Basel III risk-based capital ratios increase while leverage ratio and Net Stable Funding Ratio remain stable

Basel III risk-based capital ratios increased while leverage ratios and Net Stable Funding Ratios (NSFRs) remained stable for large internationally active banks in the second half of 2024, according to the latest Basel III monitoring exercise, published today.

The report, based on data as of 31 December 2024, sets out trends in current bank capital and liquidity ratios and the impact of the fully phased-in Basel III framework, including the December 2017 finalisation of the Basel III reforms and the January 2019 finalisation of the market risk framework. It covers both large internationally active banks (Group 1) and other smaller banks (Group 2). See note to editors for definitions.

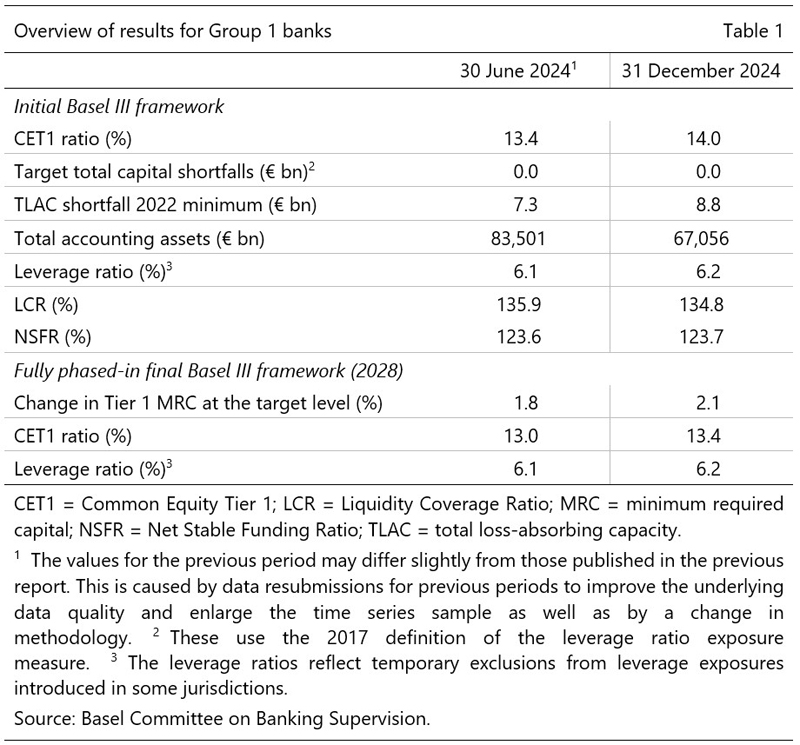

The implementation of the final elements of the Basel III minimum requirements began on 1 January 2023. At the end of the second half of 2024, the average impact of the fully phased-in final Basel III framework on the Tier 1 minimum required capital (MRC) of Group 1 banks was +2.1%, compared with +1.8% at end-June 2024. Group 1 banks report no regulatory capital shortfall, compared with €0.9 billion at end-June 2024.

The monitoring exercise also collected bank data on Basel III liquidity requirements. The weighted average Liquidity Coverage Ratio (LCR) decreased compared with the previous reporting period to 134.8% for Group 1 banks. Three Group 1 banks reported an LCR below the minimum requirement of 100%.

The weighted average NSFR was stable at 123.7% for Group 1 banks. All banks reported an NSFR above the minimum requirement of 100%.

The report is accompanied by interactive Tableau dashboards, offering users an intuitive way to explore results. New features enhance usability, while expanded explanatory text provides deeper insights into topics such as risk-based capital and operational risk. For the first time, users can also download the underlying data directly from the dashboards.

First, please LoginComment After ~