Survey on sustainable financial products: Consumers expect clear rules

BaFin surveyed consumers on the topic of sustainable financial products. The results show that sustainable products remain relevant in Germany. However, consumers want clear information and rules.

A representative online survey conducted by BaFin has shown that around two thirds of all respondents are interested in sustainable financial products (39% somewhat interested; 26% strongly or very strongly interested), while one third are not. Product categories that do not pursue clear environmental, social and governance (ESG) objectives are not perceived as sustainable by the majority of respondents interested in sustainability.

Survey method

For its representative survey, BaFin surveyed 1,528 people online in June 2025. It commissioned an external service provider for this purpose. Around 65% of respondents were interested in sustainable financial products. BaFin asked these 1,000 respondents in-depth questions about proposals for reforming the EU Sustainable Finance Disclosure Regulation.

Consumers want clear information and rules

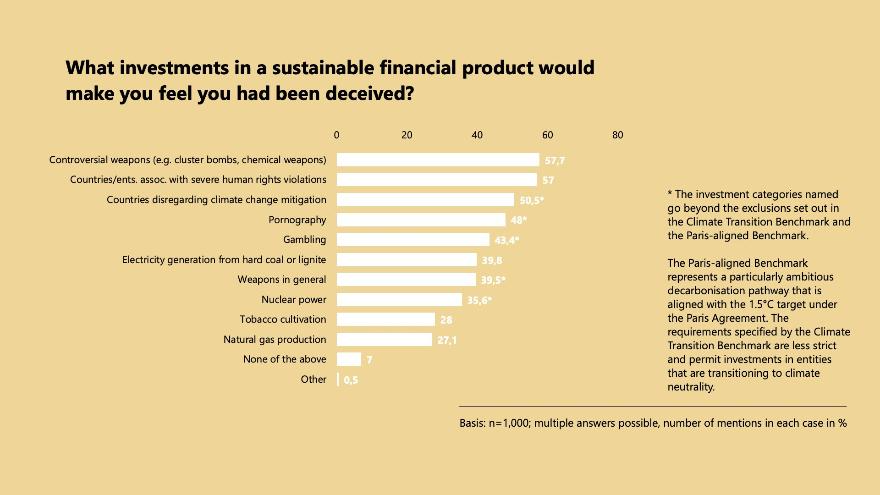

Almost all consumers surveyed expect transparent sustainability information on financial products. 60% want the provider to clearly highlight relevant sustainability information before the contract is concluded. Respondents interested in sustainability expect ESG financial products to clearly label any investments that consumers perceive to be unsustainable. 70% of respondents stated they would otherwise feel deceived. This applies in particular to controversial weapons and countries or enterprises with severe human rights violations (see infographic).

Around two thirds of the 1,000 respondents would like to see a requirement that human rights violations are excluded from sustainable financial products. More than half also expect this for other investment categories, such as controversial weapons or the expansion of coal-fired power generation. In addition, according to the respondents, at least 40% of investment capital should flow into sustainable investments or those that finance the transition to a sustainable economy.

Infographic: Deception with sustainable financial products

Revision of the SFDR offers opportunity for greater clarity

The EU Commission is currently working on an amendment to the Sustainable Finance Disclosure Regulation (SFDR). Since 2021, the SFDR has required providers to issue sustainability information for products such as investment funds or investment-based insurance products. In this context, possible explicit categories for ESG financial products are also currently being discussed: "sustainable financial product", "transition product", "exclusion product" and a "mixed product".

German consumers rate the categories very differently. Of the respondents interested in sustainable financial products, 80% consider a product that invests exclusively in ecologically or socially oriented activities – such as wind farms or hospitals – to be a credible sustainable financial product. More than half also rate transition products as sustainable. These are products that finance the transition to a sustainable economy, such as the switch from conventional to climate-neutral energy supply for a concrete manufacturer.

Only 40% rated products purely based on exclusion as sustainable. These products exclude certain activities and sectors but have no other sustainability goals. The lowest level of acceptance among the 1,000 respondents was for the possible product category of mixed products. This category combines the previous three categories, but the relative proportions of the categories within mixed products are not fixed. Just under 30% of respondents rated mixed products as sustainable.

First, please LoginComment After ~