Hong Kong Companies' Expansion into the Cross-border E-commerce Market: Multi-channel Promotion of In-house Products

From June to August 2024 in Hong Kong, HKTDC Research conducted a questionnaire survey of companies currently engaged in cross-border e-commerce business and traders planning to develop such business, in order to learn about the current situation of - and future plans for - their cross-border e-commerce business. This article shows the key findings from the company survey section:

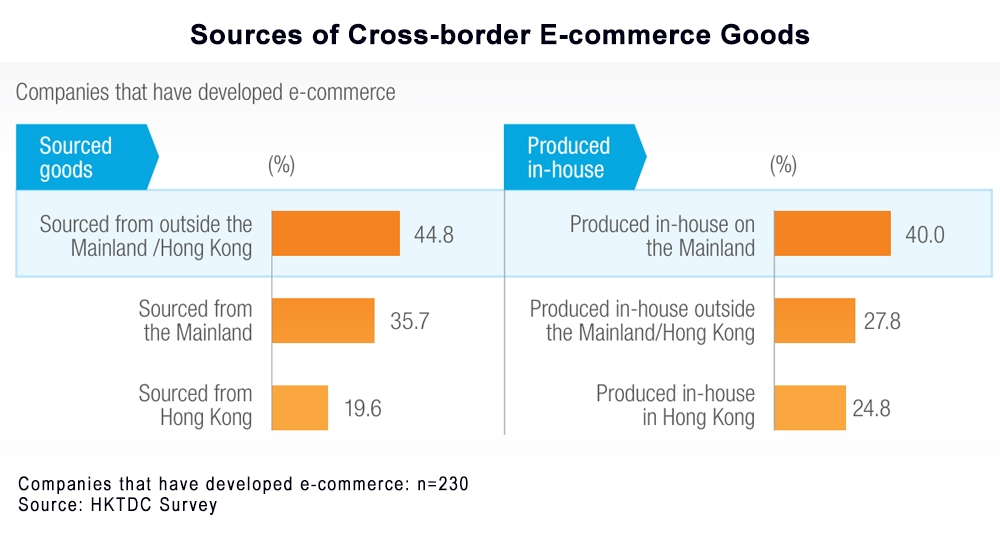

Sources of cross-border e-commerce products

Among the “companies that have developed e‑commerce”, 44.8% sell products sourced from foreign countries (outside the Mainland/Hong Kong) and 40% sell products made by themselves on the Mainland.

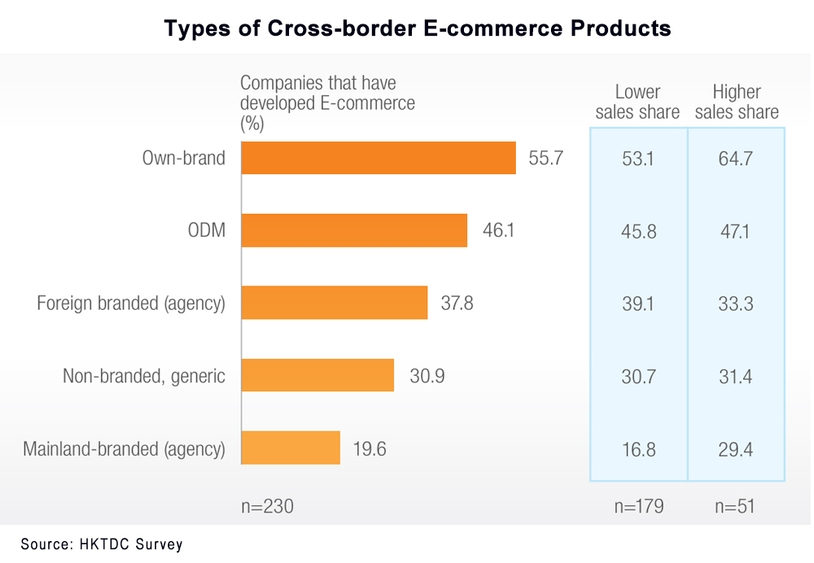

Own-brand and own-design products

When it comes to brand types, it is most common for “companies that have developed e‑commerce” to sell own‑brand (55.7%) or own‑design (46.1%) products. 37.8% say they sell foreign‑brand products on stipulated online channels through agency arrangements. Moreover, among “companies with higher e‑commerce sales share”, 64.7% prefer to sell own‑brand products.

