The Future of the Payments System

Thank you for the invitation to open the batting at this year's AusPayNet Summit. This forum is always a highlight on the calendar − for industry and policymakers alike − and I am sure this year will be no different.

Not so long ago, opining on the future of the payments system may have been a somewhat mundane affair. Not a great deal changed from one year to the next, and not too many folks, other than the true payment system diehards, were interested.

Not so now.

For a start, our payments system is rapidly evolving. New innovations are springing up at a dizzying pace.

And the payments system has never been more critical to the functioning of the economy. Almost $300 billion in payments now settle across the RBA's central infrastructure each day. This is equivalent to Australia's annual GDP flowing through the payments system every 10 days.

Furthermore, debates over the future of money and payments now regularly feature in the public square – and as I am discovering, the public square very much extends to summer barbeque conversations. In some sense, money and technology have always been the subject of popular fascination, but this seems especially true today.

In short, to channel a former Prime Minister, it has never been a more exciting time to be in payments.

My remarks today will focus on the challenges and opportunities in front of all of us involved in payments. There is no shortage of both. But before diving in, let me briefly set the scene by highlighting where our payments system stands today, and the RBA's role in it.

The current state of Australia's payments system

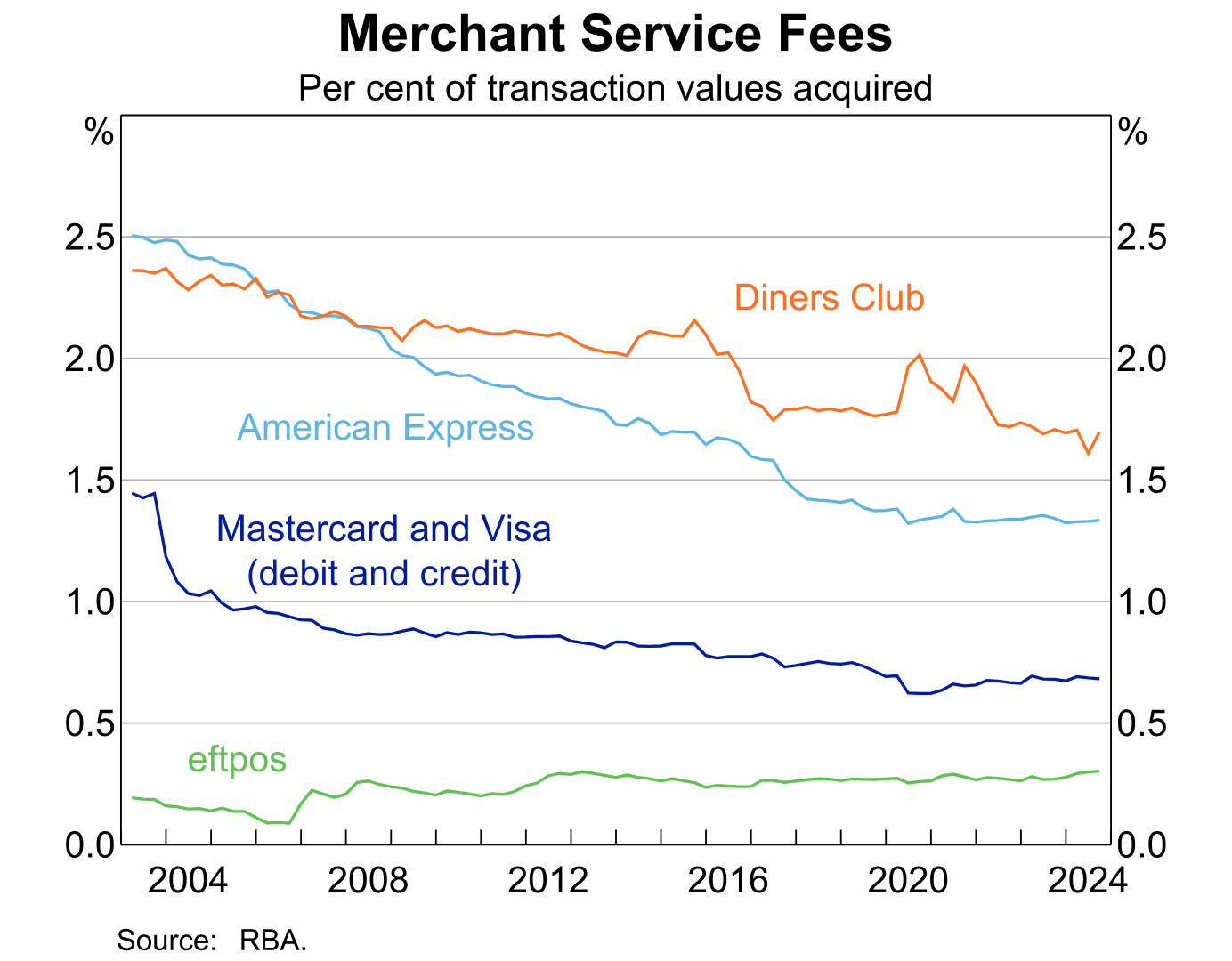

Australia has a payments system that we can be proud of. By global standards, it is fast, efficient and reliable. This is evident not only in the data, but from the discussions that I and my colleagues at the RBA and on the Payments System Board regularly have with our international counterparts. It is also worth noting that for the better part of a couple of decades, retail merchant card payment costs have trended lower in Australia in response to increased transparency and competitive tension in the market for payments services (Graph 1). Some of this competitive tension has arisen organically, and some of it has come about as a result of intervention by the RBA.

