Foreign exchange reserves and nominal effective exchange rate index for the pataca – August 2025

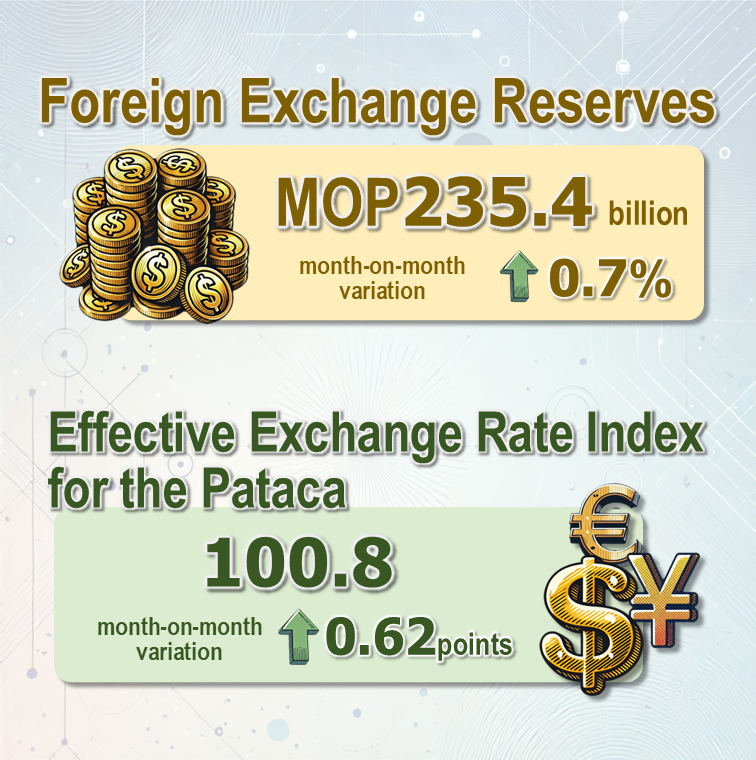

The Monetary Authority of Macao announced today (15 September) that the preliminary estimate of Macao SAR's foreign exchange reserves amounted to MOP235.4 billion (USD29.33 billion) at the end of August 2025. The reserves increased by 0.7% from the revised value of MOP233.7 billion (USD28.91 billion) for the previous month. Macao SAR's foreign exchange reserves at end-August 2025 represented 11 times the currency in circulation or 87.9% of pataca M2 at end-July 2025.

The trade-weighted effective exchange rate index for the pataca rose 0.62 points month-on month but dropped 2.44 points year-on-year to 100.8 in August 2025, implying that overall speaking, the exchange rate of the pataca grew against the currencies of Macao's major trading partners on a monthly basis but dropped on an annual basis.

Macao's Base Rate of the Discount Window Lowered to 4.50%

The Monetary Authority of Macao (AMCM) lowered the Base Rate of the Discount Window today (18 September 2025) by 25 basis points to 4.50%, marking the first policy rate cut of the year.

Given the currency peg between the Macao pataca (MOP) and the Hong Kong dollar (HKD), it is essential for the policy rate movements in both jurisdictions to remain closely aligned, so as to ensure the effective operation of the linked exchange rate system (LERS). Hence, the AMCM followed the Hong Kong Monetary Authority in lowering the Base Rate by 25 basis points synchronously. Under the LERS between the HKD and the US dollar, the corresponding policy rate adjustment of Hong Kong was based on the US Federal Reserve's policy action to lower the Fed funds rate target range by 25 basis points on 17 September 2025 (US time).

In the first seven months of 2025, the prime lending rate of Macao banks has remained largely unchanged at 5.51%. As the US Federal Reserve delivered the first interest rate cut this year, it provides room for potential downward adjustment in Macao's lending rates. This would in turn alleviate the financial pressure on corporate borrowers and mortgagors, while the reduction in financing costs would help stimulate the local economy.

In view of the prevailing uncertainties in the global economy, firms and individuals should prudently assess their financial capabilities when applying for credit facilities such as mortgages. The AMCM will continue to monitor the operation and risk profile of Macao banks, urging the banking sector to properly manage and address the relevant risks.

First, please LoginComment After ~