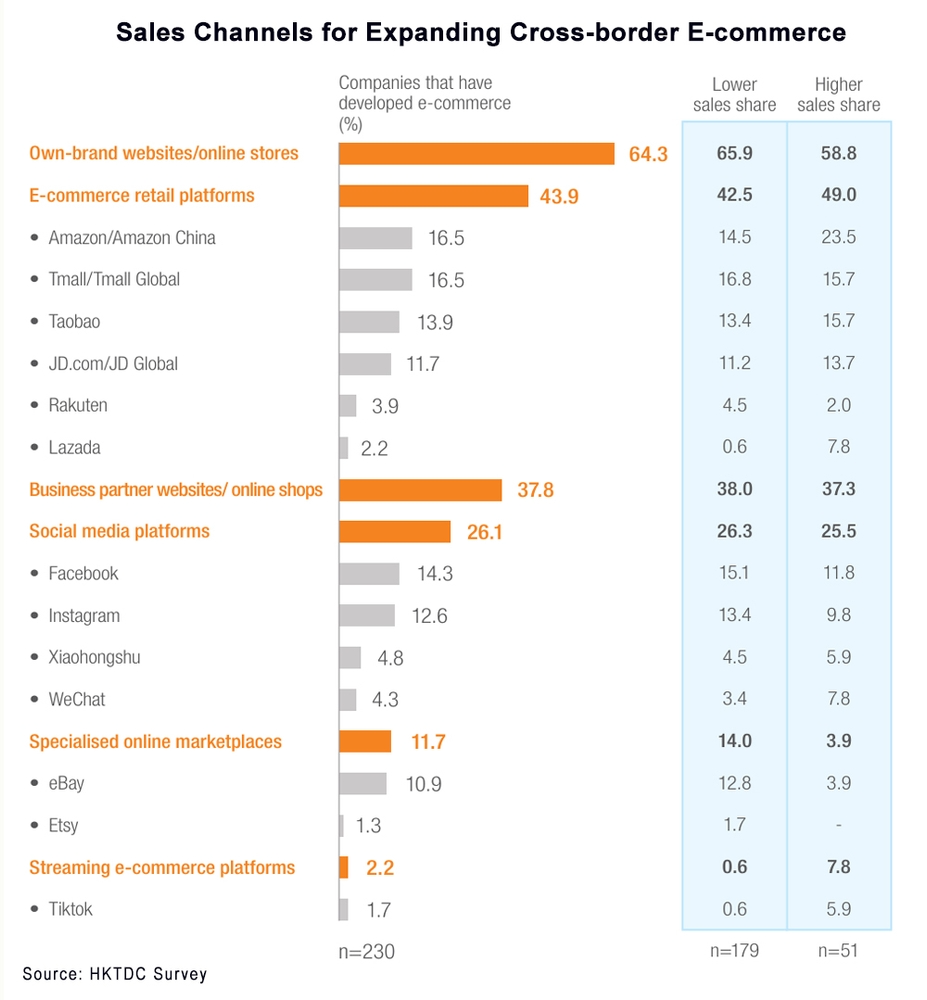

Driving cross-border business through multiple channels

The choice of e‑commerce channel can directly affect customer group coverage and the consumer online shopping experience. Around two‑thirds (64.3%) of the companies that have developed e‑commerce sell their products via their official own‑brand websites/online stores. 43.9% promote and sell via specialised e‑commerce retail platforms such as Amazon, Tmall, JD.com and Lazada. These platforms not only bring huge network traffic for e‑commerce but also provide multilingual support, detailed analysis of target markets/consumer groups and related promotional services to help e‑commerce companies expand sales. 37.8% of these companies are making use of their business partners’ online stores, while 26.1% use social media platforms such as Facebook and Instagram to reach different consumer groups. There is not much difference regarding the choice of channels between companies with lower e‑commerce sales shares and those with a higher share.

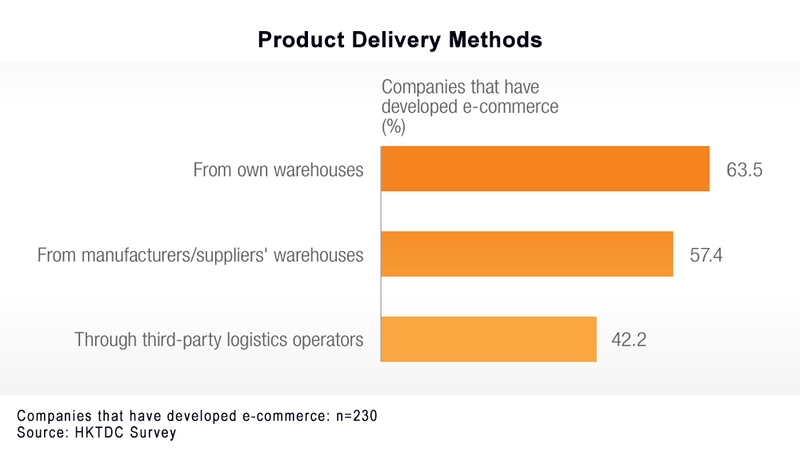

Currently, “companies that have developed e‑commerce” mainly deliver products from their own warehouses to consumers (63.5%) with many of these warehouses located in Hong Kong. 57.4% of these companies also use manufacturer/supplier warehouses in different regions to deliver products to different markets, while 42.2% prefer to use third‑party logistics companies to deliver products to consumers in a bid to raise efficiency.