This brings me to the mandate of the RBA and the Payments System Board.[1] At the broadest level, this mandate is to help shape the payments system so that it works in the best interests of Australian households and businesses. Our north star is promoting the public interest. We strive to achieve this through a combination of suasion, regulation and working with industry participants to help overcome the coordination issues that can bedevil payment systems.

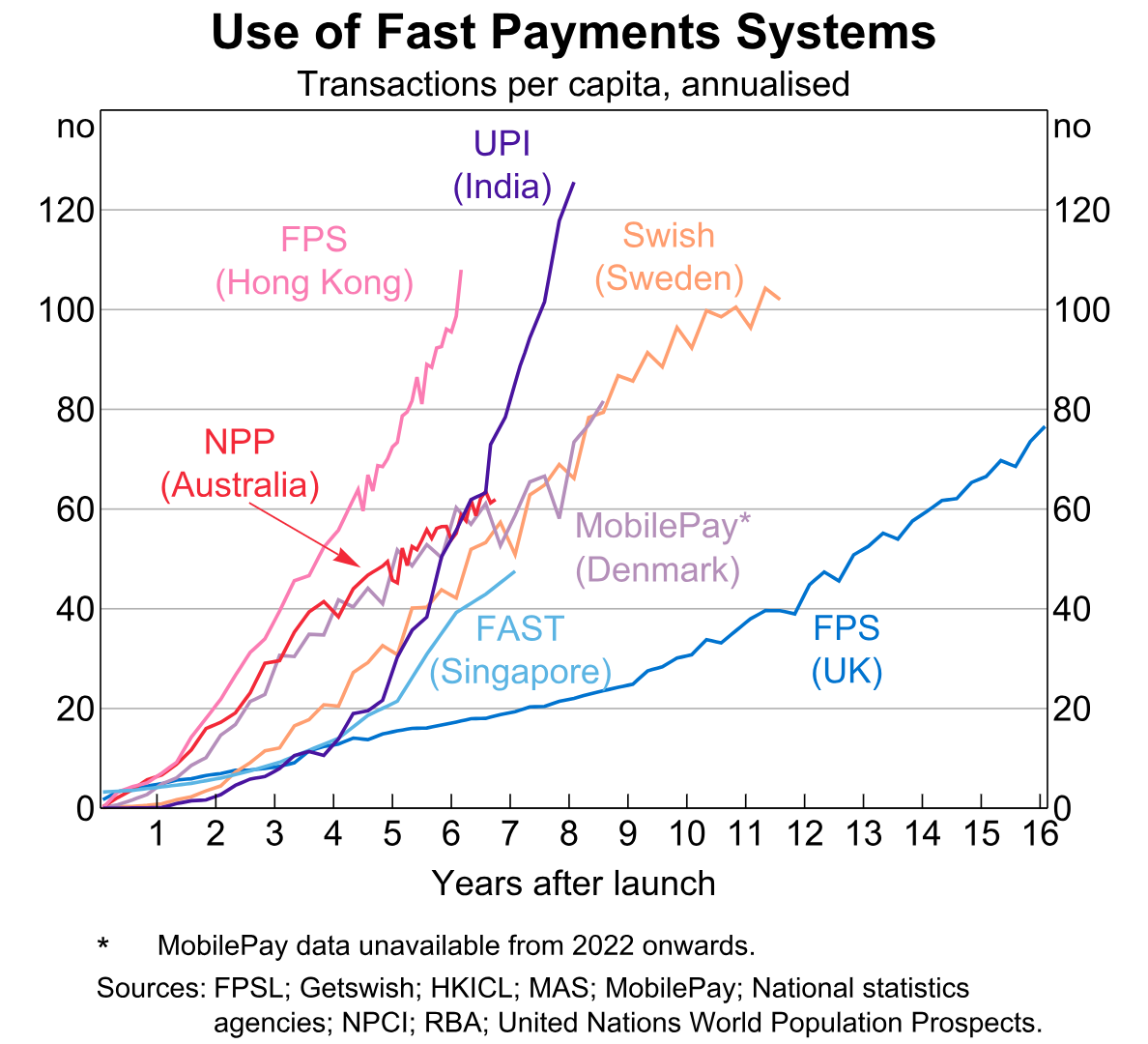

In seeking to promote efficiency, competition and safety in the payments system, we also recognise the important role of innovation in serving the public interest. Australia's productivity growth challenges make this all the more pertinent. One can think of the New Payments Platform (NPP) as a notable example of this focus (Graph 2). More recently, this year the RBA materially raised the activity threshold beyond which securities settlement facilities must comply with the Financial Stability Standards. It was assessed that the higher threshold struck a more appropriate balance between the public interest in the management of financial stability risks, and the public interest in avoiding excessive regulatory burden (particularly on small enterprises). And as I will discuss later, we also recently launched a new project with industry to examine how central bank digital currency, stablecoins and tokenised bank deposits could, along with new infrastructure arrangements, support innovation and resilience in wholesale tokenised asset markets.

Where innovation promises to not only enhance efficiency but also resilience and safety in our financial system, all the better. This recognises that we are entering a new era for operational risk – a result of rising geopolitical tension and other sources of potential disruption that include third-party vendors. For these reasons, strengthening resilience in our payment system and our financial market infrastructure is a key area of focus for the RBA in its work with other member agencies on the Council of Financial Regulators.[2]

This aside, the RBA is also working with the government to make sure that Australia's regulatory architecture is fit for purpose in the 21st century. This is a pressing issue given the foundational legislation setting out the RBA's powers was drafted in another era – one prior to the emergence of the digital economy that will be essential to Australia's future prosperity.

