Unlocking Opportunities: How China's Special Local Government Bonds Empower Global Investors

China's Special Local Government Bonds (SLGBs) are redefining the role of fiscal instruments in economic development. For international businesses seeking to establish or expand operations in China, these bonds offer a structured, transparent gateway to participate in the country's ambitious infrastructure and public service initiatives.

////

Understanding Special Local Government Bonds

ONE

SLGBs are purpose-specific bonds issued by local governments in China, dedicated exclusively to funding projects in infrastructure, public services, and other priority areas. By design, these bonds adhere to stringent regulatory requirements, ensuring funds are directed to targeted initiatives. This framework reflects China's commitment to sustainable development and economic resilience.

////

Opportunities for Foreign Businesses

TWO

-

Access to Large-Scale Projects

SLGB-financed projects span transportation, energy infrastructure, smart cities, and more. These projects align closely with China's long-term economic strategies, such as the Belt and Road Initiative and carbon neutrality goals. For multinational corporations, particularly those in construction, engineering, or green technology sectors, SLGB-backed initiatives provide a consistent pipeline of significant opportunities. -

Stable and Transparent Funding Environment

The issuance and use of SLGBs are subject to rigorous auditing and oversight. This regulatory clarity reduces uncertainty for international firms, offering a stable investment landscape often absent in other emerging markets. Furthermore, the bonds are frequently tied to projects with measurable outcomes, enhancing the predictability of project timelines and returns. -

Facilitating Local Collaboration

SLGB-backed projects often involve partnerships with local governments, state-owned enterprises, and regional stakeholders. These collaborations allow foreign firms to forge critical relationships that ease market entry, support regulatory compliance, and unlock future opportunities within China's vast domestic economy. -

Alignment with ESG Priorities

Many SLGB-funded projects emphasize environmental sustainability, including renewable energy, water resource management, and ecological restoration. For companies with strong Environmental, Social, and Governance (ESG) mandates, participation in these initiatives aligns corporate goals with actionable impact, meeting both business and ethical imperatives.

////

Key Considerations for Foreign Investors

THREE

While SLGBs present clear advantages, navigating the complexities of China's financial and regulatory systems requires strategic foresight:

-

Legal and Regulatory Compliance

Understanding the nuances of China's legal frameworks is essential. Partnering with advisors experienced in SLGB policies can mitigate risks and streamline project involvement. -

Market Localization

Building local partnerships is critical to success. Effective collaboration demands a deep understanding of cultural, administrative, and operational norms. -

Long-Term Commitment

SLGB projects often have extended timelines. Businesses must be prepared for sustained engagement, with a clear strategy to adapt to evolving economic and policy dynamics.

////

Risk Prevention and Fiscal Discipline

FOUR

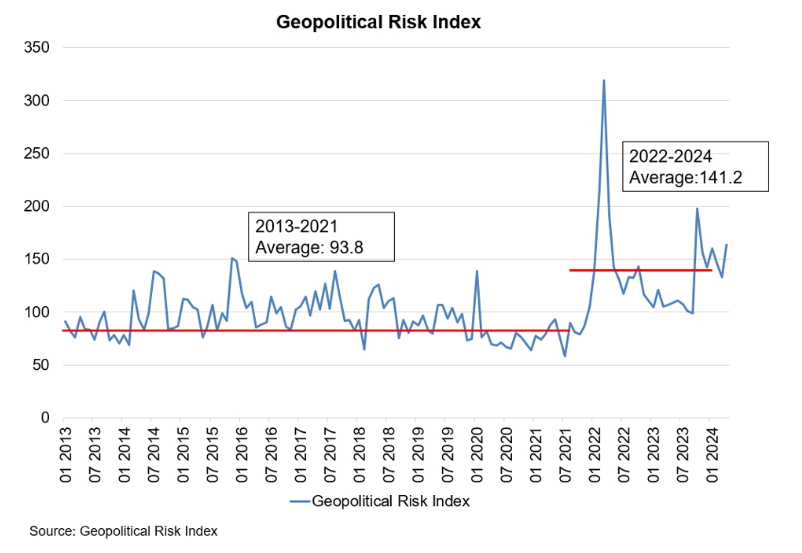

To address rising local government debt, the Ministry pledged systematic reforms and enhanced oversight. Lan Fo’an stressed the importance of mitigating hidden debt risks and strengthening fiscal governance through:

-

Zero-Based Budgeting: Promoting rational allocation of public funds.

-

Enhanced Supervision: Stricter audits to improve accountability and prevent resource misuse.

-

Debt Management: Transparency measures to curb municipal debt risks and improve financial stability.

////

Strategic Outlook: Leveraging SLGBs as a Growth Catalyst

FIVE

China's SLGB mechanism serves as more than a financing tool—it is a platform for fostering collaboration between global investors and local governments. For foreign businesses, aligning their expertise with SLGB-backed projects not only accelerates their market entry but also enhances their role in China's developmental agenda.

By investing in SLGB-funded initiatives, international firms position themselves at the forefront of a market undergoing unprecedented transformation. This is an opportunity not merely to invest in China but to become a partner in its growth, driving mutual progress and unlocking shared value.

First, please LoginComment After ~