Comprehensive Understanding of Sustainable Investment Usage and Benefits in China

While investors and corporations have notably become more aware of both sustainability issues and the related regulations, it remains unclear to what extent such evolving considerations are being incorporated into their strategies and operations. The Chinese government, however, has actively adopted a range of policies in support of its Dual Carbon targets and its macro plans. To date, these include moves to align industrial policy with green growth via both industrial and financial metrics.

As part of this green transition, corporations have been obliged to develop comprehensive business plans with a focus on, among others, energy conservation, carbon reduction, greater use of clean energy and enhanced resource recycling. In addition, partnerships with green service providers are prioritised in order to ensure compliance with sustainability objectives. Transitioning to more sustainable practices, however, is not without significant challenges, including sourcing the required finances and resources necessary for initiating fundamental changes, while negotiating the problem arising from any knowledge or skill deficits.

To gain a deeper understanding of companies’ engagement with these issues and their current business positions, the HKTDC and the ACCA have undertaken a joint research initiative, including a comprehensive survey of the sustainability strategies and beliefs of a representative selection of mainland China, Hong Kong and Macao-based businesses. In specific terms, the study aims to assess corporate understanding and the varied perspectives relating to sustainability, as well as developing an understanding of the various costs and benefits, as well as the sundry strategic approaches to securing sustainability. In addition to quantitative analysis, in-depth interviews with industry professionals were conducted as a means of providing insights into the qualitative aspects of such issues.

Sustainable Investment in China: Survey Findings

Between May and June 2024, an online survey of 283 companies was conducted with regard to their progress in adopting sustainable practices and their plans for green investment. All of the participating companies were private or state‑owned mainland enterprises or Hong Kong / Macao / overseas invested enterprises operating / investing in mainland China. Service‑sector companies comprised 69% of the respondents, while the remaining 31% were manufacturing enterprises. Large‑scale enterprises, with an annual turnover exceeding RMB2 billion, comprised 38% of the total, while 38% had annual sales ranging from RMB100 million to RMB2 billion and 24% had an annual turnover of less than RMB100 million.

Positive Business and Investment Outlook

- Enterprises confident of more positive business outlook

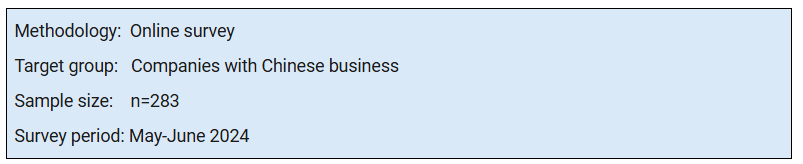

Overall, companies viewed the 2024 business environment as more positive than its 2023 counterpart. In all, some 64% of respondents said the current business environment has improved / stabilised, while 34% maintained business had improved this year. With regard to the business outlook over the next three years, 80% were optimistic, with 55% expecting business to improve and 24% expecting the situation to remain more or less the same as in 2023.

- Investment in China set to accelerate

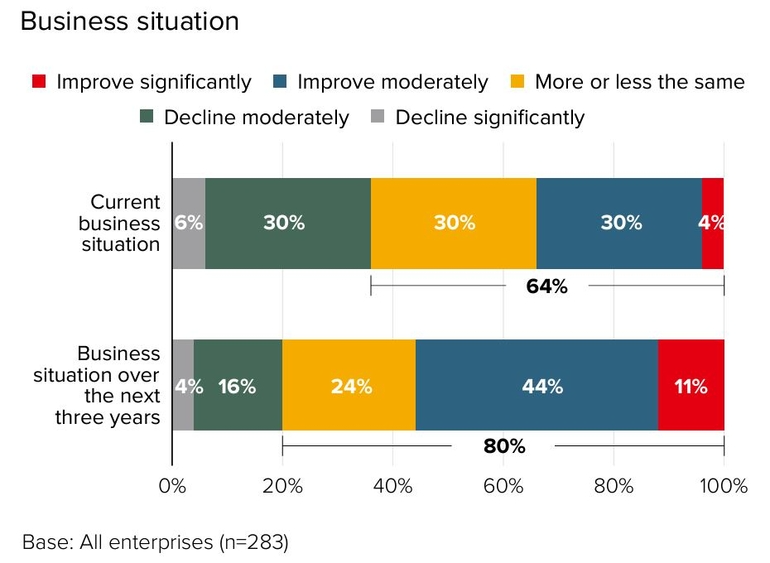

In other findings, some 77% of enterprises plan to increase or maintain their level of investment in China this year. Among these, 27% indicated their intent to increase any such investment, either moderately or significantly, while about half were committed to maintaining their current level of investment this year.

Looking ahead, the survey suggests that this rise in China‑bound investment looks set to accelerate over the next three years in line with recovering sentiment. In all, some 41% of respondents believe that investment in China will improve either moderately or significantly over the next three years, while 42% expect investment to be maintained at the current level.

