ANZ New Zealand releases 2024 Climate Statement

ANZ Bank New Zealand Limited (ANZ NZ) has set a target to fund and facilitate at least $20 billion in social and environmental outcomes in the next six years through customer activities and direct investments.

The plan is outlined in the bank's 2024 Climate Statement, released yesterday.

This is ANZ NZ's first mandatory group climate statement under the Financial Markets Conduct Act 2013. Following the voluntary Climate Report for 2023, it provides a picture of our climate-related risks and opportunities.

ANZ NZ Chief Executive Officer Antonia Watson said the Climate Statement was underpinned by significant work to identify and assess climate-related risks and opportunities.

“ANZ NZ aims to support New Zealand's transition to a low-emissions, climate resilient economy,” Ms Watson said.

“We want to help support our customers to reduce their emissions and enhance their resilience to a changing climate. We are also reducing the climate impact of our own operations.”

The ANZ Bank New Zealand Limited Climate Statement can be downloaded here.

Our climate-related targets

Ms Watson said the $20 billion funding target would include initiatives that help lower carbon emissions, protect nature and biodiversity, increase access to affordable housing and promote financial wellbeing.

“This is a major investment for us and shows our commitment to a better future for New Zealand,” she said.

ANZ NZ's other climate-related targets include providing discounted lending of at least $825m in aggregate by the end of 2025 to at least 19,700 households to help them improve the sustainability of their homes and reduce their transport emissions (starting from October 2020). This target was increased in 2024 to be more ambitious.

In 2024 ANZ NZ established a target for lending to the power generation sector, aiming to reduce the emissions intensity of this lending by 50% by the end of 2030, from a 2020 baseline. This sector was selected due to the influence it has on the emissions profile of New Zealand homes and businesses.

ANZ NZ plans to work with 20 of its largest food, beverage and agribusiness customers to support the progress of their transition plans.

Measuring emissions

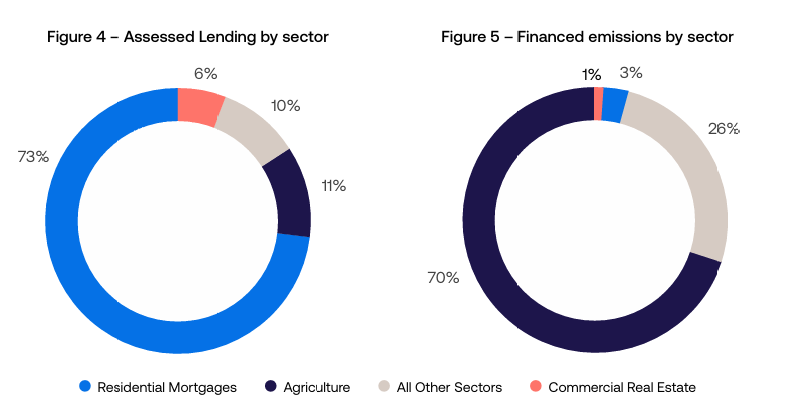

ANZ NZ's largest source of reported greenhouse gas (GHG) emissions are scope 3 financed emissions, from the businesses and activities the bank finances.

Lending to the agriculture sector represents 70% of financed emissions compared to 3% for lending to residential mortgages, ANZ NZ's largest lending portfolio. Dairy accounted for 47% of total financed emissions.

Supporting our customers to build resilience

The 2024 Climate Statement details ANZ NZ lending already underway to support households and businesses to reduce emissions and build resilience.

The bank participated in the Government's North Island Weather Events (NIWE) loan guarantee scheme between August 2023 and June 2024. Under the scheme, the Crown underwrites 80% of the credit risk on eligible loans to help significantly impacted businesses recover.

ANZ NZ's Business Regrowth Loan is a low-interest loan aimed at those in need of finance following extreme weather events.

Since August 2023 the bank has also offered assistance to customers who had been designated as Category 3 under the Government's Future of Severely Affected Land Programme, allowing eligible customers to break fixed rates and take up a discounted lending offer as they complete their Council buyout.

“When the Auckland Anniversary floods and Cyclone Gabrielle hit the North Island at the start of 2023, we saw the devastating impacts of extreme weather,” Ms Watson said.

“We continue to work with homeowners and businesses to help them recover and build resilience for future storms.”

Supporting our customers to reduce emissions

Eligible Business and Agri customers may borrow up to $3 million at a discounted rate for a Business Green Loan to finance (or refinance) assets or projects associated with energy efficiency, renewable energy, green buildings, plantings, sustainable water and wastewater, clean transportation, and pollution prevention and control.

ANZ Agri Uplift Finance, launched in 2024, offers an interest rate discount to customers who have a clear environmental vision and are focused on improving farming practices and increasing business resilience.

The Good Energy Home Loan is available to existing eligible home loan customers to upgrade their homes with solar panels, heating and insulation, double glazing, ventilation systems and rainwater tanks. It can also be used for electric and hybrid vehicles, electric bikes, and electric vehicle chargers.

The Healthy Home Loan package offers interest rate discounts and fee savings for eligible customers who are buying, renovating or already own a home with a 6 Homestar rating or higher.

ANZ NZ has also supported customers’ transition through funding and facilitating access to sustainable finance. In 2024 it participated in nine labelled sustainable finance deals, with a total deal size of $3.2 billion and an ANZ share/hold of $484 million. These transactions included initiatives to reduce emissions and promote financial wellbeing.

In 2024, ANZ NZ invested $4 million in AgriZero NZ, a partnership focused on accelerating development of tools and technologies to help reduce on-farm emissions.

Looking to the future

ANZ NZ is required to publish climate statements annually from now on, and these future climate statements will contain further details of our progress.

First, please LoginComment After ~