If there is one message to takeaway from my remarks today, it is this – while we should recognise that Australia has a world class payments system today, it would be a mistake to assume the same will be true in five or 10 years’ time without a concerted effort from everyone involved in payments. Of course, the RBA has a key role here and we remain committed to working constructively with industry in promoting the public interest. But ultimately, how industry responds to these challenges and opportunities will determine whether it will be able to deliver the services that Australians will need and should expect in the future.

Account-to-account payments

In the spirit of facing into challenges, let me begin with account-to-account payments. In her speech to this Summit last year,[3] the Governor spoke about industry’s decision to target the decommissioning of the BECS framework by 2030. The setting of a target date by industry has helped to focus attention across the ecosystem. But there is much to do here.

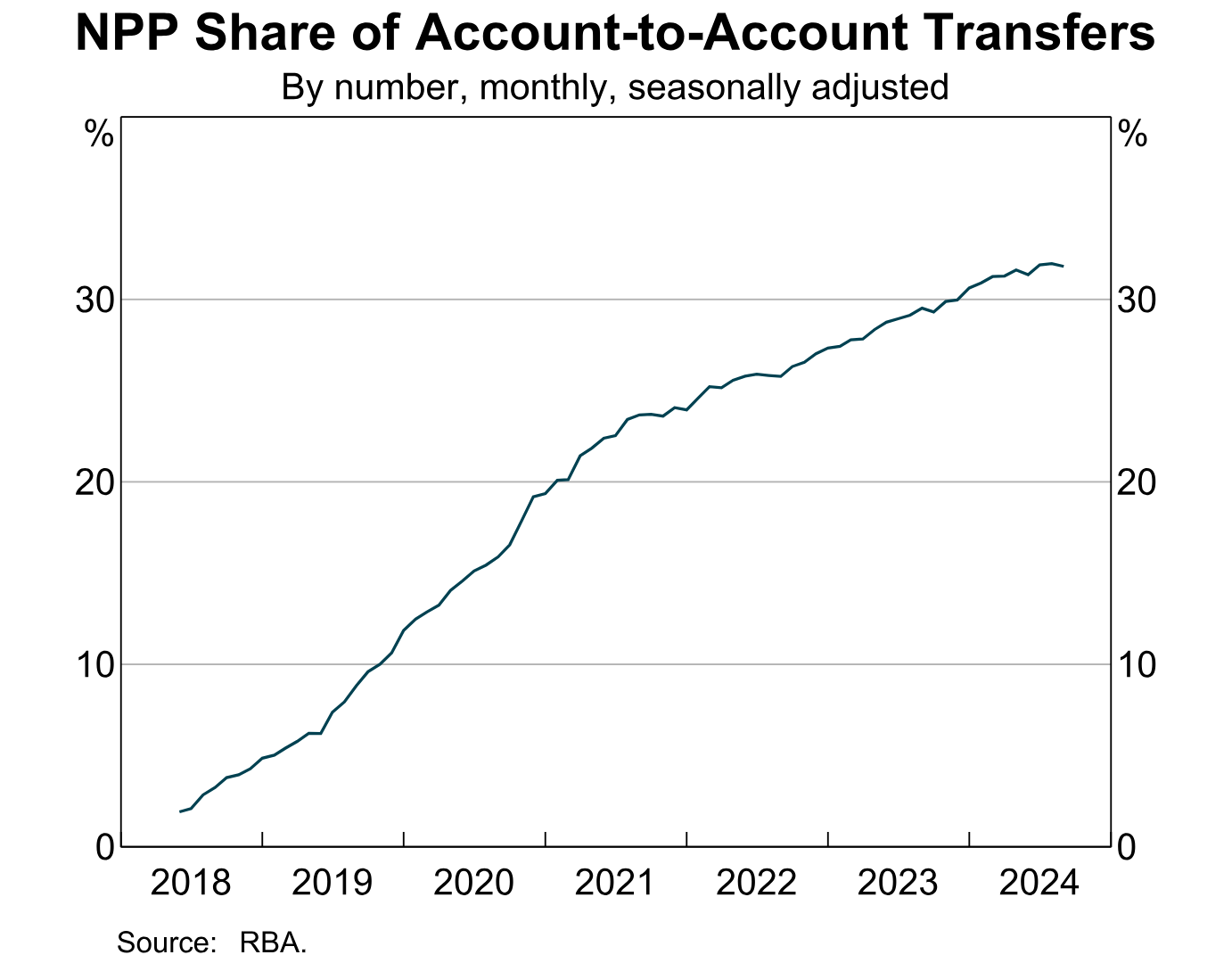

BECS is the workhorse of the account-to-account payments system. While the share of account-to-account transfers made through the NPP has increased notably (Graph 3), BECS is still used to process the majority of account-to-account payments. This includes payroll, pension and support payments that are critical to Australians.

Given the importance of BECS to our financial system, this year the Payments System Board asked RBA staff to undertake a risk assessment of the intended decommissioning. The risk assessment, which will be reported to the Board in March 2025, is drawing attention to some issues that will need to be addressed to facilitate an orderly decommissioning.

