Tariff Shocks Amid Mighty Global Capital Flows: Why Has the Economy Stayed Calm? BIS Expert Decodes Three Buffer Mechanisms and Underlying Risks

This article contains AI assisted creative content

Andrea M. Maechler, Deputy General Manager of the Bank for International Settlements (BIS), recently pointed out that the depth and breadth of global financial interconnectedness now far exceed tangible trade links, fundamentally altering the transmission channels and ultimate impact of traditional economic shocks like tariffs. She emphasized that understanding the current financial system's role as both a buffer and a potential amplifier is crucial for policymakers to design precise measures and for international business professionals to assess risks.

The Core Paradox: Expected Strong Shock vs. Actual Economic Resilience

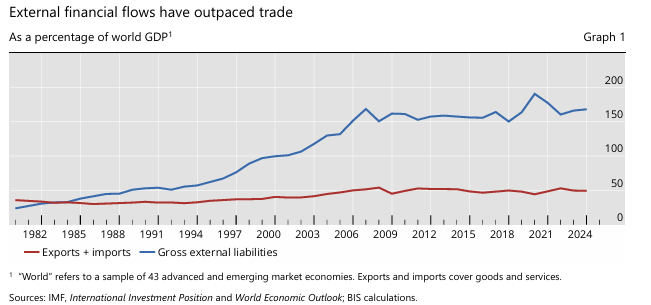

Global tariff levels increased significantly in 2025, with the US effective tariff rate projected to reach its highest level since the 1930s. Standard macroeconomic models predicted such shocks would lead to marked slowdowns in growth and rising inflation. However, real economic data has shown unexpected resilience: manufacturing PMIs stabilized after brief fluctuations, and inflation shows no signs of spiraling out of control. Maechler noted that this paradox highlights the limitations of traditional analytical frameworks. When assessing shocks, one must incorporate into the core view the massive scale of external financial liabilities—about 170% of global GDP (compared to about 50% for trade flows, Graph 1)—and their dynamics. Financial channels, rather than trade flows alone, have become the main conduit for shock transmission, initially behaving more like "shock absorbers."

Three Key Financial Buffers: How They Jointly Mitigated the Shock

TWO

Maechler analyzed three key financial factors that worked together to effectively buffer the direct negative impacts of the tariffs:

-

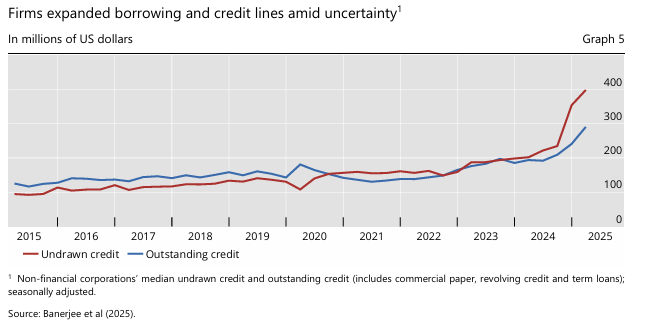

Resilient Banking System Provides Crucial Credit Buffer: A well-capitalized banking system was vital during a period of high policy uncertainty. Data show that non-financial corporations proactively increased undrawn credit lines and borrowing (Graph 5), providing them with valuable financial flexibility and a buffer to smooth purchases (e.g., observed front-loading of imports) and adjust supply chains after the tariffs took effect.

Monetary Policy Easing Expectations Support Market Confidence: The trend towards monetary policy easing in major economies (particularly some affected by the tariffs) reduced market pricing of extreme adverse scenarios and supported overall risk appetite.

-

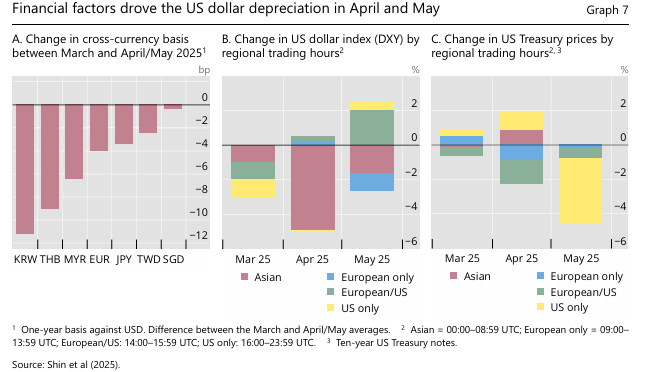

Unexpected US Dollar Depreciation Acts as a Global Release Valve: Contrary to typical trade model predictions of dollar appreciation, the US dollar depreciated following the tariff announcements. Maechler stressed this was primarily driven by financial behavior, not trade factors—specifically, hedging operations by international investors managing the exchange rate risk of their large US dollar asset holdings significantly influenced the spot rate (Graph 7). A weaker dollar alleviated global pressure in two ways: by improving the balance sheets and risk appetite of global US dollar investors, and by reducing the local currency cost of imports elsewhere, providing more policy space for relevant central banks.