Comprehensive Understanding of Sustainable Investment Usage and Benefits

- Healthy awareness of sustainable business practices / investment

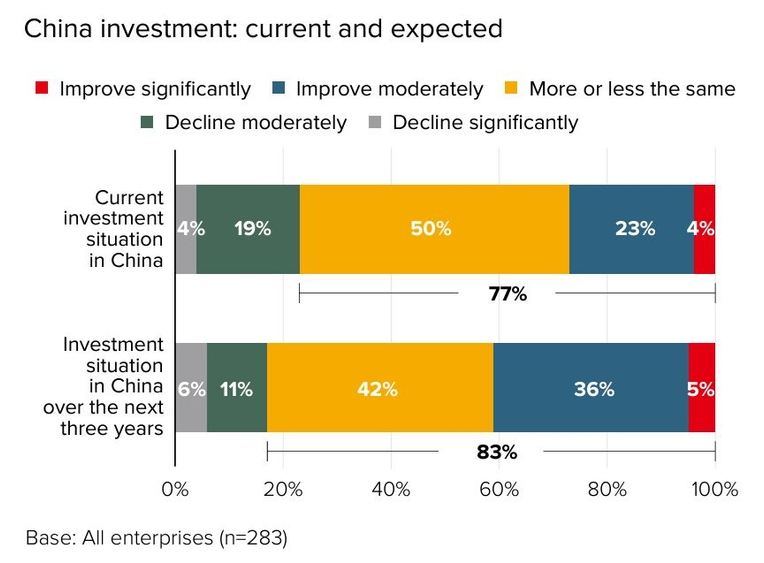

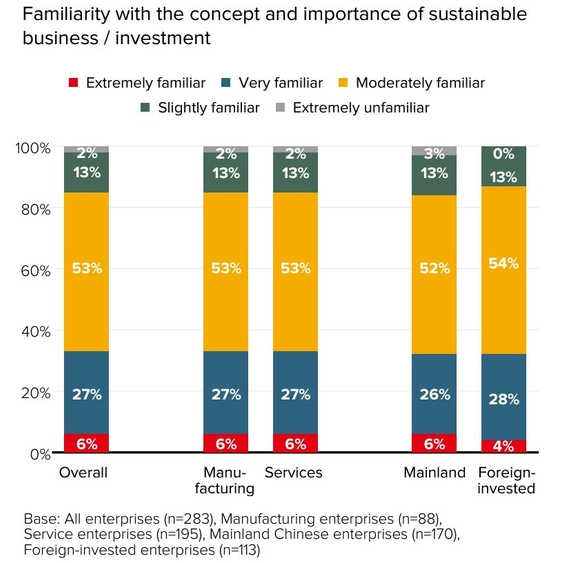

Among participating companies, there is a generally healthy awareness of the importance of sustainability, as shown, for example, by widespread moves to integrate environmental principles into boardroom agendas. In specific terms, the majority (85%) of interviewed enterprises expressed their awareness of the concept and acknowledged the importance of sustainable business / investment. At the other end of the scale, only 13% of respondents indicated they were only “slightly familiar” with the issues, while just 2% considered themselves “extremely unfamiliar”.

There is no major difference between the manufacturing and services sectors, with only a slightly higher proportion (87%) of foreign‑invested enterprises indicating an awareness of sustainable business / investment practices.

- Carbon peak / neutrality, renewable energy and green financing most recognised China policy priorities

