FSB MENA Group discusses artificial intelligence, cyber risk and operational readiness

The Financial Stability Board (FSB) Regional Consultative Group for the Middle East and North Africa (RCG MENA) met today in Saudi Arabia. The meeting was hosted by the Saudi Central Bank (SAMA), at its headquarters in Riyadh.

Technological innovation featured prominently on the agenda. Participants took stock of the advances relating to artificial intelligence (AI) in the financial sector and exchanged experiences on how AI is being applied by both supervisors and financial institutions. While the use of AI can generate efficiencies and create value, it also introduces new risks. In this regard, participants look forward to the FSB's forthcoming report on the financial stability implications of AI. Eddie Yue, co-chair of the RCG for Asia and Chief Executive of the Hong Kong Monetary Authority, attended this meeting to bring in the perspectives of the Asia region, drawn from the RCG Asia workshop in October on the financial stability implications of AI, tokenisation and crypto-assets.

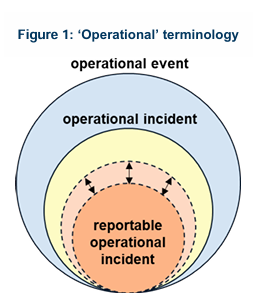

The pervasive role of technology in the financial system has also contributed to the increased frequency and elevated severity of operational and cyber incidents. Recognising that these risks to operational resilience can also arise from reliance on external providers, members discussed their approaches to third-party risk management and cyber incident reporting. They welcomed the FSB's public consultation on a Format for Incident Reporting Exchange (FIRE) and its potential to address challenges arising from the need for financial institutions to report operational incidents to multiple authorities. Together, FIRE and the FSB’s toolkit for enhancing third-party risk management and oversight can reduce fragmentation, facilitate communications and coordination within and across jurisdictions, and ultimately enhance operational resilience and incident response.

Members exchanged views on global and regional market developments, including perspectives on the financial stability outlook. Topics addressed included the management of the gradual easing in inflation expectations and the role of technology and social media in influencing depositor behaviour.

Finally, members received an update on the FSB’s work programme and expressed their views on the proposed areas of focus for 2025, bringing their regional perspective to the discussion.

First, please LoginComment After ~