Middle East Opportunities: The UAE – A Thriving Business Hub

In recent years, the member states of the Gulf Cooperation Council (GCC) have been actively inviting investment to diversify their economies, lessen their dependence on energy revenues and pursue sustainable growth. At the same time, Chinese companies on the other side of the Asian continent have sought to open up new markets in the face of an increasingly complicated economic and geopolitical landscape. These two strategic objectives are inherently complementary and present strong potential for synergy. With their high per capita incomes and stable political environments, GCC countries have naturally become popular destinations for Chinese companies seeking overseas expansion.

The United Arab Emirates (UAE) has been one of the first GCC nations to pursue economic diversification. With a mature and open market, it holds great appeal to foreign investors looking to venture into the Middle East, and Chinese companies are no exception. According to the Consulate General of China in Dubai, as of 2024 the UAE was China’s second largest trading partner and its top destination for exports and investment in the Arab region. Over 8,000 Chinese companies have established a presence in Dubai and some 370,000 Chinese nationals work and live in the city.

The UAE is also Hong Kong’s most important trading partner in the Middle East. By 2024, the UAE was Hong Kong’s sixth largest export market globally and its largest trading partner in the Middle East, with exports reaching double the 2018 figure, thanks in large part to China’s increasingly close economic relations with the UAE, and to the city’s advantages in enjoying strong support from Mainland China and being an international financial centre. In 2024, Hong Kong exported US$12.2 billion worth of goods to the UAE, with more than 70% (approximately US$8.7 billion) originating from Mainland China. Figures published by the General Administration of Customs showed China’s exports to the UAE totalled US$65.6 billion in value during the same period. In other words, the total value of goods originating in China and re exported to the UAE via Hong Kong was equivalent to about 13% of the goods directly exported to the UAE from the Mainland.

Open culture and economic vitality

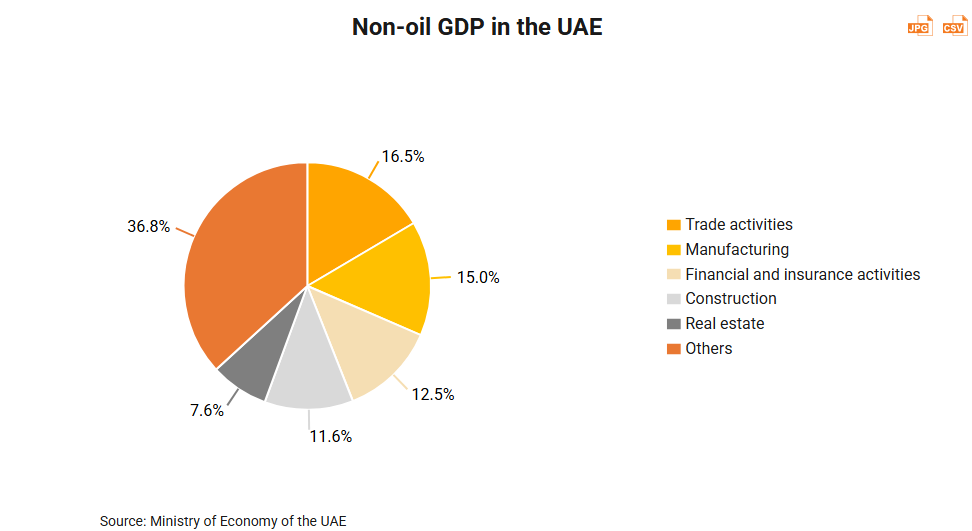

Developing diversified industries is the core driving principle of the UAE’s social and economic development, and even that of the entire GCC. In the UAE, non oil sectors contribute to approximately 75% of the nation’s GDP, reflecting the success of its diversification efforts. Key contributors to this non oil revenue include trade, manufacturing, finance and insurance, construction and real estate, which together account for over 60% of non oil income.