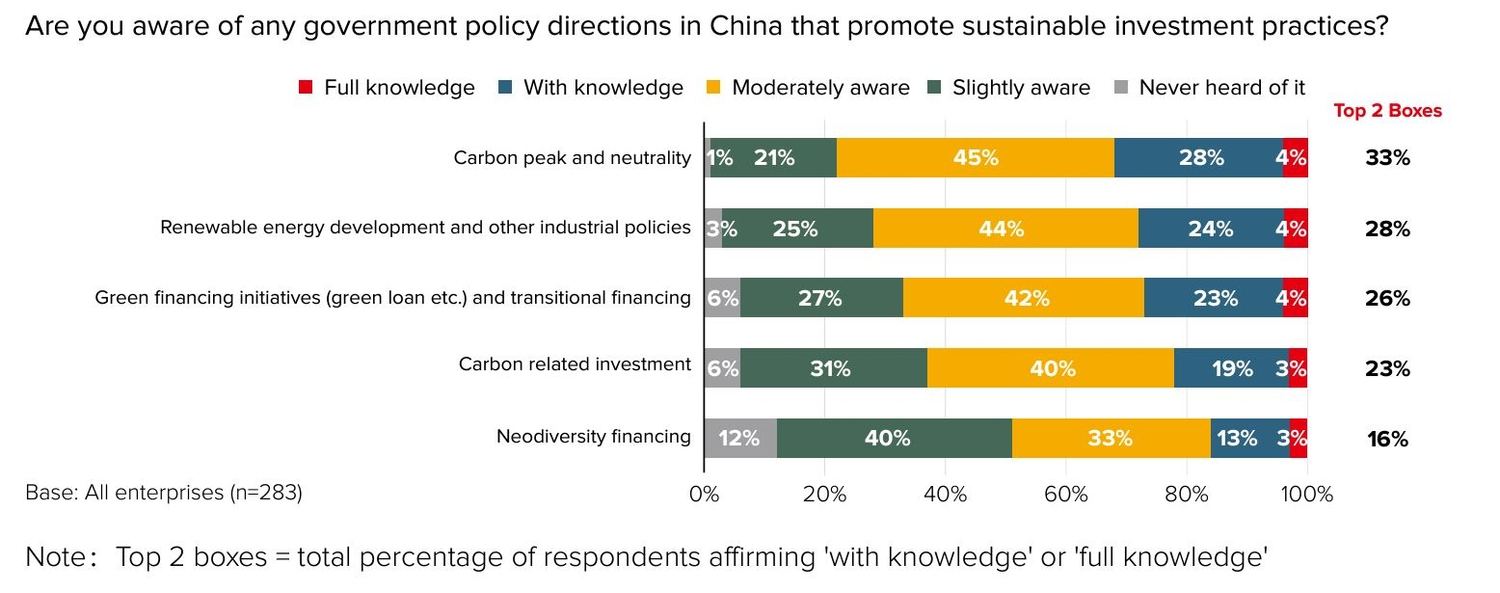

It has been widely recognised that China attaches considerable importance to tackling climate change and cutting carbon dioxide emissions. Accordingly, it has adopted a series of measures specifically geared to meeting such challenges. Of these, carbon peak / neutrality is the most recognised policy among survey respondents at 33% (Top 2 boxes). Renewable‑energy development comes in second at 28%, followed by green‑financing initiatives (26%). Despite this, there remains ample room to increase knowledge of a number of other policies that promote sustainable investment practices, including carbon‑related investment and neodiversity financing.

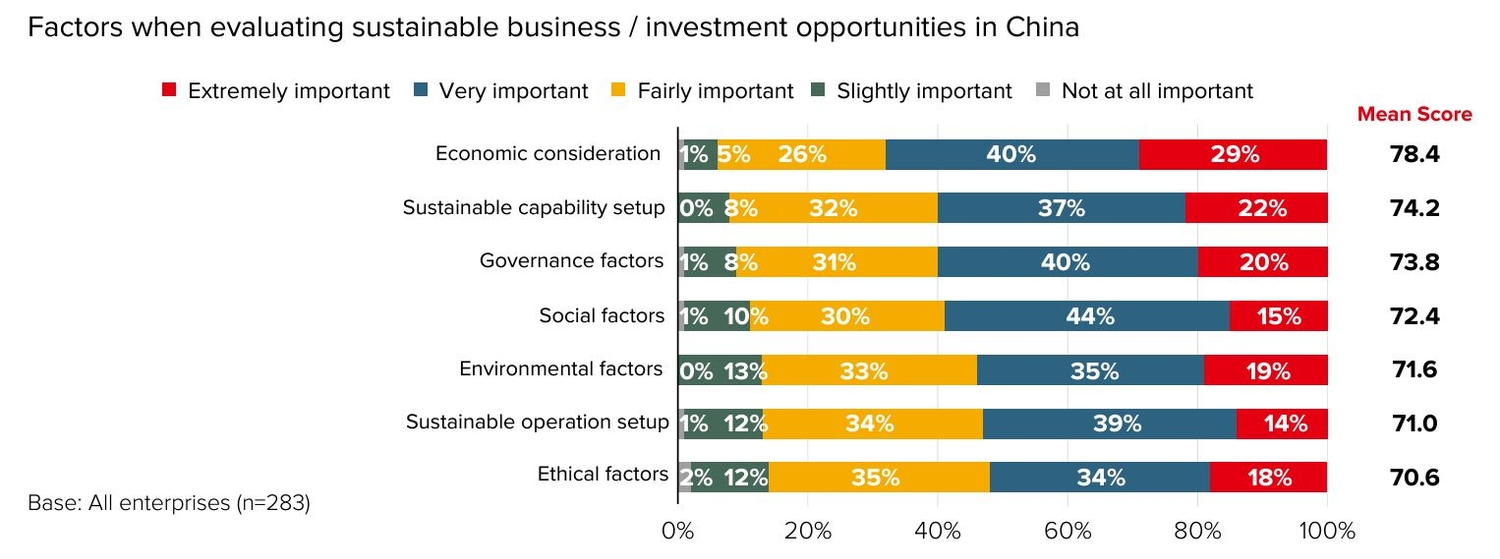

Finding ways to maintain the momentum of the green agenda, while ensuring that existing targets are met, is famously far from easy, frequently obliging enterprises to strike something of a balance. Highlighting this, some 70% of survey participants indicated that economic factors were very or extremely important (with a mean score of 78.4 out of 100) when evaluating business / investment opportunities in China. Furthermore, almost 60% viewed establishing a sustainable capability (mean score of 74.2) and appropriate governance (mean score of 73.8) as essential, closely followed by addressing relevant social factors (mean score of 72.4).

First, please LoginComment After ~