Navigating Geopolitical Tensions and Trade Barriers-Part 3

HKTDC Research recently held a webinar on “Successful Global Supply Chain Management in Uncertain Times”, with experts invited to give an overview of the latest developments in international geopolitical tensions and several US trade‑related issues. Companies were also offered practical solutions to help them comply with trade requirements and mitigate risks.

Reviewing Product Content in Response to Export Restrictions

Tiffany Chong, Senior Director at Sandler Travis & Rosenberg, Limited, pointed out that coming up against these new trade policies, many Hong Kong and mainland companies are striving to restructure their supply chains or change the origin of their products to avoid Section 301 tariffs. They will, for example, first export raw materials, parts and components to places like Southeast Asia, Mexico and India, and export the final products to the US to reduce tariff costs.

Chong explained: “Hong Kong companies should note that the US adopts a rule of origin to determine whether a product is entitled to preferential tariff treatment. According to the US rule of origin, if the raw materials of a product come from several countries, production processes such as processing or assembling should meet the substantial transformation standard by giving the product a change in name, character or use. The product in question will belong to the last place that has substantially transformed it.

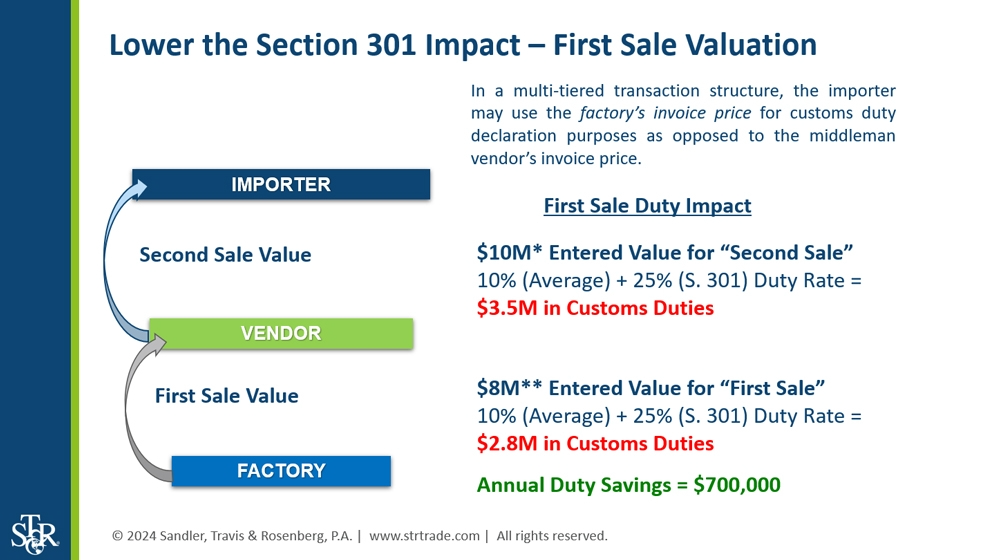

“It takes time for an enterprise to restructure its supply chain and some may not be able to relocate their production lines from the mainland in a short time. Under such circumstances, in the short term, they can make use of the US ‘First Sale Rule’ for valuation and declare a lower price at US customs. This means that even if tariffs remain unchanged, an enterprise can declare ‘ex‑factory prices’ at customs to lower landed costs and buy time to restructure its supply chains.”

Chong also said that, in restructuring supply chains, an enterprise should familiarise itself with the related export restriction policies. For instance, producers of electronic products have to source raw materials, parts and components from different parts of the world. So, when designing its supply chains, an enterprise should carefully consider whether the related raw materials and technologies are subject to export restrictions.

Hong Kong companies can take advantage of the US “First Sale Rule” for valuation

and declare “ex‑factory prices” to minimise landed costs.

Looking to the future, Chong said enterprises are focusing more on flexibility and resilience when it comes to restructuring their supply chains and diversifying their production bases. Instead of being over‑reliant on a single market, global supply chains are now extending across multiple global sources. For many countries and regions, this means greater opportunity for economic growth, with Latin America, for instance, a clear beneficiary of the growth in nearshoring. Thanks to its multi‑layered labour structure, meanwhile, Southeast Asia has demonstrated its capability to handle precision manufacturing in addition to its existing low‑tech strengths. The abundant supply of raw materials across the region has also sharpened its competitive edge.

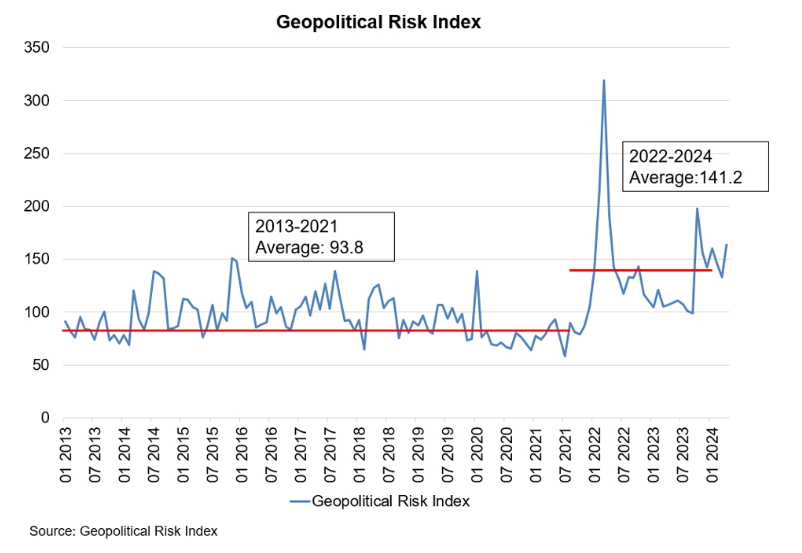

The new geopolitical landscape has also created significant opportunities in many emerging markets. It is, therefore, important for Hong Kong companies to gain a deeper understanding of these markets, including their trade infrastructure, industry competitiveness and level of human resources development. Companies should also enhance their adaptability and keep abreast of the latest trade policies in their various target countries and regions in order to swiftly adjust their operational strategies in case of any escalating geopolitical risks.

First, please LoginComment After ~