch on some emerging opportunities we are going to discuss at this conference. I will focus on two panel themes: digital trade transformation and innovative trade finance – two topics that are increasingly relevant as we transition towards a digitalized global economy.

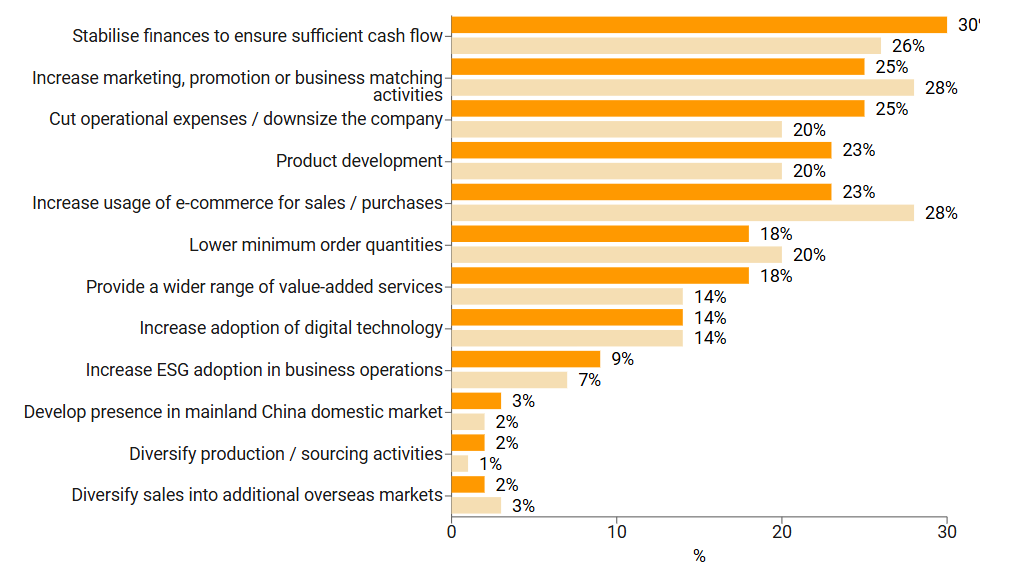

13.Digitalisation of trade offers a range of benefits. For firms, digital transformation of trade and supply chain processes can produce efficiencies in terms of time and labour saved. It also enhances the traceability and security of cross-border trade in goods and services, by enabling real-time visibility into all stages of the supply chain from production to delivery.

14.For economies, digital trade transformation offers substantial productivity gains through, for example, rapid growth of e-commerce. It also offers better prospects of helping to distribute the gains generated from trade more widely and equitably among the various stakeholders.

15.Indeed, digitally delivered services already account for a little over half of total services trade1. They are increasingly facilitating trade flow across borders, in support of raising the market share of developing economies, which has increased from about 20 percent to 30 percent of global service trade between 2005 and 2023.

16.Meanwhile, digital technologies can be leveraged to enhance cross-border trade settlement and financing, where there is plenty of scope for coordinated solutions to existing pain points. For example, Project mBridge has been exploring the use of wholesale central bank digital currencies of Hong Kong and a number of other participating central banks as a way to speed up cross-border payments at reduced cost, faster settlement, and with better transparency.

17.Equally exciting is the use of innovative technologies in trade finance – from blockchain, AI to digital signatures – and greater cooperation around cross-border interoperability that will help close the widening global trade finance gap, estimated by the Asian Development Bank last year to have reached a record US$2.5 trillion.

18.Another area of opportunity and cooperation is around green technologies. The consequences of climate change, in the form of higher frequency of extreme weather events, have only become more visible these last few years, and Asia is particularly exposed.

19.We need open and predictable trade to enable scale economies and direct low-carbon technologies and services to where they are most needed. In this respect, major regional trade networks can serve as key platforms that facilitate sustainable trade and investment, support climate-resilient economic developments, and enhance the ecosystem of green finance.

20.Let me close by noting that the global trading system as we know has brought mutual benefits and shared prosperity to the world economy. Granted, there's always scope to make the system work better and fairer. Let's focus not just on the challenges, but more on the solutions and the opportunities.

21.There are excellent research papers to be presented at the conference, covering many of the topics I outlined just now. So I wish you all a most engaging and productive conference.

22.Thank you.

1 Globalization today, Adam Jakubik, Elizabeth van Heuvelen, IMF, June 2024

First, please LoginComment After ~