Young adults in Germany often inexperienced with loans

(BaFinJournal) An 18th birthday unlocks many doors previously closed to young people. Those with an independent source of income are now allowed to take out a loan. Young adults show keen interest in loans, but they are often unaware of the costs involved. By Dr Daniela Röstel and Ursula Weigold, BaFin Consumer Protection

Do young adults use overdrafts? How many repay their credit card debts in instalments? And how much do they know about the interest on loans? To find answers to these questions, BaFin carried out a survey among 1,002 young consumers (between the ages of 18 and 29).

Here are the most important findings:

- Around 30 percent of young adults assess their financial situation as “not very good” or “bad”.

- Nearly half of those surveyed have no qualms about using an overdraft.

- One fifth use credit cards with minimum payments (Kreditkarten-Teilzahlungen).

- Fifteen percent use both: overdrafts and credit cards with minimum payments.

- Many do not know the conditions for consumer finance loans.

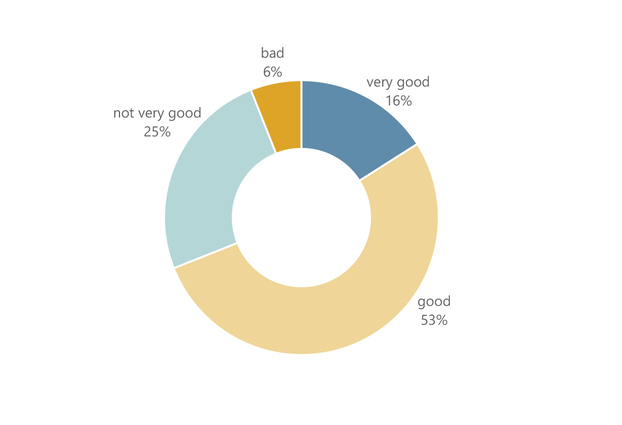

Nearly 70 percent assess their current personal financial situation as positive. However, a significant number of young people expressed concern about their finances, with six percent even assessing them as bad (see figure 1).

Figure 1: Current personal financial situation

Source: BaFin

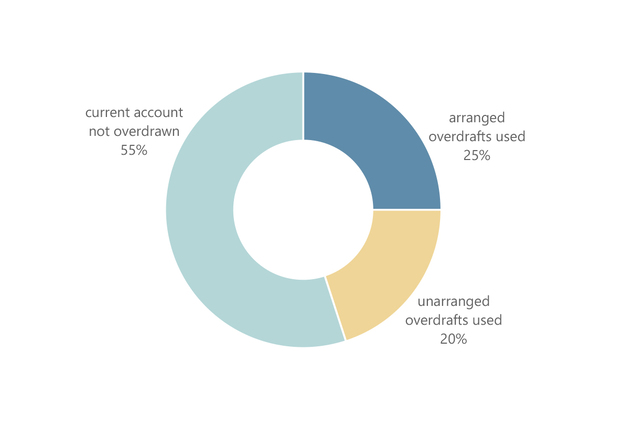

Of the young adults surveyed, 45 percent have overdrawn their current accounts in the last twelve months (see figure 2). Nearly half of them failed to remain within the contractually arranged overdraft facility. This unarranged overdraft was tolerated by the credit institution.

Figure 2: Use of overdrafts

Source: BaFin

Little understanding of interest rates

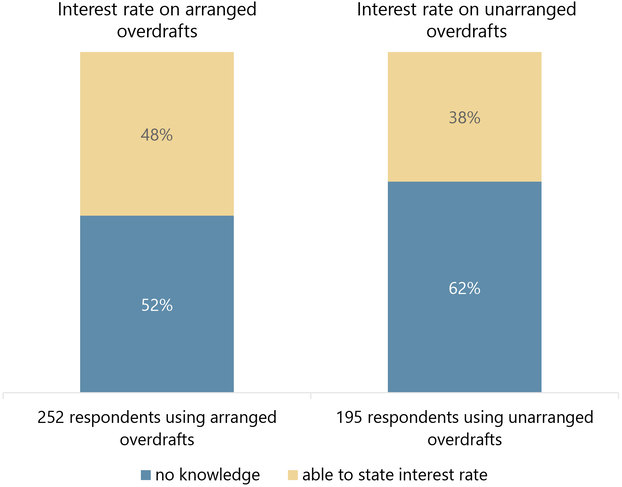

Around 70 percent of the 1,002 persons surveyed were unable to say how high the interest rates on arranged and unarranged overdrafts were. Only around 30 percent were able to state the interest rates on these two types of overdraft. The interest rate for an arranged overdraft was estimated at an average 13.4 percent and for an unarranged overdraft at 12 percent. As interest rates vary greatly from one bank to another, there was no way to check who was right or wrong.