In the course of engaging with a wide range of stakeholders – banks, payment service providers, payment schemes, end users and government agencies – RBA staff have heard plenty of support for the migration to more modern payment rails such as the NPP. There are features of the NPP that many stakeholders find beneficial, including 24/7 operation, real-time settlement, richer data and enhanced data exchange capabilities.

At the same time, some stakeholders have raised concerns about aspects of the migration. I will set these out in a moment, but my colleagues at the RBA and on the Payments System Board see the central challenge as this – industry is yet to arrive at a shared vision of the desired features of account-to-account payments in Australia. This is a foundational issue. While the point of departure has been announced by industry – transitioning from BECS as we know it – establishing a common vision of the features underpinning a desired end state will be essential if a program of this scale is to succeed. Once a consensus has emerged here, a roadmap with milestones can guide industry progress toward the ultimate objective.

Now let me share with you some of the feedback we have heard so far:

- There has been insufficient industry coordination, planning and certainty regarding the transition. This in turn has had made it difficult for industry participants to press on with their individual plans, including those who will have a key role in ensuring the ongoing competitiveness and safety of the system.

- There is scope for the needs of end users to be given more prominence in industry discussions on the future of account-to-account payments. BECS is the payment rail used to make the majority of essential payments to millions of Australians, so any replacement must be capable of reliably meeting end user needs.

- A solution for the processing of bulk payments will be important.[4] Key end users need confidence that bulk payments will be supported into the future, recognising that many have integrated systems that manage the initiation and reconciliation of payment instructions. The NPP and the fast settlement service (FSS) will need to have capacity to handle a much higher volume of payments.

- The cost of the transition and per transaction costs in the future system are a concern for some stakeholders. End users, including those who do not have advanced functionality requirements, understandably want options that represent value for money. The RBA is working to better understand the pricing of account-to-account payments.

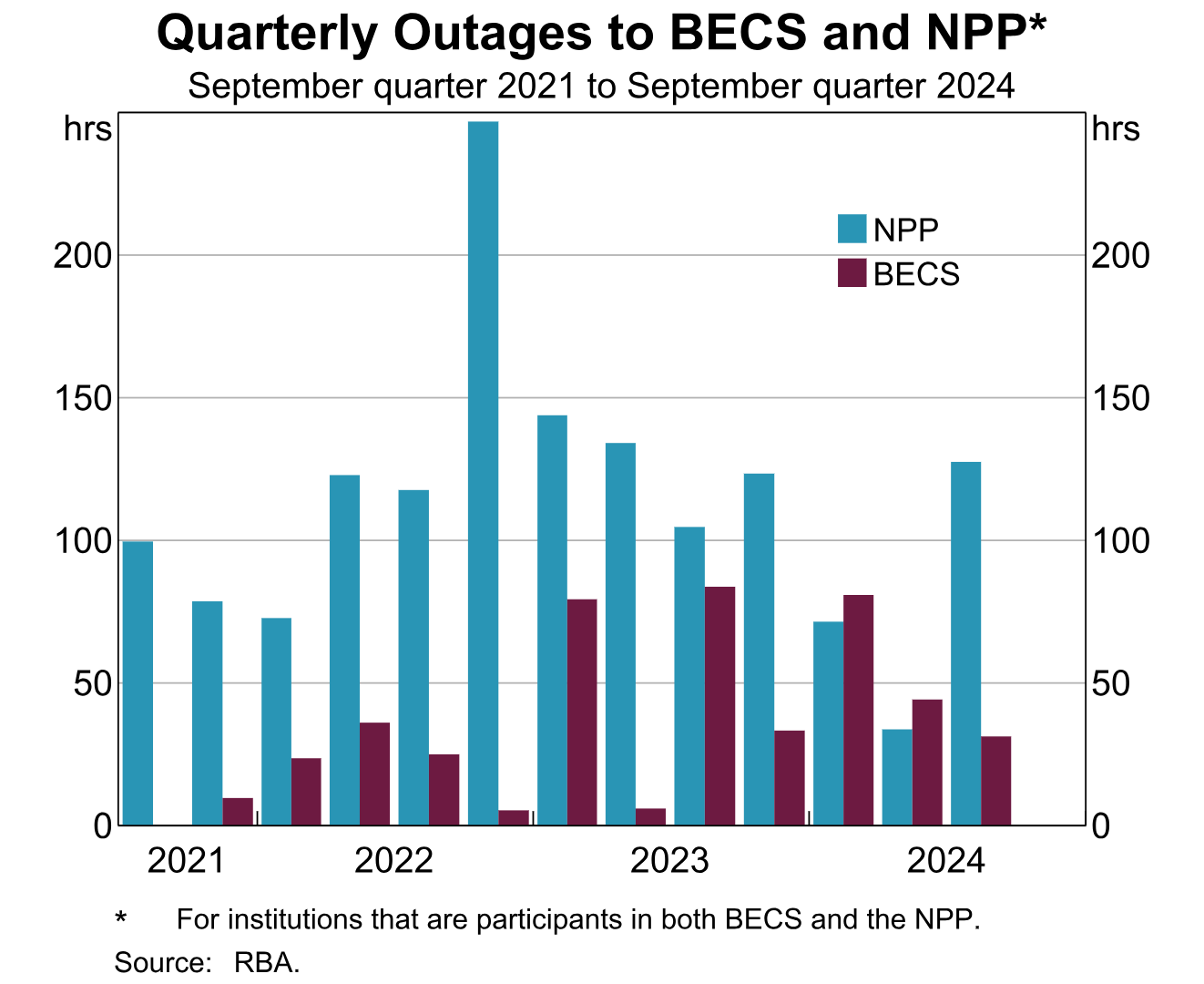

- Many stakeholders have expressed a desire for resilience to feature prominently in future account-to-account system arrangements. BECS outages have typically been low (Graph 4). Contingency arrangements in the future system will need to ensure that end user needs can continue to be met even when operational issues are experienced.[5] This suggests resilience will need to be built into the solution from the outset. As mentioned earlier, the RBA and the Australian Prudential Regulation Authority (APRA) are stepping up their focus on operational resilience in the financial system, including payments.[6]

