AMCM: Monetary and financial statistics – September 2024

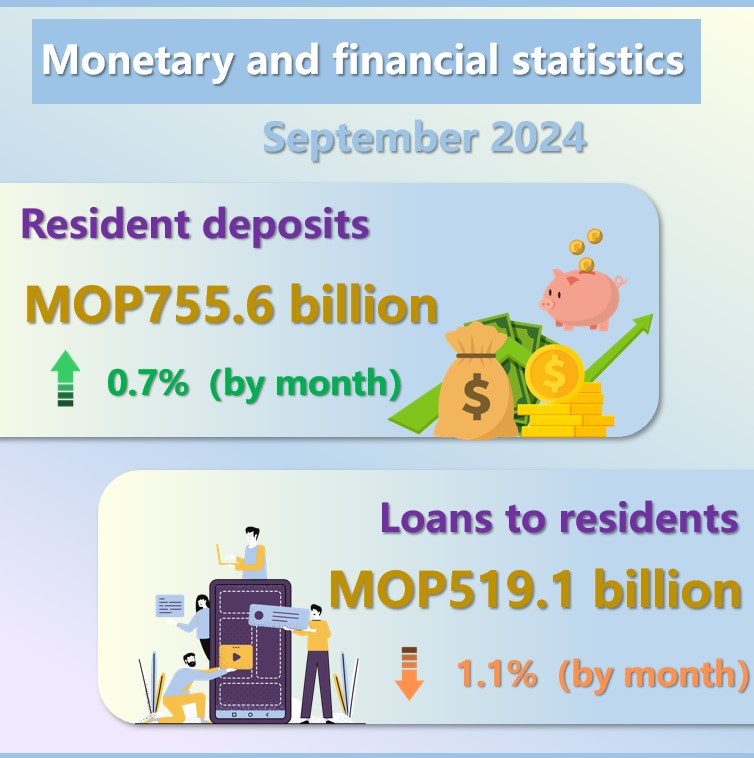

According to statistics released today (1 November) by the Monetary Authority of Macao, resident deposits rose from a month ago whereas loans to residents posted a decline in September.

Money supply

Currency in circulation and demand deposits rose 0.9% and 2.8% respectively. M1 thus increased 2.3% from one month earlier. Meanwhile, quasi-monetary liabilities grew 0.4%. The sum of these two items, i.e. M2, rose 0.6% to MOP776.3 billion. On an annual basis, M1 and M2 grew 0.2% and 6.7% respectively. The shares of pataca (MOP), Hong Kong dollar (HKD), renminbi (RMB) and United States dollar (USD) in M2 were 33.1%, 45.1%, 7.0% and 13.4% respectively.

Deposits

Resident deposits increased 0.7% from the preceding month to MOP755.6 billion whereas non resident deposits decreased 0.6% to MOP312.9 billion. On the other hand, public sector deposits with the banking sector grew 1.1% to MOP200.3 billion. As a result, total deposits in the banking sector rose 0.4% from a month earlier to MOP1,268.8 billion. The shares of MOP, HKD, RMB and USD in total deposits were 20.3%, 44.6%, 9.6% and 23.8% respectively.

Loans

Domestic loans to the private sector decreased 1.1% from a month ago to MOP519.1 billion. Analysed by economic sector, “transport, storage and communications” and “manufacturing” grew at respective rates of 28.2% and 8.9% when compared with a quarter ago, whereas “wholesale and retail” and “restaurants, hotels and similar activities” fell 18.5% and 5.0% respectively. Meanwhile, external loans dropped 1.4% to MOP527.4 billion. As a result, total loans to the private sector fell 1.2% from a month earlier to MOP1,046.5 billion. The shares of MOP, HKD, RMB and USD in total loans were 21.5%, 43.2%, 14.0% and 17.3% respectively.

Operating ratios

At end-September, the loan-to-deposit ratio for the resident sector decreased from 55.3% at end-August to 54.3%. Meanwhile, the ratio for both the resident and non-resident sectors decreased from 83.9% to 82.5%. The one-month and three-month current assets to liabilities ratios stood at 62.2% and 56.4% respectively. Concurrently, the non-performing loan ratio increased from 5.1% at end-August to 5.2%.

Detailed Monetary and Financial Statistics are available in the latest issue of Monthly Bulletin of Monetary Statistics. https://www.amcm.gov.mo/en/research-statistics/research-and-publications?type=financial_statistics_monthly

First, please LoginComment After ~