The level of knowledge among those actually using arranged or unarranged overdrafts was hardly any better. More than half were unable to state the rate they were being charged for their overdraft (see figure 3).

Figure 3: Knowledge of interest rates

Source: BaFin

Credit cards with minimum payments: very popular – also in combination with an overdraft facility

In the last twelve months, 59 percent of the surveyed young adults used a credit card for their payments. Of these, around one third – i.e. 189 of the total 1,002 persons surveyed – stated that they owned a credit card based on a minimum payment or instalment payment option and that they also made use of this possibility.

Of these, 32 percent exhibited poor knowledge of the conditions applying to their particular cards. They wrongly assumed that in the last twelve months they had not paid any interest on them – despite the fact that credit cards with a minimum payment option are not generally offered on an interest-free basis.

This means that 15 percent of all persons surveyed were running up debt on two counts: their current account was overdrawn and they were using a credit card with a minimum payments option.

Little knowledge of how much the various types of loans cost

Prices for consumer loans differ greatly. For consumer loans on which interest is charged (i.e. credit lines (Rahmenkredite) or instalment loans), banks usually grant comparatively favourable conditions. The interest rates on arranged overdrafts are often significantly higher. And the costs of credit cards with minimum payments are often even greater, with peak interest rates often way exceeding those on unarranged overdrafts.

The survey participants were asked to classify the various kinds of consumer loans on a scale from “cheap” to “expensive” based on what interest rates and costs they would usually expect. Few were able to give correct answers here. Of those surveyed, 16 percent incorrectly assumed that revolving credit cards (see background information) were the cheapest and 29 percent believed that they were the second cheapest. When asked which kind of loan is usually the most expensive, an incorrect answer was often given, with 24 percent stating that it was the traditional instalment loan offered by banks.

Why are young adults so uninformed about loans?

Why do young adults have such little knowledge of consumer financing options? While this was not the subject of BaFin's survey, it is still worth mentioning the possible reasons for this:

- It is difficult to calculate interest on overdrafts and credit cards with minimum payments. Unlike an instalment loan, the amount drawn on a credit card changes from month to month depending on whether the cardholder continues using the card. Credit institutions often do not agree fixed instalment options for credit cards. It is therefore easy for cardholders to underestimate the interest accumulating on their cards, even if the amounts they are drawing are low.

- For some consumers, calculating interest rates can be quite a challenge, as BaFin established in an earlier study.

- Consumers do not compare the loans available – if they did, they might realise how much they could save. They evidently do not gather enough information.

- Young consumers appear to be inexperienced – they lack practical experience. Dealing with money, including loans, is a skill that has to be learned.

A word of advice – get information and make comparisons

Overdrafts and credit cards with minimum payments might be suitable for bridging short-term liquidity gaps, should the need arise. If someone additionally requires a consumer loan for making purchases, they are well advised to obtain information from various providers and compare the offers. For make no mistake – a person with financial knowledge will be better able to assess their personal financial situation.

Information can be obtained from BaFin as well as other sources. The BaFin website provides explanations of how credit cards function and offers advice on how to compare consumer loans. BaFin also advises consumers to obtain as much detailed information as possible on the different kinds of loans from the various providers.

The methodology underlying BaFin's survey: BaFin commissioned a market research institute to conduct an online questionnaire among 1,002 consumers aged between 18 and 29 years in March 2023. The participants had declared in advance that they were willing to take part in online surveys and be added to a panel for this purpose. They were selected representatively from this panel according to sex, age and federal state.

First, please LoginComment After ~