Hong Kong's Export Outlook for 2025: A Year of Two Halves

In 2025, Hong Kong's merchandise exports are expected to enjoy moderate growth of 4%, an outcome set to be underpinned by the continued upcycle of Asia's electronics sector.

Despite this broadly positive forecast, it is clear that a number of challenges lie imminently ahead. In particular, there are the massive tariff hikes on goods imported to the US from multiple sources (including Mexico, Canada and mainland China), as proposed by President‑elect Donald Trump. Should they actually be implemented, global trade flows would inevitably be negatively impacted, while the process of trade diversion would be accelerated.

While, at present, it remains unclear as to how, when and to what extent this may actually occur, the heightened uncertainty clearly represents a substantial downside risk. Ultimately, it may have implications for the export forecast as it currently stands, especially as it is likely to undermine exporter confidence over the near‑term (as reflected in the 4Q2024 Export Confidence Index recently released by HKTDC Research).

2024: The year Hong Kong's electronics exports rebounded

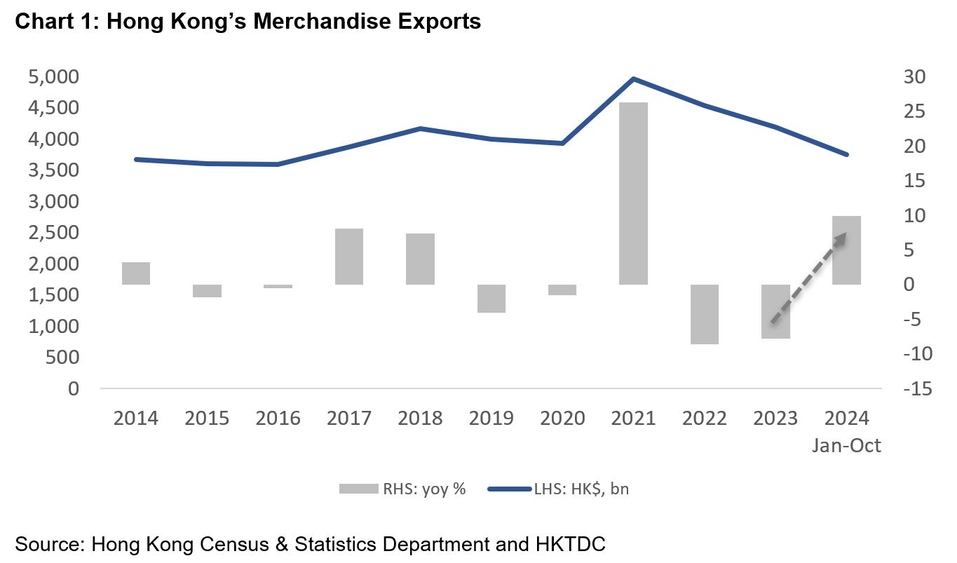

Hong Kong's exports grew by 9.9% in the first 10 months of 2024, an outcome broadly in line with HKTDC Research's earlier 9‑11% forecast1. Overall, this uptick can largely be attributed to the strong recovery in the level of electronics exports, while the low comparison base from the previous year also played its part (see Chart 1). It should also be noted that, while electronics exports grew by 13.5% year‑on‑year, every other sector showed a decline over the same period (see Table 1).

Table 1: Hong Kong’s merchandise exports by key sector

2023 | 2024 Jan-Oct | |||||

HK$ mn | Share | Growth | HK$ mn | Share | Growth | |

Electronics | 2,939,730 | 70.4% | -10.5% | 2,710,611 | 72.4% | 13.5% |

Precious Jewellery | 87,754 | 2.1% | 23.0% | 68,009 | 1.8% | -5.5% |

Watches & Clocks | 54,511 | 1.3% | -0.5% | 40,844 | 1.1% | -10.0% |

Clothing | 51,167 | 1.2% | -4.4% | 40,766 | 1.1% | -1.6% |

Toys | 17,490 | 0.4% | -18.2% | 11,283 | 0.3% | -24.5% |

All products | 4,177,405 | 100% | -7.8% | 3,742,067 | 100% | 9.9% |

Source: Hong Kong Census & Statistics Department and HKTDC | ||||||

Strong ASEAN and mainland China ties boost export growth

For 2024, there was something of a mixed performance across the individual markets (see Table 2). While, year‑on‑year, exports to the ASEAN bloc rose by 18.0% and to mainland China by 17.1% in the first 10 months of 2024, exports to the EU remained weak and shipments to Japan and South Korea actually declined. More positively, exports to the US rose by 12.3%.

