Green Financing Opportunities in China

Intuitively, both long‑term value considerations and regulatory requirements are driving Chinese companies to increasingly utilise green financing for their operations. The HKTDC and ACCA have recently completed a joint research initiative specifically focussed on sustainable business and investment of Chinese companies, namely Seizing Opportunities in China's Sustainable Investment. In specific terms, the study aims to assess corporate understanding and the varied perspectives relating to sustainability, developing an understanding of the various costs and benefits, as well as the sundry strategic approaches to securing sustainability. Quantitative analysis was conducted as a means of providing insights into the qualitative aspects of such issues.

Part of the key survey findings, particularly focusing on Opportunities in Green Financing as follows:

- The vast majority of survey participants are prioritising meeting the government’s policy objectives in the environmental impact space, especially with regard to substantially reducing their carbon emissions. Many companies also highlighted other benefits of adopting greener business practices, including enhanced access to green finance and establishing positive brand values on an international basis.

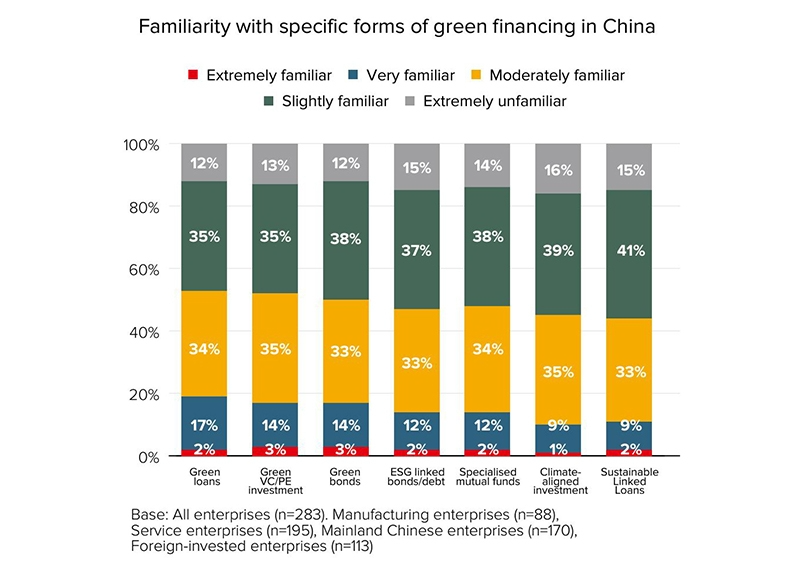

- The awareness of green financing options in China is still relatively low, with some 47%-56% of respondents indicating a lack of familiarity with many of the available options. Some 71% of respondents, however, maintained that they were willing to make wider use of green financing channels, including green loans and green bonds, while reducing their reliance on traditional financing options.

Details as follows:

Creating long-term values and complying with regulatory requirements

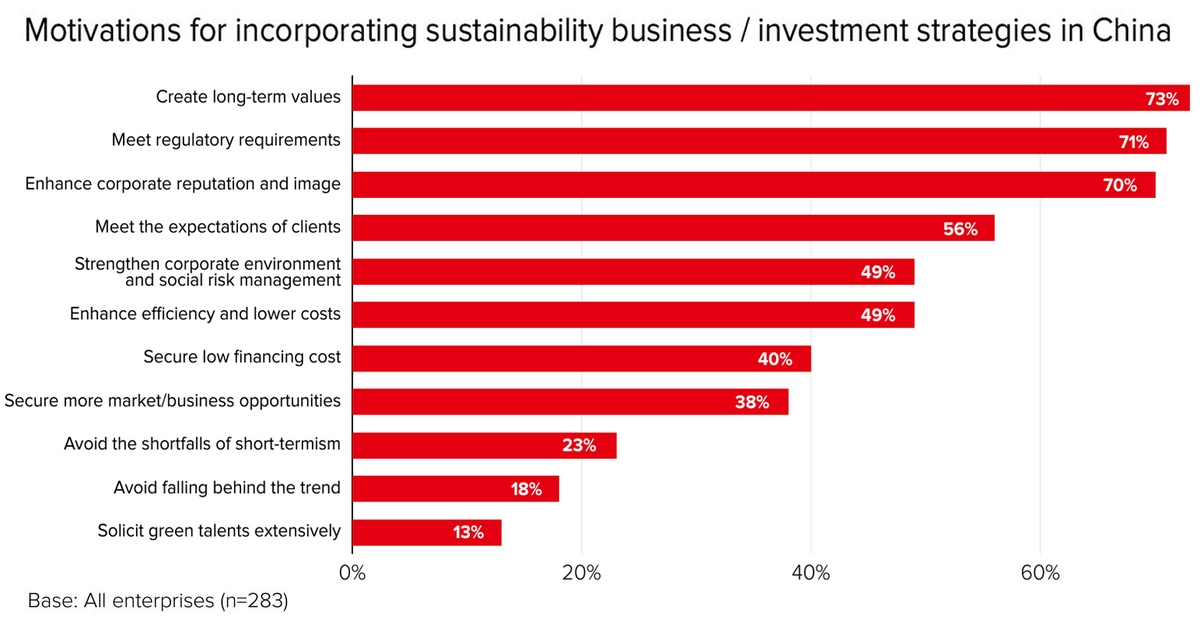

Many survey respondents had clear ideas as to the likely benefits of committing to a green transformation and adhering to sustainable development principles. To this end, 73% of respondents saw creating long‑term values as their key motivation, followed by meeting the regulatory requirements of government policies / laws and regulators (71%) and enhancing corporate reputation and image (70%). In general terms, respondents believed favouring green investment options would help them align with trends in the macro environment and secure market opportunities over the long term. The likelihood of a bolstered brand image and a resulting upturn in competitiveness delivering significant economic benefits was also widely cited.