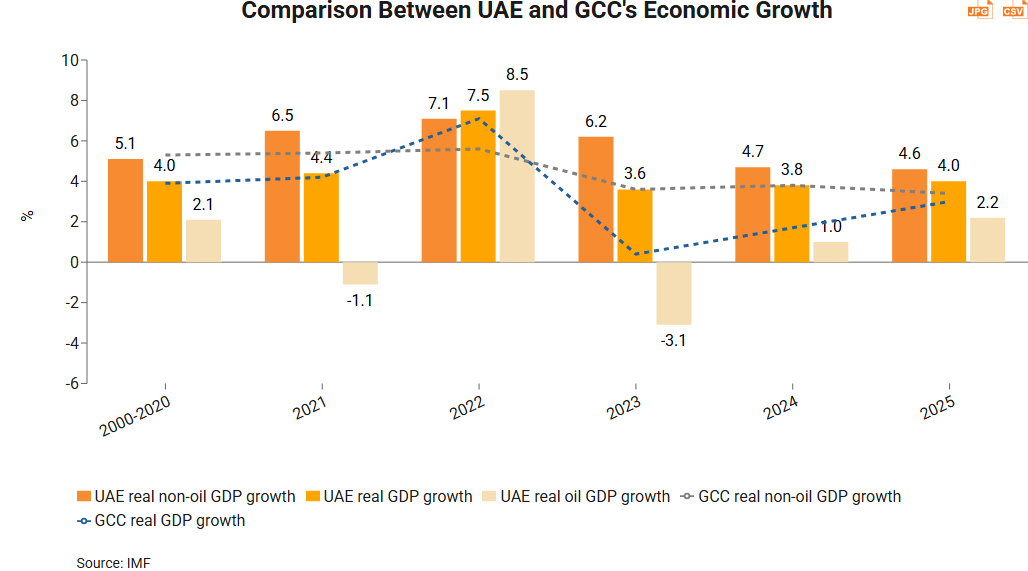

The UAE has emerged as a frontrunner among GCC nations in terms of economic diversification in recent years. According to the International Monetary Fund (IMF), the UAE’s real non‑oil economic growth consistently exceeded 6% annually from 2021 to 2023, surpassing the overall average of GCC nations each year. This has allowed the UAE to maintain real economic growth of approximately 4% despite sluggish growth in its energy sector. Notably, this overall growth rate also outpaced the GCC average.

The UAE owes its robust economy not only to the strong growth momentum of its non oil sectors but also to adopting open policies in relation to culture, investment and other respects. Pork, alcohol and gambling have always been Islamic taboos, but in the UAE non Muslims are free to buy pork in supermarkets and to enjoy alcoholic drinks in restaurants and bars. In 2024, Wynn Resorts secured the first commercial gaming license in the UAE. Its Ras Al Khaimah project is expected to open in 2027 and will be the first casino resort in the region.1 As early as 2021, the UAE government transitioned from the traditional Islamic Sunday to Thursday work week to the more globally recognised Monday to Friday schedule in a bid to align with international business practices. This reflects the country’s determination to integrate with the world.

