Asian Development Bank Report: Reshaping Personal Income Taxation in Asia and the Pacific

The full report, "Personal Income Taxation in Asia and the Pacific: Future Directions" by Janet Stotsky and Maria Hanna Concepcion P. Jaber

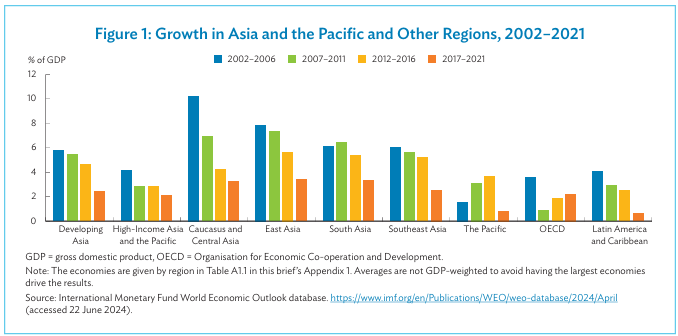

In the dynamic realm of international finance, few regions offer as compelling a narrative as Asia and the Pacific. This area, home to some of the world's most rapidly expanding economies, faces unique challenges in tax policy and administration. A recent report by the Asian Development Bank (ADB) provides valuable insights into the state of personal income taxation across this diverse region, highlighting both progress and areas for improvement.

The Current Tax Landscape: A Story of Uneven Progress

The personal income tax systems in developing Asia and the Pacific struggle to fund essential public services while promoting social equity. Rapid economic growth has transformed income distribution, yet tax systems have failed to keep pace. Traditional approaches, focused on corporate taxes and trade taxes, have not effectively addressed widening income gaps.

Recent data reveals that the share of taxes in gross domestic product (GDP) in developing Asia and the Pacific has been rising, though unevenly. High-income Asian economies maintain higher tax-to-GDP ratios than their developing counterparts, though still below OECD levels. South Asia shows a consistently rising tax-to-GDP ratio, despite remaining lower than other subregions.

Structural Challenges: Why Current Systems Fall Short

Personal income taxes remain weak throughout the region, with several structural issues undermining their effectiveness:

1.Informal Labor Markets: Widespread informality in labor forces reduces tax compliance.

2.Political Economy Factors: Groups benefiting from weak compliance and poor governance resist reforms.

3.Administrative Limitations: Tax administrations often lack automation and skilled personnel needed for modern income tax management.

Redistributive Potential: The Promise of Progressive Taxation

Personal income taxation has clear potential to help governments address income inequality and fund public services. The report highlights several key aspects of this potential:

l Progressivity: A progressive personal income tax, where average tax rates increase with income, is crucial for improving income distribution.

l Capital Income Taxation: Current systems often fail to adequately tax capital income, which tends to be more mobile and concentrated among higher-income individuals.

l Tax Expenditures: These represent significant revenue losses, estimated at about 2% of GDP or 14% of revenue across the region.

Administration and Compliance: Building a Stronger Foundation

Improving tax administration is identified as a critical priority. Key recommendations include:

l Automation: Implementing sophisticated compliance risk management systems and electronic filing processes.

l Staffing: Recruiting and training qualified personnel while improving civil service systems.

l Withholding and Reporting: Strengthening systems for wage and capital income withholding, and third-party reporting.

Wealth and Property Taxes: Complementary Tools for Equity

The report advocates for greater use of wealth and property taxes to complement personal income taxation:

Property Taxes: These are more commonly found at subnational levels but remain underutilized in many developing economies.

Wealth Taxes: Though administratively challenging, limited forms of wealth taxation could supplement income taxes, particularly for high-net-worth individuals.

Corporate Income Taxes: Still a Vital Component

l The corporate income tax remains an important component of the tax system, especially given weak capital income taxation at the personal level. The report notes:

l Corporate income tax rates have been declining globally but remain relatively stable in the region.

l Tax incentives for specific industries or firms are often arbitrary and fail to generate sufficient benefits to offset revenue losses.

Conclusions and Recommendations: Charting a Path Forward

The report concludes that governments in Asia and the Pacific have considerable scope to improve their personal income tax systems through both policy and administrative reforms. Key recommendations include:

1.Setting appropriate tax thresholds based on subsistence income and administrative considerations.

2.Ensuring thresholds diminish relative to per capita income over time.

3.Using progressive marginal tax rate schedules.

4.Limiting inefficient exemptions, deductions, and credits.

5.Strengthening capital income taxation.

6.Developing effective tax policy units.

7.Enhancing tax administration through automation and staffing improvements.

8.Strengthening withholding and third-party reporting systems.

9.Focusing on hard-to-tax taxpayers like unincorporated businesses and high-net-worth individuals.

10.Participating in international initiatives to improve tax reporting and enforcement.

For international business professionals operating in or considering investments in Asia and the Pacific, understanding these tax dynamics is essential. The evolving tax landscape impacts investment decisions, risk management strategies, and operational planning. As tax systems strengthen, businesses may face changing compliance requirements and tax burdens, particularly regarding personal income taxation for expatriate employees and wealth taxation for high-net-worth individuals.

First, please LoginComment After ~