PBOC Financial Statistics Report (November 2024)

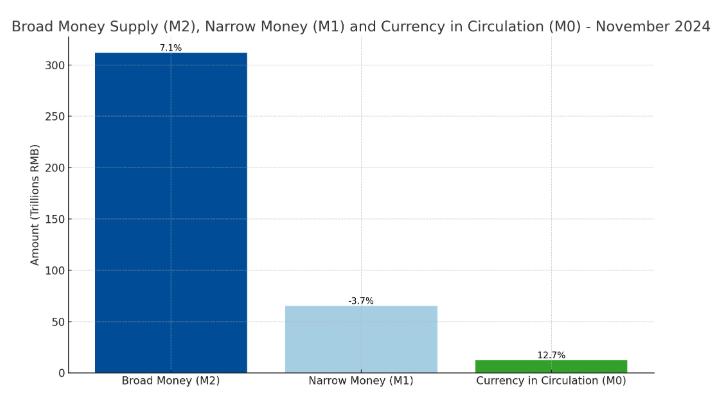

1. Broad Money Supply (M2) Growth at 7.1%

At the end of November, China's broad money supply (M2) stood at RMB 311.96 trillion, representing a year-on-year growth of 7.1%. Narrow money supply (M1) amounted to RMB 65.09 trillion, down 3.7% year-on-year. Currency in circulation (M0) reached RMB 12.42 trillion, a robust year-on-year increase of 12.7%. Over the first eleven months, a net RMB 1.07 trillion was injected into circulation.

2. RMB Loans Expand by RMB 17.1 Trillion in First Eleven Months

By the end of November, the outstanding balance of RMB and foreign currency loans totaled RMB 258.65 trillion, reflecting a 7.3% year-on-year increase. Outstanding RMB loans grew to RMB 254.68 trillion, up 7.7% year-on-year.

New RMB Loans: RMB 17.1 trillion were issued in the first eleven months.

Breakdown by Sector:

• Household loans: Increased by RMB 2.37 trillion (short-term: RMB 414.4 billion; medium- and long-term: RMB 1.95 trillion).

• Loans to enterprises and public institutions: Grew by RMB 13.84 trillion (short-term: RMB 2.63 trillion; medium- and long-term: RMB 10.04 trillion; bill financing: RMB 1.12 trillion).

• Non-banking financial institutions: Loans increased by RMB 228.6 billion.

Outstanding foreign currency loans were USD 551.5 billion, down 17.6% year-on-year. This reflects a net decrease of USD 104.9 billion over the first eleven months.

3. RMB Deposits Increase by RMB 19.39 Trillion

As of end-November, the outstanding balance of RMB and foreign currency deposits stood at RMB 309.58 trillion, reflecting a 6.8% year-on-year increase. RMB deposits totaled RMB 303.65 trillion, up 6.9% year-on-year.

Deposits Growth Breakdown:

• Household deposits: Increased by RMB 12.07 trillion.

• Fiscal deposits: Rose by RMB 1.46 trillion.

• Non-banking financial institutions: Deposits climbed by RMB 5.76 trillion.

• Non-financial enterprises: Deposits declined by RMB 2.1 trillion.

Outstanding foreign currency deposits reached USD 825.9 billion, reflecting a 4.1% year-on-year increase, with a net rise of USD 28 billion in the first eleven months.

4. Interbank Market Activity and Interest Rates

In November, interbank RMB market activity totaled RMB 199.45 trillion, with the daily average turnover rising 15.3% year-on-year to RMB 9.5 trillion:

Interbank lending: Daily turnover decreased 13.3%.

Cash bond trading: Daily turnover rose 9.9%.

Pledged repo trading: Daily turnover increased 18.3%.

The monthly weighted average interest rates for November were:

Interbank RMB lending: 1.55% (down 0.04 percentage points month-on-month and 0.34 percentage points year-on-year).

Bond pledged repos: 1.59% (down 0.06 percentage points month-on-month and 0.39 percentage points year-on-year).

5. RMB Cross-Border Settlement Overview

Current Account Settlements: RMB 1.4 trillion in November, including:

• Trade in goods: RMB 1.11 trillion.

• Trade in services and other current account items: RMB 0.29 trillion.Direct Investment Settlements: Totaled RMB 0.69 trillion, with:

• Outbound Direct Investment (ODI): RMB 0.26 trillion.

• Foreign Direct Investment (FDI): RMB 0.43 trillion.

Notes:

All figures are preliminary and subject to revision.

Data includes lending and deposits for non-banking financial institutions as of 2015.

e-CNY in circulation has been included in M0 calculations since December 2022.

Starting January 2023, data from consumer finance, wealth management, and financial asset investment companies have been incorporated into financial statistics.

First, please LoginComment After ~