- End users will be unable to move payments from BECS until all customers can receive payments via an alternative channel. Some banks using BECS are yet to connect to the NPP, and even for those that have done so, some of their BECS-reachable accounts are not currently reachable via the NPP. It might be that not all of these unreachable accounts will need transactional capabilities in the future, but this is something institutions need to examine.

Let me offer a positive take on this feedback. It has surfaced some issues that, if addressed appropriately, can give industry a solid basis on which to move forward. The focus on resilience, functionality and end user needs is particularly relevant here. The announcement by industry of a target date of 2030 for BECS decommissioning has already sparked some useful dialogue. But all stakeholders need a voice, and a broad consensus on some key issues is now essential if Australia’s account-to-account payment system arrangements are going to be fit-for-purpose in the next decade. Time is now of the essence.

Review of Retail Payments Regulation

As many of you will be aware, the RBA recently launched a Review of Retail Payments Regulation.[7] While we hoped to conduct a broad review, including of issues arising from new types of players and technologies in digital payments, proposed amendments to the Payment Systems (Regulation) Act 1998 (PSRA) that would bring relevant participants into the RBA’s regulatory remit currently remain before the Australian Parliament. Given the limitations of our remit under the current PSRA and the significance of the issues, it is important that these reforms are passed as soon as possible.

For now, we are focused on whether there are further actions the RBA could take to put downward pressure on merchant card payment costs and whether the surcharging framework remains fit for purpose. These issues can be dealt with under the PSRA in its current form and are inextricably linked: merchants are less likely to surcharge if their payment costs are low. Given the shift towards electronic payments, card payment costs are an ongoing concern for merchants, as they are for consumers. Keeping downward pressure on merchant fees for card payments, particularly for smaller merchants that tend to be charged higher fees, will keep consumer costs down, and so is an important priority for the RBA.

The Issues Paper for the Review outlines a broad suite of issues and possible policy responses for stakeholders to consider. We have asked for feedback on the following:

- the current level of interchange fee benchmarks and caps, and whether there is a case for more structural changes to interchange regulation[8]

- whether further regulatory action could increase competitive pressure on scheme fees and whether further action is required to promote least-cost routing for in-person transactions

- options to reduce complexity and improve transparency to facilitate merchants shopping around to get the best value, as this would boost competition in the acquiring market.

As the payments landscape has evolved significantly since the surcharging framework was introduced in 2003, it is timely to review whether the current rules are still achieving their intended purpose. There are arguments on both sides of this debate, and we recognise that some views are strongly held. We are open to exploring all possible options to find a position that will best serve the public interest, consistent with our legislative mandate.

Some of the arguments for retaining the current surcharging framework include:

- it provides a price signal to consumers to use a lower cost payment option – where consumers vote with their feet, this puts competitive pressure on card networks to lower their wholesale fees

- merchants value the ability to surcharge to recover the cost of payment choices made by customers

- surcharging rules have made a significant contribution to the long-run decline in average fees that merchants pay for card transactions (recall Graph 1).

However, the decline in cash usage, increased prevalence of surcharging and changes in the way merchants are charged for card payments have led to reasonable concerns about the current framework. In particular:

- Fewer consumers transact with cash today and are therefore unable to avoid card surcharges at the point-of-sale.

- Many small merchants are now on blended or single-rate payment plans that charge the same fee to merchants for accepting all types of cards. This dulls the price signal to consumers, and can mean users of cheaper card payments cross-subsidise users of more expensive cards.

- Consumers are sometimes unaware of the surcharge amount before paying and/or surcharged for amounts in excess of merchants’ cost of acceptance.[9]

We received over 70 submissions to our Issues Paper, many from institutions represented here today. Thank you to those who took the time to set out their views. We plan to publish submissions on our website in January, and to take a summary of the feedback you have provided to the Payments System Board in March. Following this, we aim to release a consultation paper with potential policy actions around mid- 2025. Thereafter a conclusions paper would set out the Board’s final decisions, likely by the end of the year.

Cross-border payments

I’ll now turn to the topic of cross-border payments.

Australian businesses and households that undertake international activities need efficient and safe ways to send and receive money. But cross-border payments services are still more expensive, more opaque and slower than their domestic counterparts. Enhancing cross-border payments is therefore one of the Payments System Board’s strategic priorities and an international commitment for Australia under the G20 Roadmap.