Table 2: Hong Kong's exports by key markets

2023 | 2024 Jan-Oct | |||||

HK$ mn | Share | Growth | HK$ mn | Share | Growth | |

Mainland China | 2,320,368 | 55.5% | -9.7% | 2,194,818 | 58.7% | 17.1% |

ASEAN | 331,370 | 7.9% | -8.0% | 320,303 | 8.6% | 18.0% |

EU (27) | 273,732 | 6.6% | -12.4% | 231,191 | 6.2% | 1.1% |

US | 272,476 | 6.5% | -6.9% | 250,230 | 6.7% | 12.3% |

India | 167,022 | 4.0% | -2.7% | 114,333 | 3.1% | -14.7% |

Taiwan | 138,842 | 3.3% | -9.9% | 115,383 | 3.1% | 0.9% |

Japan | 84,398 | 2.0% | -17.7% | 67,634 | 1.8% | -3.2% |

South Korea | 73,706 | 1.8% | -9.5% | 57,581 | 1.5% | -7.7% |

World | 4,177,405 | 100% | -7.8% | 3,742,067 | 100% | 9.9% |

Source: Hong Kong Census & Statistics Department and HKTDC | ||||||

Export outlook for 2025: A year of two halves

The baseline forecast is steady growth …

For 2025, global trade activity is likely to expand at a steady pace, although the probability of escalating trade conflict‑related disruptions remains high. In its October 2024 update on the global trade outlook2, the World Trade Organisation (WTO) predicted that global merchandise trade would increase by 3.0% in volume terms in 2025, slightly higher than the 2.7% gain estimated for 2024. In more specific terms, import growth is expected to go up from 2.0% in 2024 to 3.0% in 2025, while export growth is expected to be relatively steady at 3.1% in 2025 compared to 3.3% in 2024.

… underpinned by consistent demand for AI-enabled electronic devices

In terms of product mix, electronics is the single largest sector of Hong Kong's export portfolio, currently accounting for more than 70% of Hong Kong's total export value. Reassuringly, within the sector, industry players view 2025 with a degree of optimism, largely on account of the consistent demand for AI‑enabled systems on the part of the global business community. Similarly, the launch of a new generation of AI‑enabled smartphones, PCs, and other digital devices is expected to boost consumer sales levels.

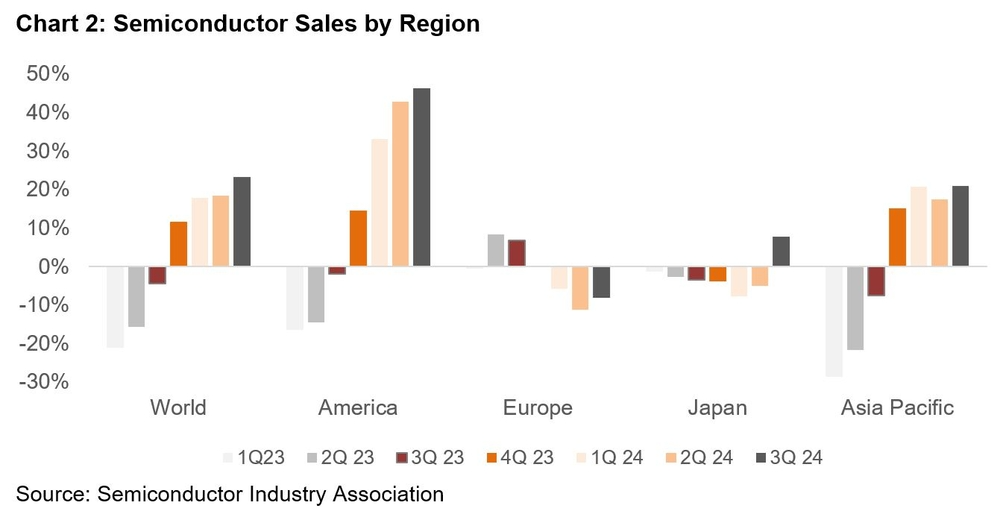

As a forward‑looking indicator of the likelihood of sustained demand for consumer electronics products, global sales of semiconductors spiked by 23% year‑on‑year in 3Q24, well above the 18% recorded for 2Q24 and the 17% for 1Q24, according to figures from the Semiconductor Industry Association (SIA) (see Chart 2). The SIA is currently predicting a 11.2% rise in global semiconductor sales in 20253, a development that would definitely benefit Hong Kong electronics exporters.