Awareness of green financing in China remains low

In general, the awareness of green financing options in China is still relatively low, with some 47%‑56% of respondents indicating a lack of familiarity with many of the available forms of green financing. Ultimately, given green finance’s facility to ensure a smooth transition to a low‑carbon, sustainable future, there is a massive and pressing imperative for this knowledge gap to be bridged.

More than 70% of survey participants open to green financing options

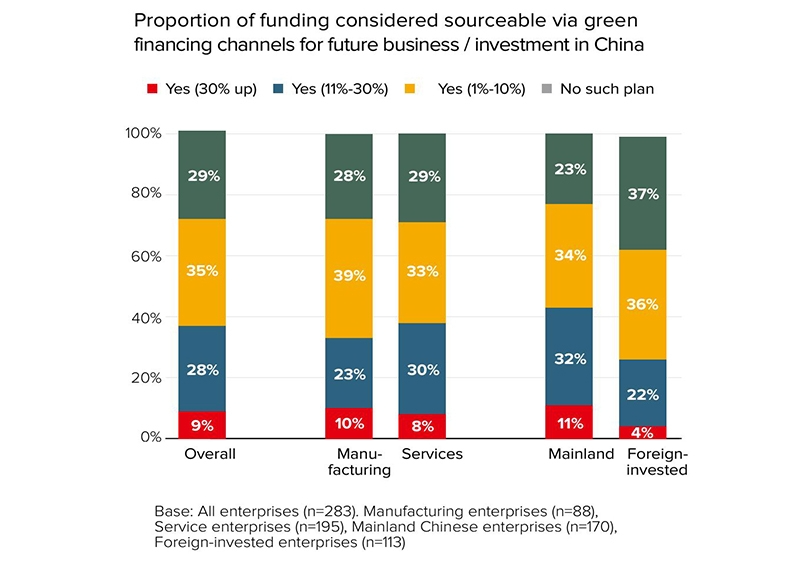

Most respondents (71%) would welcome an opportunity to make wider use of green financing channels (including green loans and green bonds), while reducing their reliance on traditional financing options. Drilling down a little deeper, some 9% of interviewed enterprises would consider raising more than 30% of their overall funding requirements via green‑financing channels.

Notably, respondents from both the manufacturing and service sectors manifested similar attitudes towards green financing. In terms of backing, a higher level of domestically‑funded enterprises (77%) than foreign‑invested businesses (63%) affirmed an interest in using green financing to fund their future China‑focussed sustainable initiatives.

Overall, respondents were largely satisfied with progress towards sustainable investment integration on a number of business and operational fronts

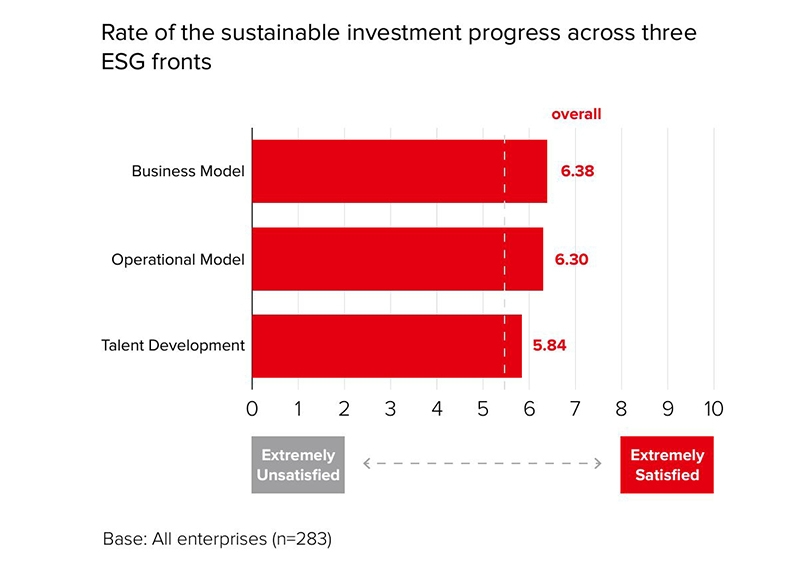

The survey also asked respondents to self‑assess their progress and efforts towards integrating sustainable investment in China on a 10‑point scale across three ESG metrics – “business model”, “operational model” and “talent development”. Overall, most participants were more than satisfied on the business model front (with a mean score of 6.38 out of 10) and with regard to the operational model (mean score of 6.30). Talent development, however, was accorded the lowest score (mean score of 5.84), but the potential / likelihood of improvement was also clearly highlighted.

First, please LoginComment After ~