The Double-Edged Sword of Deep Interconnectedness: Buffers Can Turn into Amplifiers

THREE

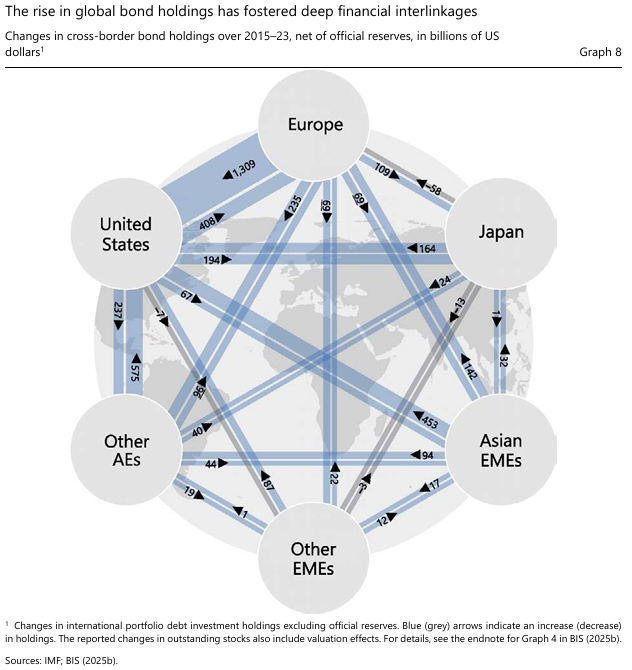

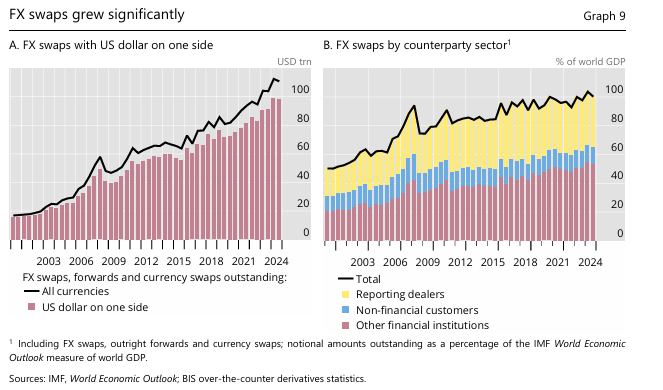

Maechler warned that although the financial system has so far acted as an effective buffer, the high degree of global financial interconnectedness is itself a double-edged sword. Soaring cross-border bond holdings and the massive $111 trillion (of which $98 trillion involves the US dollar) foreign exchange derivatives market (Graphs 8 & 9) create an extremely complex financial network. This means market risk sentiment could quickly reverse due to negative news and transmit rapidly across borders through these channels. Currently lofty asset valuations (e.g., high-yield bond spreads near historical lows) suggest near-perfect market pricing. Should financial conditions tighten unexpectedly for any reason (such as worsening inflation expectations or a weaker growth outlook), underlying economic vulnerabilities could be quickly exposed and amplified, creating a negative feedback loop.

Key Implications for Policy and Markets: Rising Complexity Demands Enhanced Financial Insight

FOUR

This new reality implies more complex trade-offs for central bank monetary policy. When facing supply shocks like those from tariffs, focusing solely on traditional economic indicators (like output gap, inflation rate) is no longer sufficient. Central banks must pay greater attention to how financial linkages affect the anchoring of inflation expectations and the tightening or loosening of overall financial conditions. Simultaneously, policymakers need to prioritize gaining deeper insights into the behavior patterns, liquidity needs, and leverage of non-bank financial institutions (e.g., large asset managers) under stress. International cooperation for monitoring cross-border financial risks has also become increasingly important. For corporate decision-makers and investors, this means that when assessing geopolitical or trade policy risks, analyzing the direction of global capital flows, the policy paths of major central banks, and the trend of the US dollar has become as important as, if not more important than, interpreting the tariff details themselves.

First, please LoginComment After ~