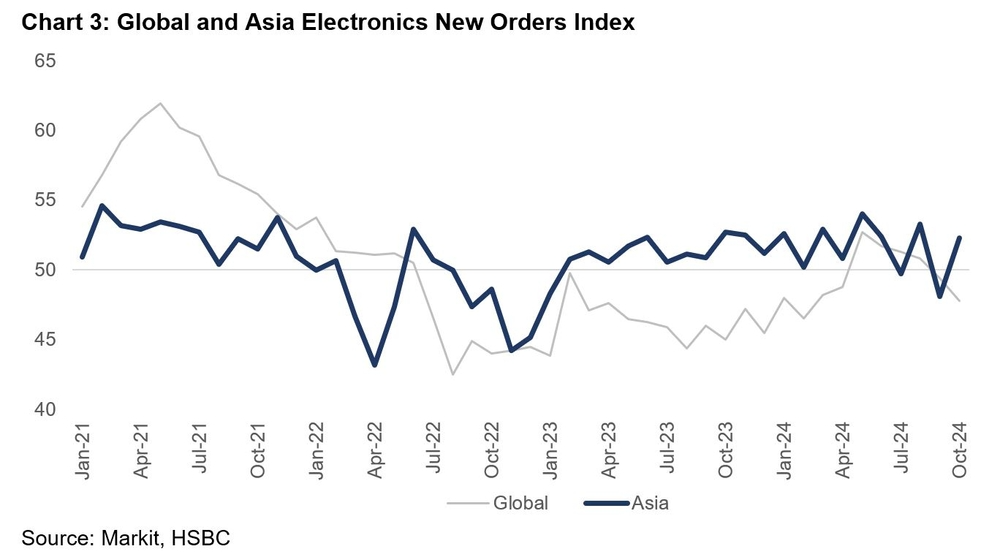

Another key leading indicator, the Electronics New Orders Index, however, suggested new global electronics orders were somewhat subdued, with an eight‑month low of 47.8 recorded for October 2024. Zeroing in on Asia, though, a more positive picture appears, with the relevant regional index value rebounding to 52.3 in October compared to 48.1 in September (see Chart 3). More locally still, a survey conducted during the October 2024 Hong Kong Electronics Fair (Autumn Edition) highlighted the likelihood of a sustained solid export performance for the sector in 2025. Overall, some 39% of respondents expected their sales volumes to increase in next 6‑12 months, while 57% were confident it would at least remain the same.

Uncertainty over trade tensions impacting sentiment more than business

If implemented, President‑elect Donald Trump's proposed massive tariff hikes would, almost certainly, negatively impact US trade flows with its major trading partners, while also accelerating trade diversion. It does, however, remain unclear as to how, when, and to what extent this may happen, with some maintaining it is likely to be a strategy of escalating prior to de‑escalating. In any case, this heightened uncertainty is likely to undermine overall exporter confidence. Even factoring this in, however the 4Q24 HKTDC Export Confidence Index indicated that exporters remained optimistic with regard to their near‑term prospects in the US (51), with only ASEAN (55.9) and mainland China (52.7) attracting higher scores.