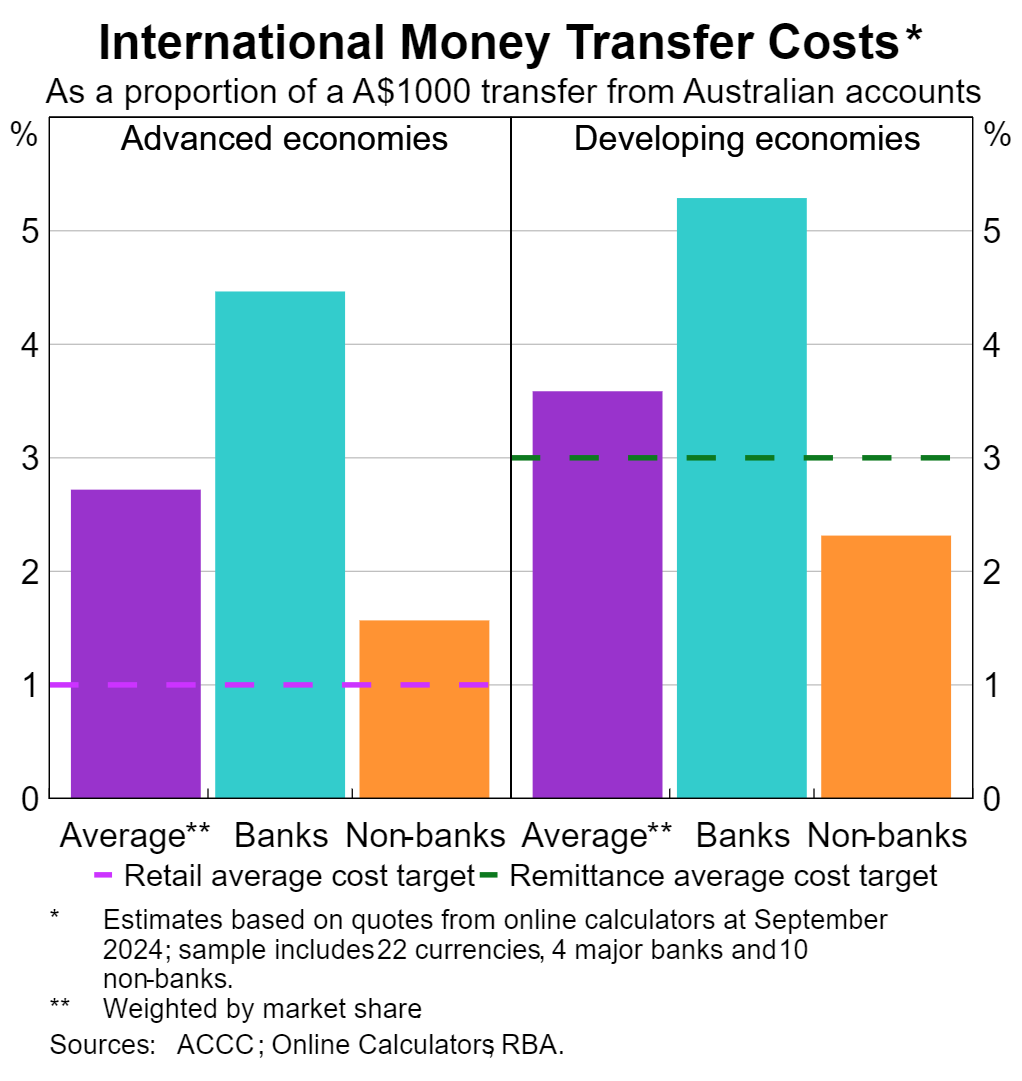

A recent review by the Financial Stability Board indicated that much more progress is needed to move toward the G20 Roadmap cost targets.[10] Lowering the cost of cross-border payment services has proven challenging almost everywhere. In Australia, we estimate that the average cost of sending A$1,000 to other countries still significantly exceeds the relevant G20 targets (Graph 5).[11]

However, the cost of sending money overseas from Australia can vary significantly across providers. Banks are generally more expensive than non-bank providers, reflecting the size of the mark-ups they typically apply to the wholesale foreign exchange rate. By contrast, there are some non-bank digital providers offering prices that are around, or a bit below, the G20 target levels. These differences highlight the importance of transparency over prices and of customers shopping around.[12]

The speed of cross-border payments is another area where more progress is required. Bank-intermediated cross-border transactions often take a day or more to reach the recipient. Slow processing reflects a range of factors including differing operating hours, inconsistent payments messaging practices, and complex compliance checks.

Making use of the new NPP International Payments Service, which allows the final Australian dollar leg of inbound cross-border payments to be processed on a near real-time 24/7 basis, will help. There are also a range of ISO 20022 messaging initiatives where more progress is needed.[13] Achieving international consistency in the data carried in payments messages will reduce the need for manual intervention by providers in the processing of cross-border payments, and therefore increase the speed and lower the costs of transactions.

Finally, the RBA continues to participate in initiatives like Project Mandala, a collaboration with the Bank of International Settlements (BIS) Innovation Hub and the central banks of South Korea, Malaysia and Singapore. This project examines a common technical model for automating regulatory compliance processes in cross-border payments, including sanctions and AML/CTF requirements, with a view to increasing the speed of compliance procedures and reducing failed transactions.[14]

The future of digital money

This leads me to another focus area for the RBA and the Payments System Board – shaping the future of money in Australia. A central element of this program is determining whether there is a public policy case to introduce a central bank digital currency (CBDC) in Australia, and if so, in what form. We recently published a report with Treasury that provided an updated assessment of the case for a CBDC in Australia, and outlined, for the first time, a three-year roadmap for future work.[15]

Our current assessment is that a public interest case to issue a retail CBDC has yet to emerge in Australia. At the present time, we see the potential benefits of a retail CBDC as modest or uncertain, relative to the challenges it would likely introduce. However, as these trade-offs could evolve over time, and as more international experience comes to light, the RBA and the Treasury will continue to examine the issues.