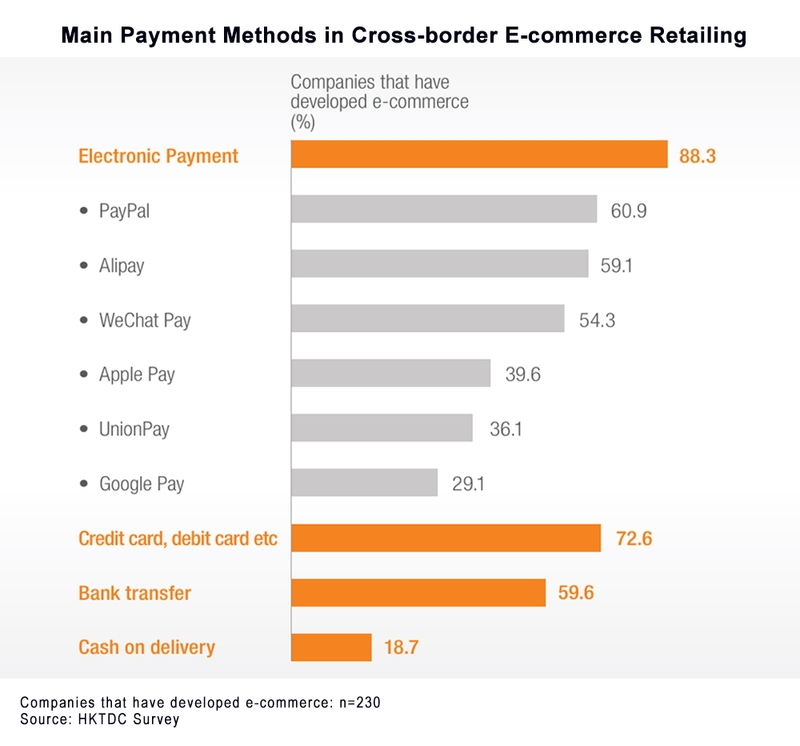

Diverse payment methods

The development of electronic payment systems in recent years has made cross‑border payments more convenient while also promoting the growth of cross‑border e‑commerce. The survey found that the payment methods currently offered by “companies that have developed e‑commerce” are very diverse. In addition to traditional methods such as credit card/debit card payment (72.6%) and bank transfer (59.5%), 88.3% offer a variety of electronic payment methods to cater to the needs and usage habits of consumers in different markets. Such electronic payment methods include the very popular PayPal (60.9%), Alipay (59.1%) and WeChat Pay (54.3%).

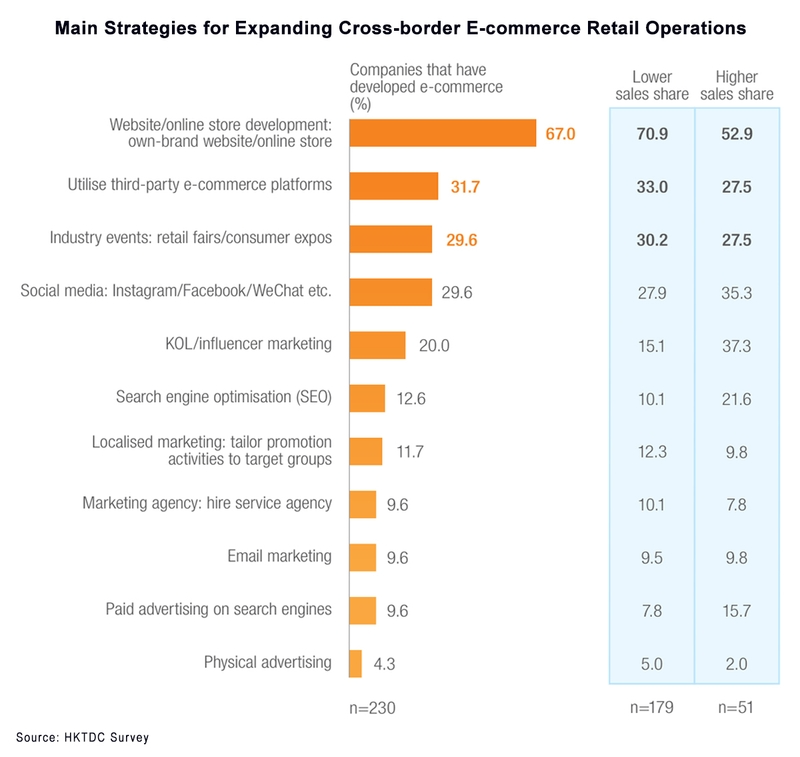

Promoting sales via own brand websites

Creating own‑brand websites and online shops for marketing is the method used by most of the “companies that have developed e‑commerce”, with 67.0% of them adopting this method in their marketing strategy. The next most popular method was promoting via third‑party e‑commerce platforms (31.7%).

For “companies with higher e‑commerce sales share”, the main strategies to enhance company visibility were collaborating with key opinion leaders (KOLs)/influencers (37.3%), utilising social media (35.3%) and search engine optimising (SEO, 21.6%).

This article forms part of a joint study conducted by Hong Kong Export Credit Insurance Corporation and HKTDC: “Unleashing the Lucrative Potential of Cross-border E-commerce for Hong Kong Traders (Company survey and expert opinion)”

First, please LoginComment After ~