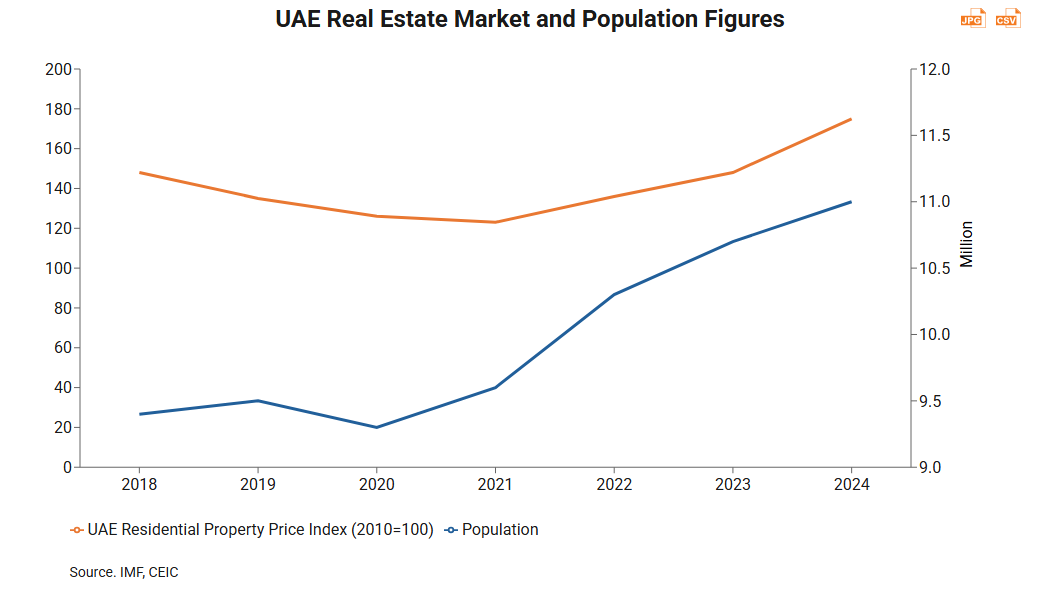

Figures relating to population growth, property price hikes and incoming visitors also show the rewards the UAE has received for its efforts in opening up and integrating with the world. According to the IMF, the UAE’s population increased by nearly 20% within a short span of four years since 2020. The UAE has a predominantly expatriate population, with foreign nationals accounting for approximately 90% of the total population. This demographic composition strongly suggests that the country’s population growth is largely driven by its success in attracting expatriates. The UAE’s rapid demographic growth may in fact be traced back to the time of the COVID 19 pandemic. At that time, the UAE was one of the first countries to reopen its borders. This, coupled with changes to modes of working, attracted many people to go to work and live in the UAE. The country’s Golden Visa policy, which it started to implement in 2019, also facilitates immigration to a large extent, as it allows people who buy or own property worth AED 2 million (approximately HK$4.2 million) to apply for a 10 year renewable residency permit for their whole family. According to Dubai’s official figures, more than 280,000 Golden Visas were issued in Dubai alone between 2021 and 2023. Population growth also gave the real estate market a real boost. Figures published by the China Entrepreneur Investment Club (CEIC) show that property prices in the UAE had rebounded by over 40% by the first quarter of 2024 from a low point in the third quarter of 2020. At the same time, Dubai welcomed 18.72 million international overnight visitors in 2024, marking a 9% year on year increase.

Inflows of foreign direct investment into Dubai showed a 33% year on year increase in 2024, suggesting that foreign investors see great promise in Dubai’s economic prospects. Hotels and tourism and real estate were the leading sectors in attracting foreign investment, each accounting for 14%, followed by software and information technology services (9.2%), building materials (9%) and financial services (6.8%).

The UAE as a regional hub

The UAE amended its foreign investment law in 2018 to facilitate the inflows of foreign capital, allowing up to 100% foreign ownership of on shore business entities in designated sectors. The country further amended this law in 2021 to expand the scope of applicable sectors. As a result, over 1,000 businesses in both Abu Dhabi and Dubai have benefitted from the reform.

The UAE boasts more than 40 multidisciplinary free zones, including the Dubai South Free Zone for aviation and logistics industries, the Dubai International Financial Centre, and the Abu Dhabi International Financial Centre. These zones typically permit 100% foreign ownership and free repatriation of capital and profits. Tax exemptions and streamlined business registration processes are also offered to varying extents. More importantly, while one stop services offered in these free zones inevitably incur additional fees, the pricing is transparent. These services also save new companies the trouble of having to deal with different government agencies, leaving them free to concentrate on growing their business.

The UAE has already evolved into a relatively mature commercial centre, particularly in the cities of Dubai and Abu Dhabi. Hong Kong companies operating in the UAE may negotiate business partnerships with other companies that have established subsidiaries in the country. China, for instance, has more than 15,500 companies doing business in the UAE. Hong Kong companies across different trades and professions may therefore use the UAE free zones as a springboard to access the Middle East and African markets, just as Mainland and overseas companies use Hong Kong as a platform to expand their business in Asia. ARTE Capital, a leading regional investment group headquartered in Hong Kong, has set up an office in the Abu Dhabi International Financial Centre to help sovereign wealth funds in the region identify investment opportunities. To learn more, please read Middle East Opportunities: Bridging Two-way Investments.