Like a number of central banks in advanced economies, we see the potential case for a wholesale CBDC as more promising, though not definitive at this point. A wholesale CBDC could have a key role in facilitating the settlement of transactions in tokenised asset markets, and in enhancing cross-border payments. This recognises the key role of central bank money in serving as the ultimate safe settlement asset, particularly in systemically important markets – a point emphasised in international standards. Implementing a wholesale CBDC is also likely to be less disruptive and pose fewer policy challenges than issuing a retail CBDC. It would represent a more incremental change to existing arrangements where digital central bank money is already issued to eligible financial institutions in the form of Exchange Settlement Account balances. But there are still issues that require closer scrutiny here.

In that respect, we have made a strategic commitment to prioritise our applied research agenda on innovations in wholesale digital money – namely, wholesale CBDC, tokenised bank deposits and stablecoins. Our most immediate priority is to launch a new research project with the Digital Finance Cooperative Research Centre (DFCRC), known as Project Acacia. Our focus here is on opportunities to uplift the efficiency, transparency and resilience of wholesale markets through tokenised money, assets and new settlement infrastructure. We recently published a consultation paper seeking industry feedback and inviting expressions of interest to collaborate with the RBA and the DFCRC as part of this project.[16] I encourage anyone who is interested to reach out to our project team.

In addition to Project Acacia, we have a number of other CBDC initiatives in line over the next year. We are currently exploring options for engaging with the public to better understand their needs, preferences and concerns relating to CBDC. We are also planning to convene industry and academic forums to provide more systematic engagement with external experts on retail and wholesale CBDC issues.

In short, we have an ambitious agenda on the future of money. But all our efforts are directed to ensuring that our future monetary arrangements are fit for purpose in the digital age.

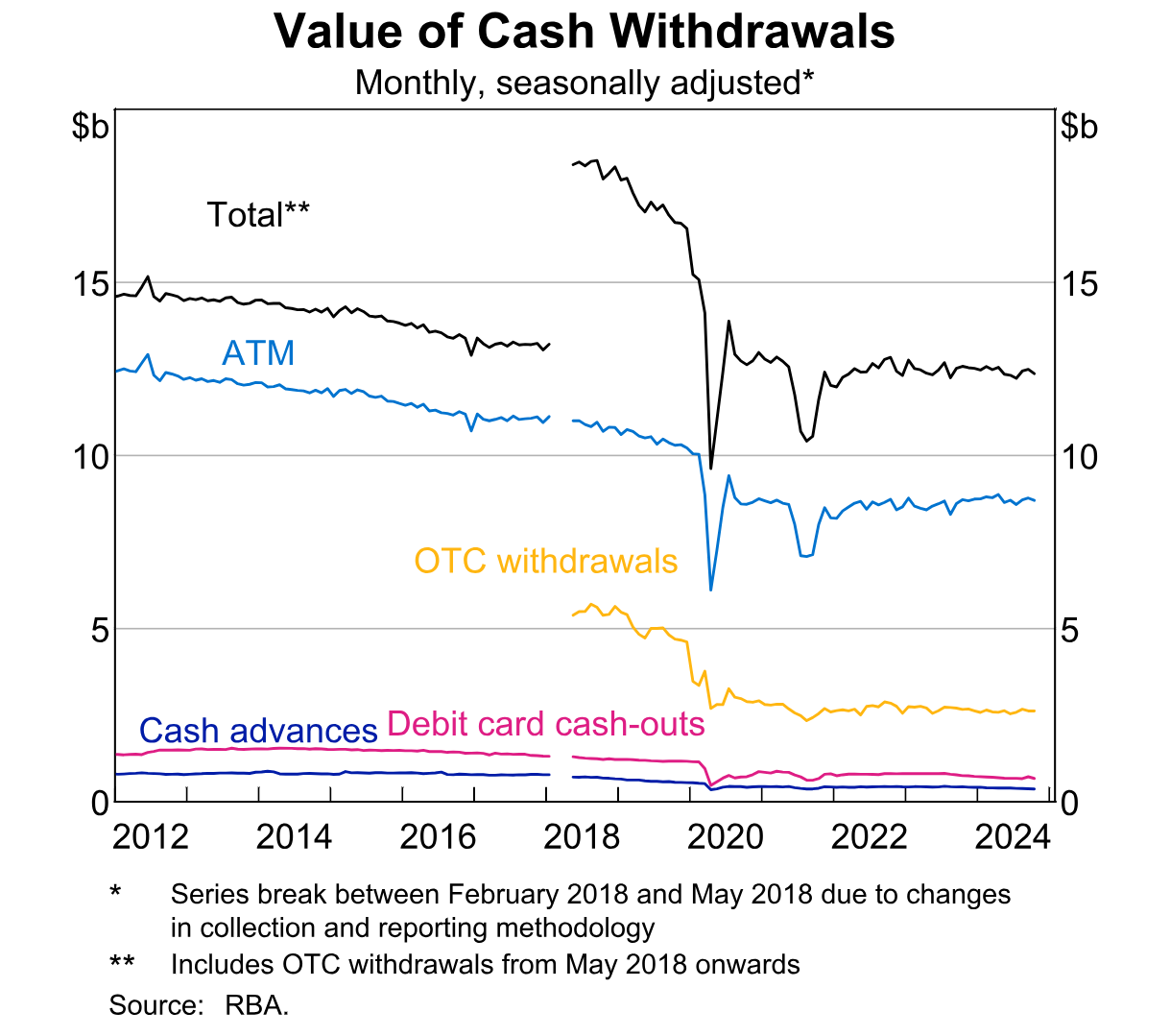

The future of cash

While cash use has declined in recent decades, it remains an important means of payment for many folks in our community (Graph 6). A significant number of Australians still primarily rely on cash to participate in the economy, including our more vulnerable members of society. Cash remains an important store of value, particularly during periods of economic uncertainty. And in serving as a backup means of payment when electronic payment methods are unavailable, including during system outages or natural disasters, cash helps to promote a more resilient payment system overall. For these reasons, the government and the RBA remain committed to supporting access to cash.

