Asset Purchase Facility Quarterly Report - 2025 Q2

Overview

This report contains information on the Bank of England’s Asset Purchase Facility (APF) for 2025 Q2, describing operations from 1 April 2025 to 30 June 2025. It also contains information about how cash flows between the APF and HM Treasury (HMT) might evolve over time. More information on what the APF is and what it does is available in our Market Operations Guide. A short timeline describing the history of the APF is provided as background at the end of the report.

APF operations in the past quarter

This section contains details of UK government bond (gilt) operations conducted for monetary policy purposes during 2025 Q2. It also includes information on gilts lent to the Debt Management Office (DMO).

At its September 2024 meeting, the Monetary Policy Committee (MPC) voted to reduce the stock of gilts held in the APF by £100 billion over the 12-month period from October 2024 to September 2025, comprising both maturing gilts and sales.

Over 2025 Q2, in line with the MPC’s decision, the Bank continued with the sale of the APF’s stock of gilts held for monetary policy purposes. A total of three gilt sales operations were run during April 2025.footnote[1] These sales led to a reduction in the stock of gilts held for monetary policy purposes of £2.9 billion. Gilt maturities over the quarter led to a further reduction in the stock of gilts held for monetary policy purposes of £29.6 billion (measured in initial proceeds terms). As of 30 June 2025, the stock of gilts held for monetary policy purposes stood at £590 billion.

On 20 June 2025, the Bank published the schedule for gilt sales in 2025 Q3.

Summary of holdings

Table A: Summary of stocks in the APF in 2025 Q2 (a) (£ millions)

Week ending | Gilts (b) |

|---|---|

2025 Q1 (c) | 622,521 |

2 April 2025 | 622,521 |

9 April 2025 | 621,470 |

16 April 2025 | 620,557 |

23 April 2025 | 620,557 |

30 April 2025 to 4 June 2025 | 619,661 |

11 June 2025 to end-2025 Q2 | 590,018 |

Footnotes

- Source: Bank of England.

- (a) The outstanding amount in each facility is reported on a settlement date basis. ↩

- (b) The overall stock of APF gilt purchases for monetary policy purposes, net of sales and redemptions, valued at initial purchase price. ↩

- (c) 2025 Q1 measured as the amount outstanding as of 26 March 2025. ↩

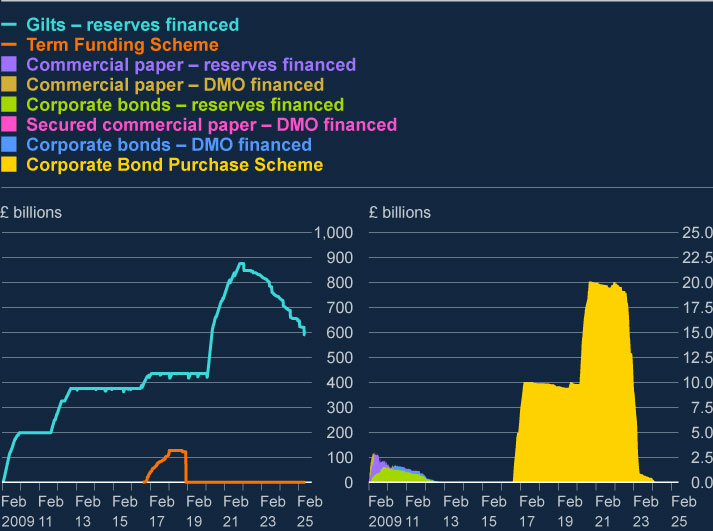

Chart 1 shows the cumulative net value of APF transactions between the establishment of the APF in 2009 and the end of 2025 Q2.

Chart 1 is separated into two panels with different scales. Gilt purchases and the Term Funding Scheme (TFS) – which from 2016 to 2019 was on the APF balance sheet before its transfer to the Bank’s balance sheet – are on the left panel.footnote[2] The legacy corporate bond and commercial paper schemes that have been operated via the APF balance sheet are shown on the right panel.

Chart 1: Cumulative APF purchases by type: amounts outstanding (a) (b)

Footnotes

- Source: Bank of England.

- (a) Data based on settled transactions. ↩

- (b) On 21 January 2019 the TFS drawings were moved to the Bank’s balance sheet and therefore are not reported after this date. ↩

Asset Purchase Facility Quarterly Report - 2025 Q2 | Bank of England

First, please LoginComment After ~