Government finance statistics: net financial worth

The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. The difference between the stock of financial assets and the stock of liabilities is called net financial worth.

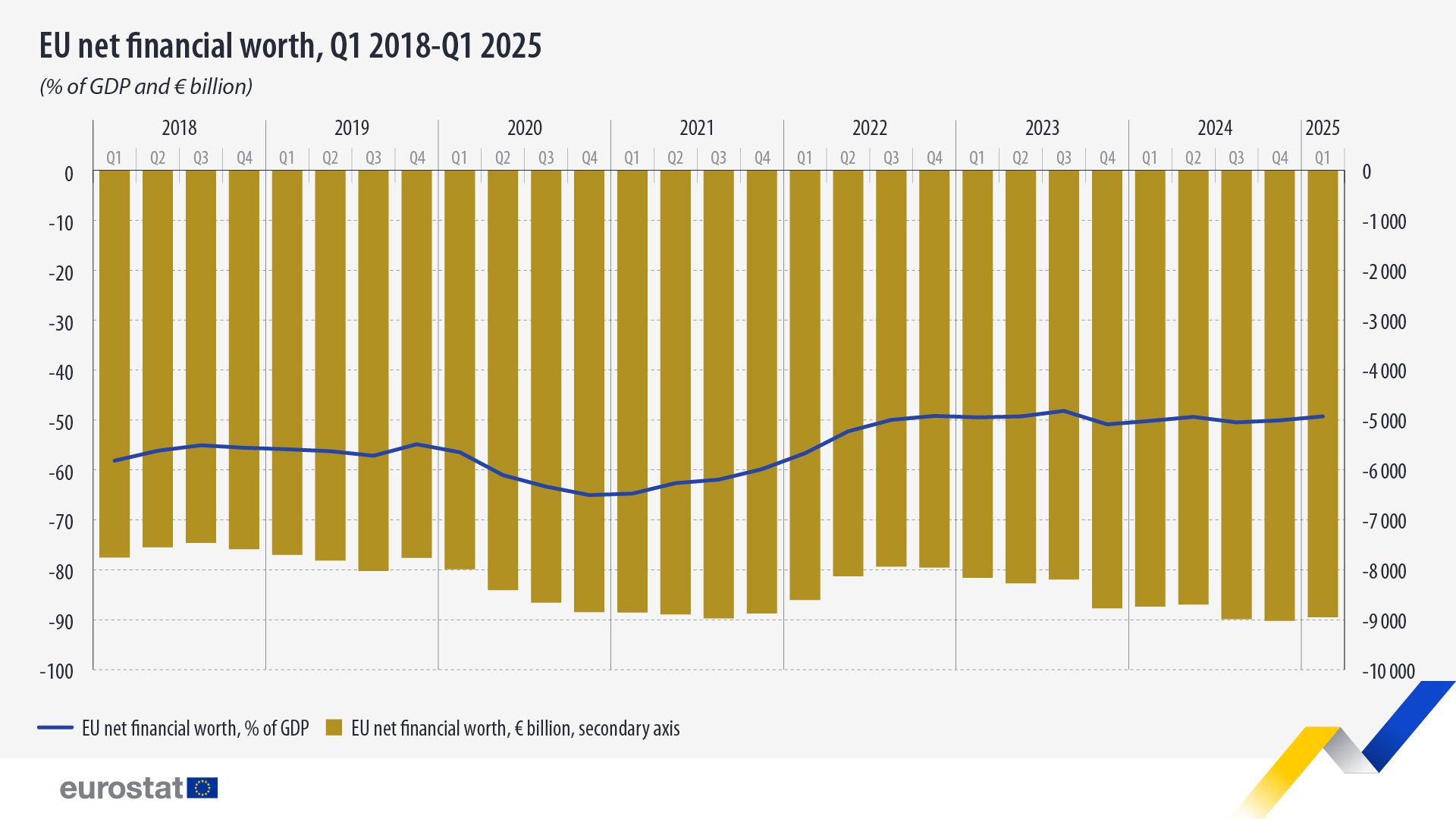

At the end of the first quarter of 2025, the EU net financial worth stood at -€8 948 billion or -49.4% of the gross domestic product (GDP). Compared with the end of the fourth quarter of 2024, the EU net financial worth increased by €72 billion. Compared with the end of the first quarter of 2024, the EU net financial worth decreased by €213 billion.

This information comes from data on quarterly government finance published by Eurostat today. This article presents a handful of findings from the more detailed Statistics Explained article.

Source dataset: gov_10q_ggfa

The net financial worth can change due to transactions or due to other economic flows (mainly price changes, also known as holding gains or losses). The main liabilities on the EU general governments’ balance sheets are debt securities. As these instruments are traded on the financial markets, their value changes over time and can be volatile.

At the end of the first quarter of 2025, the continued EU general government deficit (net financial transactions, measured as transactions in financial assets minus the transactions in liabilities, -€166 billion) contributed negatively to the evolution of net financial worth. However, at the EU level, compared with the fourth quarter of 2024, the net financial worth improved due to the financing of the deficit being off-set by positive revaluation of financial assets (+€137 billion), notably equity, as well as negative revaluations of liabilities (-€101 billion), notably debt securities.

For more information

- Statistics Explained article on government finance statistics - quarterly data

- Thematic section on government finance statistics

- Database on quarterly government finance statistics

- Database on government finance statistics

Methodological notes

- In the European System of Accounts (ESA 2010), most assets and liabilities are valued at market value. This means that the stock of financial assets and liabilities fluctuates due to transactions, but also due to ‘other flows’, notably revaluations (nominal holdings gains and losses).

- The stock of assets and liabilities and net financial worth as a percentage of GDP are calculated for each quarter using the sum of quarterly GDP for the four last quarters.

For information on upcoming releases visit our release calendar. If you have any queries, please visit our contact us page.

First, please LoginComment After ~