However, as cash use has declined, the cost of moving it around the country has increased. A significant effort to put cash-in-transit services on a more solid financial footing is now underway across industry. But there is still considerable work to be done to develop a sustainable long-term model for cash distribution. The challenge now for industry is to deliver more efficient cash distribution services, while meeting the public interest in ensuring cash remains an affordable and viable means of payment for Australians.

Conclusion

Let me wrap up. Australians expect their payments to be convenient, reliable and represent value for money. At the RBA, we share these expectations. We want to see a payments system that is a hotbed of innovation and competitive tension, driving efficiency up and costs down. And we want to see a payments system that is safe and resilient – one that Australians can rely on.

As we contemplate what shape the payments system of the future might take, my colleagues and I at the RBA and on the Payments System Board are committed to working constructively with AusPayNet and the wider industry. We are in this together. There is much to celebrate in the Australian payments system, but as I’ve made clear today, also much to do.

On that note, I look forward to taking your questions.

Thank you.

Endnotes

I would like to thank my colleagues in Payments Policy Department for their valuable assistance in the preparation of these remarks. All errors of omission and commission are my own.[*]

More formally, the Payments System Board’s responsibilities and powers are set out in four separate Acts. These are: Reserve Bank Act 1959 ; Payment Systems (Regulation) Act 1998 ; Payment Systems and Netting Act 1998 ; and Cheques Act 1986. The Reserve Bank Act, as amended, gives the Payments System Board responsibility for determining the RBA’s payments system policy. It must exercise this responsibility in a way that will best contribute to: controlling risk in the financial system; promoting the efficiency of the payments system; and promoting competition in the market for payment services, consistent with the overall stability of the financial system.[1]

Council of Financial Regulators (2024), ‘Quarterly Statement by the Council of Financial Regulators – December 2024’, Media Release No 2024-05.[2]

Bullock M (2023), ‘Modernising Australia’s Payments System’, Speech to the Australian Payments Network Summit, Sydney, 12 December.[3]

Bulk payment functionality allows payment instructions to be grouped together and sent as a single payment file, supporting efficient processing of large volumes of payments (compared with sending each payment individually). Bulk payments are widely used by government departments and companies for regular payments such as welfare, salary and dividend payments and the payment of bills.[4]

BECS is a technologically simpler solution than modern payment rails. While this simplicity means that it is no longer fit for purpose for many payment use cases, it does have some desirable features. In particular, end users do not expect instant payments processing across BECS. When operational issues affect availability of the service, the payments can be delivered in a subsequent batch settlement without much impact to the end user.[5]

This includes through the geopolitical risk program under the Council of Financial Regulators, and in the case of APRA, through CPS 230.[6]

RBA (2024), ‘Merchant Card Payment Costs and Surcharging – Issues Paper’, October.[7]

This could include having only interchange caps instead of both caps and benchmarks, removing ad valorem interchange caps and benchmarks (so that they are solely cents-based), or limiting the number of interchange categories.[8]

This includes the impact of other service costs being bundled into the surcharge that is passed onto consumers.[9]

Financial Stability Board (2024), ‘Annual Progress Report on Meeting the Targets for Cross-border Payments: 2024 Report on Key Performance Indicators’, 21 October.[10]

The Financial Stability Board has, for the purposes of its targets, defined remittances as low value, high volume payments primarily sent to recipients in emerging market and developing economies. Retail payments are all other payments under US$100,000.[11]

This task has been helped by recent updates to the guidance from the Australian Competition and Consumer Commission on how international money providers can improve the transparency of these services. This included guidance around how international money providers should display information to consumers, requiring standardised illustration of costs and other service features, such as the time it will take for the recipient to receive the funds. See ACCC (2024), ‘Best Practice Guidance for Foreign Cash and International Money Transfer Services’, October.[12]

For instance, the RBA is working to ensure that the Australian industry adopts the globally harmonised ISO 20022 messaging requirements for cross-border payments. Work is underway to plan the NPP’s adoption of globally harmonised ISO 20022 messaging, and we expect industry to have adopted the globally harmonised ISO 20022 messaging requirements for high-value and fast payments by the end of 2027.[13]

See BIS Innovation Hub (2024), ‘Project Mandala: Streamlining Cross-border Transaction Compliance’.[14]

For the paper, see here: RBA and Treasury (2024), ‘Central Bank Digital Currency and the Future of Digital Money in Australia’, September. See also Jones B (2024), ‘Financial Innovation and the Future of CBDC in Australia’, Speech at the Intersekt Conference, Melbourne, 18 September.[15]

RBA (2024), ‘RBA and DFCRC Joint Consultation Paper Project Acacia – Exploring the Role of Digital Money in Wholesale Tokenised Asset Markets’, Media Release No 2024-25.

First, please LoginComment After ~