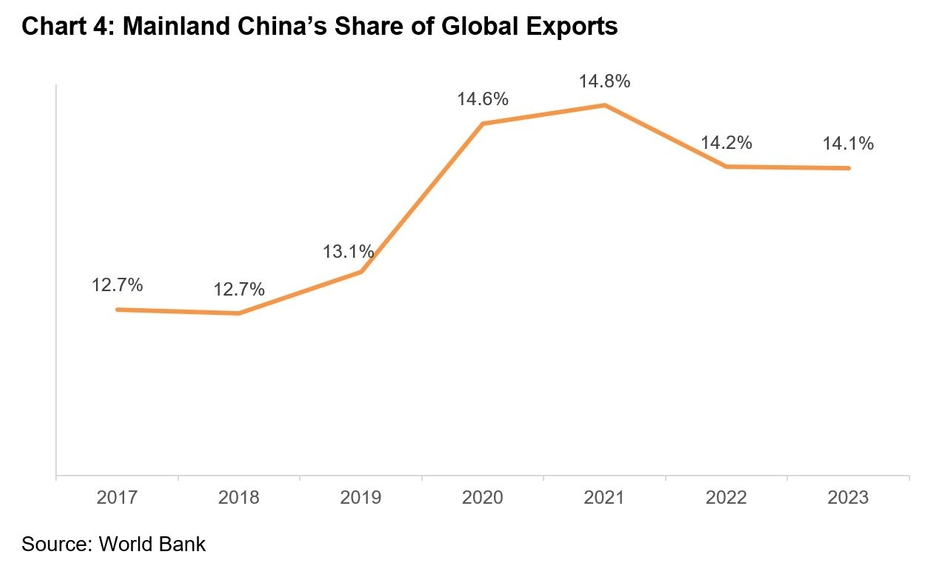

It should be borne in mind, however, that, even though US tariffs have applied to about two‑thirds of Chinese exports to the US since 2018, mainland China's global export share has risen from 12.7% in 2018 to 14.1% in 2023 (see Chart 4). In another reassuring finding, the 3Q24 HKTDC Export Confidence Index indicated that the majority of Hong Kong exporters are well‑prepared for further tariff hikes. This saw 60% of respondents indicating that they do not expect their trade business to be affected, while 39% expected only a mild to moderate downside. In all, only 1% of respondents anticipated significantly negative consequences. Despite this, it is probable that front‑loading of shipments will become an ever more common practice over the coming months.

The EU decarbonisation legislation: A challenge to exporters

Another emerging challenge for Hong Kong exporters is the EU's new sustainable products regulatory requirement. This has seen the bloc implement the European Green Deal – a comprehensive framework of interrelated policies and regulations designed to transform the EU into a circular and sustainable economy. At the core of the European Green Deal is the circular economy concept, which embodies a widespread commitment to reducing waste and improving resource management efficiency. Further to this, the 2020 Circular Economy Action Plan (CEAP) sets out a coherent policy framework under which sustainable products, services and businesses become the norm throughout the EU.

Within this new regulatory framework are the Ecodesign for Sustainable Products Regulation (ESPR), the Directive on the Repair of Goods, and the Green Claims Directive, all of which set requirements related to sustainable product performance and the provision of consumer information. Ultimately, this raft of legislation will lead to ecodesign requirements that virtually all product sectors will have to comply with if they are to be granted access to the EU market. In addition, the ESPR establishes a digital product passport, while creating a framework that will prevent unsold consumer products – including textile and footwear items – from being destroyed.

Over the course of the next few years, the number of sector‑specific requirements will gradually increase. These changes in mandatory production information requirements and performance standards will inevitably have a significant impact on exporters who do business with the EU (for further details, see The EU Circular Economy Strategy: An Overview).

The 3Q24 HKTDC Export Confidence Index also showed that the overwhelming majority of Hong Kong exporters are not fully prepared to adapt to the requirements of this incoming EU legislation. This was highlighted by the low awareness of the ESPR, with more than 80% of respondents having little to no familiarity with its statutes or implications, a situation that could lead to compliance issues and future disruptions in business activity.

Solid growth with divergent paths in the first and second half

All things considered, HKTDC Research, however, remains optimistic with regard to Hong Kong’s 2025 export performance. In line with this, it is forecasting export growth of 4% over the next 12 months, while cautioning that a good first half of the year may be followed by a deceleration in the second half, partly on account of the likelihood of traders front‑loading shipments.

1 2024 Mid‑Year Trade Review and Outlook, HKTDC, June 2024.

2 Global Trade Outlook and Statistics, WTO, October 2024.

3 Global Semiconductor Sales Increase 22.1% Year‑on‑Year in October; Annual Sales Projected to Increase 19.0% in 2024, Semiconductor Industry Association, 5 December 2024.

First, please LoginComment After ~