Leading-edge manufacturing

Besides being a commercial centre, the UAE has also tried to inject stimulus into its economic diversification by actively promoting local manufacturing. What merits attention is that while land costs are high in the core areas of Dubai and Abu Dhabi, the surrounding areas are more viable. Indeed, industrial parks such as Dubai Industrial City, Khalifa Industrial Zone Abu Dhabi (KIZAD), Sharjah Airport International Free Zone (SAIF Zone) and Ajman Free Zone (AFZ) are not far from the urban areas, and their proximity to airports, container terminals and other infrastructure facilities aids logistics efficiency. As a major energy power with an abundant supply of migrant workers, energy costs and manpower are not a problem in the UAE. However, Hong Kong businesses must bear in mind that, in step with the higher cost of living, wages in the UAE are still higher than in Southeast Asian countries. Moreover, the UAE government requires companies over a certain size operating in 14 designated sectors – including manufacturing; construction; finance and insurance; and information and telecommunications – to employ local workers. Since 2025, companies in these sectors with 20 to 49 employees are required to hire at least two Emirati citizens. This poses a challenge to affected employers, as it typically costs considerably more to hire local employees than migrant workers. Local people can also be reluctant to take up arduous work. Theoretically speaking, the limited size of local population also restricts the workforce size.

On the other hand, the UAE enjoys obvious geographical advantages. Being situated in the Middle East means a shorter distance and fewer carbon emissions to export goods to Europe – an important consideration for European markets, where sustainable development is increasingly a priority. The UAE also cares about sustainable development: it is committed to achieving net zero carbon emissions by 2050 and has been actively investing in and developing renewable energy sources in recent years. This will help to drive reductions in carbon emissions in the manufacturing sector. Notably, a Hong Kong start up named Archireef has established a manufacturing base in Abu Dhabi for 3D printing of clay reef tiles designed to restore damaged coral reefs. To learn more, please read Middle East Opportunities: Restoring the Reefs of the UAE.

Opportunities abound in the UAE

The Middle East may seem quite far away, but there are increasingly close ties between Hong Kong and the UAE. In February 2023, Hong Kong Chief Executive John Lee led a business delegation to Saudi Arabia and the UAE, resulting in the signing of 13 letters of intent and memoranda of understanding. In May of the same year, the Hong Kong Monetary Authority and the Central Bank of the UAE held their first bilateral meeting in Abu Dhabi. In July 2024, the Hong Kong Stock Exchange added the Abu Dhabi Securities Exchange and the Dubai Financial Market to its list of Recognised Stock Exchanges, which means public companies listed on the main markets of these UAE exchanges can apply for a secondary listing in Hong Kong. Then, in December 2024, a delegation of the Central Bank of the UAE visited Hong Kong for a second bilateral meeting in order to further cement co operation and connectivity between the financial services sectors of the two jurisdictions. The meeting concluded with the signing of a memorandum of understanding, in which the two authorities agreed to establish connectivity between their debt capital markets and related financial market infrastructures with a view to facilitating cross boundary debt securities issuance and investment activities.

Up to June 2024, the overwhelming majority of GCC companies with a presence in Hong Kong, numbering around 40, are from the UAE. Many Hong Kong companies have also expanded their operations to the UAE in recent years. In addition to the regional investment group ARTE Capital and the start up Archireef, both mentioned above, Lalamove – a Hong Kong based on demand delivery platform – also entered the UAE some time ago, with its delivery services covering the whole of Dubai, as well as Sharjah and Abu Dhabi.2 Meanwhile, Hong Kong listed food delivery platform Meituan is launching it first overseas drone delivery service in Dubai.3 These examples show that opportunities in the Middle East are not to be ignored. Companies with far reaching aspirations should explore the region’s market potential to expand their business horizons.

1 https://www.reuters.com/business/wynn-resorts-says-it-gets-uaes-first-gambling-license-2024-10-05/

3 https://www.chinadailyhk.com/hk/article/600595

First, please LoginComment After ~