Central Banks in Transition: Lessons from the Post-Pandemic Inflation Surge and Future Challenges

In the wake of unprecedented economic disruptions, central banks worldwide are reassessing their monetary policy frameworks to stay ahead of rapidly evolving market dynamics. Agustín Carstens, the General Manager of the Bank for International Settlements (BIS), recently delivered the Homer Jones Memorial Lecture in 2025, reflecting on the evolution of monetary policy and the lessons learned from the pandemic-driven inflation surge.

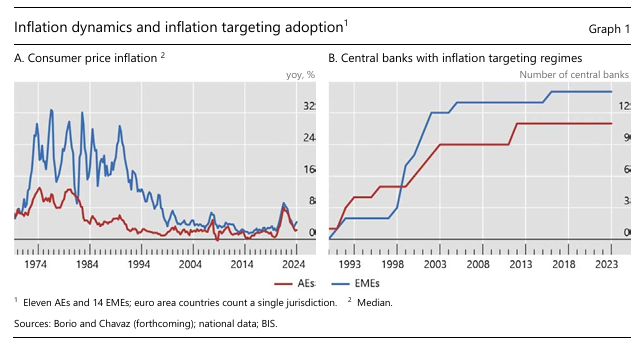

Evolution of Inflation Targeting: From the 1970s to Present

Over the past several decades, central banks have made significant strides in curbing inflation, learning from the turbulent period of the 1970s. The Great Inflation era, marked by skyrocketing prices and economic instability, catalyzed the adoption of more rigorous and credible monetary policies, leading to the widespread implementation of inflation targeting frameworks in the 1990s and early 2000s. These frameworks, Carstens noted, have been instrumental in achieving low, stable inflation, a primary goal for many central banks.

At the heart of successful inflation targeting are three critical components: clear numerical inflation targets, central bank autonomy, and transparency. These elements not only anchor public expectations but also ensure that central banks can pursue decisions based on economic conditions rather than political pressures. Despite these successes, however, central banks have had to acknowledge that no one-size-fits-all approach exists. Variations in inflation targeting policies among different nations reflect differences in priorities, such as full employment or financial stability.

Framework Reviews of 2020–21: Addressing New Economic Realities

The 2020–21 framework reviews were shaped by lingering concerns over persistently low inflation and the challenges posed by the effective lower bound (ELB) of interest rates. As central banks sought to adjust to these conditions, many incorporated unconventional tools like balance sheet policies, forward guidance, and even negative interest rates into their frameworks. The Federal Reserve, for example, made a historic decision to allow inflation to temporarily exceed its target to make up for prior undershooting.

However, Carstens underscored that these policy adjustments were not without challenges. The COVID-19 pandemic, which triggered initial deflationary pressures, led to an unexpected inflationary surge once economies began to recover. This shift demonstrated that inflation risks are far more complex and two-sided than previously understood. While central banks initially downplayed inflation, viewing it as transitory, the persistence of price increases forced a dramatic policy pivot.

The Post-Pandemic Inflation Surge: Lessons for Central Banks

The pandemic exposed critical vulnerabilities in the post-Great Inflation era. Central banks, especially in advanced economies, were initially slow to react to the inflation surge, misjudging it as a temporary blip. In contrast, emerging market economies (EMEs), often more attuned to the risks of high inflation, responded more swiftly. As inflationary pressures became entrenched, central banks worldwide had to recalibrate their strategies.

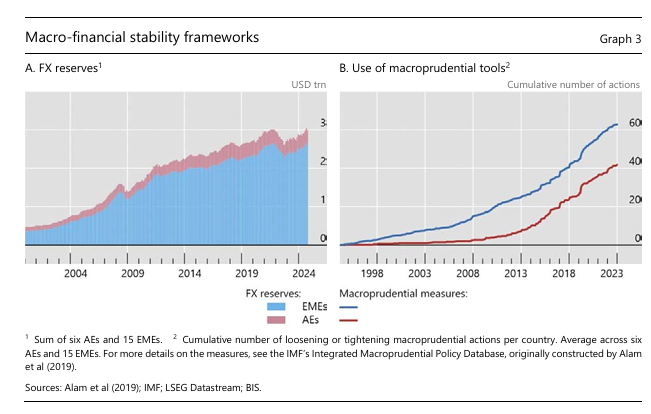

The lesson from the pandemic, according to Carstens, is that inflationary risks are more unpredictable than many policymakers anticipated. After years of stable, low inflation, the sudden spike in prices highlighted the challenges central banks face in balancing both deflationary and inflationary pressures. Financial stability concerns also became more pronounced, with the collapse of institutions like Silicon Valley Bank demonstrating the fragile nature of the financial system when subjected to rapid monetary tightening.

The pandemic's inflationary spike also highlighted the substantial role that fiscal policy plays in driving inflation. Governments' large, sustained fiscal deficits contributed significantly to inflationary pressures. Central banks, therefore, are not the sole actors in maintaining economic stability. Their success depends heavily on coordinated fiscal policies that ensure public debt sustainability.

Moving Forward: Key Considerations for Ongoing Framework Reviews

As central banks continue to refine their monetary policy frameworks, several considerations emerge from Carstens' analysis. The first is a shift towards preparing for inflationary surges, given the unpredictability of future economic disruptions. Central banks must reconsider policies that only focus on inflation undershooting, as these do not necessarily lead to sustained deflationary dynamics. Instead, central banks might need to explore "make-up" strategies that allow for controlled overshooting after periods of underperformance.

Additionally, Carstens stressed the need for clearer communication strategies. Central banks must convey the inherent uncertainty of their policy decisions and demonstrate greater flexibility in responding to a broad range of economic developments. The use of scenario analysis to project potential policy evolutions could become a standard tool for navigating the complex economic terrain ahead.

Finally, Carstens cautioned against overreliance on balance sheet policies, especially during non-crisis periods. Interest rate policies should remain central to monetary decision-making, and balance sheet interventions should be reserved for extreme situations.

Conclusion: Coordination Between Fiscal and Monetary Policies

Carstens concluded by emphasizing the importance of aligning monetary and fiscal policies to achieve long-term stability. The success of monetary policy, he argued, does not rest solely on central banks. Instead, coordinated efforts across both fiscal and monetary policies are necessary to navigate the post-pandemic economic landscape. With public debt levels rising globally, managing fiscal imbalances is becoming increasingly critical.

The post-pandemic era has provided valuable lessons on the evolving role of central banks. As they continue to adapt their frameworks to emerging challenges, the global financial community will need to monitor these developments closely. For international investors and financial professionals, understanding the implications of these shifts in policy is crucial for making informed decisions in an increasingly uncertain world.

For central banks to continue delivering on their mandates of low inflation and financial stability, it is essential to address the broader economic factors that contribute to instability, particularly unsustainable fiscal policies. As Carstens emphasized, the evolving landscape presents both challenges and opportunities for refining global monetary policies, ensuring that they are well-equipped to confront the uncertainties of the future.

First, please LoginComment After ~